One of the most important decisions for your investment portfolio is your choice of asset allocation. Asset allocation refers to how a portfolio is divided up among the various types of investments (also known as asset classes) that are available to invest in. Examples of asset classes include UK Equities, North American Equities, Gilts, Property, Emerging Markets, and commodities such as gold and oil.

Asset allocation is typically expressed in terms of the percentage of a total portfolio that is devoted to each of the various types of investments within it (For example, 60% UK Equities, 10% North American Equities 30% UK Gilts, and 10% cash).

Careful selection of the asset classes that comprise a portfolio, as well as the individual investments within each asset class, is essential to the ultimate performance of the portfolio. While there is some debate over the exact percentage of portfolio performance that should be attributed to asset allocation, there is general agreement among investment experts that asset allocation is an important determinant of portfolio performance.

Indeed, our report 'How Asset Allocation Can Account For More Than 70% of Your Portfolio Growth' goes more in-depth into this topic and highlights the wide disparity in growth between similar risk portfolios that use different asset allocation models.

Allocating The Right Amount To The Right Asset Class

Because asset allocation plays a vital role in determining portfolio results, emphasis should be placed on allocating the appropriate target percentage for each asset class. Only after determining the asset classes you will invest in, and the proper proportions of each for your portfolio should you begin to analyse which individual investments (e.g. equities, fixed income, bonds) you will invest in.

How you allocate your assets depends on several factors, including your investment objectives, attitudes toward risk, desired return, age, income, tax bracket, time horizon, and each of these can be broken down even further depending on how specific your needs or situation is. However, no matter what allocation you choose, this will naturally change over time and may need adjusting as your circumstances change.

For example, let's say your investment objective is substantial asset growth, you have a 10 to 15-year horizon, and you are willing to assume a high amount of risk. You might choose to place a more significant percentage of your money in funds in asset classes such as emerging markets, that may offer a higher return but involve a greater degree of risk. Another investor with a 5-year time horizon, whose objective is the preservation of principal and who doesn't want substantial risk, may invest more heavily in low risk, but lower growth government bonds. The underlying principle in asset allocation is the understanding that different categories of investments have shown varying rates of return and levels of price volatility over time. By diversifying your investments over multiple asset classes, you potentially reduce risk and volatility, since downturns in one investment class may be tempered or even offset by favourable returns in another.

Risk and Return: Understanding What’s Right For You

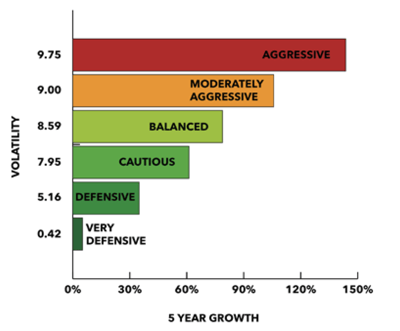

Risk is inversely related to return. The higher the risk, the greater the potential for a higher return and the greater potential for loss. Investors expect to be rewarded with higher returns in exchange for accepting greater risk and accept lower returns in exchange for lower risk. A major goal of designing and managing an investment portfolio is to maximise total return while keeping overall risk to an acceptable level.

Generally, the higher the expected return on an investment, the higher the risk involved in trying for that return. The longer your investment time horizon, the more volatility you may be able to handle, allocating more of your investments to higher-risk assets and making your portfolio more aggressive.

With a longer investment horizon, you have a better opportunity to ride out several economic cycles. Whereas a shorter time frame usually requires a more conservative approach as there is less time to try and recover from a market downturn. As the time approaches to convert your investments to cash that can be used for a particular goal, you may want to allocate investments into a lower volatility mix of asset classes.

Monitoring and Rebalancing Your Asset Allocation

As noted earlier, your asset allocation may change over time; what was appropriate in the past may not be right today, and what works today may not be suitable for you in the future. This can be the result of economic conditions or changes in your circumstances and/or investment objectives. Also, growth or decline within asset classes may cause your asset allocation ratios to shift. For this reason, it's essential to monitor your asset allocation periodically and rebalance your portfolio as needed. Rebalancing your portfolio involves moving funds from one asset class to another to return to the ratios you have determined are appropriate for your investment portfolio.

For example, let's say that on 1st January, you determined that you should have 30% of your assets in UK Equities, 30% in US Equities, 20% in Gilts, and 20% in cash, and invested your assets accordingly. At the end of a year, the UK and North American equities have done very well, and as a result, you discover that your ratios have shifted. Now, 40% of your portfolio's value is in UK Equities, 40% in US Equities, 15% in Gilts, and 5% in cash, even though you have made no changes in your investments.

Efficient investing requires continuous monitoring of both asset allocation and portfolio composition. By ensuring your portfolio contains quality funds that have continuously outperformed their peers and your portfolios asset balance fits your investment profile and objectives will help you get the most from your investments.