As a restricted advice firm, St James's Place and their partner advisers can only provide customers with access to SJP branded funds, and from this selection, their Investment Committee has put together a range of model portfolios to cater for different investor profiles.

Each of these portfolios contain a spread of funds that cover a wide range of asset types and regions. They have been created to offer a ready-made investment solution that caters to the differing needs of investor’s.

The ‘Investment Committee’ state the objective for their portfolios is to “generate superior investment results for our clients”. But with a significant proportion of their funds underperforming, how well have their portfolios performed?

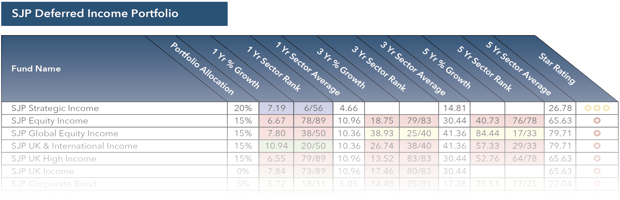

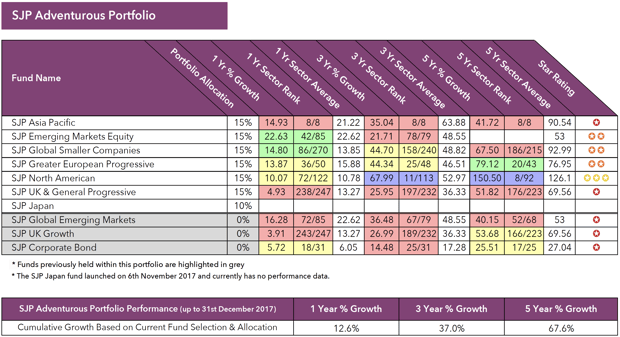

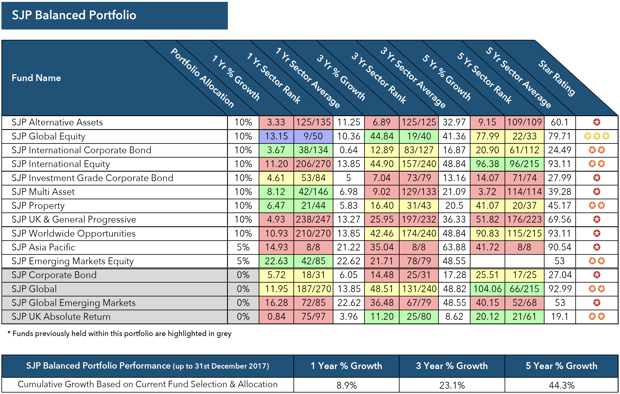

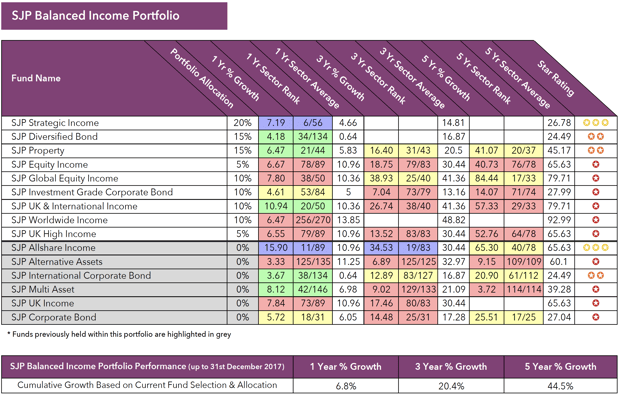

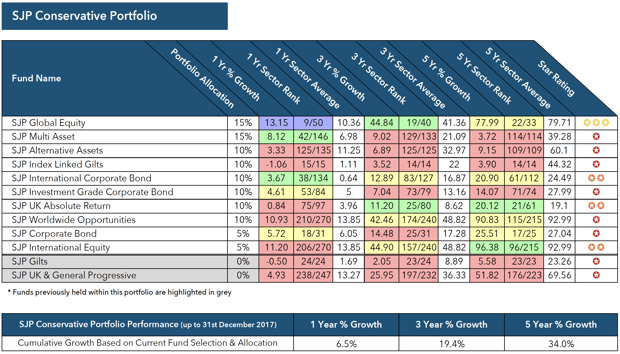

This report details the 1, 3 & 5-year growth for all 9 SJP model unit trust portfolios. This includes the performance, sector rank and overall quality rating for each portfolio’s underlying funds. Access our latest St James Place review for up to date performance analysis of SJP funds, their investment portfolios and charges.

How do their portfolios compare?

Each SJP portfolio has been created to suit different investor profiles assuming varying levels of risk and growth opportunities.

Below we identify the recent 1, 3 & 5 year growth for each of the 9 SJP unit trust/ISA portfolios that are currently available as well as the individual performance, sector ranking and rating for each of the underlying funds that make up their portfolios.

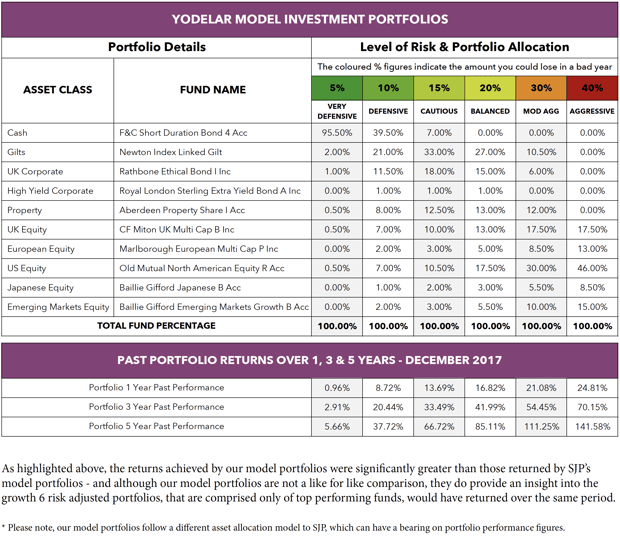

In order to compare the growth of St James's Place portfolios to portfolios containing consistently top performing funds we have detailed the growth figures of 6 top performing risk based portfolios below, over a 1,3 & 5 year time frame.

Our model portfolios follow the asset allocation model used by the consumer watchdog Which? And contain funds that have consistently outperformed their peers.

(These portfolios are for illustrative purposes and should not be viewed as a recommendation to invest. If you require investment advice, please click here for more information.

Our model portfolios are for information purposes only and have been created to provide an insight into the growth returned by 6 risk-adjusted portfolios that contain only top performing funds.)

For further information and performance information on St James's Place Wealth Management visit the recent St James's Place review. Here you can access our latest SJP performance analysis and further research on their charges.