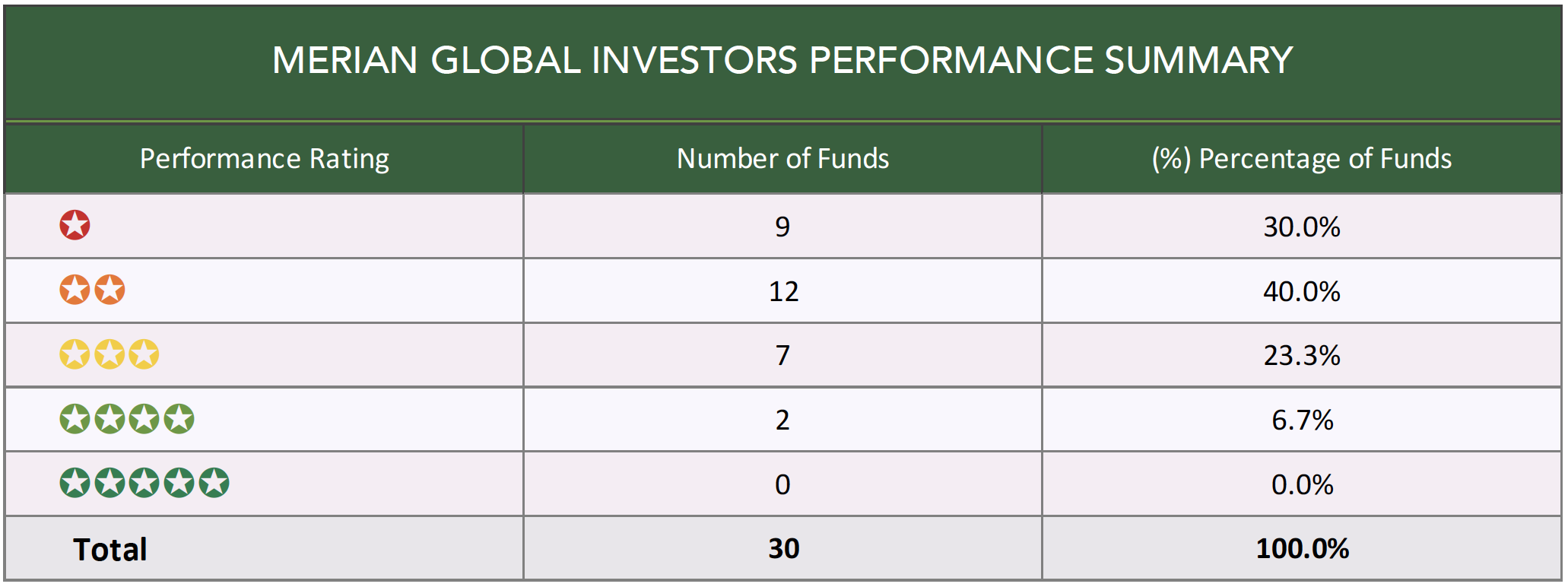

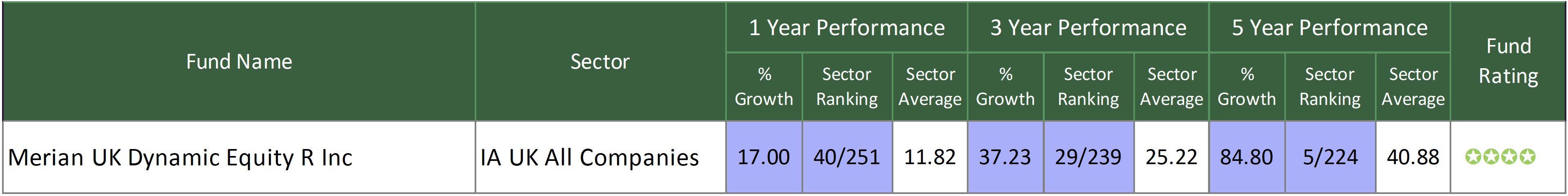

- The Merian UK Dynamic Equity fund returned 5 year growth of 84.80%, which was more than 3 times greater than sector average.

- Over the past 5 years the Merian UK Smaller Companies Focus fund outperformed 81% of competing funds within the same sector.

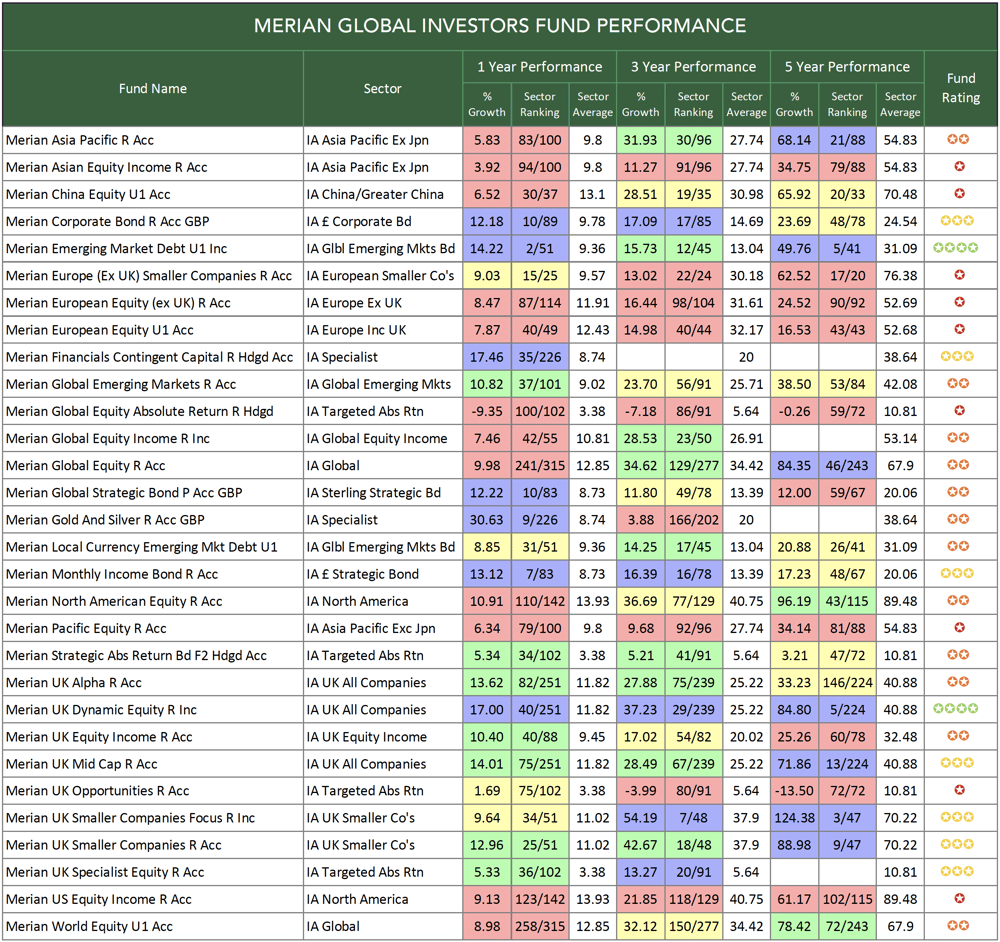

- Of the 30 Merian funds analysed, 70% received a poor 1 or 2 star rating for their performance over the past 1, 3 & 5 years.

In September 2017, it was announced that Old Mutual Global Investors was to separate their multi-asset and single-strategy teams into two distinct companies. The company that would mainly focus on investments in single asset classes, such as UK shares or bonds, was to be renamed Merian Global Investors.

Merian Global Investors formed in June 2018 when its management team, together with funds operated by the global growth private equity firm, TA Associates, acquired the “single-strategy” investment capabilities of Old Mutual Global Investors.

The firm said the Merian name is inspired by the “remarkable life of the scientist, artist and adventurer Maria Sibylla Merian”. Born in Frankfurt in 1647, the company said Merian is considered one of the first scientists to challenge and debunk widely believed myths about her discipline. At the time, the then CEO Richard Buxton said ‘the Merian name represents our core belief that investors should not be constrained by a ‘house view,’ demonstrating our understanding that investment can be considered both an art and a science.'

In recent months, the firm has experienced heavy withdrawals as investors, concerned with the performance of Merian funds, have decided to move elsewhere.

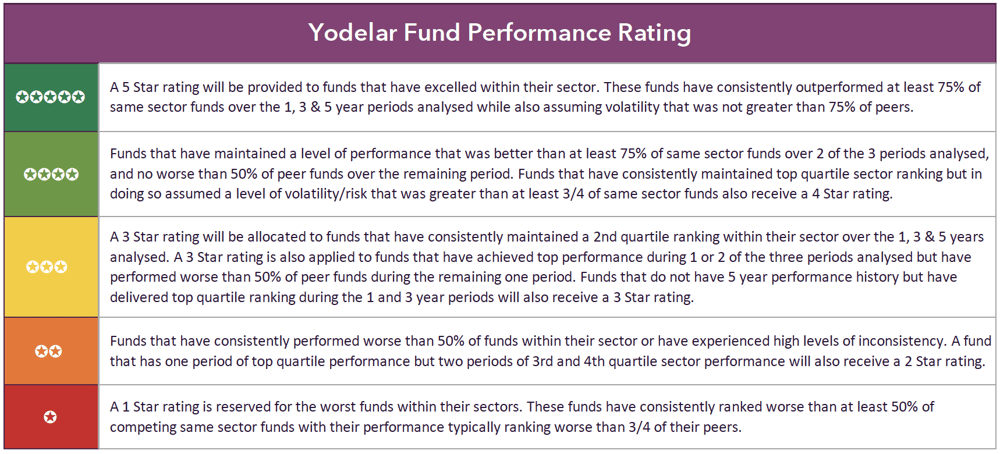

To find out how their funds have performed we analysed the performance and sector ranking of each Merian fund over the past 1, 3 & 5 years, and identified the majority of funds to be consistently underperforming.

Merian Fund Performance Summary

From our analysis of 30 Merian funds, 9 (30%) received a very poor 1-star performance rating. Each of these 9 funds has consistently ranked among the very worst in their respective sectors. 12 Merian funds (40%) received a poor 2-star rating for consistently performing below the sector average. 7 funds (23.3%) had a mediocre 3-star rating with the remaining 2 funds receiving a positive 4-star performance rating.

The Best Merian Funds

One fund has managed to maintain a top-quartile sector ranking over the recent 1, 3 & 5 years, with the vast majority of their funds struggling for competitive performance.

Merian UK Dynamic Equity

From all 30 Merian funds analysed for this report, the Merian UK Dynamic Equity fund was the only one that has been able to maintain a top-quartile performance ranking within their sector over the recent 1, 3 & 5 years.

The Merian UK Dynamic Equity fund invests primarily in UK companies outside the FTSE 100, with consumer services companies and financial companies accounting for roughly half of their total holdings.

Over the past 1, 3 & 5 years this fund has returned growth of 17.00%, 37.23% and 84.80%, whereas the average growth across all 251 funds in the same sector was 11.82%, 25.22%.

Merian Emerging Market Debt

The Merian Emerging Market Debt Fund invests in bonds and similar debt investments issued by governments and other public entities and companies. At least two-thirds of the Fund's value is invested in emerging market countries and over the 5 year periods, it has been one of the top performers in its sector with growth of 49.76%. In contrast, the average growth for the sector over the same period was 31.09%. Despite ranking in the 2nd quartile of its sector for performance over 3 years, over the most recent 12 months it has ranked 2nd out of 51 funds within the same sector with growth of 14.22%, which was considerably higher than the 9.36% sector average.

Merian UK Smaller Companies Focus

The Merian UK Smaller Companies Focus fund launched 14th January 2002 with the aim of providing capital growth from investing primarily in an equity portfolio of UK smaller companies.

Over the past 10 years, this fund has returned cumulative growth of 419.90%, which was considerably higher than the 231.59% averaged by all other funds in the IA UK Smaller Companies sector. Over the last 5 years the funds growth of 71.86% ranked it higher than 81% of competitors. However, over the recent 1 & 3 year periods analysed the fund has slipped down the sector rankings with growth of 12.96% and 42.67% respectively. These figures were still above the sector average but they were not quite high enough to maintain a top-quartile sector ranking for the periods.

The Worst Merian Funds

Of the 30 Merian funds analysed, 70% received a 1 or 2-star performance rating as they each consistently ranked among the worst in their sectors for performance.

Merian European Equity

Among the funds to consistently underperform was the Merian European Equity fund. This fund holds a diverse range of assets across many European markets, but it is primarily weighted in the UK, French, Swiss and German companies with holdings predominantly in financial and healthcare companies. Over the past 5 years, this fund has had the worst performance in its sector, ranking 43rd out of 43 funds. This fund has consistently been one of the worst in its sector with recent 1 and 3-year growth of 7.87% and 14.98% falling well below the sector average. In comparison, the Fidelity European Dynamic Growth fund, which sits within the same sector, returned growth of 25.60%, 59.13% and 107.47% over the past 1, 3 & 5 years.

Merian Pacific Equity

The Merian Pacific Equity fund has consistently underperformed compared to competing funds within the same sector. Over the past 3 & 5 years this fund returned growth of 9.68%, and 34.14%, which fell below the sector average of 27.74% and 54.83% for the period, and ranked worse than 92% of its peers. Since its launch (18th June 2010), the Merian Pacific Equity fund has returned cumulative growth of 89.74% which is some way behind the sector average of 103.29% for the same period.

Merian US Equity Income

The Merian US Equity Income fund launched 11th April 2002 and it currently manages £171 million on behalf of UK investors, many of whom remain unaware that the fund has consistently ranked among the bottom of its sector. The North America sector has enjoyed a long period of high returns with the sector averaging growth of 89.48% over the past 5 years.The Merian US Equity Income fund has continually delivered returns that fall well below the sector average and nowhere near the returns of the top performers.

Over the past 1, 3 & 5 years this fund returned growth of 9.13%, 21.85%, and 61.17%, which was consistently worse than at least 86% of all funds within the IA North America sector. In contrast, the Artemis US Select fund, which has consistently been one of the top-performing funds in the North America sector, returned growth of 18.08%, 58.94%, and 118.07% over the same 1, 3 & 5 year period.

Merian Funds Blighted By Poor Performance

Merian funds have taken a hit in recent times with some of their funds rooted at the very bottom of their associated sectors. This poor performance has had a big impact on their business prompting huge outflows that have forced them to cut their workforce to reduce costs. For investors, none of this instils confidence, particularly in the wake of the Woodford fiasco, and with many better performing funds on the market, it is not difficult to see why investors and advisers are looking elsewhere. Yet despite a large proportion of their funds underperforming, Merian have a proportion of funds that have performed well in comparison to their competitors. Their UK Dynamic Equity fund has consistently maintained a top quartile sector ranking with few competitors able to match its quality, and as such, it has been an excellent UK equity for investors.

The overall performance of Merian funds has been a disappointing, but like most fund managers, a selection of their funds, albeit small, have shown their quality through their consistently competitive performance, and as a result, such funds could prove to be a worthy addition to a suitably diversified investment portfolio. Therefore, as investors, it is important to look beyond the overall performance of a fund manager and instead look at the individual performance of their funds, as this can identify if they have any top performing funds, that could potentially be the most suitable option for their portfolio.