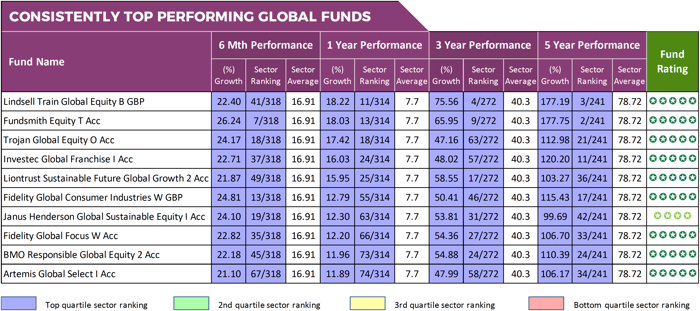

- Over the past 5 years, the average growth returned by funds in IA Global sector was 78.82%.

- The Fundsmith Equity fund returned growth of 177.75% over the recent 5 year period.

- Over the recent 6 months, the IA Global sector has averaged growth of 16.91%, which was the 4th highest average from all 36 IA sectors.

A growing number of investors are attracted by the greater diversity offered by funds within the Global sector, and in 2018, it was the most heavily invested sector on the market. But as the sector encompasses a wide and diverse range of markets, the disparity between fund performance can be huge and much more pronounced than other sectors which focus on specific regions.

As a result, selecting efficient, top quality Global funds can be more difficult for investors. Indeed, 62% of investment funds within the Global sector continually underperform, and only a small proportion of Global funds have managed to consistently maintain a top quartile performance rating.

In this report, we analysed the performance of all 320 funds within the IA Global sector and feature 10 funds, that have consistently outperformed their competitors and represent some of the most attractive Global investment opportunities.

The Global funds that consistently deliver

Each of the 10 funds featured in this report have consistently proven their ability to excel by delivering growth over the recent 1, 3 & 5 year periods that was better than at least three-quarters of all other funds in their sector. They are listed in no particular order.

*Performance figures up to 1st August 2019

1. Lindsell Train Global Equity Fund

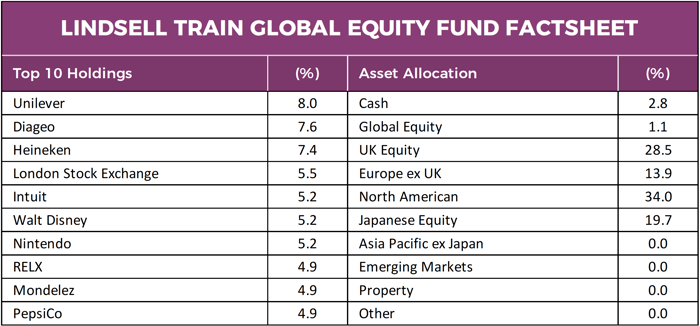

Lindsell Train’s strategy for their Global Equity fund is to hold a concentrated portfolio of between 20 and 35 stocks, with beverage brands Diageo and Heineken among its top holdings.

The fund has a Global focus and invests in companies primarily based in Japan, Europe, America and the UK. Currently the fund manages £8.9 billion of client money and has consistently been one of the top performing funds in the Global sector.

Since its launch in March 2011 up to 1st August 2019, the Lindsell Train Global Equity fund returned cumulative growth of 349.96%. In comparison, over the same period, the IA Global sector averaged growth of 104.24%.

Over the recent 6 months, 1 year, 3 years and 5 years the fund has consistently ranked highly in its sector with growth returns of 22.40%, 18.22%, 75.56%, and 177.19% respectively.

2. Fundsmith Equity Fund

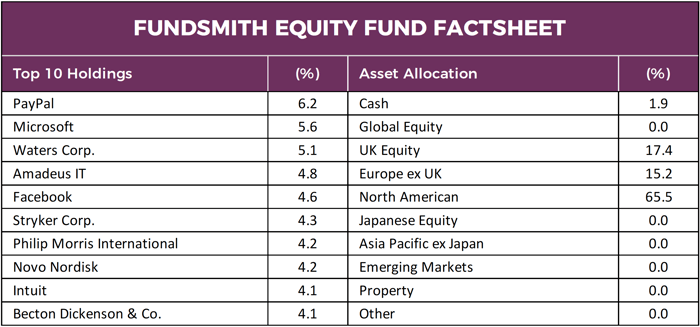

The Fundsmith Equity fund is a direct rival to the Lindsell Train Global Equity fund and even more popular with funds under management currently totalling £19 billion, which makes it the largest of all unit trust & OEIC funds that are available to UK investors.

The Fundsmith Equity fund has continually performed well despite various political and economic challenges that have negatively impacted the performance of many competitors. This fund has consistently been one of the best performing funds in the Global sector and over the past 5 years it returned growth of 177.75%, which was higher than 99% of rival funds and more than double the 74.14% sector average for the period.

Although 65.5% of the Fundsmith Equity fund is invested in US equities, Mr Smith has said this is not deliberate. “We have no bias towards any country, including the US, and are simply looking for the best companies to invest in. We are looking for a combination of high quality and reasonable value, wherever they may be incorporated, headquartered or listed in the world.”

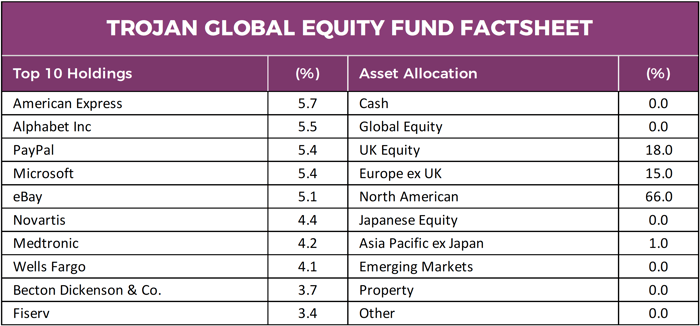

3. Trojan Global Equity Fund

Although this fund has not returned the same level of growth as the Lindsell Train Global Equity and Fundsmith Equity funds, it has still been one of the best and most consistent funds in the Global sector. Since its launch on 6th March 2006 up to 1st August 2019, the Trojan Global Equity fund returned cumulative growth of 264.40%. Over the past 6 months, 1 year, 3 year, & 5 year periods the fund maintained a top quartile sector ranking with growth of 24.17%, 17.42%, 47.16%, and 112.98%.

Since its launch, the Trojan Global Equity fund has amassed a relatively small £295 million of client assets under its management.

But despite being overlooked by many, the funds history of stellar performance makes it one of the most attractive Global funds on the market.

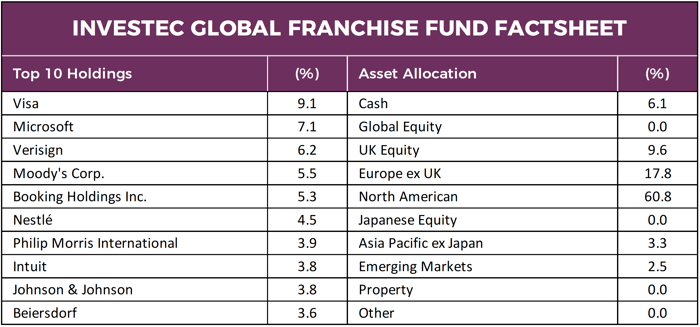

4. Investec Global Franchise Fund

88% of the Investec Global Franchise fund is made up of UK, European and North American assets. The funds objective is to achieve long-term capital growth primarily through investment in shares of companies from around the world that the manager deems to be of high quality, which are typically those associated with global brands or franchises.

The Fund takes an unrestricted approach in its choice of companies either by size or industry, or in terms of the geographical location. The fund primarily has holdings in I.T, Consumer staples, and Financial companies with Visa, Microsoft and Nestle featuring in their top 10 holdings.

Similar to the other Global funds featured in this report, the Investec Global Franchise fund has consistently ranked in the top 25% of performers in its sector over the recent 6 months, 1 year, 3 year, & 5 year periods, where it returned growth of 22.71%, 16.03%, 48.02%, & 120.20% respectively.

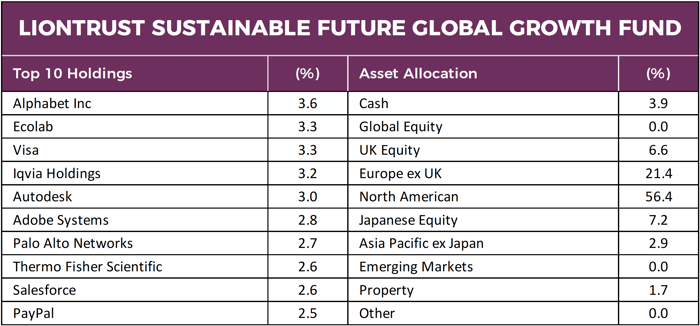

5. Liontrust Sustainable Future Global Growth Fund

Unlike most of its rival, the Liontrust Sustainable Future Growth Fund follows an Ethical investment methodology. The Fund was launched in February 2001 with the primary aim of delivering strong returns by investing in sustainable companies.

Liontrust advise the fund’s investment process is based on the belief that in a fast-changing world, the companies that will survive and thrive are those which improve people’s quality of life, be it through medical, technological or educational advances; drive improvements in the efficiency with which we use increasingly scarce resources; and help to build a more stable, resilient and prosperous economy.

The process seeks to generate strong returns while benefiting society through identifying long-term transformative developments and investing in companies exposed to these powerful trends that have a positive impact and can make for attractive and sustainable investments.

In the first several years since its launch in 2001, the Liontrust Sustainable Future Growth Fund endured a difficult period where it struggled to deliver positive growth, but over the past 7 years it has consistently delivered competitive returns. Over the past 5 years the fund returned growth of 103.27%, which was better than 85% of all other Global funds, and this past year, it returned growth of 15.95%, which more than double the sector average.

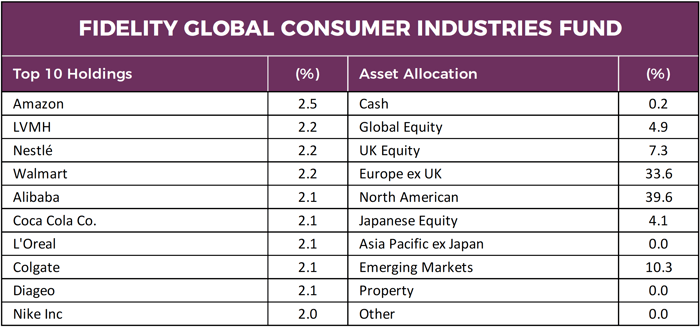

6. Fidelity Global Consumer Industries Fund

The Funds manager Aneta Wynimko adopts a bottom-up stock selection approach based on in-depth company analysis involving meetings with company management and industry competitors. She looks for businesses with pricing power, strong brands and valuable intellectual property. She places a lot of importance on the quality of the management team and their track record, as she believes a clear vision on brand and coherent execution are key in a globalised world made up of a multitude of competitors. For those companies with a global scale, she requires them to demonstrate local agility. She also looks for innovative companies that are able to develop products for which customers are willing to pay a premium. She aims to create a concentrated portfolio of long-term winners whose outlook is undervalued by the market. The fund is expected to have a quality bias compared to the overall consumer sector.

Some of the world’s most influential and successful companies account for the funds top holdings, which include Amazon, LVMH (Louis Vuitton, Moët, Hennessy), Nestlé, Walmart, Alibaba, Coca Cola, L’Oreal, Colgate, Diageo and Nike.

Over the past 10 years the Fidelity Global Consumer Industries fund returned strong growth of 311.11%, and over the recent 1, 3 & 5 years it has maintained a top quartile sector ranking with growth of 12.79%, 50.41% and 115.43% for the periods.

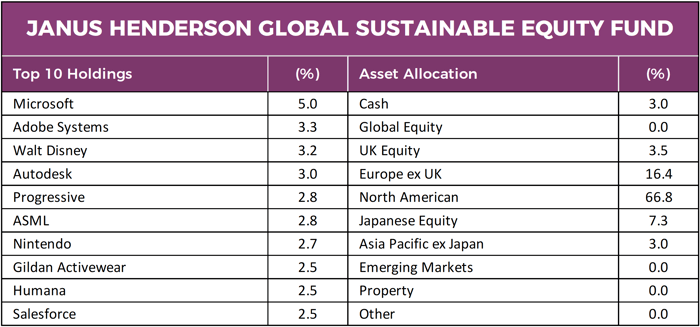

7. Janus Henderson Global Sustainable Equity Fund

The Janus Henderson Global Sustainable Equity fund seeks to invest in global companies whose products and services are considered by the Investment Manager as contributing to positive environmental or social change and thereby have an impact on the development of a sustainable global economy. The fund will avoid investing in companies that the Investment Manager considers to potentially have a negative impact on the development of a sustainable global economy.

Since its launch in 1991, the fund has amassed client funds under management of £924 million. The fund has bounced back from a difficult last quarter of 2018 where it returned losses of -14.01%. However, after a strong start to the year the fund managed return cumulative growth of 12.30% for the past 12 months, which was well above the 7.7% sector average. Over the past 5 years the Janus Henderson Global Sustainable Equity fund returned growth of 99.69%, which was also comfortably above the 78.72% and better than 83% of all other funds in the Global sector.

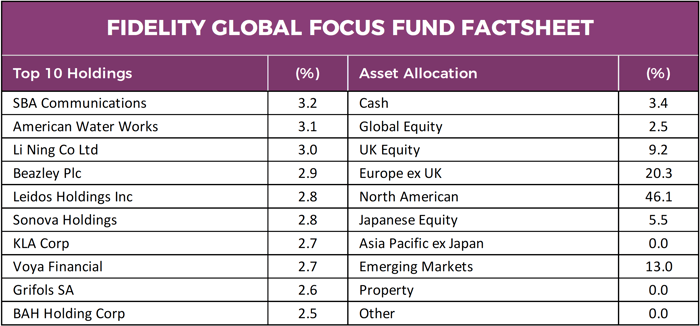

8. Fidelity Global Focus Fund

The Fidelity Global Focus fund is managed by one of Fidelity’s most experienced fund managers Amit Lodha. Mr Lodha believes stock markets are only semi-efficient, and he aims to exploit this by finding what he believes to be the best investment opportunities in medium-sized companies with structural growth advantages and sustainable pricing power. His investment process is based on in depth understanding of global value chains, acquired by working closely with Fidelity’s large team of research analysts and global sector specialists. Amit identifies attractive macro themes and within those favours companies that have a healthy balance sheet and operate with high sustainable margins.

The funds strategy is to hold a concentrated portfolio within a range of 40-60 securities, and unlike many of his peers, who invests primarily in US, UK and European companies, Lodha’s approach is to hold shares across a diverse range of Global regions including India, Japan and Sweden, and as a result, most of this funds largest holdings are not used by competing fund managers.

Despite the funds unique composition, it has consistently ranked near the top of the Global sector for performance. Over the past 1, 3 & 5 years it returned cumulative growth of 12.20%, 54.36% and 106.70%, which supports the fund managers strategy and emphasizes the funds overall quality.

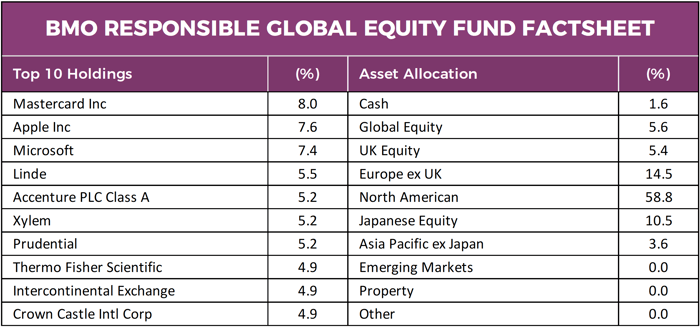

9. BMO Responsible Global Equity Fund

The BMO Responsible Global Equity fund launched in October 1987 and currently manages £574 million in client assets.

The Manager invests only in assets which meet the Fund's ethical screening criteria. The ethical screening applied to the Fund means that a number of the largest companies are screened out on ethical grounds. Investment is concentrated in companies in any market whose products and operations are considered to be making a positive contribution to society and seeks to avoid companies which, on balance, do particular harm (including those involved in the sale of armaments) or operate irresponsibly (for example with regard to the environment or human rights).

The fund has a very competitive performance history and has consistently ranked in the top quartile of the Global sector for performance over the past 6 months, 1 year, 3 year and 5 year periods.

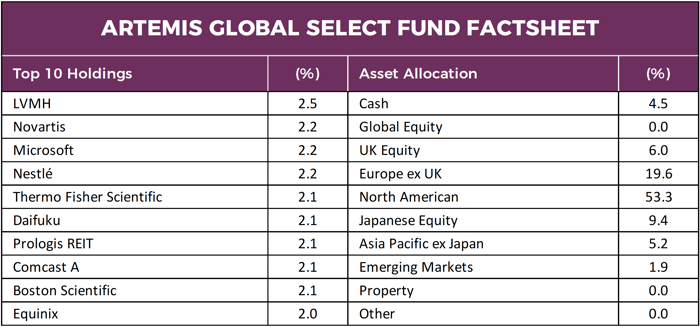

10. Artemis Global Select Fund

The Artemis Global Select Fund aims to deliver growth by investing in high-quality Global companies with strong positions in their markets, excellent balance sheets and sustainable pricing power. Regardless of the short-term economic environment, these companies are considered by the fund manager to have the strength and financial resources to grow and prosper.

It is a relatively small fund compared to most of its rivals, but it has consistently been one of the best funds in the Global sector since it launched in June 2011. Like most Global funds, the Artemis Global Select fund is primarily weighted in US Equities, but it does have a very diverse portfolio of companies from many different regions.

The fund has a very strong performance history. Since its launch just over 8 years ago it has returned cumulative growth of 180.25% and over the recent 1, 3 & 5 years it has returned growth of 11.89%, 47.99% and 106.17% respectively.

The Best Performing Global Funds

Global funds invest in a wide range of stocks across world markets, with this broad focus potentially helping to minimise the impact of stock market shocks on a portfolio. For example, if one region or sector suffers a knock, hopefully gains elsewhere will help offset these losses.

However, in recent times, a large proportion of growth enjoyed by Global funds can be attributed to their heavy weighting in US stocks, with North American equities continuing to average some of the highest returns across all asset classes. But with a young, educated workforce across developed Asia. Rising household income in China, India and Brazil. Natural resources in Canada, Australia and Russia, there are many Global markets that have a positive long term outlook which Global funds can capitalise on.

The 10 Global funds in this report utilise a diverse range of markets to deliver for their investors. They have been featured solely because they are some of the most consistent and best performing funds in the IA Global sector in both the short-term and long term. Of course, future performance is never guaranteed but it is reasonable to assume the funds which have proven their consistency over a 5 year period, will continue to outperform their peers in the future.