- 27.69% of ethical funds have consistently ranked in the top quartile (top 25% of their sector). In contrast, just 10% of all unit trust funds have achieved this.

- Some of the highest growth funds in recent years are ethical themed funds

- New legislation will give a competitive advantage to companies who efficiently put in place ethical and sustainable practices and thus improve the opportunities available to ethical investors

- In this report we analysed 137 ethical and sustainable funds and identified how they each performed and ranked within their sectors over the past 1, 3 & 5 years

2020 has had the biggest impact on how we live our lives since World war 2. There is no doubt that the upheaval to public life has been significant and the long-term ramifications of the global covid19 pandemic is not clear.

Covid19 has been at the forefront of global news and the biggest social and economic issue that governments currently face, but it will subside, and now that vaccines are passing their clinical trials and national distribution begins there is an end in sight.

As the plan to suppress and control the virus takes effect, it will make way for the issue of climate change to retake centre stage. The issue of climate change has been around for decades but in recent years, with scientific evidence showing just how critical the current climate issue is, governments have been clear in their aim to reduce our carbon footprint and prioritise the development of more environmentally efficient and ethically sustainable means to maintain our quality of life.

Over the last decade, sustainability has become increasingly important in the investment world and more investors now want to know where their money is going and what it’s being used for.

In response, more industries across a wide range of sectors are adopting the (ESG) Environmental, Social, and Governance principles, which in turn has helped to increase the number of ethical and sustainable funds that are available to investors.

Identifying suitable ethical funds to invest in has traditionally been a difficult task, but online fund platform Interactive Investor, in collaboration with independent experts SRI Services, and data provider Morningstar, have developed a list of 137 ethical investment funds that have been categorised based on their ethical style and the strategy of each fund. This list sheds light on a large selection of ethical focused funds.

To add further clarity, we have analysed each of the funds listed for both performance and sector ranking over the recent 1, 3 & 5 years and identify which ethical funds have performed the best.

The EU Green Deal Could Transform Business Structure

The EU Green Deal is a policy framework and package that aims to transform the European economy with the overarching goal of achieving climate neutrality by 2050 and increasing ambition in existing emissions reduction targets.

Announced in 2019, this multi-year project will create new and revamp existing policies, including the EU’s first ever Climate Law. It is ambitious, far-reaching and will impact almost all sectors of the economy.

In addition, the plan focuses on policies and strategies to ensure the supply of clean and affordable energy, establish a circular economy, eliminate pollution, safeguard biodiversity, and create sustainable food and transport systems.

A combination of financial and real economy policies have been proposed to achieve this climate ambition. We have highlighted key elements below, though there is a much longer list (~50) of associated policies and initiatives.

What are the investment implications?

It is believed that the Green Deal will have major structural implications for the EU economy in the coming decades, impacting everything from the way we produce and use power, to how we travel, heat our homes, and even how we eat.

This will provide significant opportunities for industries and companies that are well placed to take advantage of the transition.

The major policy areas highlighted in the Green Deal can be mapped to four key investment themes. Understanding how these policies can affect industries and companies can be key to how investment decisions are made.

The Factors That Fund Managers Consider When Creating Ethical & Sustainable Funds

The companies within these sectors that adapt to these processes efficiently could gain a competitive advantage within that sector and thus represent an excellent investment opportunity. It is by carefully analysing their strategies that fund managers are able to put together ethical and sustainable funds that meet the required framework but are also well positioned to deliver strong returns for investors.

Environmental Themes

CLEAN ENERGY - A global energy mix shifting to renewable and cleaner energy is crucial in order to limit global temperature increases. Additionally, battery storage will play an essential role in enabling renewables to become a mainstream source of energy by smoothing the peaks and troughs associated with variable output from solar and wind farms.

Impacted Sectors - Renewable energy developers and operators, renewable energy technology, battery technology

EFFICIENCY - Roughly two-thirds of the primary energy contained in fossil fuels globally is wasted. As well as reducing emissions, efficiency gains are necessary in the use of all-natural resources, including materials, food and water. At its core, efficiency is about minimising environmental impact while still providing essential goods and services to society.

Impacted Sectors - Electrical equipment, industrial process and automation technology, building materials, software, semiconductors

ENVIRONMENTAL SERVICES - The value of ‘natural capital’ is not captured in economic measures and yet it is the foundation of prosperity. There are many negative impacts on the environment associated with population growth and a linear economic model. Waste management, pollution control, environmental protection and remediation, and the creation of circular business models are all required.

Impacted Sectors - Recycling and circular economy, natural capital, sustainable packaging, waste management, environmental engineering & infrastructure

SUSTAINABLE TRANSPORT - Transportation is one of the main contributors to global greenhouse gas emissions and pollution and is a key target for government curbs. There is significant opportunity for companies at the forefront of pioneering new energy technologies, vehicle efficiency, public transport infrastructure and other low-carbon solutions.

Impacted Sectors - Electric vehicles, electric vehicle technology, rail, public transport, shared economy, cycling

WATER MANAGEMENT - Water is under pressure from both the supply side (insufficient fresh water, uneven distribution, poor quality and climate change) and the demand side (increasing use in agriculture, industry and municipal/residential areas). Substantial investment is required in infrastructure, alongside behavioural changes, in order to bridge the supply gap.

Impacted Sectors - Water utilities, water technology, water infrastructure

Social Themes

KNOWLEDGE & TECHNOLOGY - There is a close link between sustainability and innovation. Technological innovation and the advancement of knowledge play an integral role in the development of a more sustainable economic model. The world needs companies that provide tools and services that enable greater productivity and innovation.

Impacted Sectors - Software, semiconductors, AI, cloud computing, robotics, communication services, education and publishing

HEALTH - Ageing populations are putting systemic pressures on health provision and social care services. The demand for healthcare increases with age, and the challenge will be providing affordable care and services for this growing segment of society over a longer time horizon – as life expectancies are also rising – in addition to supporting healthcare innovation to address unmet needs.

Impacted Sectors - Health insurance, HCIT, healthcare services, diagnostics.

SAFETY - Growing populations, technological change and climate change are leading to an increase in the scope and complexity of risks. Companies with goods and services that prevent or mitigate risks are necessary to protect human life and enhance economic resilience. Examples are technology or services related to road safety, natural disasters, cyber security and food safety.

Impacted Sectors - Food, drug and environmental testing, transportation and electrical safety, public safety equipment, insurance, quality assurance

SUSTAINABLE PROPERTY AND FINANCE - Financial services play an integral role in the development of a sustainable economy. Banks provide essential products and services for savers, borrowers and business. Insurance companies contribute to economic resilience. Urbanisation, demographic trends and climate change necessitate the construction of sustainable and resilient housing and other types of property used in the provision of social services.

Impacted Sectors - Financial technology, insurance, commercial and retail banks, housing, digital payments.

QUALITY OF LIFE - Thousands of years of human development have resulted in rich and diverse societies with complex needs. There are many companies with goods or services that make a positive contribution to society and human culture by improving quality of life, including healthy living, sustainable consumer goods, and entertainment and leisure.

Impacted Sectors - Entertainment and leisure, sports and fitness, sustainable clothing, healthy food.

How Ethical Are Ethical Funds?

There are significant factors for fund managers to consider when putting together an ethical investment policy and each of these policies can be challenged as a policy that is ideally suited for one person will be inappropriate for another.

The list of categorised funds in this report goes some way in helping investors to find funds that best suit their personal aims and opinions.

While some funds avoid oil stocks, others may include them if the company is believed to be transitioning towards focusing on renewable energy. Another example is where environmentally friendly companies need to use certain metals such as cobalt for electric car batteries or silver for solar panels. These minerals are mined - but mining is a sector that is traditionally perceived as controversial.

These conflicts are inherent in the ethical investment world as some fund policies are more pragmatic than others. Some will balance the pros and cons of different business strategies and focus on themes that can help support growth and encourage progress, whereas others have more binary in/out policies.

The list of funds in this report have been compiled by investment platform Interactive Investor who used their (ACE) Avoids, Considers, Embraces screening process to identify the funds available on their platform that have an ethical strategy.

Although the 3 stages of this process help to segment the funds there is still a wide variation between funds within each of these stages.

Avoids

Summary Description: Funds that focus on simply excluding companies, sectors or specific business practices.

Pros: Fund managers that screen out unethical companies may give peace of mind to investors who are actively looking to avoid certain sectors.

Cons: There is huge disparity in relation to the range of sectors and companies that are excluded from funds that apply negative screening. Some very ethical funds can exclude over 60% of available investments, while others only avoid 3%. Customers should do further due diligence to ensure any investment option fits with their personal ethical criteria.

Considers

Summary Description: Funds that carefully consider an often wide range of ethical and/or environmental, social and governance (ESG) issues or themes when balancing positive and negative factors.

Pros: Managers who consider ethical issues will often invest in ‘best in sector’ companies that they consider to be operating more sustainably than their peers.

Cons: This is a wide-ranging group covering many different approaches. Each fund manager will consider some ethical criteria as part of their analysis of individual companies, so investors will need to do further research to determine whether a particular fund meets their ethical requirements.

Embraces

Summary Description: Funds that focus on companies delivering positive social and/or environmental outcomes.

Pros: The fund manager’s primary aim is to make a tangible, positive impact on the environment or society. They proactively support & 'encourage' companies either through stock selection, responsible engagement, or an impact focus.

Cons: These managers will choose investments based on their ethical criteria above all else - and financial considerations may be secondary to ethical requirements. This may result in the investment being more volatile and less likely to match the performance of standard indices over time.

Ethical Funds Can Deliver Better Returns

Ethical investing has been notoriously difficult to assess but Interactive investors long list of funds has helped investors to gain a thorough understanding of 137 funds with an ethical approach. The funds listed have varying ethical strategies which investors can assess using the criteria as defined by the interactive investors, SRI services, and Morningstar’s ethical categories.

Each of these Ethical funds covers a wide range of asset classes and the majority are classified within specific sectors. In order to gauge how competitive they are, we completed a comprehensive performance analysis of each fund.

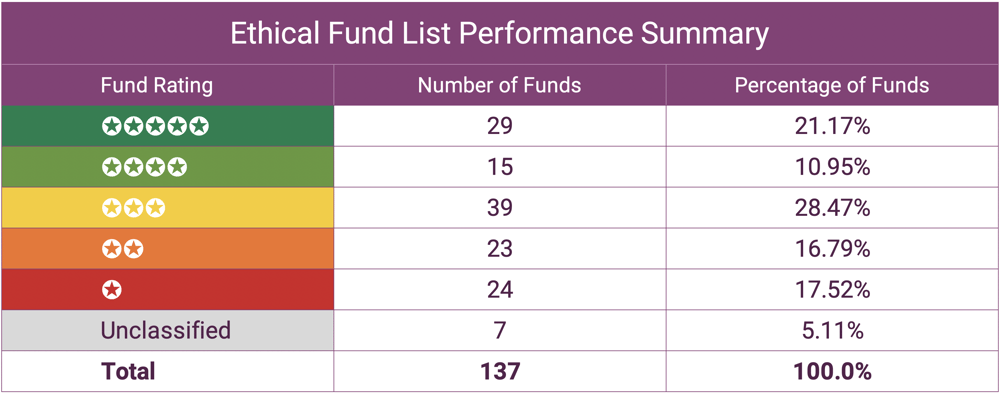

For each featured fund we analysed their recent 1, 3 & 5-year performance and provide each with a rating between 1 and 5 stars based on how their performance ranked when compared to their competitors within the same sector.

Our analysis identified that of the sector classified funds analysed some 27.69% had consistently maintained a top quartile sector ranking during the periods analysed. In comparison, of all sector classified unit trust and OEIC funds available to UK investors approximately 10% are able to maintain this level of performance which implies that ethical and sustainable funds on average deliver better returns.

With more companies and sectors adopting an ethical strategy, the greater the quality of opportunities available to ethical fund managers. For investors, investing in ethical funds no longer means they have to sacrifice growth as there are now options available that not only meet ethical requirements but consistently deliver returns above and beyond that of their competitors.