- Poor performance and high charges from Hargreaves Lansdown.

- 12 of 13 Hargreaves Lansdown funds have consistently ranked among the worst performers in their sectors

- 56% of the funds they recommend in their Wealth 50 list have underperformed

- Their second largest funds, the HL Multi Manager Special Situations fund, was outperformed by 95% of funds in its sector over the past 5 years.

- All but 1 Hargreaves Lansdown fund has returned losses over the past 12 months.

Founded in 1981, Hargreaves Lansdown is the biggest fund supermarket in the UK. They are a FTSE 100 company that has built a dominant position in the self investor market with their investor platform responsible for administering more £120 billion.

In recent years, they have made use of their vast online authority by diversifying their business model to put greater emphasis on fund management. They currently have 13 funds on the market which combined hold £8.5 billion of funds under management.

They sell these funds individually on their platform but they also package them into their ‘Portfolio Plus’ range of ready made portfolios, which are designed to offer investors access to pre-built risk adjusted portfolios that invest in a broad mix of assets. Aside from promoting their own range of funds, Hargreaves Lansdown's website features the highly popular and somewhat controversial Wealth 50 list, which is a list of 73 funds that HL believe offer the greatest performance potential.

In this report, we analysed the performance, sector ranking and overall rating of all 13 of their in-house range of funds as well provide a detailed analysis of the funds they favour in their Wealth 50 list recommended fund list.

Click here to download the full Hargreaves Lansdown Fund Review

Our analysis identifies 12 of their 13 funds have consistently underperformed. This report also identifies that some 56% of the funds within their Wealth 50 list of recommended funds also have a history of consistent poor performance.

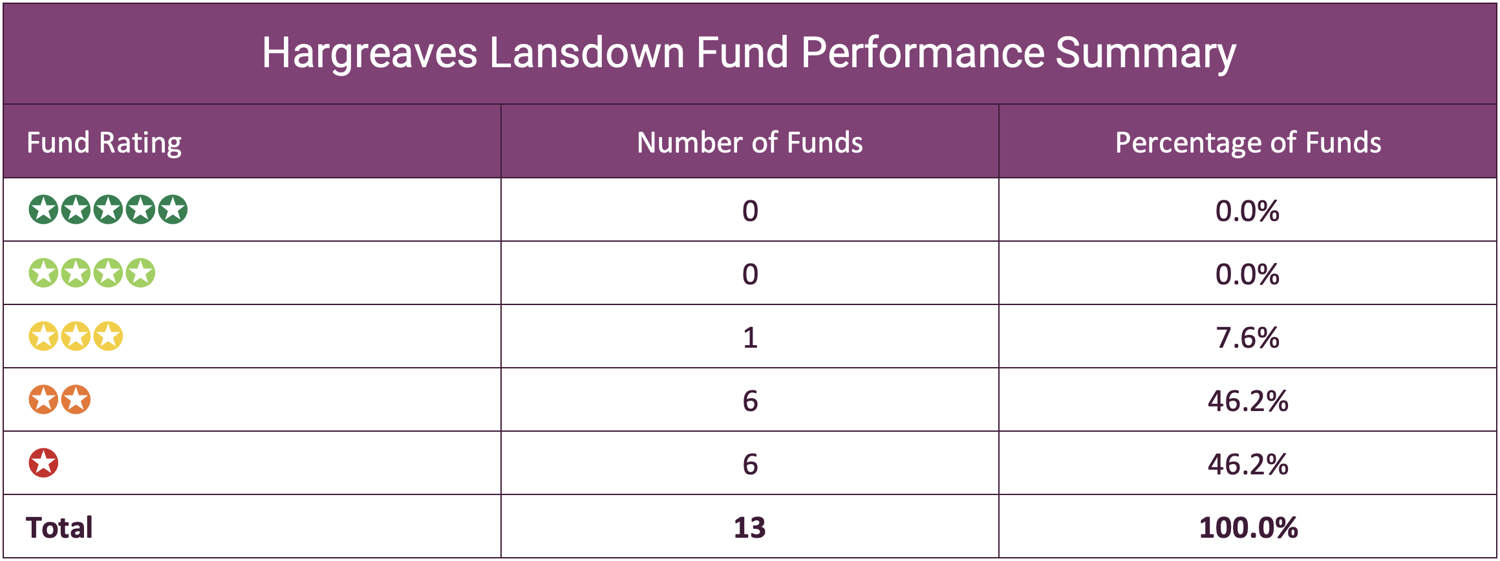

Hargreaves Lansdown Fund Performance Summary

Our analysis of Hargreaves Lansdown’s 13 own branded funds identified that only 1 fund received a moderate 3-star rating with 12 receiving a poor performing 1 or 2 star rating. These 12 funds have consistently ranked among the worst performers in their sector.

Hargreaves Lansdown Funds Consistently Underperform

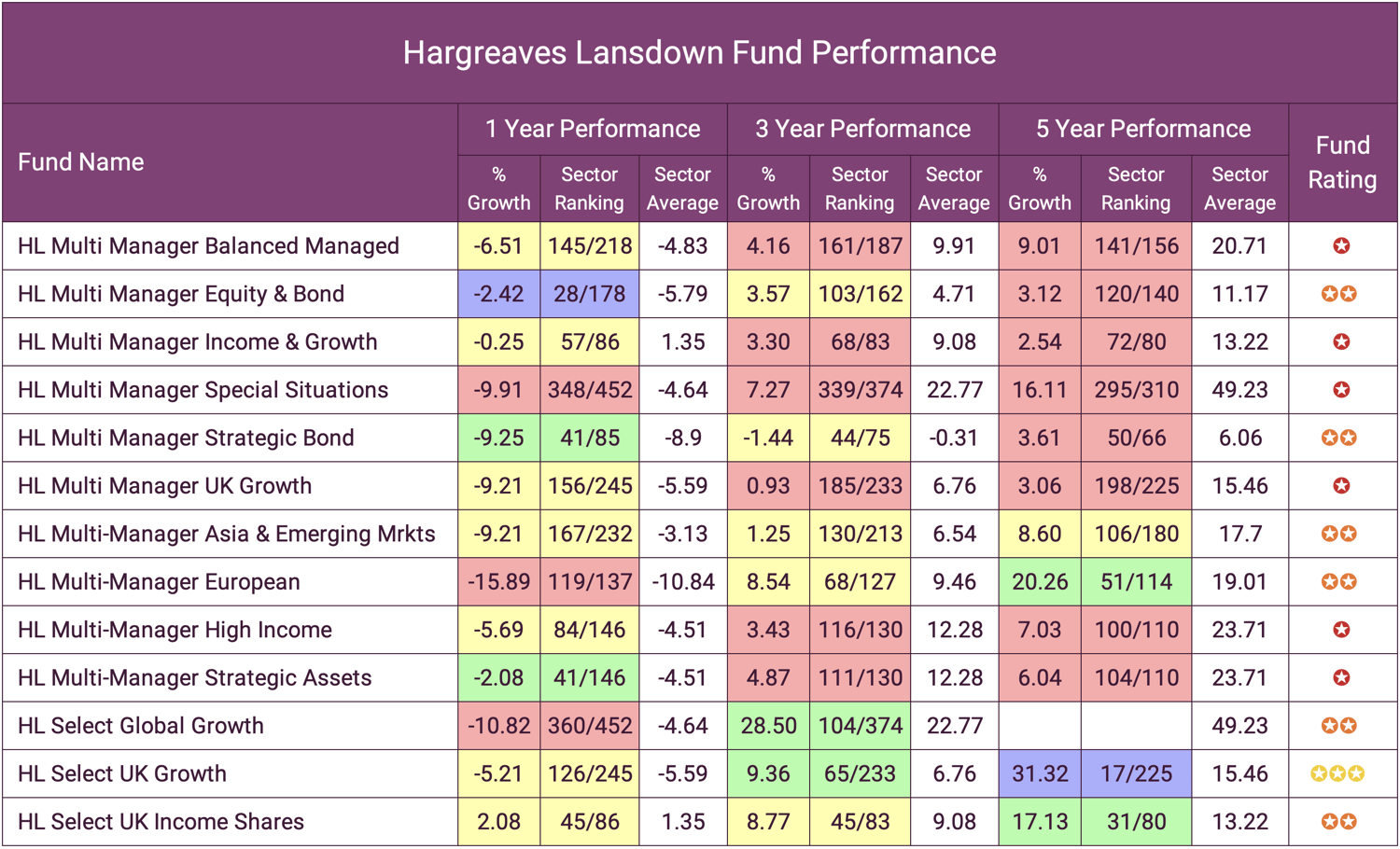

Our analysis of the 13 Hargreaves Lansdown funds identified widespread underperformance with their newest funds, the HL Select Global Growth fund, the only one to maintain a top quartile sector ranking over the past 12 months.

The HL Multi Manager Special Situations fund has £1.88 billion of investor assets under its management which makes it their second largest fund. Yet despite its popularity the fund has consistently ranked among the worst performers in its sector. Classified within the IA Global sector, the fund has been outperformed by 95% of the funds in this sector over the past 5-years with cumulative growth of 16.11% falling well below the sector average of 49.23%.

The largest of their funds with some £2.0 billion of client money under management is the Multi Manager Income & Growth fund. Again, this fund has a history of poor performance and over the past 5 years it returned growth of 2.54%, which ranked 72nd out of all 80 main unit funds in its sector.

Only the HL Select UK Growth fund has delivered 1, 3 & 5 year returns that was above the sector average. Over 5 years the fund ranked 17th out of 225 funds in its sector with growth of 31.32 well above the average of 15.46. However, this level of performance hasn’t sustained over the past 1 & 3 years with the fund slipping down the sector rankings.

Hargreaves Lansdown Admit Funds Not Offering Value

Hargreaves Lansdown’s most recent value assessment report admits that in relation to performance their Multi-Manager Asia & Emerging Markets fund and Multi-Manager Strategic Assets fund do not currently offer investors value. Indeed, the latter has consistently languished at the bottom of the performance rankings within its sector where it ranked as one of the worst 3% for performance over the past 5 years.

In the same value assessment, Hargreaves Lansdown has said 8 of their 13 funds need improvement when it comes to performance. For the remaining 5 funds HL have said they are satisfied with their performance and the value these funds have delivered for their clients. But as identified in our analysis, 12 of these funds have consistently performed below the sector average.

Among the funds Hargreaves Lansdown have said they are happy with in regard to performance is the HL Multi-Manager Balanced Managed fund. This fund is the 3rd largest of their range of funds with £1.2 billion of client money under its management. As identified in the performance table, this fund has consistently performed worse than at least 50% of its sector over the past 1, 3 & 5 years.

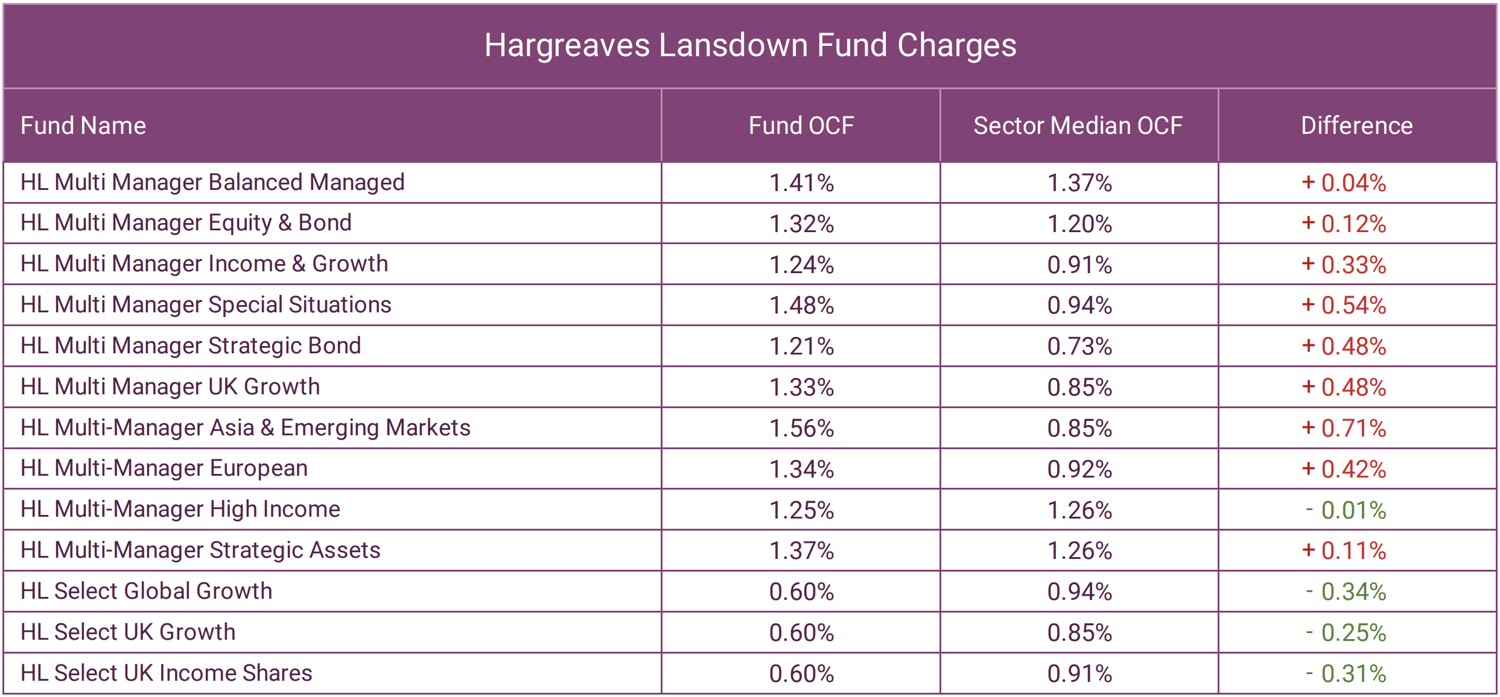

High Charges For HL Funds?

In their value assessment report Hargreaves Lansdown commented that all 13 funds offer value in relation to their costs. However, 12 of the 13 funds have performed poorly when compared to all same sector funds, and 9 out of 13 funds have a higher ongoing charge figure (OCF) when compared to their sector average.

The table below shows that 9 of their 13 funds have higher ongoing charges than the average for funds in their sectors.

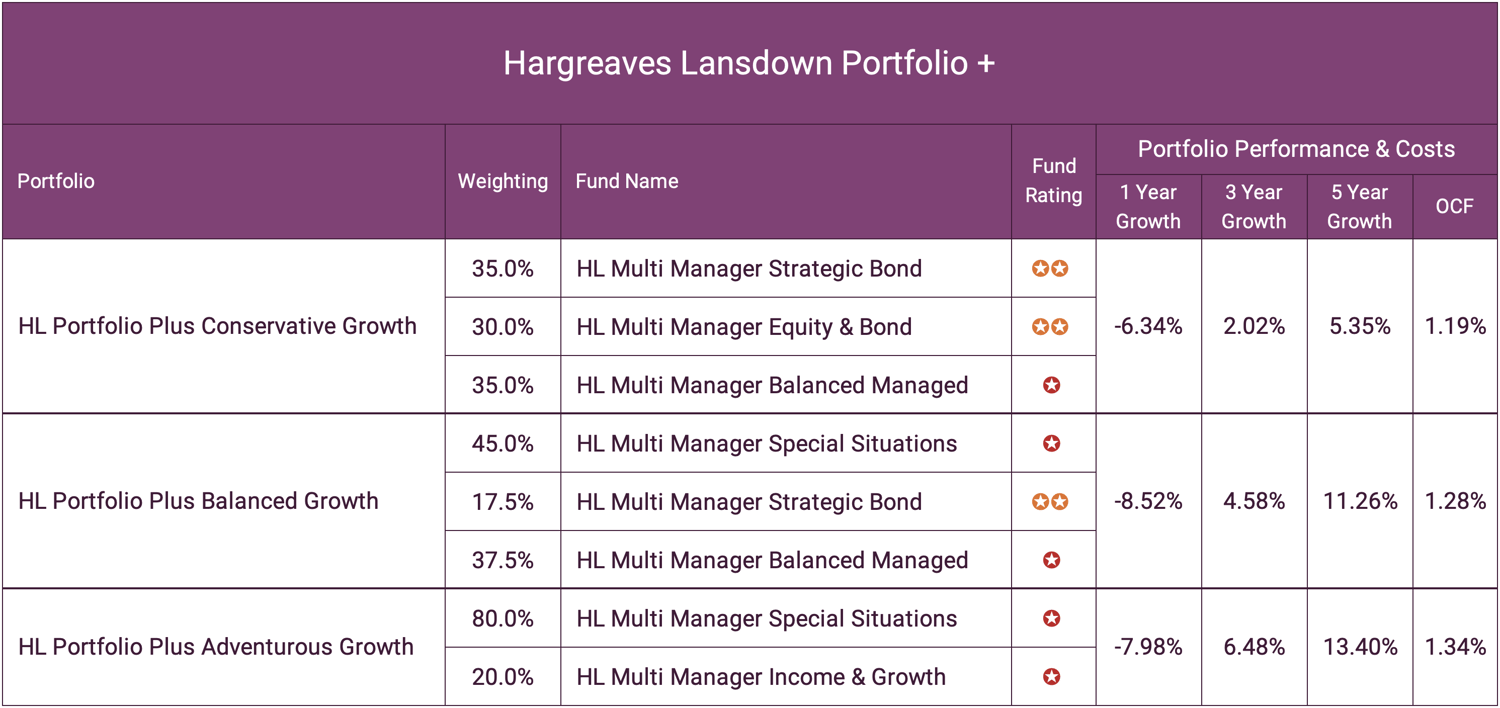

Hargreaves Lansdown Portfolio Plus

Hargreaves Lansdown also provide a range of readymade, risk rated portfolios that have proven to be popular with investors who do not wish to seek financial advice but lack the time or expertise to manage their investments effectively.

Each of these portfolios is made up entirely of Hargreaves Lansdown’s own range of Multi Manager funds, which as we have identified have consistently struggled for competitive performance.

As these portfolios contain only poor performing funds, their performance is significantly compromised. As a consequence, a similar risk portfolio made up of consistently better quality funds would have delivered significantly greater returns.

Our investment philosophy is to build efficient, top performing portfolios by utilising funds and fund managers that have proven their quality by consistently outperforming their peers. This removes any bias and emotional decision making that can be detrimental to a portfolio’s objectives.

CLICK HERE TO BOOK A NO OBLIGATION CALL WITH OUR ADVICE TEAM

Hargreaves Lansdown Wealth 50 Review

Although Hargreaves Lansdown have increased their focus on fund management they are primarily recognised as a fund supermarket and for providing DIY investors with access to thousands of funds through their platform. One of their most popular resources widely used to assist in fund choices is their influential Wealth 50 list of recommended funds.

Yodelar have over the years questioned the motives of such lists. We have concerns over the extent of their influence with investors. Download our full performance analysis on Hargreaves Wealth 50 list.

75% of DIY investors use recommended funds lists

Recommended fund lists are very popular among DIY investors.

According to Interactive Investor, around 75% of DIY investors use recommended funds lists when making investment decisions. The influence these lists have on investment decisions and the flow of money is huge.

For fund managers whose funds are featured on the list, lists can drive greater inflows into their funds, boosting their assets under management thus generating higher ongoing revenue.

The influence of these recommended fund lists cannot be understated - with arguably the most popular being the Hargreaves Lansdown Wealth 50 list.

The Wealth 50 has come under criticism for the funds it has recommended. Yodelar was the first organisation to highlight Neil Woodford's long term poor performance (as far back as when under the wing of Invesco), and later the deep connection with Hargreaves, and his prominence within their wealth 50 and wealth 150 lists .

The inclusion of the consistently poor performing Woodford Equity Income fund and the subsequent fallout after the fund was closed down led to legal claims against Hargreaves Lansdown.

For recommended funds lists such as the Wealth 50, there will always be subjective opinions regarding the merits of the funds it promotes. But what is not subjective is the fact that 56% of the funds in the Wealth 50 list have a history of poor performance when compared to their sector peers.

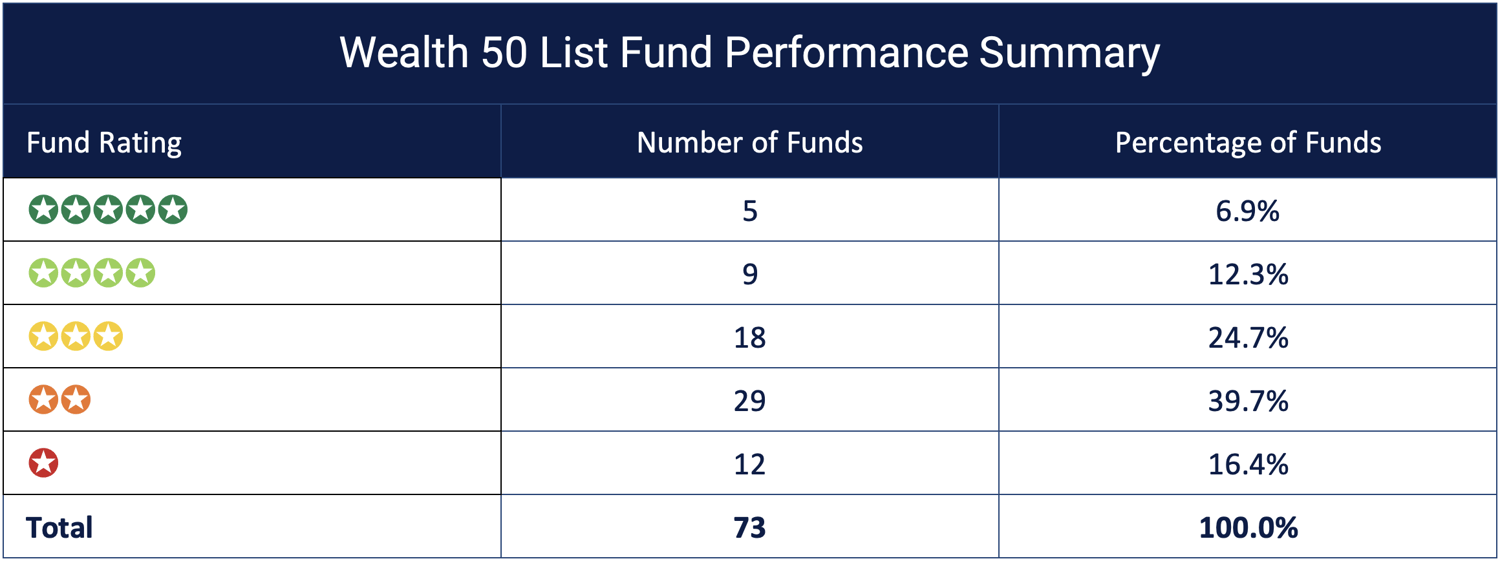

Wealth 50 Fund Performance Summary

The Hargreaves Lansdown Wealth 50 list contains 73 funds that cover a range of asset classes and investment objectives.

In this report, we analyse the 1, 3 & 5 year performance of each fund and provide an overall performance rating based on how each fund factually performed compared to all other funds within their sectors.

Our analysis identified that over 56% of the funds in Hargreaves Lansdowns recommended funds list have a history of underperformance, with some of these funds consistently ranking among the worst in their sectors.

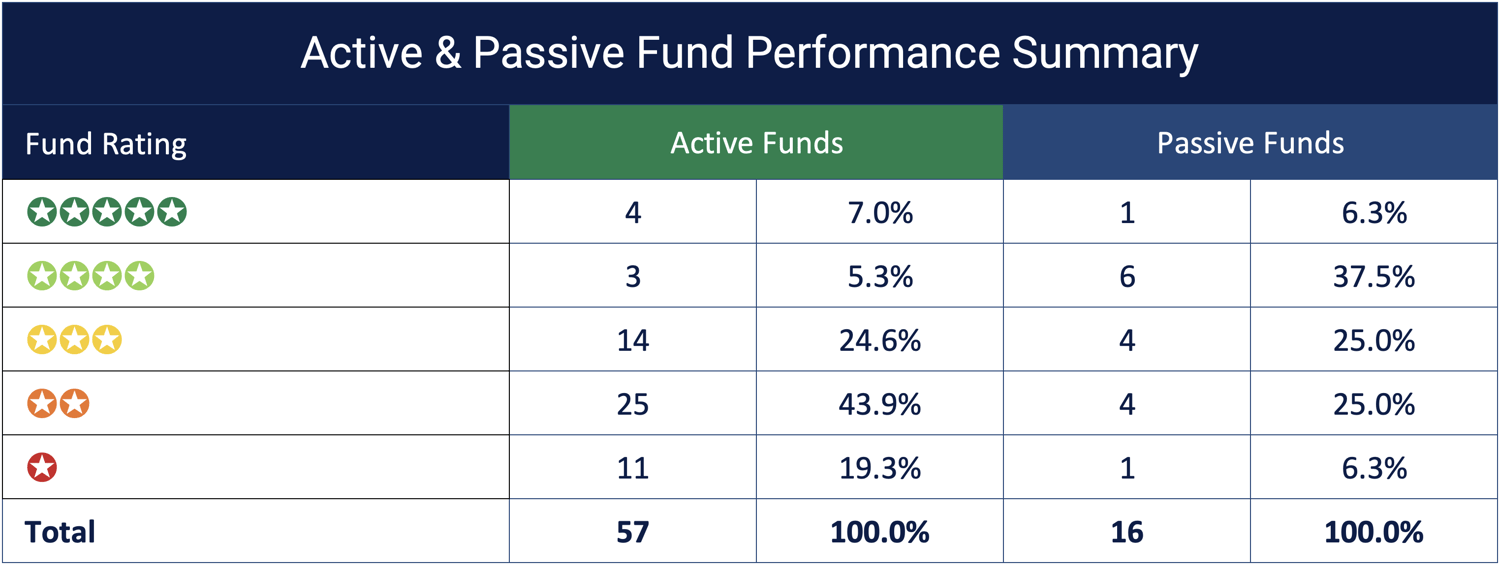

From the 73 funds within the Wealth 50 list, 57 are actively managed with the remaining 16 tracker funds.

From the 14 funds that had a good 4 or 5 star performance rating 7 of these funds were active and 7 were passive funds. Of the funds that had a poor performing 1 or 2 star rating 36 were actively managed and 5 were passive.

Wealth 50 Selection Process

The Wealth 50 is a selection of funds Hargreaves Lansdown say have excellent long-term prospects. The purpose of the list is to make it easier for investors to make fund choices by filtering through the 3,500 plus available funds and producing a list that consists of just 73 funds that give investors a few options in each of the main investment areas, or sectors.

What they look for:

Hargreaves Lansdown are clear to point out that they do not take payment or receive commission for funds that appear on their Wealth 50 list. They say their selection process looks for:

- A distinguished career - we analyse the manager's entire career, so we know their strengths.

- A fantastic track record - a fund manager needs a history of good performance across different market conditions.

- A robust process - we meet managers a number of times to get a deep understanding of how they invest, and at least once a year when they're on the list.

The Wealth 50 Lists Controversies

The Hargreaves Lansdown promoted funds list is highly influential, going to its 1.7 million private investors, many of whom act on their recommendations. But the list has often courted controversy. The primary source of contention was a result of the inclusion of the Woodford Equity Income and Woodford Income Focus funds in Hargreaves Lansdown's recommended funds list when it was known as the Wealth 150.

The continued inclusion of both of these funds was met with concern as both had a history of significant underperformance. At the time, Mark Dampier, Hargreaves Lansdown’s research director, said: “We have known Neil Woodford for a very long time. And we have had some tough times with him in the past. He has now been through two poor periods in his career. The easy thing would be to take him off the list. That would actually be less hassle for us. We are long-term conviction investors.” Of course, not long after, the Woodford Equity fund collapsed resulting in huge losses for investors in the fund.

Hargreaves Lansdown found themselves at the centre of the controversy surrounding the suspension and ultimate closure of Neil Woodford’s funds, with accusations of bias towards the fund manager whose funds had been very lucrative for HL in the past. Many Woodford investors blamed Hargreaves Lansdown for their promotion of the fund as a reason for their investing in it. Which has resulted in legal claims against Hargreaves Lansdown.

The Hargreaves Lansdown, Neil Woodford debacle undoubtedly hurt HL and it resulted in them promptly rebranding their recommended fund list from the Wealth 150 to the more condensed Wealth 50 that we know of today.

But the new list quickly earned the wrath of star fund manager Terry Smith as the list failed to include his Fundsmith global equity fund - which is the largest fund in the UK, and one of the top performing funds in the Global sector in recent years.

According to The Times, Smith, who founded Fundsmith in 2010, accused HL of recommending funds based on their potential to maximise the fund supermarket's profits rather than their ability to outperform for clients.

Problem With Recommended Fund Lists

Convenience, accessibility and lower charges provided by many self investment platforms such as Hargreaves Lansdown, Fidelity, interactive investor and Bestinvest has led to the continued rise of self managed or DIY investors and combined now administer well in excess of £100 billion of investor money.

At the forefront of their marketing strategy and key to attracting new investment clients, platforms publish guides and resources that help to promote their platform none of which are more popular than their recommended funds lists.

These short lists of favourite funds have proven to influence the fund choices of many self-investors and thus generate significant investment for the investment platforms. We have continued concerns over how these lists are formulated based on the quality of some of the funds they feature.

Through the likes of the Hargreaves Lansdown Wealth Shortlist, investors are making fund choices based on what is presented as the best investment opportunities. But how much credence should be placed on these promoted funds? And do they represent the best opportunities for investors?

As identified in this report, a large number of the funds within the HL Wealth 50 list have a history of poor performance with 56% consistently ranking among the worst in their sectors.

Proceed With Caution

Recommended fund lists are widely used by investors and can be very influential when making fund choices, but they are also a valuable marketing resource for the brands who provide them as they increase investment through their platforms.

The motives of fund lists have long been questioned with controversy surrounding certain fund inclusions most notably Hargreaves Lansdown’s continued inclusion of Neil Woodford's now defunct LF Woodford Equity Income fund in their Wealth 50 list even as the fund continued to underperform and lose money. Indeed, our analysis identifies some questionable inclusions with several funds consistently ranking among the worst performers in their sectors.

When assessing the drivers for a recommendation of funds, a study by the Financial Conduct Authority pointed to the conflicts of interest inherent in many of these lists. It found that funds affiliated with platforms are “significantly more likely to be added to the recommendation list than non-affiliated funds”. The study also found that “recommended funds share a higher proportion of their revenues with the platforms than non-recommended funds”.

Summary

It is clear that fund management is now an integral part of Hargreaves Lansdown's business model, with a significant proportion of their revenue coming from their own brand of funds. Factually the majority of these funds have a history of poor or mediocre performance and the subsequent portfolio plus range, which is built using these funds, has struggled to deliver competitive returns.

For many investors, the real value from Hargreaves Lansdown is likely to come through their platform/technology, where they provide access to thousands of funds, often at discounted rates, and not necessarily from the range of funds they currently manage.

Hargreaves influential Wealth 50 list of favourite funds primarily contains funds that have consistently underperformed. When making fund choices it is important to remain objective and before investing in any of the funds the list may recommend it would be prudent to complete additional due diligence. You can assess the performance of any fund and compare to all other same sector funds using free Yodelar resources

To summarise, the only effective way to assess funds is to compare their performance to all other same sector funds, only on this basis can we tell how efficient a fund manager is.

Click here to download the complete Hargreaves Lansdown Review.