- 57 of the funds analysed in this report have outperformed the majority of their peers over the past 5 years, which is more than any other fund manager in the UK.

- 102 of the funds analysed were from Royal London’s pension fund range. Our analysis of these funds found that 31 have consistently outperformed 75% of their peers with their returns considerably higher than the sector average.

- Royal London recently ranked number one in our fund manager league table for the performance of their unit trust range of funds over the past 1, 3 & 5 years.

Royal London is the largest mutual life, pensions and investment company in the UK, with funds under management of £164 billion, 8.8 million policies in force and 4,267 employees.

They are among the largest investment brands in the UK and their recent number one ranking in our fund manager league table regarding the performance of their unit trust range clearly demonstrates they offer quality options for investors. In this report we analyse their life and pension fund range as well as their selection of unit trust funds and ranked the performance of each fund based on how they performed in comparison to their sector peers over the past 1, 3 & 5 years.

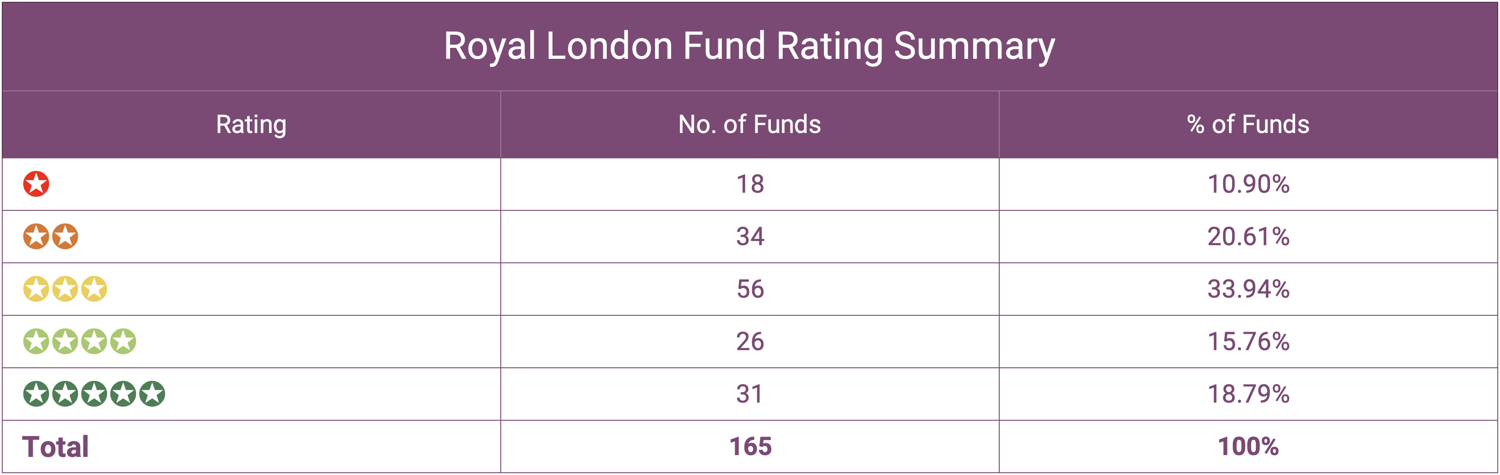

In total, we analysed 165 Royal London funds. In this report we detail the top Royal London funds and also identify their funds which have underperformed.

Royal London Fund Performance

To identify the performance and sector ranking for each of Royal London’s 165 funds we compared their returns to every other competing fund within the same sector over the recent 1, 3 & 5year period, up to 1st April 2022.

The Best Royal London Funds

Royal London’s range of unit trust funds are highly regarded by investors and advisers as some of the best funds on the market and in our most recent fund manager league table, which analysed 2,781 funds and 122 fund managers, Royal London ranked as number one for the performance of these funds.

In this analysis we also assessed the performance of their wider range of life and pension funds and identified that of the 165 funds analysed 34.55% received a top performing 4 or 5 star rating.

Royal London Sterling Credit Fund

The £2.2 billion Royal London Sterling Credit fund has consistently been one of the best performing funds in the IA Sterling Corporate Bond sector. This corporate bond fund invests in fixed interest securities, primarily in the Banking and Financial services sector with holdings in Prudential, Co-Operative and Santander UK. Its strategy has returned growth of 7.86% and 15.17% over the recent 3 & 5 years, which ranked higher than at least 75% of all other funds in the same sector. Over the past 12 months the fund has returned losses of -3.05% but this is almost entirely a result of volatile market conditions. This is reflected in the sector average for the period which was -4.39%.

Royal London UK Equity Income Fund

With client assets under management of £1.2 billion the Royal London UK Equity Income fund is one of the largest funds in the UK Equity Income sector. This fund has warranted its high status with Investors by ranking among the best in its sector for growth in the short term and long term. Over the past 5 years this fund has returned growth of 27.99%, which was comfortably better than the 20.24% sector average.

Royal London Sustainable World Trust

The managers of this fund aims to provide capital growth over the long-term from a portfolio of principally equities, but some exposure to bonds, which have all been selected based on their sustainability characteristics and the net positive benefit they have on society. Using this sustainability approach the managers aim to outperform the IA Mixed Investment 40-85% sector, which it has consistently managed to achieve.

The fund has continually outperformed and over the past 3 & 5 years it ranked 1st in a competitive sector of 152 funds with growth returns of 52.08% and 80.60%.

Royal London Sustainable Leaders Trust

The Royal London Sustainable Leaders Trust invests primarily in UK based Industrial, Financial, Healthcare and Technology companies and is classified within the IA UK All Companies sector.

The fund is managed by highly experienced investor Mike Fox, who is head of sustainable investments at Royal London and has managed the fund since its launch in 2003. The manager and his team combine both negative and positive screenings as part of the process and will not invest in companies that derive more than 10% of their revenue from the likes of military applications, animal fur products, pornography and gambling.

This fund currently manages £3.3 billion of client assets and it has consistently been one of the top performers in its sector. Over the recent 5 years it returned growth of 65.53%, which was more than double the sector average and better than 98% of competing funds within the same sector.

Royal London Sustainable Managed Growth Trust

Like many of Royal London’s funds the Royal London Sustainable Managed Growth Trust has over 300 holdings. This fund follows an ethical investment policy and despite sitting within the low risk IA Mixed Investment 0-35% Shares sector it has managed to return growth of 16.21% and 25.95% over the past 3 & 5 years, which were the highest growth returns in the entire sector of 60 funds.

Underperforming Royal London Funds

Not all of Royal London’s unit trust funds managed to deliver competitive returns. One of their most disappointing funds was their Royal London Absolute Return Government Bond fund, which currently is entrusted to manage over £1.8 billion of investor’s money. This fixed interest fund is one of 75 funds classified within the IA Targeted Absolute Return sector. Over the past 5 years the fund returned growth of just 2.46%, which fell well below the 14.31% sector average, ranking 64th out of 75 funds in the sector.

The Royal London UK Opportunities fund was another Royal London fund that has struggled in comparison to its peers. Launched in 2007, the Royal London UK Opportunities fund is entrusted to manage £873 million of client assets. This UK focused fund aims to achieve above average returns but in recent years it has been among the worst 50% in its sector for performance. Over the recent 12 months it has returned 4.33%, which ranked 143rd out of 242 funds in its sector, and over 5 years it returned growth of 19.29% which was well below the 25.74% sector average.

Royal London Pension Funds

102 of the funds analysed were from Royal London’s pension fund range. Our analysis of these funds found that 31 have consistently outperformed 75% of their peers with their returns considerably higher than the sector average.

Royal London International Pn

One of Royal London’s best performing pension funds was their Royal London International pension. This fund is classified within the Global equities sector and over the recent 1, 3 & 5 year period this fund has returned growth of 16.69%, 53.57% and 69.14% respectively, each of which were among the highest in the sector.

Royal London Asia Pacific ex Japan Tracker Pn

The focus of the fund is on growing the capital value of investments over time through a portfolio of Asian equities.

The fund invests in physical securities and because of the slight ESG approach it follows an optimised approach. An optimisation approach is when a manager looks to replicate the majority of an index, however it will not invest in every single component of the index. As such, the manager has a wide degree of freedom relative to the index and may take larger, or smaller, positions in companies. This strategy has helped this fund to significantly outperform the index and sector average.

Over the past 1, 3 & 5 years the funds has returned growth of 4.56%, 36.96% and 56.79% in comparison to the sector average of -3.54%, 26.07% and 37.98%.

Royal London European Growth Pn

The Royal London European Growth Pension fund is a European Equity fund which aims to provide above average capital growth over the medium to long term by investing in a portfolio of securities of companies in any European country, including Turkey, but excluding the United Kingdom.

The European Equities sector averaged returns of 4.98%, 32.06% and 37.91% over the past 1, 3 & 5 years. In contrast the consistently top performing Royal London European Growth Pension fund returned growth of 9.16%, 38.15% and 59.77%.

Royal London Governed Portfolio 4 Pn

The ‘Royal London Governed Portfolio 4’ pension fund aims to deliver above inflation growth in the value of the fund at retirement, whilst taking a level of risk consistent with a moderately cautious or balanced risk attitude over a long time period. The fund acts as a readymade portfolio with underlying holdings consisting of a range of Royal London funds.

Over the past 1, 3 & 5 years the fund has returned growth of 13.38%, 26.51% and 36.53%, which is among the very best in the sector and even more impressive considering its relatively low risk approach in a sector with considerably more adventurous funds.

Royal London Global Equity Select 2 Pn

Launched in March 2002, the Royal London Global Equity Select 2 Pn fund predominantly invests in the shares of companies globally that are listed on a stock exchange. At least 90% of the Fund will be invested in shares of companies globally, both in developed and emerging markets. The fund is one of Royal Londons smaller funds with less than £100 million under management but it is also one of the best performers. Over the past 12 months this fund ranked 1st out of 1052 funds in the PN Global Equities sector with returns of 25.18%. In comparison the sector average for the period was 10.35%.

Underperforming Royal London Pension Funds

Royal London has a high proportion of top performing funds but as identified in the analysis 32.29% of their funds consistently performed worse than at least half of their peers during over the past 1, 3 & 5 years.

Among the worst performers was the Royal London Fixed Interest Pn fund. This sterling fixed interest fund has regularly struggled for competitive performance. It has consistently returned losses and over the past 5 years it ranked 89th out of 102 funds in the sector.

The Royal London Open Portfolio (20%-60% Shares) Pension fund was another Royal London pension fund to underperform. It is a low risk fund that aims to achieve a higher return than would be achieved by investing in a bank or building society account. However, over the past 12 months this fund has returned negative growth of -2.71% and over each of the periods analysed it has ranked within the bottom 50% of performers in the sector.

Royal London Life Funds

12 of the 165 funds analysed were from Royal London’s Life fund range. From this range, an impressive 7 consistently returned growth that was higher than the sector average and ranked among the best performers in their sectors.

RLL Defensive Managed

The RLL Defensive Managed fund invests in other Royal London Asset Management (RLAM) funds and is designed to maximise "real returns" over a five year time period. This fund has consistently excelled within its sector and over the recent 5 years it has managed to return growth of 21.93%, which was comfortably above the 12.31% sector average and better than 95% of competitors.

RLL Fixed Interest

The RLL Fixed Interest fund invests in a spread of fixed interest investments including government and corporate bonds. This fund is classified within the LF Sterling Fixed Interest sector, which has endured a difficult period these past few years, but the RLL Fixed Interest fund has consistentlyl ranked among the top of the sector for performance.

RLL American Tilt

Launched in March 1984, the RLL American Tilt fund aims to deliver returns in line with its sector average, whilst reducing its carbon intensity and improving the ESG and Responsible Investment profile. The invests entirely in North American companies, the majority of which are in the Technology and Healthcare sectors. Over the past 1, 3 & 5 years the fund has returned growth of 19.50%, 58.52% and 80.81%, which was comfortably above the sector average.

RLL Managed

The RLL Managed fund is designed to maximise "real returns" over a ten-year period. The fund invests in other Royal London Asset Management (RLAM) funds. The manager ensures the maximum potential for capital growth exists for the given level of risk. This fund has consistently been one of the top funds in its sector as it returned growth of 9.38%, 24.38%, and 32.03% over the recent 1,3 & 5years.

Royal London Review

57 of the funds analysed in this report have outperformed the majority of their peers over the past 5 years, which is more than any other fund manager in the UK. However, this only equates to 34.55% of the total funds analysed, with 52 Royal London funds ranking within the bottom half of their sectors for performance.

As one of the biggest fund management brands in the UK, Royal London and their group of companies provide investors with access to a huge range of funds. As identified in this report, some of which have consistently delivered exceptional returns but there have also been those that have struggled and failed to produce competitive returns. This highlights the importance of fund research as well as fund manager research.