In the last weeks of the year global markets experienced huge disruption with the outbreak of the Omicron variant which abruptly halted plans for recovery. This merged with inflation fears, interest rate rises and all that this entails has resulted in the first 2 months of the year being the worst for investment markets since the turn of the century. Compounding this negative sentiment is the recent invasion of Russia into Ukraine, which will have Global consequences.

Needless to say, it has been an anxious and uncomfortable period for investors, with the fear of seeing portfolio values decline prompting many to make changes to their portfolios and investment strategies, with many selling off their existing funds in favour of so-called ‘value’ or ‘recovery’ funds. But are such investors making a mistake? What should investors be doing during such unsettling periods for the markets?

Should You Move Into Value Stocks?

One of the themes which dominated 2021 and indeed the start of 2022, has been around the so-called ‘rotation’ from quality stocks into so-called value stocks, which in many cases is simply taken as equating to lowly rated companies. Mid last year there was some excitement over so-called reopening stocks which could be expected to benefit as and when we emerge from the pandemic — airlines and the hospitality industry, for example.

There are multiple problems with an approach which involves pursuing an investment in these stocks. Timing is obviously an issue. Another is that their share prices may already over anticipate the benefits of the so-called reopening.

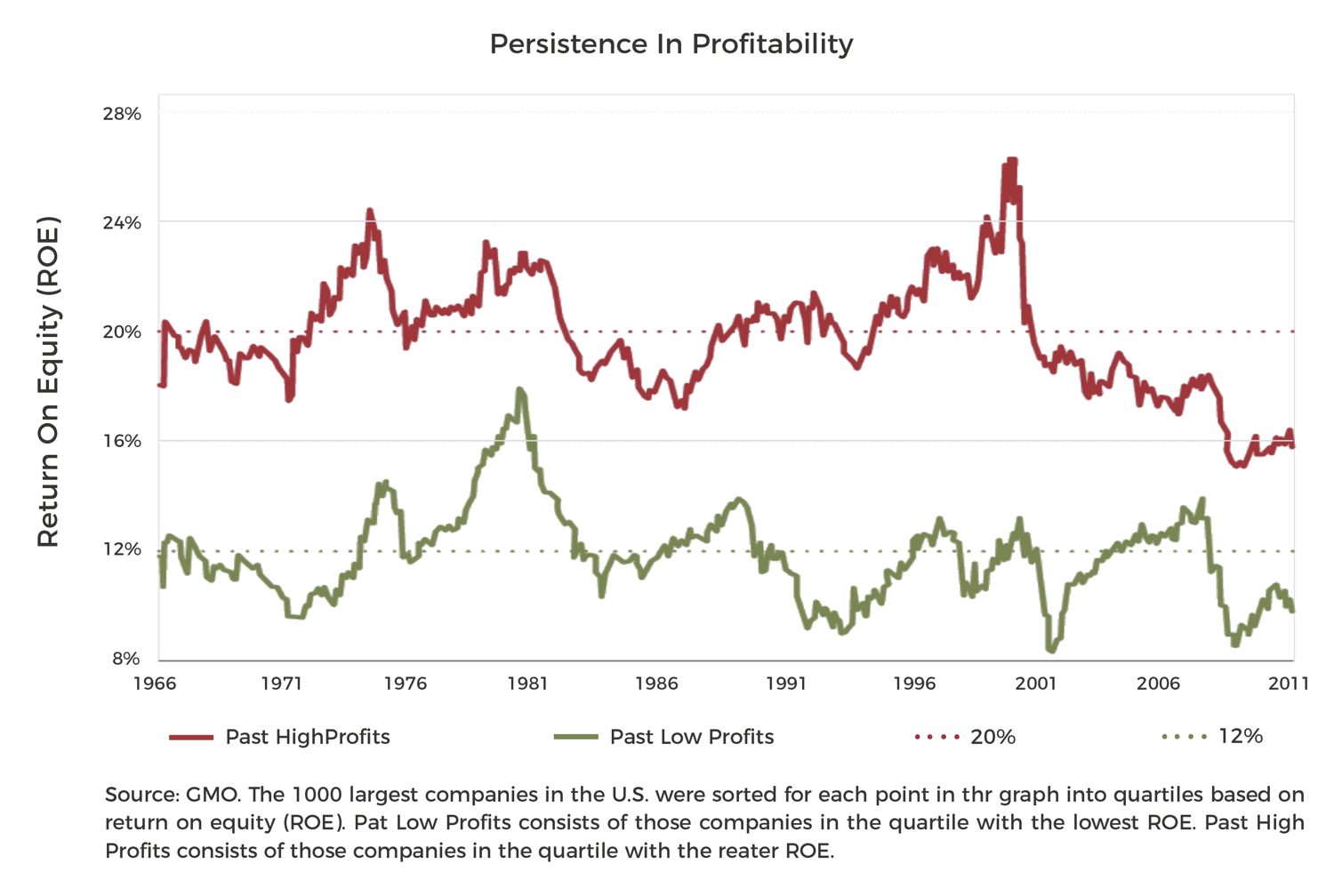

In our view, the biggest problem with any investment in low quality businesses is that on the whole the return characteristics of businesses persist. Good sectors and businesses remain good and poor return businesses also have persistently poor returns as the chart below shows:

These return characteristics persist because good businesses find ways to fend off the competition — what Warren Buffett calls ‘The Moat’ — strong brands; control of distribution; product development, innovation, marketing and promotion; patents and installed bases of equipment and/or software which are troublesome to change for example.

Poor returns also persist because companies which have many competitors, no control over pricing and/or input costs, and an ability for consumers to prolong the life of the product in a downturn (like cars) cannot suddenly throw off these poor characteristics just because they are lowly rated and/or benefit from an economic recovery.

Contrary to the mantra that every fund has to recite, past returns of companies are a good indicator of efficiencies and potential future returns.

Even if you manage to identify a value fund whose holdings are in companies whose values are currently low, and time the rotation into that fund correctly so as to make a profit, this will not transform it into a good long term investment. This is because you would need to sell it at a good moment (presumably when other investors will be doing so).

Simply because ‘value’ funds may invest in cheap companies with the potential to have a greater recovery, will not transform them into good funds. In the long run it is the quality of the businesses within the funds you invest in which determines your returns.

Why Not Taking Action Can Be The Best Course of Action

When investing it is difficult if not impossible to find funds which are resilient in a downturn but which also benefit fully from the subsequent recovery. Of course, you could try to trade out of the former and into the latter at an appropriate time but trying to time markets is never recommended and rarely ends positively.

In short, we believe it would be a mistake to sell funds that invest in good businesses in order to invest temporarily in ‘value’ funds who invest in companies which are much worse but may seem to have greater short term recovery potential.

One of the most important things to remember when investing is that you don't lose any money unless you sell. Even if stock prices plummet, you haven't technically lost anything as long as you continue to hold your investments.

Eventually, the market will recover. The stock market has experienced dozens of crashes and corrections over the decades, and it's bounced back 100% of the time to recover and grow further.

By holding your investments, you can simply ride out the storm and wait for prices to rebound. Again, you won't lose anything if you don't sell, and your portfolio will bounce back.

The key, then, is to make sure you're investing in quality long-term stocks. The best investments are the ones with solid underlying fundamentals, as they're the most likely to survive market volatility. By filling your portfolio with stocks from strong, healthy companies, it's very likely your investments will survive even the worst market crash.

Investing Should Never Be A Short Term Strategy

“Time in the market is more important than timing the market.” It is impossible for anyone to know exactly when share prices might rise or fall, so investors should remain focused on their long-term objectives, rather than trying to guess when a correction will occur.

Adopting a ‘buy-and-hold’ strategy means that you stay invested throughout market cycles, helping prevent you from making any knee-jerk reactions during turbulent times which could mean you sell at just the wrong time.

As you’re holding your investments for the long term, it also means you’ll pay less in fees as you’re making fewer transactions.

Avoid Emotional Investing

Whatever you do, don’t let your emotions dictate your investment decisions. It’s important not to be scared by a falling market, so always think about the reasons why you picked your investments in the first place, and refer back to this when you are feeling spooked.

Considering in advance how you may react to a market correction could help prevent you from making any expensive mistakes, and selling shares at a loss instead of waiting for an upturn in the market.

Remember too that corrections are going to occur and are an inevitable part of investing. They might be unsettling, but holding your nerve could be the best way to protect your investments.

No investment strategy will outperform in every reporting period and every type of market condition. So, as much as we may not like it, we can expect some periods of underperformance.

Of course, if the quality of your portfolio was low during previous market cycles it is reasonable to assume it will be poor going forward, so in such circumstances reviewing your portfolio and its underlying fund performance would be beneficial in helping to identify whether or not alternative options need to be considered.