Many investors invest in passive investment funds, without researching the best passive investment funds available. Just over a year ago the investment industry reached a major milestone, as the amount of US investors’ money in passive funds overtook the amount invested in active funds for the very first time.

In recent years, the UK has also seen a shift towards passive fund management, with latest Investment Association figures showing that Tracker funds under management stood at £251 billion at the end of 2020, and their overall share of industry funds under management was 18%. A decade ago, there was £31 billion under management in tracker funds, equivalent to a 6% share of industry funds.

Passive investing continues to evolve as its popularity increases, but despite their objective of essentially replicating an index their performance can vary, sometimes significantly, which has caused confusion among investors, especially those considering tracker options for the first time.

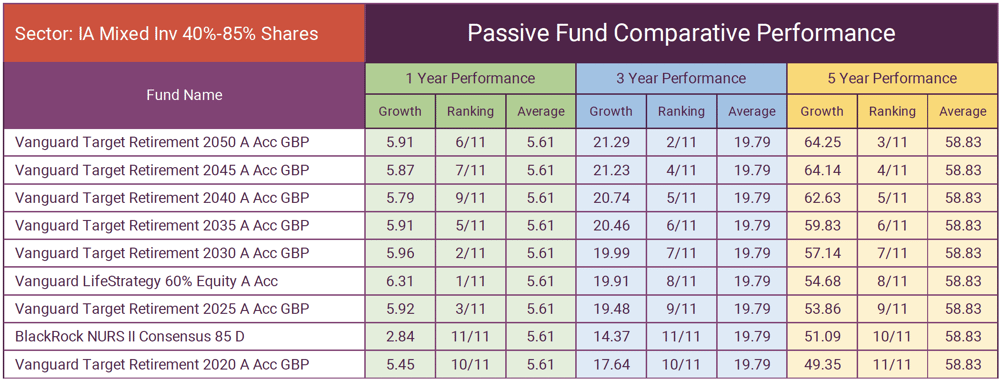

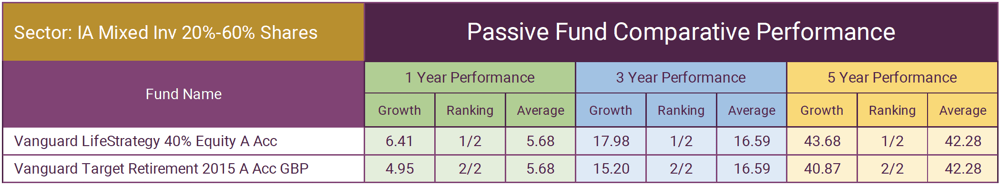

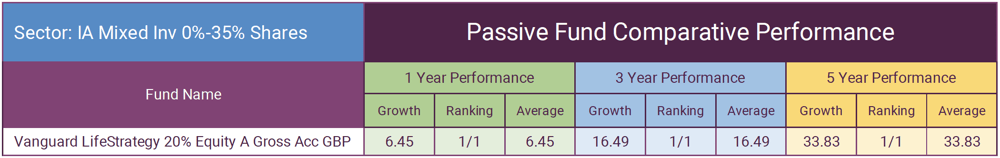

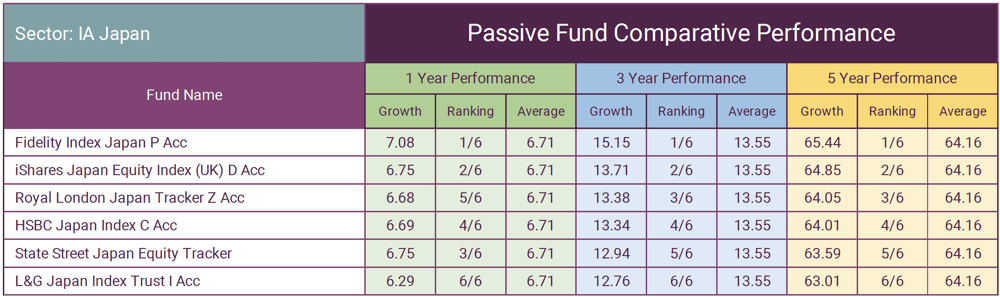

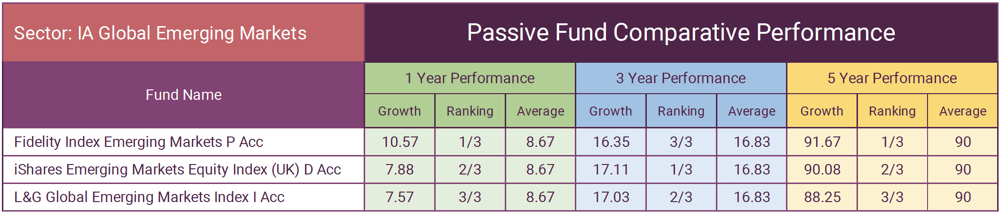

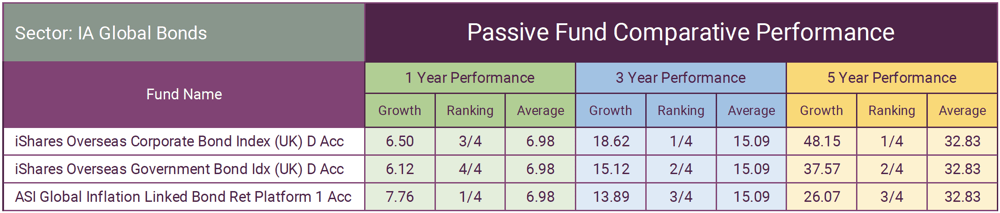

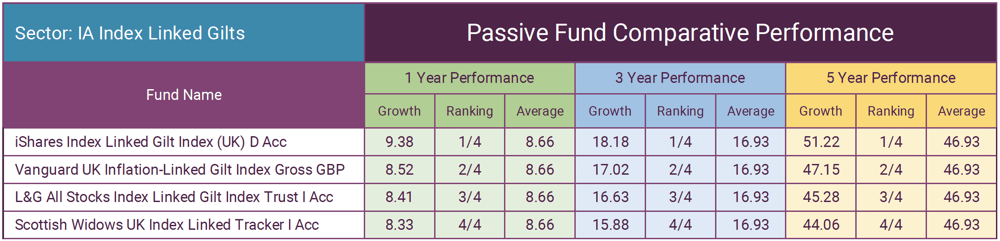

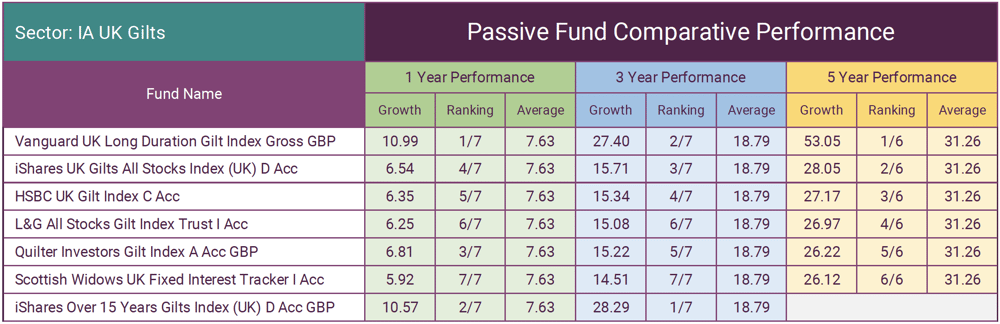

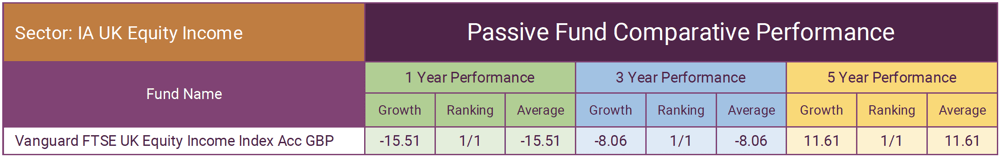

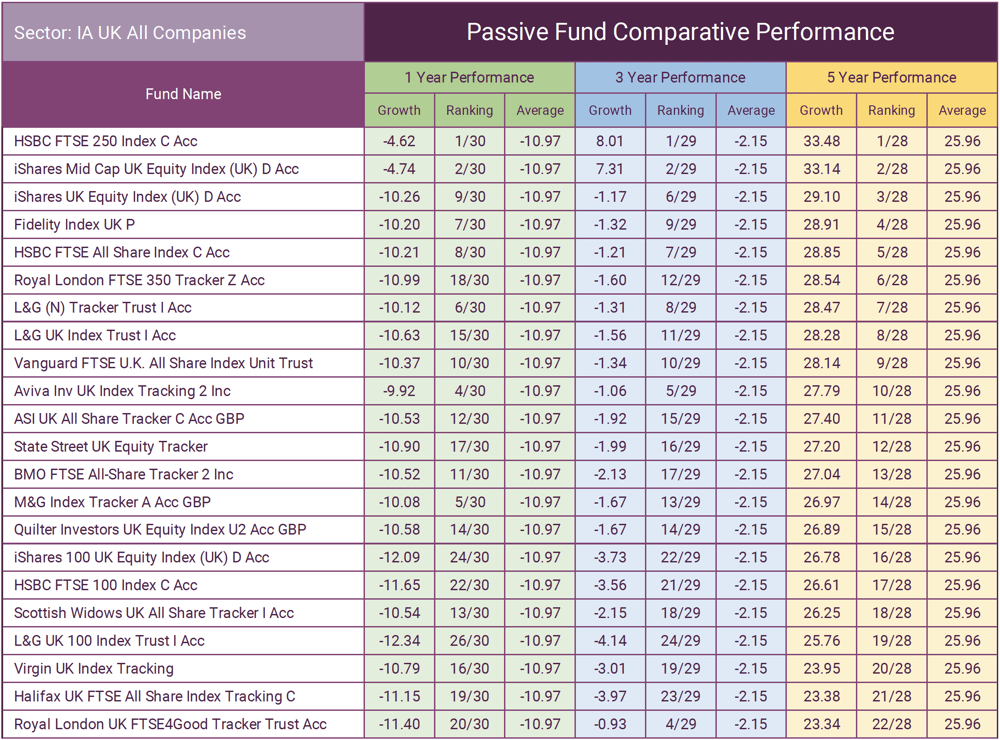

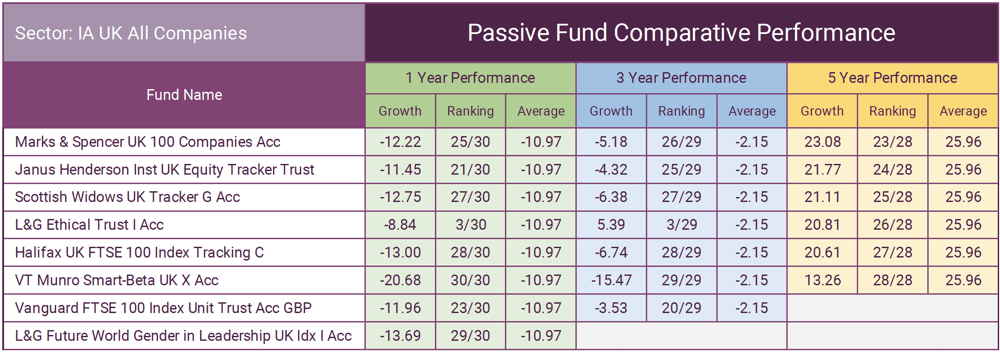

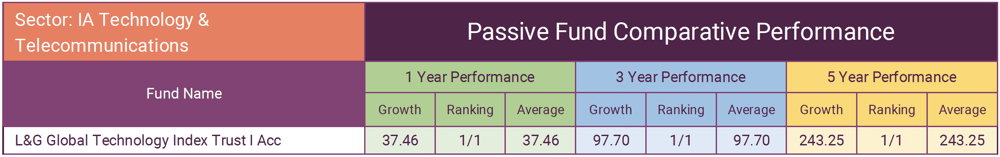

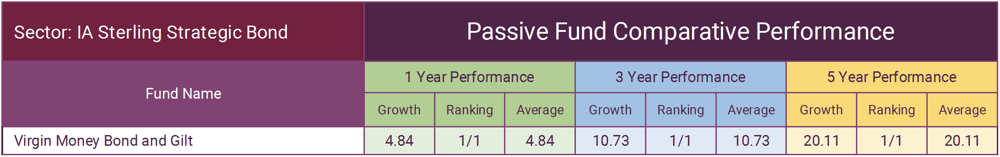

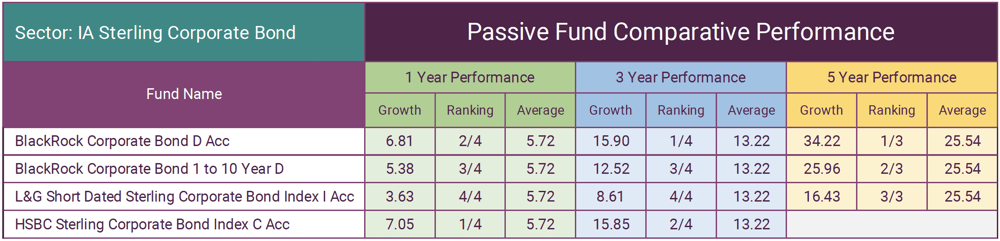

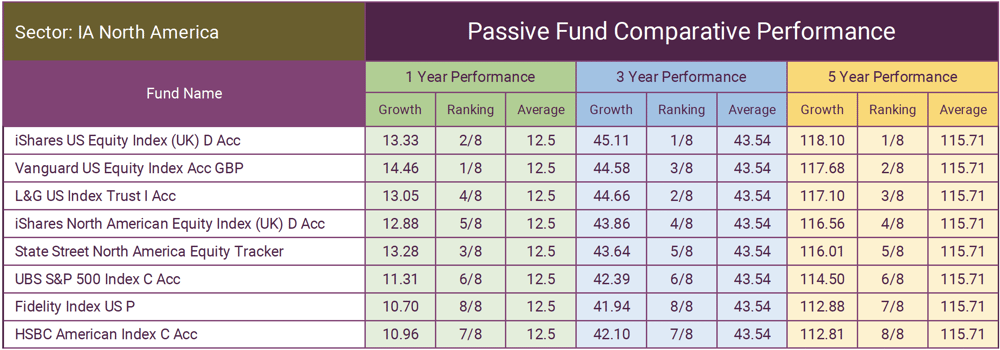

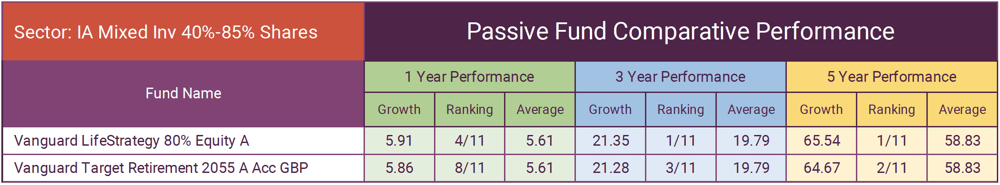

In this report, we look at why the performance of passive funds can differ, and we also provide a 1, 3 & 5-year performance analysis of 111 index tracker passive funds that have a sector classification from the Investment Association. Our normal approach would be to compare the passive funds against all other same sector funds (Active & Passive), but in this review, we have compared all passive funds within their relevant same sectors, identifying the best passive funds available to UK investors. This analysis shows the significant variance in performance between similar sector passive funds.

Passive Investing In A Nutshell

A passive investor accepts that they will not beat the market or sector averages, and invests in a ‘bit of everything’ in order to generate the average market return. The passive fund will aim to match the return of an index by investing in most companies contained within that index. Therefore mathematically the return of the fund will always closely match the index average.

Due to particularly large indices, such as the FTSE All-Share which has 650 constituents, investing in each and every one of the stocks is not practical. The bottom 50 stocks in the FTSE All-Share make up less than 0.5% of the index, meaning the transaction costs involved in buying these stocks far outweigh the benefits of owning them.

As a result, managers resort to building an optimised portfolio of stocks. The primary idea of the optimisation is to build a new portfolio with the same characteristics as the index with fewer securities to reduce transaction costs and exposure to illiquid assets.

Why The Performance of Funds That Track The Same Index Can Differ

Many investors are confused when the return of the passive fund they invest in does not match that of the index its tracking.

Tracking error is often cited as a key factor in the difference in returns of a passive funds performance compared to similar tracker funds. Tracking error is a fundamental measure of how well the job is being done.

A tracker’s role is to deliver the returns of its benchmark index. In an ideal world, if the FTSE All-Share index returns 15% a year, then a FTSE All-Share tracker will also return 15%. But this is rarely the case, as tracking errors can result in a notable variation between passive funds with similar objectives.

This is an important consideration for passive investors because it can reveal which passive tracker funds offer the most value for money. There’s no point choosing a passive fund with a total cost that is 0.2% cheaper than its rivals if its returns consistently fall below the same benchmark by an extra 0.5%.

There are two primary ways that passive investment funds mimic the performance of an index.

Full replication

This is the process of buying all components of an index. For example, a FTSE 100 tracker fund will buy shares in all 100 companies in the index, in proportion to the size of the companies within the index. This means that funds can mirror the performance of the index as closely as possible.

Partial replication

When it is difficult to buy all the shares in an index, some passive funds invest in a sample of an index that is generally representative of the whole index. A good example of this is the MSCI World index. This comprises more than 1,700 companies from 23 countries. The time and cost it would take to hold all the companies in the index for full replication could be detrimental to the portfolio. Instead, many passive funds will purchase a sample of the companies that are most representative of the index itself.

This approach is known as sampling, and it aims to match the characteristics of the index and track its returns, without necessarily buying all the securities in the index is is not as straightforward as you may think. It requires experienced teams to evaluate the relative value and creditworthiness, particularly for corporate and government bonds.

Not All Same Sector Funds Track The Same Index

Another issue to keep in mind when comparing index funds within the same category is that they may not track the same index. For example, the Vanguard US Equity Index fund tracks the ‘S&P Total Market Index’ but the L&G US Index Trust tracks the ‘FTSE World USA Index’. The FTSE World USA Index has a basket of 600 constituents but the S&P Total Market Index has almost 4,000 constituents. Although these passive funds are in the same sector they each track different indexes, therefore, we can expect their returns to differ somewhat.

Why Passive Investing Has Grown

The primary reason for the growth of passive funds is cost, more specifically their tracking structure enables them to be in some cases, significantly lower cost than actively managed funds. However, the fundamental reason for investing is to grow wealth, ‘not save money’. Granted, lower costs are better than higher costs, but receiving value should be the focus.

According to the promoters of passive investing, tracking the performance of a chosen market is cheaper, delivers better performance, and is more reliable than active funds, which rely on a fund manager to pick the stocks and manage the fund.

Certainly, research has contested whether active managers can demonstrate such an ability. But one recent study by Antti Petajisto, whilst a finance professor at the NYU Stern School of Business, has found that, on average, active equity managers do have the ability to outperform.

It is true that most active funds are more expensive, but the reality is passive funds cannot come close to matching the performance of the better fund managers, which is a fact that is often lost in the active versus passive debate.

So, although passive funds are an easy sell, for growth focused investors they are not necessarily the best option.

How Passive Funds Compare

When compared alongside active funds whose performance can be well above or below the index it means the performance of passive funds is mainly average in comparison. But instead of comparing their performance alongside all other funds (Active and Passive funds) and putting the active versus passive debate aside, we compared the performance of passive funds alongside that of other passive funds within the same sectors.

We analysed the 1, 3 & 5-year performance of 111 index tracker funds that have a sector classification from the Investment Association.

This analysis shows the variance in performance between similar sector passive funds can be significant.