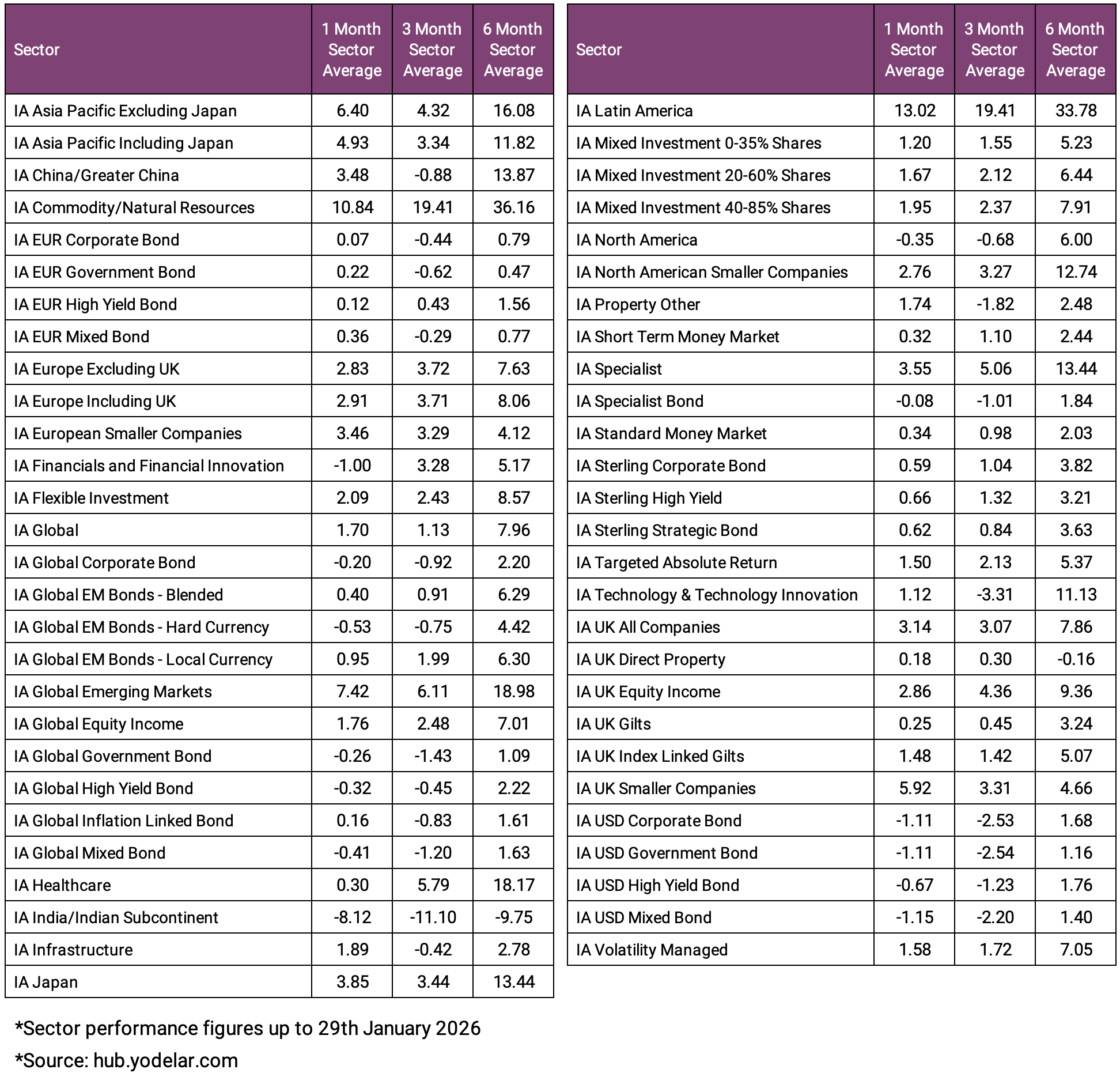

- We analysed more than 4,000 Investment Association sector classified funds, reviewing average returns across 1 month, 3 month and 6 month periods to understand how markets have moved recently.

-

Most sectors remain positive over six months, but shorter term results vary widely, with clear differences between regions and asset types.

-

Several smaller sectors, including Latin America, commodities and global emerging markets, have delivered some of the strongest recent average returns.

-

North America and technology have produced weaker average results over one and three months, despite remaining positive over six months.

Recent market conditions have delivered very different outcomes depending on where capital has been allocated. Some parts of the market have continued to grow, while others have struggled.

To understand what has driven these differences, we analysed 4,321 Investment Association sector classified funds. The analysis reviews average sector returns over the 1, 3 and 6 month periods analysed, providing a clear view of how different areas of the market have behaved without relying on individual fund examples or short term commentary.

The data shows that while most sectors have continued to deliver growth, results have varied significantly. Several of the largest IA sectors have been among the weaker performers over the periods analysed, highlighting how uneven recent market progress has been.

Sector Averages

Most Sectors Remain Positive Over Six Months, but Shorter Periods Vary

Across the full dataset, most Investment Association sectors delivered positive average returns over the six month period analysed. This helps explain why broader market progress has remained intact over that time.

Shorter periods tell a different story. Over the 1 and 3 month periods, a number of sectors recorded weaker or negative average returns, including several of the larger developed market equity sectors. At the same time, some smaller sectors delivered stronger short term growth.

This contrast highlights an important feature of recent markets. While six month results have remained positive for many sectors, short term performance has been more uneven, with outcomes increasingly dependent on sector allocation rather than overall market direction.

Stronger Returns Have Come From a Narrow Group of Sectors

A small number of sectors have stood out over the periods analysed.

Latin America delivered the strongest average returns across all three periods. Although the sector is relatively small, returns were consistently strong across the funds included, rather than driven by a single outlier.

Commodity and natural resources funds also recorded strong average returns. However, results within this sector varied considerably between individual funds, meaning outcomes would have differed significantly depending on fund selection.

Global Emerging Markets produced solid average returns across one, three and six months. With a large number of funds contributing to the sector average, this suggests broader participation rather than isolated performance.

These sectors represent more specialist areas within the IA universe and sit outside the largest developed market groupings.

Asia and Japan Have Delivered Steadier Progress

The IA Asia Pacific excluding Japan and the IA Japan sectors both delivered positive average returns across the periods analysed.

While these sectors did not produce the strongest short term gains, returns were more consistent and did not rely on a single strong month to lift averages. This type of performance pattern can be overlooked but plays an important role in portfolios seeking regional diversification.

North America Has Been Weaker Over Shorter Periods

Although the IA North America sector remained positive over the six month period analysed, average returns were negative over both the one and three month periods. This reflects a period where gains have been harder to achieve compared with other regions, as geopolitical uncertainty and currency movements have weighed on GBP based returns.

It is also notable that IA North American Smaller Companies delivered stronger results than the broader North America sector over recent months, showing that smaller companies have held up better during periods of volatility.

Technology Has Been Less Reliable in the Short Term

The IA Technology and Technology Innovation sector remained positive over the six month period analysed but delivered weaker results over the three month period.

This follows a prolonged period of strong growth, which has left many technology focused funds more sensitive to changes in market expectations. As a result, returns have been more uneven over shorter periods, with sharper movements than seen in some other sectors. The data also shows a wide spread of returns between individual funds, reinforcing that fund selection remains important even within established areas of the market.

UK and European Equities Have Held Up Better Than Expected

UK and European equity sectors delivered positive average returns across the periods analysed.

IA UK All Companies, IA UK Equity Income and IA Europe excluding UK all recorded steady results. IA UK Smaller Companies delivered a strong one month return, although weaker earlier performance reduced the six month average.

Bonds and Cash Have Behaved as Expected

Bond sectors generally delivered modest positive returns, consistent with their defensive characteristics.

Sterling based bond sectors were relatively stable. In contrast, US dollar bond sectors delivered weaker results in GBP terms over shorter periods, reflecting currency movements rather than bond price changes alone.

Money market sectors remained stable, producing small but predictable positive returns.

One Sector Has Stood Out for the Wrong Reasons

IA India and Indian Subcontinent was the only sector to record a negative average return across all three periods analysed.

This does not indicate long-term weakness. It does, however, show how quickly results can change within individual regions, even when most other sectors have delivered positive returns.

Sector Averages Do Not Tell the Full Story

While sector averages provide useful context, the data shows that results within the same sector can vary between funds.

In many sectors, the gap between the strongest and weakest fund was significant. This means that two investors holding funds from the same sector could have experienced very different outcomes over the same period.

This remains a consistent finding across our analysis: sector performance sets the backdrop, but fund selection plays a major role in results.

What This Tells Us About the Current Market

Three clear observations emerge from the data.

1. Recent gains have not been evenly spread. Some sectors have delivered strong results, while others have struggled over shorter periods.

2. Several of the largest developed market equity sectors have been less reliable in recent months.

3. Differences between funds within the same sector can be significant, reinforcing the need to look beyond sector labels alone.

Markets have continued to move forward overall, but outcomes have depended heavily on the mix of sectors and funds held.

Reviewing Portfolios Against Current Market Conditions

Sector analysis is most useful when applied at portfolio level.

A portfolio review can help show how individual holdings have performed against their sector averages, where exposure may be more concentrated than intended, and whether recent results reflect market movements or fund choice.

If you want an objective review of how your portfolio compares with the wider market, you can request a no-obligation portfolio analysis or book a call to discuss what the data shows and how it relates to your current investments.

Past performance is not a guide to future returns. This article is based on historic analysis and does not constitute personal advice.