- From an analysis of 3,095 funds only 516 have consistently outperformed their sector peers over the past 1, 3 & 5 years.

- Some of the worst performing funds are from the largest fund management brands in the UK.

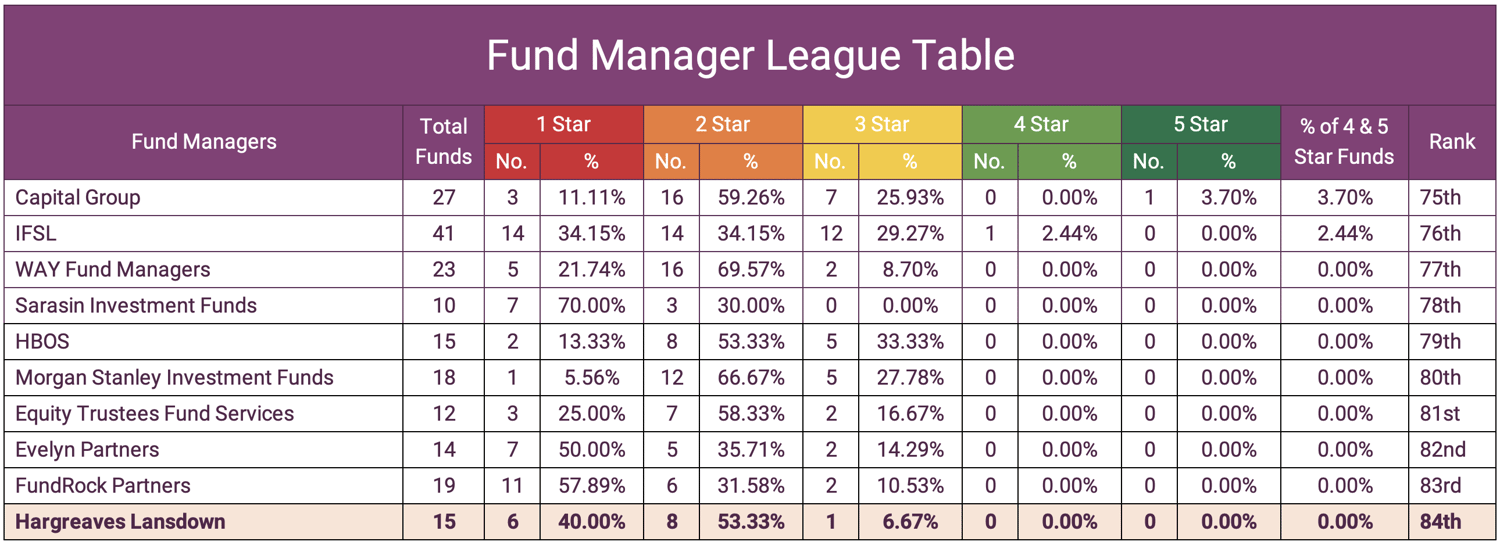

- Hargreaves Lansdown ranked last in our league table of 84 fund managers with 14 of their 15 funds receiving a poor performing 1 or 2 star rating.

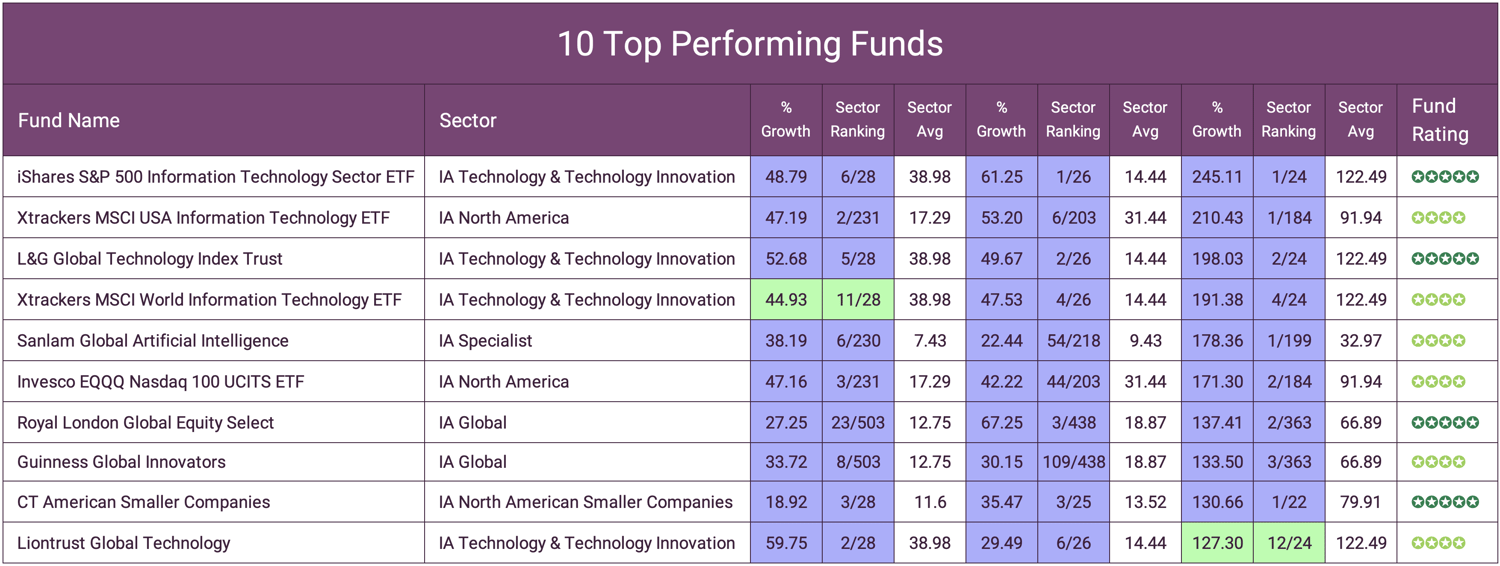

- 4 of the 10 highest growth funds in our best funds report are classified within the IA Technology & Technology Innovations sector.

- 49% of Royal London funds received a top performing 4 or 5 star rating.

- 25 of their 36 funds managed by the UK's largest wealth manager St. James's Place, rated as poor performing 1 or 2 star funds.

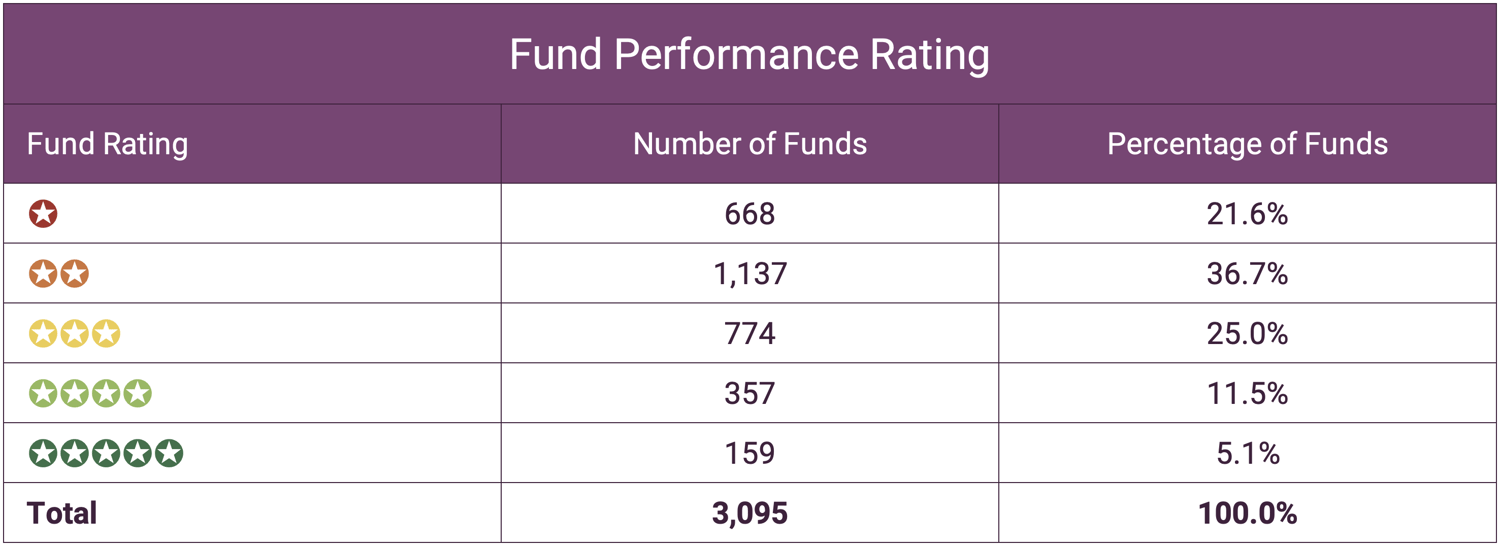

We analysed the performance of 3,095 funds from 134 leading fund management firms to determine which brands consistently deliver top returns for investors.

In this report we identify the fund management brands whose funds have excelled for investors and highlight those who have underperformed with many of their funds languishing towards the bottom of the sector rankings.

Our analysis identifies that just 16.7% of the 3,095 have consistently outperformed and rated as 4 or 5 star performing funds.

In this report we also provide access to the complete list of top performing funds which showcases the 516 funds across all fund management brands that have excelled over the past 1, 3 & 5 years.

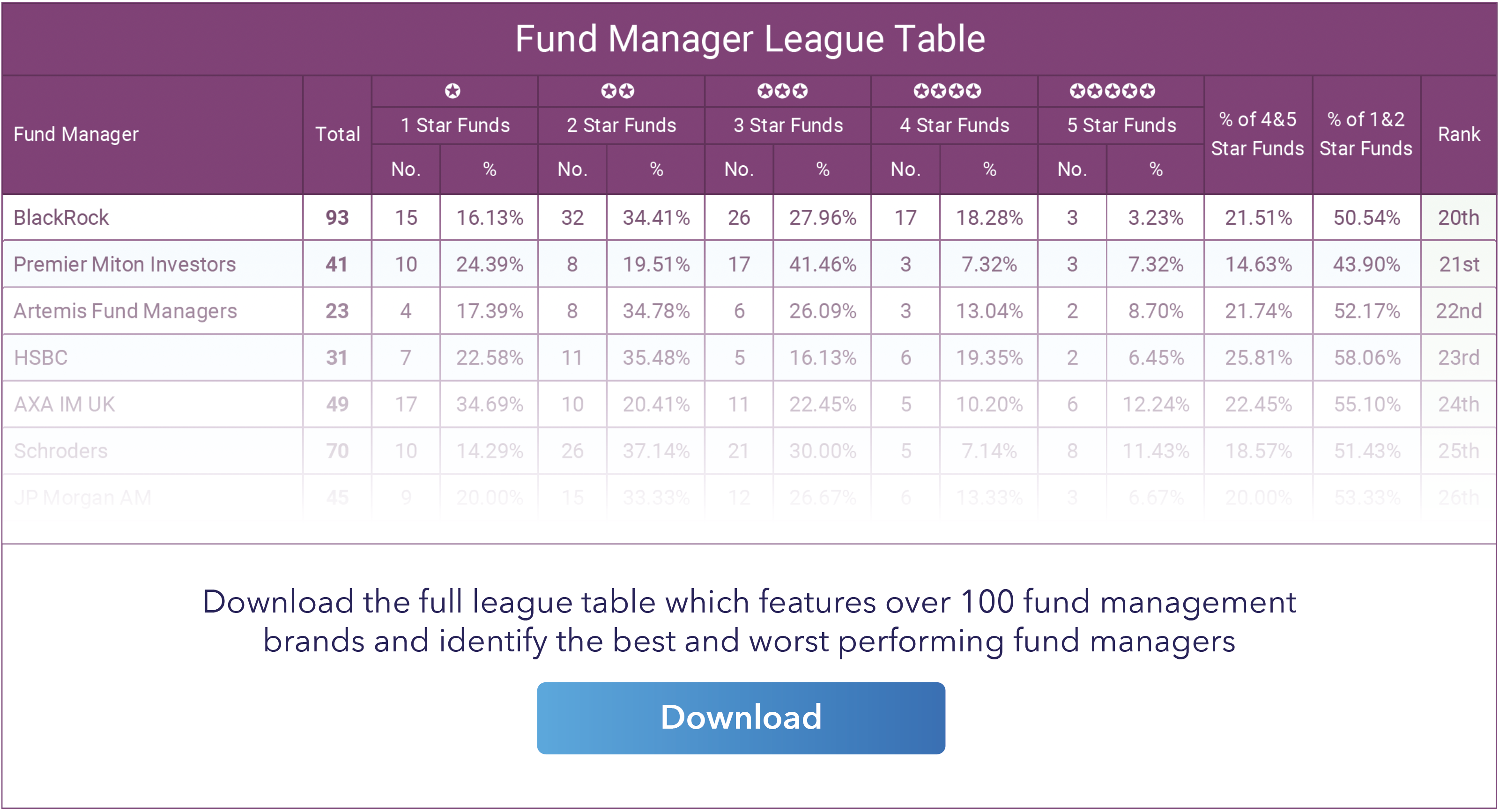

Fund Manager League Table

Our league table includes 84 leading fund management firms with 10 or more funds under management. Brands are ranked based on the percentage of their funds that have achieved top-tier 4 and 5 star ratings, which indicate products that have consistently ranked in the top quartile of their respective sectors over the most recent 1, 3, and 5 year periods.

How Yodelar Rate Fund Performance

Funds rated 1 or 2 stars have persistently underperformed, consistently languishing in the bottom half of their sector. By comparing the proportion of high and low rated funds from each manager, we quantify which brands reliably oversee strong products versus those with histories of poor returns.

Fund managers like Fundsmith and Lindsell Train were excluded from the rankings due to having under 10 funds. However, all 134 fund managers analysed are included in the full report with performance details and star ratings for every underlying fund.

Access The Complete Fund Manager League Table

The report illuminates worrisome industry trends - only a tiny fraction of managers oversee mostly 4 and 5 star funds, while many firms struggle badly with the majority of their products severely lagging the competition. This demonstrates the flaws of brand reliance and importance of diversification using managers with proven performance histories.

MAN Funds Top The League Table

MAN Fund Management claimed the top spot in our league table, with a stellar 50% of their 12 funds earning 4 or 5 star ratings. They oversee £7.5 billion in assets across a focused lineup that includes 6 standout funds that feature in our exclusive Best Funds report.

6 of the 12 MAN funds analysed received a 4 or 5 star rating as they each consistently ranked among the top performers in their sectors over the recent 1, 3, and 5 year periods - a remarkable feat considering only 16.7% (516) of the 3,095 funds analysed achieved this top-tier 4 and 5 star performance threshold and feature in our best funds report.

The Man GLG Japan Core Alpha C fund is the largest fund under their management with just under £2 billion of client assets held in this fund. The fund has a very strong performance history and warrants its 5 star rating by consistently ranking among the top performing funds classified within the IA Japan sector.

With half their concentrated range demonstrating very competitive performance across varying strategies, MAN represents an alluring option for investors seeking active management grounded in quality.

Royal London Excels Among Larger Managers

Royal London almost matched MAN in percentage of top-flight 4 and 5 star funds at 49%, exceptionally impressive given their diverse lineup of 49 funds under management.

While MAN has a slightly higher percentage of top performing funds, Royal London's ability to propagate consistent success across four times as many funds spanning a wider array of asset classes arguably makes their ranking even more outstanding. On top of this, Royal London has over £60 billion of client money under the management of their 49 funds with over 2 thirds of this within their top performing 4 and 5 star fund range, which further validates their status as one of the best fund management brands in the UK.

No Single Manager Monopolises Top Performance

While MAN Fund Management and Royal London topped our league table, even they have weaknesses - from their fund range, 17% (MAN) and 22% (Royal London) still consistently underperformed. This reinforces that no one brand reliably delivers top funds across all asset classes. Diversification using multiple managers in different sectors remains essential for efficient portfolios.

The results support a diverse model that grants investors whole-of-market fund access. In contrast, restricted platforms limiting clients to a narrow subset of funds can severely hamper returns. For example, the UK's largest restricted advice firm St. James' Place has 69% of its lineup rated just 1 or 2 stars in our analysis.

At Yodelar Investments, our risk-rated model portfolios are strategically constructed from best-in-class managers and funds identified through rigorous research. Our process analyses the performance histories of over 100 fund managers along with thousands of underlying funds.

This level of diligence allows us to pinpoint top quality investments for inclusion across our strategies, which are designed to provide investors the strong growth potential at every risk tolerance through diversified allocations to top-performing funds across major asset classes.

Some of The Most Popular Brands Performed The Worst

The UK's largest restricted advice manager St. James's Place oversees £168 billion for clients across their in-house range of funds. Our analysis shows 25 of these 36 funds received a poor 1 or 2 star rating, ranking SJP a lowly 62nd out of 84 fund management brands. Despite their continued poor performance, St. James’s Place continues to increase their customer base and grip on the UK investment market with many of their investors unaware of just how poor the majority of their funds rank comparative to their peers.

Hargreaves Lansdown Finish Last

Hargreaves Lansdown, founded in 1981, has grown into the UK's largest investment platform administering over £130 billion in assets. The FTSE 100 firm leveraged its dominant position with self-directed investors to expand into fund management.

However, results thus far have proven to be nothing short of dismal. Hargreaves Lansdown ranked last in our league table with 14 their 15 funds, representing £9.2 billion of their £10.2 billion under management, with a 1 or 2 star performance rating. Their lone fund which escaped a poor rating was the HL Growth Fund, which only launched in December 2021.

As one of the few major UK fund managers without a single top-tier 4 or 5 star fund, Hargreaves has clearly yet to effectively translate its powerful distribution platform into investment competencies on par with top-performing rivals.

Download the complete Fund Manager League Table

The Best Performing Funds

Our analysis of all 3,095 sector classified funds and 134 fund management brands has enabled us to compile our fund manager league table. However, separate to the league table we have also composed a report that lists each of the best performing 4 and 5 star funds.

Our latest Best Funds Report includes the names, performance growth, sector rankings, and star ratings for each of the 516 featured funds.

Of the 516 funds featured in our best funds report, 159 (5.1%) received a top performing 5 star rating and 357 (11.5%) received a very good 4 star rating.

Download your copy of our latest Best Funds Report

Technology Funds Dominated Performance In 2023

As identified in our best funds report, the sector with the highest average returns for the past year was the IA Technology & Technology Innovation sector which averaged returns in 2023 of 38.98%.

The funds in this sector have vastly outpaced other sectors for the year, which marks a significant swing in performance compared to the previous year where technology funds suffered a sharp drop in performance.

The 10 Highest Growth Funds

The below table features the 10 funds from our best funds report with the highest growth returns over the past 5 years.

Although the report includes funds from 52 sectors the 10 top performing funds are from just 5 sectors, with 4 of the funds coming from the IA Technology & Telecommunications sector. This sector also had the highest average returns for the past year of 38.98%, which marks a significant swing in performance compared to the previous year where technology funds suffered a sharp drop in performance.

Why Performance History Is Important

Evaluating fund performance is a critical metric for investors and reputable advisory firms. Performance analysis ensures portfolios effectively align with investment objectives while entrusting assets to fund managers with a consistent track record of generating above-average returns. Though past performance does not guarantee future results, investors often exhibit a preference for fund managers with a history of excellence across various time horizons. Our best funds report features the top-performing funds managed by managers who have consistently outperformed the majority of their peers over the past 1, 3 & 5 years, with many sustaining outperformance over multiple time periods.

Comparative Benchmarking

Each fund's performance can be assessed relative to competing peer group funds classified under the same sector. This comparative analysis across multiple time horizons provides insights into a fund’s overall quality and the capabilities of its management team.

Manager Skill

Historical returns serve as an indicative gauge of a fund’s efficacy and the competencies of its managers. Funds able to consistently maintain a high ranking within their respective sectors over time typically signal a notable level of expertise. Conversely, fund managers overseeing perennially lagging funds showcase deficiency in quality and an inability to deliver competitive returns. While past performance alone cannot predict future returns, it is a valuable tool to assess manager skill.

Navigating Market Cycles

Over a multi-year span, investments traverse various economic and political environments. How capably a fund and its managers navigate these cycles offers clues into their abilities and competence.

Summary

In summary, our analysis of 3,095 sector classified funds and 134 fund management brands revealed that the vast majority consistently underperform.

While past performance alone should not dictate investment decisions we believe those with a demonstrated track record of exceeding benchmarks may merit special consideration by investors seeking superior risk-adjusted returns. However, building a prudently diversified portfolio involves much more than chasing last year's winners.

Factors like total costs, portfolio concentration, manager tenure, and investment strategy should also be evaluated. Working with a qualified financial advisor can help investors select funds aligned with their unique goals, time horizon, and risk tolerance. Though the number of top-tier funds remains limited, ample opportunities exist for those willing to do their homework.

Data Driven Portfolios

At Yodelar, our investment portfolios are grounded in rigorous due diligence. Over many years, our research team has conducted an extensive evaluation of the investment universe, assessing more than 100 fund managers, tens of thousands of funds across vehicles like mutual funds, ETFs, and investment trusts, and analysing over 40,000 model portfolios.

This careful scrutiny consistently reveals that only a small fraction of available funds and fund managers are able to consistently outperform their benchmarks across market cycles. In fact, our analysis shows that over 90% of model portfolios contain underlying funds that chronically underdeliver.

By identifying the attributes of top-tier funds and managers, we've developed portfolio construction methods aimed at maximising risk-adjusted returns. This research-driven process underpins our suite of strategically allocated, risk-rated model portfolios, which exclusively utilise best-in-class investment vehicles tailored to each asset class.

At Yodelar, we believe advanced analytics and active due diligence can give investors an advantage. To learn more about our disciplined approach and explore how we can help grow your wealth, schedule a no-obligation consultation with one of our advisors today.