If left unattended, portfolio drift (the unmonitored increase of decrease of asset class proportion) can impact your portfolio to such a degree that it can significantly increase risk resulting in damaging losses.

Portfolio drift is a natural part of investing. It occurs when the balance of assets in a portfolio shifts over time to differing degrees as each performs differently. Higher risk asset classes, such as emerging markets, will typically experience greater movement than lower risk asset classes such as cash or bonds. As a consequence, the portfolio growth or losses from such movements will alter the portfolios composition, resulting in more or less weighting in one or more asset classes.

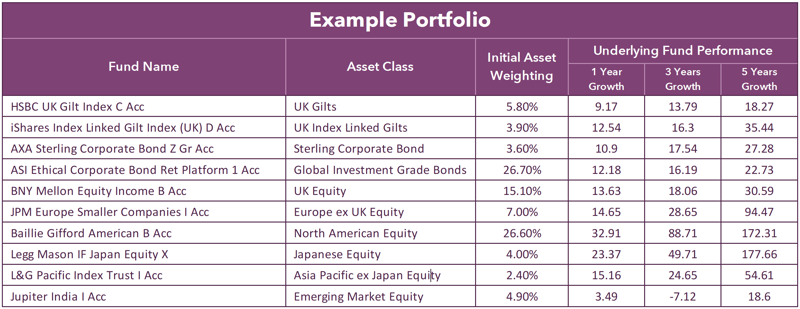

To show the impact of portfolio drift we built a sample portfolio using a spread of funds from several different fund management firms that were then balanced to fit the same asset allocation model that is used by Vanguard for their LifeStrategy 60% Equity fund, which is one of the largest funds on the market with over £8 billion of client money under its management.

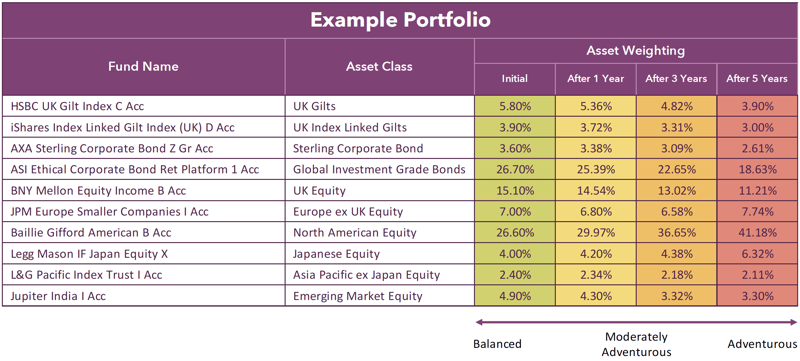

This report identifies that left for just 5 years without rebalancing, a mid-level risk portfolio would go so far out of kilter that it would take on a level of risk that is more suitable to a very adventurous investor.

Key Findings

- Our sample portfolio shows that if it wasn’t rebalanced for 5 years the weighting of assets changed by as much as 64%.

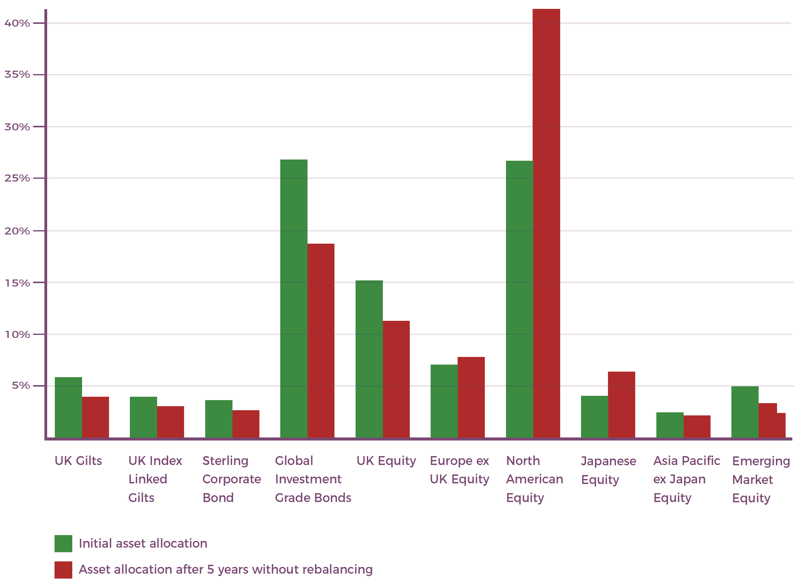

- The North American sector has been one of the top performing sectors of recent years. In our sample portfolio, an initial 26.6% weighting in North American assets increased to 41.18% after 5 years of no rebalancing.

- In just 5 years, the asset allocation of balanced portfolio suitable to a mid level risk investor drifted to such a degree that it ended up as a high risk portfolio suitable to adventurous investors.

How Portfolio Drift Hides Behind Performance

The increase in risk from a portfolio’s shift in balance is often masked by an increase in performance, as during periods of growth higher risk portfolios typically achieve better returns, and unaware of their portfolios increase in risk, it can be easy for investors to wrongly attribute this increase in performance to the underlying quality of their portfolio.

Unfortunately, the realisation that a portfolio is assuming much more risk than intended can sometimes come at great cost.

It is not until markets drop (and their portfolios sustain much greater losses than they were prepared for) that any issues with a portfolio’s balance become apparent - At which point, it can be too late.

This was the unfortunate reality for some investors as a result of the financial crash of 2008. When the crash came, the portfolios of those who failed to regularly rebalance experienced much larger losses than they thought possible. This devastated many people’s net worth and forced many to postpone their retirement.

About This Report

To provide a representative example of the effect of portfolio drift and the implications failing to address this drift can have on a portfolio, we built a sample portfolio to fit the asset allocation model as used by Vanguard for their highly popular LifeStrategy 60% Equity fund. We used 10 random funds, each of which represents a specific asset class and are managed by different fund management brands.

In Just 5 years a Balanced Portfolio Became An Adventurous Portfolio

Our sample portfolio shows that if it wasn’t rebalanced for 5 years the weighting of assets changed by as much as 64%.

Each of the funds and asset classes within the portfolio have experienced different levels of returns over the past 1, 3 & 5 years. By using these figures, we were able to identify how this variance in growth would have impacted on this portfolio’s balance over those periods. As can be seen in the above table, North American and Japanese equities have returned significantly higher returns than other asset classes in our sample portfolio. As a result, the initial weighting of 26.60% for North American equities and 4.00% for Japanese equities will increase and shift the balance of the portfolio towards these higher-risk asset classes.

After 5 years without rebalancing or addressing portfolio drift our sample portfolio’s asset allocation has skewed. The higher risk, higher growth funds now hold significantly more weighting than originally intended. Subsequently, the portfolio which was initially balanced to fit a mid-range level of risk has now shifted in balance to become much more adventurous and no longer suitable for a mid-range investor.

The swing in balance is so significant that in just a few years where portfolio drift is not addressed the increased level of risk could have catastrophic consequences for unsuspecting investors.

Why You Should Never Chase Performance

Many investors spend substantial time defining their investment goals and selecting an asset allocation to help them achieve those goals while also being mindful of their tolerance to risk. To meet their objectives they must be able to stick with an appropriate investment plan in all kinds of markets.

But for some, the lure of performance can lead them to make investment decisions that can have huge implications. For instance, when a particular sector such as the North American or the Technology sectors performs strongly, investors without a disciplined rebalancing strategy may be tempted to abandon their strategic asset allocation to increase their exposure to these markets. But such an approach makes investors vulnerable to market correction, which could ultimately jeopardise their chances of meeting their financial goals.

Portfolio rebalancing can be an emotional decision for investors, requiring the selling of currently outperforming assets to buy currently underperforming assets. But it is essential to maintain a structured, planned investment strategy that is prepared for all conditions.

A Disciplined Approach To Portfolio Rebalancing

Disciplined rebalancing is an insightful strategy for all investment seasons. It provides a means for investors to keep spreading their risks and opportunities.

There are a number of alternative rebalancing practices that investors can use to trigger the rebalancing of their portfolio's asset allocation, focusing primarily on three:

Time-only: With this approach, the only consideration is time – not how much a portfolio has drifted from its strategic asset allocation. For instance, investors following this approach might rebalance, say, annually or at set times during a year.

Threshold only: Under this strategy, a portfolio is only rebalanced when a portfolio has drifted from its strategic asset allocation by more than a predetermined percentage, such as 5%. One of the drawbacks of the "threshold only" approach is that the portfolio would require consistent monitoring.

Time and threshold: With this approach, the portfolio is rebalanced at a scheduled time, such as annually, only if its asset allocation has drifted by more than a predetermined minimum of, say, 5%.

How Yodelar Investments Use The Spread Of Assets To Improve Portfolio Efficiency

The balance of investments across different asset classes is the primary driver of portfolio returns, but the funds used to create the correct balance are essential to maximising portfolio growth and efficiency. Yodelar Investments ensure that each the funds they use to achieve this balance are consistently among the very best performers within their set asset class. Each fund selected is thoroughly evaluated by the investment committee and only the most suitable options are selected to be included in portfolios.

All sector classified investment funds are made up of a selection of holdings in companies that fit within the funds sector classification. For example, funds classified within the UK All Companies sector are required to invest at least 80% of their assets in UK equities that have a primary objective of achieving capital growth. The remaining 20% can be spread across other asset classes that the fund manager deems appropriate to the fund’s overall objectives. The spread of this remaining amount can have numerous implications which we carefully analyse when composing our portfolios.

Formulating the appropriate blend of investment funds to fit a portfolio’s specified asset allocation model and optimise growth potential is a complex process that requires thorough analysis. It is an important part of how Yodelar portfolios are built and it reveals an attention to detail that helps to improve portfolio efficiency.

Finding The Right Balance For Your Portfolio

For most, a broadly diversified portfolio of equities and bonds, that is annually or semi-annually monitored and rebalanced will produce a reasonably structured portfolio that is both controlled and cost-effective. Cost efficiency is also important to consider as rebalancing often involves transaction and tax costs, which is why an annual or semi-annual rebalancing is the most common. However, much depends on the circumstances of each investor and the rebalancing strategies they adopt.

Efficient investment advice firms can add value by helping an investor set an appropriate strategy for periodically rebalancing their portfolios in a non-emotional, cost-effective and impartial way.