As the end of the tax year approaches so too does the deadline for this year’s tax-free growth ISA investment. It’s a busy time with as much as half of all ISA investments occurring in the last three months of the tax year and 15% in the final two weeks alone.

Last year experienced a 16 year low in ‘cash ISA’ investments and a rise of more than 700,000 non-cash ISA investments with more people choosing to invest their ISA allowance in the pursuit of long-term higher growth.

With growing initiatives to stimulate ISA investment we look at the options available for consumer investors this ISA season, highlighting the different type of ISA wrappers available. For those that opt for Stocks and Shares ISAs we analyse the top 10 performing ISA funds 2019.

The 6 Different ISA Wrappers

An ISA is not an investment in its own right; it’s a tax wrapper that holds your money in order to benefit from tax free growth or income. How efficient your ISA performs will be down to factors such as interest rates for cash-based products or the fund performance of underlying holdings for investment-based stocks and shares ISAs. The current limit for ISA investment per adult in the UK is £20,000 per annum.

There are six types of ISAs including cash, stocks and shares, Innovative Finance ISAs, Junior ISAs, Lifetime ISAs, and the Help to Buy ISAs, each with different benefits and limitations.

1) Cash ISAs

A cash ISA is a tax-free way to save money. Cash ISAs are offered by banks and building societies. Like regular savings accounts, there is a variety of cash ISAs available, including instant access, regular savers and fixed-rate deals. Interest is always paid tax-free.

In a cash ISA up to £85,000 of your money is covered by the Financial Services Compensation Scheme (FSCS), which provides government protection should the ISA provider go bust.

Given the low-interest rates on cash ISAs, they are not seen as suitable to growth-seeking investors who can potentially obtain much higher growth by investing their ISA allowance in a higher risk environment.

2) Stocks and Shares ISA

This type of ISA allows you to invest in shares in individual companies, Investment Trusts, ETFs, Unit Trust & OEIC funds and bonds. The money you invest is free from UK capital gains and income tax. With a stocks and shares ISA, you have the potential to earn much better returns than a Cash ISA, but the underlying assets can carry more risk. Similar to an investment portfolio, risk can be mitigated by investing in better quality funds within a suitably balanced asset allocation model.

3) Junior ISAs

Aimed at parents who want to save on their children’s behalf, the Junior ISA also allows money to be put into cash or stocks for cash free growth. The annual limits are lower than a basic ISA: at the moment, no more than £4,260 can be put into a Junior ISA each year per child.

Control of the money in a Junior ISA passes to the nominated child when they turn 16, but no withdrawals can be made until their 18th birthday. At this point, the ISA converts to an adult ISA.

4) Help to Buy ISA

The Help to Buy ISA scheme was launched on 1st December 2015 with accounts available through banks, building societies and credit unions. The scheme enables people saving for their first home to receive a 25% bonus to their savings from the government when they buy a property of £250,000 or less (£450,000 in London).

For every £200 saved, first-time buyers can receive a government bonus of £50. The maximum government bonus is £3,000. The scheme will be open to new savers until 30 November 2019, although Help to Buy ISA account holders can continue saving into their account until 30 November 2029.

5) Lifetime ISA

The Lifetime ISA was announced in the Budget of 2016 and became available in April 2017. People who are under the age of 40 can open a Lifetime ISA and save up to £4,000 per year. The government will then top this amount up by 25%.

Therefore, for people who save the maximum each year, the government will top up the account with £1,000. Lifetime ISA funds can be put toward a deposit for a home that is worth a maximum of £450,000 in all areas of the UK or taken at age 60 to be used as retirement income.

The bonuses are only paid on the Lifetime ISA if the money is used to buy a first home or if it is withdrawn after the age of 60. Withdrawals for other purposes or before the holder’s 60th birthday will mean the government imposes a 25% penalty, which effectively offsets any bonus payments.

6) Innovative Finance ISA

An Innovative Finance ISA (IFISA) is a peer-to-peer lending or crowdfunding product. Peer-to-peer lending matches investors with borrowers such as new businesses or property developers. The potential rates of interest are higher than traditional savings accounts or Cash ISAs because of the higher risk profile of investing in new businesses or individuals.

The IFISA is also subject to the same £20,000 annual ISA allowance so you can split your money between this ISA, as well as cash and stocks and shares.

While this is regulated by the FCA, peer-to-peer lending is not covered by the FSCS meaning your capital is not protected.

Best ISA wrapper

Although there are six different ISA products, they can be condensed into three main types - Cash ISA, stocks and shares ISA, and Innovative Finance ISA. Despite their different structures Junior, Lifetime, and Help to Buy ISAs are made up of either cash or stocks & shares.

Investing in new businesses or property through peer-to-peer is still largely ignored as just 31,000 of the 10.8 million ISA accounts subscribed to in 2018/2019 were Innovative Finance ISAs. Cash ISAs and Stocks & Shares ISAs continue to dominate.

According to HM Revenue & Customs, low-interest rates saw minimal returns from Cash ISAs and led to the number of Cash ISAs investments falling by 697,000 in the last tax year.

According to The Sunday Times, the worst cash ISA in Britain paid just 13p interest for every £100 saved. Low interest rates resulted in an all-time low 2018/2019 in the number of Cash ISAs, with many investors, including those with low confidence in the markets, switching preference to the Stocks and Shares alternative.

Top Performing ISA Funds 2019

2018/2019 had a record number of investors invest in Stocks & Shares based ISAs compared to previous years. At a time of wavering confidence 246,000 new Stocks & Shares ISA accounts were registered demonstrating a bigger appetite for consumer investing compared to consumer saving!

According to Moneyfacts the average growth of a Stocks & Shares ISA 2018/2019 was 4.8%. Although significantly lower than 20.4% the previous year, it was still well above the average Cash ISA rate of 0.97% for the same period.

However, a difficult 2018 for investment markets has meant many investors achieved little to no growth this past year. As political and economic uncertainty continues, there are differing views as to what lies ahead for investors. Some analysts have been buoyed by the positive start to the year as 34 of the 36 Investment Association sectors returned positive growth this past month.

Despite market uncertainty, people continue to move their ISAs away from cash-based products and into longer term investment products suggesting investors are becoming more comfortable in the current landscape. The quality and performance of the funds and the fund managers you choose to invest your ISA in can have a significant bearing on how well your ISA will perform.

With a Stocks & Shares ISA, the underlying investments can be made up of Shares, Investment Trusts, ETFs and Investment Funds.

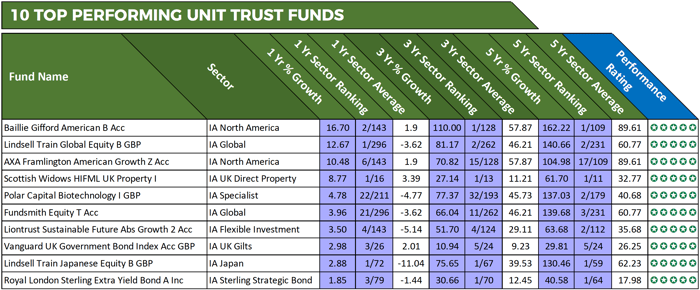

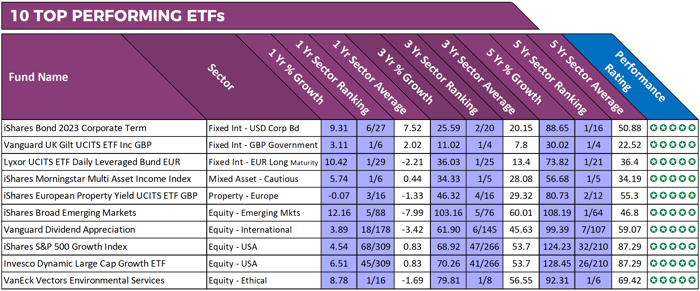

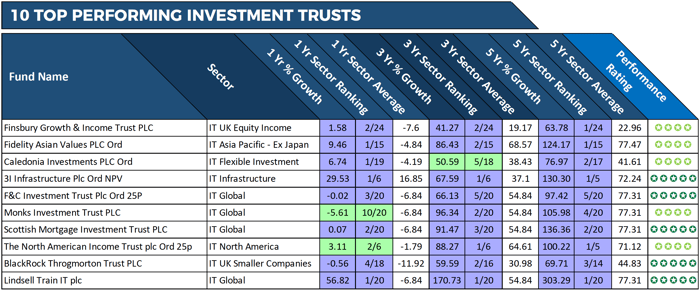

In the tables below we feature 10 Investment Trusts, ETFs and unit trust investment funds that have consistently been among the best performing funds in their respective sectors over the past 5-years. Past performance does not guarantee future success, but it does help to identify some of the quality funds and fund managers that have continually outperformed their competitors over recent years.

Fund performance figures up to 1st February 2019

Summary

Over the medium to long term you’re likely to get better returns in a stocks and shares ISA than you would with a Cash ISA. This is particularly true at times when interest rates are low, as they have been in recent years. But like any investment, it is essential to invest in an asset allocation model that is suitably balanced to fit your risk objectives.

Through the right mix of asset allocation and fund selection, investors give themselves the best opportunity to make the most of this year’s ISA allowance and maximise their overall portfolio performance.