Whether your portfolio is efficient and performing well or whether it lacks quality and is underperforming can only be determined by comparing its growth to that of a similar risk portfolio that is comprised only of consistently top performing funds.

The unfortunate reality is that many investors could achieve substantially greater growth on their investments, without increasing risk, but by placing their money within the consistently best performing funds.

No one can accurately predict the future, but from transparent data we can identify the funds and the relevant fund managers that consistently demonstrate a level of skill within their chosen sector to achieve better returns than other funds and their fund managers.

How does your portfolio growth compare?

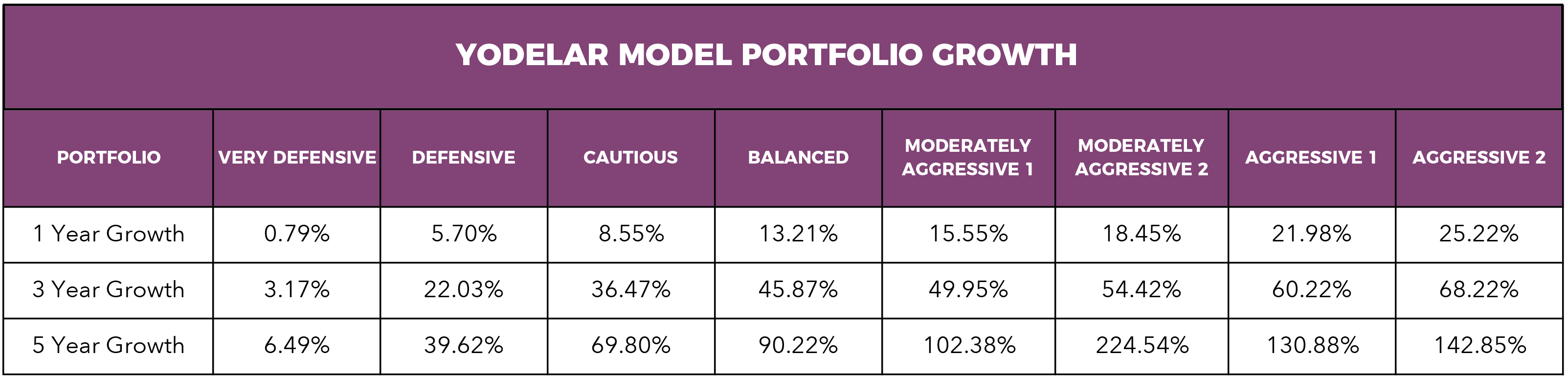

Different levels of risk will influence the growth potential of your portfolio. Comparing the growth achieved by your portfolio to that of a similar risk portfolio that is comprised of consistently top quartile performing funds will allow you to identify the overall quality of your portfolio.

Growth figures up to October 2017

Growth figures up to October 2017

Identify if your funds are TOP or POOR performing

As an investor, you have the choice to invest in funds that consistently deliver top performance OR funds that underperform within their given investment sector. Investors are continually informed that past performance is not an indicator of future success, but in every aspect of life past results/quality of work is an important metric in choosing a product or service provider. Past performance can identify fund manager expertise, and an ability to do better than their peers. In every industry past performance is relevant - the investment sector is no different.

No one knows what the future holds but fund managers who have consistently achieved top performance offer better potential than those who have a history of poor performance.

With the Yodelar portfolio review tool you are able to clearly identify the exact performance and sector ranking of each fund you are currently invested in. This helps establish the quality of investment advice you have received or the fund choices you have personally made to date as a self-investor. Our independent fund review service has helped 1,000’s of investors identify poor fund selection (or bad advice), identifying a need to improve their portfolio.

Does your portfolio fit your risk profile?

The 2 most important elements of investing are asset allocation and fund selection. The asset allocation model of your portfolio will reflect your overall investment objectives and the level of risk you are willing to take to reach those objectives.

Each fund is classified within a particular investment sector based on the type of asset, region or industry in which they invest. Each sector therefore represents different growth potential and different levels of risk. How you spread your portfolio allocation across these sectors dictates the level of risk you are willing to assume.

Over time, the asset allocation of your portfolio will change as different sectors perform better or worse than others. This can result in an investment portfolio assuming more or less risk than intended. For example, someone who is a ‘middle of the road’ or a balanced investor may initially have 5.5% of their portfolio invested in higher risk ‘Global Emerging Markets’ funds (funds that focus on capital growth by investing in companies within emerging market countries). As a higher risk sector it has the potential to deliver greater growth than lower risk sectors such as the ‘Money Market’ sector, which is focused on capital protection. If the funds within the emerging markets sector grow more than other sectors the initial 5.5% held in these funds may now be much greater which will alter the allocation of your portfolio. This may result in a balanced investor unwittingly assuming a more aggressive investment profile with more associated risk /downside.

The Most Efficient Process

1. Asset Allocation

The asset allocation model of any portfolio or ISA is the single most important aspect of investing and is critical to ensuring your portfolio does not assume more or less risk than you are comfortable with. Investing in funds across varying asset classes allows you to diversify, minimising the impact on your portfolio should one sector take a dip.

Once your asset allocation model is defined, it is important to regularly review your portfolio and rebalance if required. Rebalancing is the process of realigning the weightings of assets in your portfolio when one sector grows more than another, shifting the percentage you have invested within particular sectors.

2. Fund Selection

Selecting funds that consistently outperform their peers and fit within a suitable asset allocation model will help investors to maximise their portfolios growth potential.

If your portfolio is managed by a financial adviser you want to make sure you are partnered with someone with a knowledge of fund performance. There are financial advisers who demonstrate great expertise and knowledge when it comes to fund selection. However, fund performance is not a regulated aspect of financial planning, and financial advisers are not required to research funds. As a result, a large proportion demonstrate a poor level of knowledge on fund performance or the actual quality of funds they recommend.

By ensuring your portfolio contains only consistently top performing funds, within an asset allocation model suitable to your risk profile, you have added the 2 main ingredients to building a successful portfolio.

Whether you prefer to manage your own portfolio or have someone do it for you, Yodelar is an essential knowledge base suitable for all investors. As a subscriber, investors have access to all factual fund performance and ranking reports, including the top performing funds report, detailing all funds that have consistently maintained top quartile sector performance over the recent 1, 3 & 5 years. These factual and independent reports enable investors to clearly identify which funds are top or poor performing, and help investors to make more informed investment decisions.

Maximise your portfolios efficiency

Our model top performing portfolio's represent a realistic benchmark of what can be achieved by investing in consistently top performing funds within a suitable asset allocation model. Only by comparing your portfolio growth to that of a similar risk top performing portfolio can you clearly define how well your portfolio has performed.

By following the processes detailed in this article investors have the ability to efficiently maximise their portfolio performance and potentially achieve greater levels of future growth from their portfolio without assuming any extra or unnecessary risk.