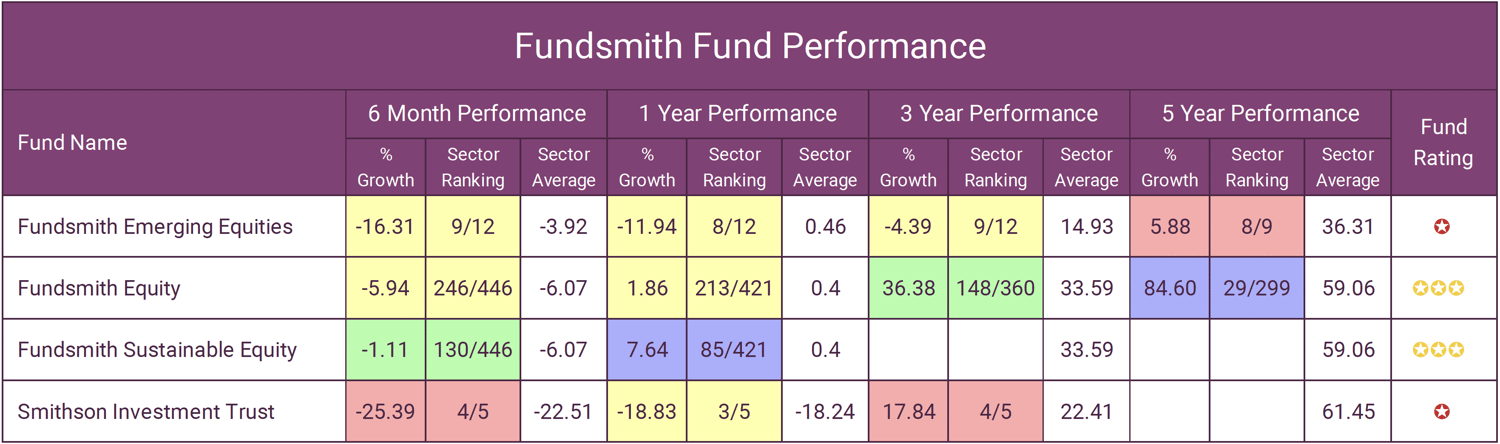

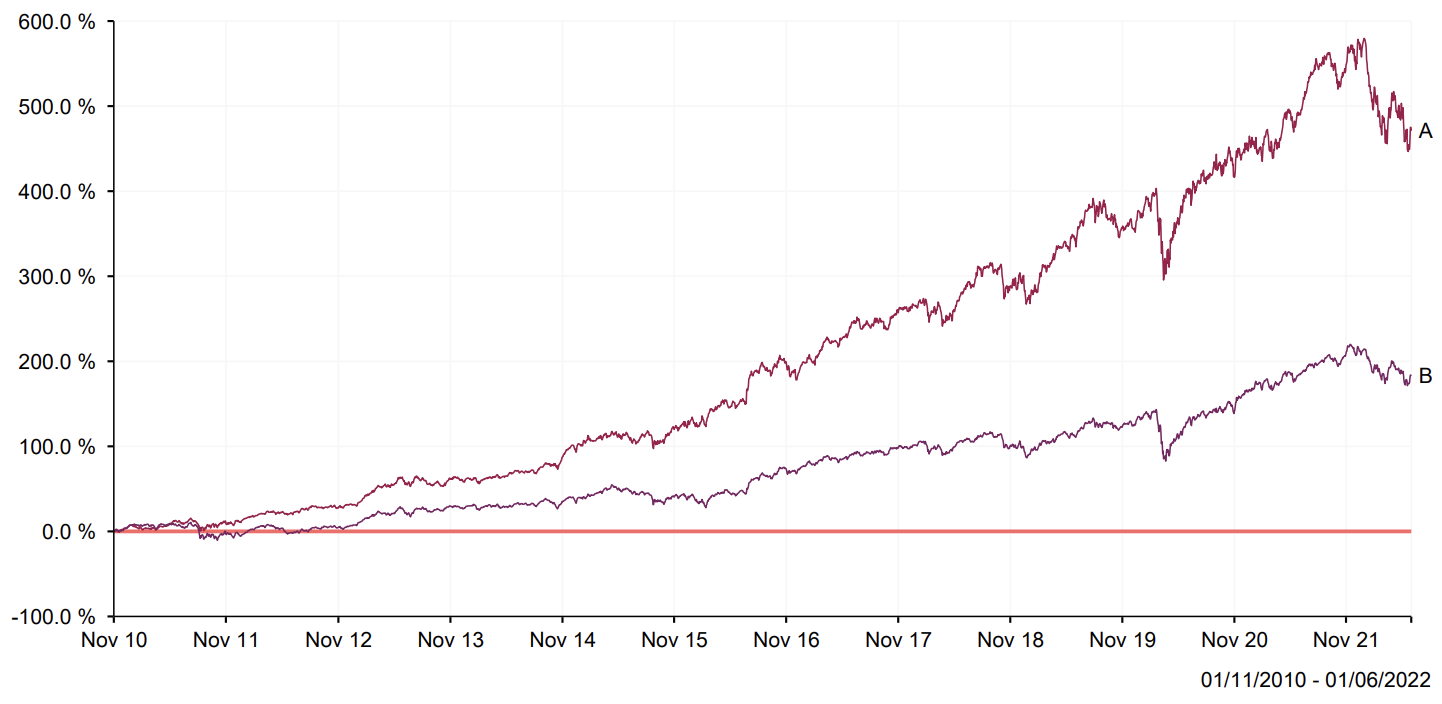

- Since inception up until 1st June 2022 the Fundsmith Equity fund has returned cumulative growth of 471%, which is considerably greater than the 182.94% sector average.

- Over the past year the Fundsmith Equity fund has delivered returns that were below the sector average.

- Since its launch in 2014, the Fundsmith Emerging Equities Trust has consistently underperformed the sector average.

The past 18 months has been a volatile time for investors with sharp and unpredictable market swings making for an uncomfortable landscape with almost all major regions, markets and industries experiencing significant challenges.

The period has seen a number of trends that have prompted some investors to alter their strategy and change the funds in which they invest.

With fluxing markets and general uncertainty, there was an increase in the number of assets held in funds with a Global strategy as investors sought comfort in Globally diverse funds, entrusting their managers to navigate the challenging market conditions.

The most popular Global equity fund and indeed the largest equity fund is, and has been for some time, the Fundsmith Equity fund with current assets under management at £27.5 billion. The fund has been a favourite of investors for some time but over the past 18 months it has experienced periods of underperformance and there have been signs that confidence in the fund is not as it once was.

In this report, we analyse the performance and sector ranking of the Fundsmith Equity fund as well as the performance of Fundsmiths' 3 other funds, the 'Smithson Investment Trust', 'Fundsmith Sustainable Equity Fund' and the 'Fundsmith Emerging Markets Equities Fund'.

Our analysis identified that despite periods of underperformance over the past 18 months, the Fundsmith Equity fund has performed comparatively well in the longer term. In contrast, the popular Smithson investment trust and Fundsmith Emerging Equities trust have both consistently underperformed.

Terry Smiths Investment Strategy

Fundsmith’s success is built on a simple investment strategy, which involves taking bold bets on a small number of companies and holding them for the long term, without paying attention to the quirks of a macroeconomy. This is rooted in Mr Smith’s belief that “nobody is capable of consistently predicting macro events” and that it is more worthwhile to identify good companies, a skill he honed over decades working as an analyst. “You might think every fund manager tries to invest in good companies, but I can assure you they don’t,” he says. “At Fundsmith we have spent a lot of time coming up with a definition of what is a good company.” Fundsmith invests in mature companies with strong balance sheets and established brands, which are capable of reinvesting their profits and compounding value for investors over time, while excluding cyclical sectors, such as mining and financials.

He avoids companies that require leverage to generate profits, which is why he won’t invest in companies which require borrowed money to function or survive – such as banks.

Terry Smith says that his philosophy of investing in good companies is easier said than done, but he believes most other fund managers don’t do this. “Very few investment managers boast about the fact that they invest in low quality businesses, but most of them do, often because they consider such businesses as ‘cheap’.

They buy these companies because they believe the price to be too low relative to their assets or earnings and then wait for the market to revalue them upwards. This is logical; however, the revaluation will depend on the whim of the market or events which are difficult to predict, such as the business cycle, takeovers, restructuring or management change.

So the revaluation might happen quickly, it might take a long time, or it may never happen at all. None of these are particularly good for an investor.”

Download the full Fundsmith Review here >>

Focus on Long Term Quality Not Short Term Trends

Terry Smith has dismissed the last years trend that saw many investors move into so called value stocks, insisting his focus on quality growth companies will win out in the long term and that ‘no amount of recovery or low valuation will turn a poor business into a good one’.

The veteran stock picker was irritated by commentary around the stock market shift at the start of 2021, which caused companies that would benefit from lockdown ending to surge, while growth stocks fell out of favour.

The Fundsmith Equity fund went on to lag the MSCI World index in five of the seven months from November to May.

But the value trade has petered out over the last number of months as concerns about the strength of the economic recovery have mounted, leading investors to switch back into quality growth stocks.

Smith said: "there are several lessons to be learnt from this, not the least of which is that no amount of recovery or low valuation will turn a poor business into a good one and quality is the main determinant of long-term performance.

Fundsmith Equity Fund (471.00%)

IA Global Sector Average (182.94%)

Fundsmith Equity Fund

The table above shows that since its inception, the Fundsmith Equity fund has significantly outperformed the sector average. This is even after the highly volatile past several months which have hit the fund hard compared to many of its peers.

Since inception up until 1st June 2022 the Fundsmith Equity fund has returned cumulative growth of 471%, which is considerably greater than the 182.94% sector average and one of the best Global funds, and better than some of its most popular rivals including Lindsell Train.

Fundsmith Sustainable Equity Fund

Despite previously saying that ethical funds perform poorly, Terry Smith entered the sustainable investment market in November 2017, by launching his Fundsmith Sustainable Equity fund.

The Fundsmith Sustainable Equity Fund follows the same Global strategy as the highly successful Fundsmith Equity Fund but as an ethical themed fund it has a number of key differences. The fund excludes sectors that do not fit sustainability categories of environmental, social, governance and innovation.

Sectors excluded from the Sustainable Equity fund are:

- No Aerospace and Defence

- No Brewers, Distillers and Vintners

- No Casinos and Gaming

- No Gas and Electric Utilities

- No Metals and Mining

- No Oil, Gas and Consumable Fuels

- No Pornography

- No Tobacco

The sustainable investment industry is of growing importance to investors and Fundsmith aims to capitalise on this interest with their Sustainable Equity fund. The fund currently manages £613 million of client assets, which although small in comparison to their flagship equity fund it is still a sizeable share of the ethical investment market.

This fund has closely mirrored the performance of the Fundsmith Equity fund and since its launch in November 2017 it has returned growth of 64.93% up to 1st June 2022.

But over the last 12 months the fund has performed better than 80% of competing funds within the IA Global sector with returns of 7.64%.

Fundsmith Emerging Equities Trust (FEET)

Fundsmith launched FEET as a variation on their existing investment strategy with the Fundsmith Equity fund but with one added dimension: the companies invested in by FEET will have the majority of their operations in, or revenue derived from, Developing Economies and will provide direct exposure to the rise of the consumer classes in those countries.

Since its launch in June 2014, the performance of the Fundsmith Emerging Equities Trust has been very disappointing and yet to come close to that returned by the Fundsmith Equity fund. For the 5 year period up to 1st June 2022, the trust has only managed to return growth of 5.88%, which is well below the 36.31% sector average for the period.

In 2019, disappointed by the trust's performance, Terry Smith apologised to his investors and announced that he was handing over the day to day control of the trust. At the time Smith said, ‘Every human being, including me, has a limit to the amount of things they can focus on,’ he said. ‘Having people who are actually full time working on the trust as portfolio managers is more of a necessity than I thought it was.’ Indeed, since the handing over of the trust its performance has been more in line with the sector average, which is still some way short of expectations.

Smithson Investment Trust

When Smithson launched in October 2018, it received unprecedented demand that saw it break the record for raising the greatest amount ever by a UK domiciled trust in its initial public offering (IPO).

Terry Smith launched Smithson as he believes small and medium sized companies have been shown to outperform large companies. Smith points out that small and mid cap companies have fewer research analysts studying them than larger ones and as such, it stands to reason that there may be less known about the mid cap stocks and consequently more discrepancies between price and value that Smithson can take advantage of.

Fundsmiths philosophy for Smithson is to look at companies within industries which have a history of delivering long-term value and avoid the temptation of looking at companies in industries that do not. One of the reasons for this is because Fundsmith believe there are many fads in investing which come and go: “the Dotcom boom; the mining “supercycle” (which turned out to be just a plain old cycle); the credit bubble; and most recently the cryptocurrency craze, one more example in a continuous stream of ‘new’ ways to make money. There are no new ways to make money. It is now a subject over which people have obsessed for centuries and so radical discoveries are unlikely.”

The Smithson has experienced a difficult few years. It has performed below the sector average over the past 3 years with returns of 17.84% well below the 22.81% sector average.

Since its launch in October 2018 up until 1st June 2022, the Smithson has returned growth of 28.30% which is still above the average of 25.29% for the period.

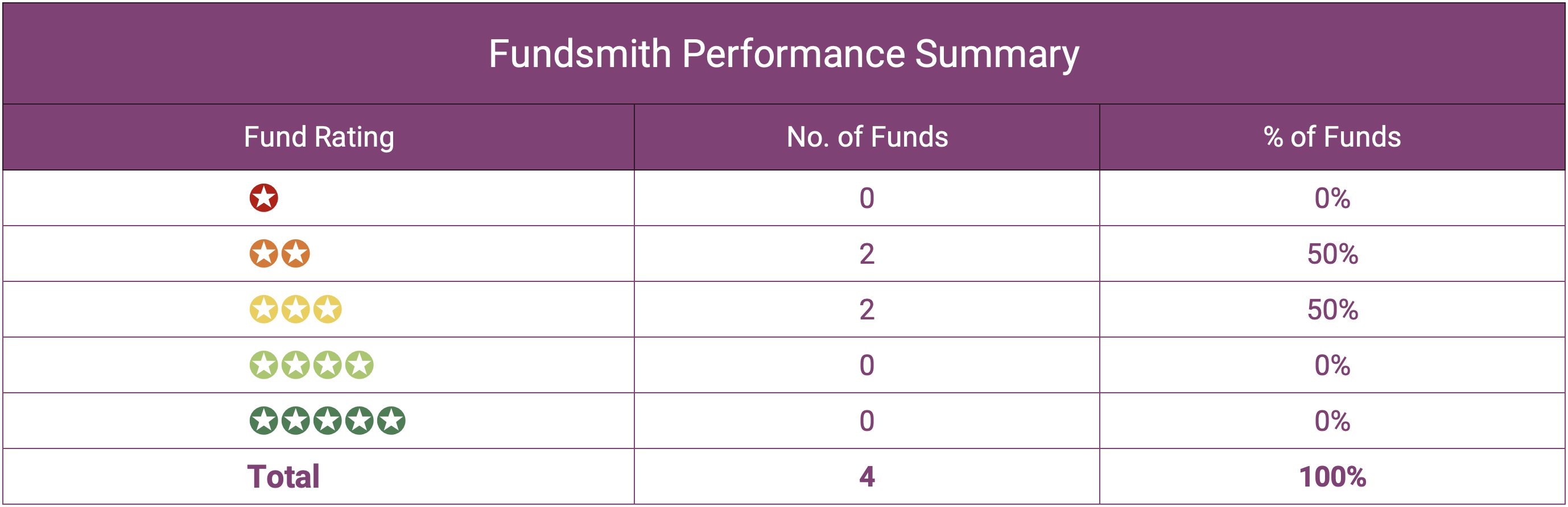

Fundsmith Performance Summary

It is undeniable that the Fundsmith Emerging Equities Trust and Smithson Investment Trusts have both underwhelmed, with better performing alternatives available in their sectors.

Fundsmiths flagship equity fund has also endured a difficult period but as identified in this report the Fundsmith Equity fund has a history of outperforming its peers in the longer term, which reflects Fundsmiths ability to develop and deliver superior risk adjusted return to investors through a Global investment strategy.

Terry Smith is often outspoken and not afraid to ruffle industry feathers but as a fund manager his results are somewhat of a mixed bag.

Despite the underperformance of his investment trusts and the difficulties experienced by his equity and sustainable equity funds Smith remains as confident as ever that his strategies will deliver in the long term.

Get A Free Performance Analysis of Your Portfolio of Funds

Over 90% of investors are unaware they are invested in poor performing funds, funds that rank in the worst 25% of their sector. Upload a statement, or spreadsheet showing the breakdown of your investment funds and our team will generate your free analysis

Our portfolio analysis service provides a clear insight into how each of your individual funds is performing while grading your entire portfolio based on its overall performance - making it easy to identify areas for potential improvement.