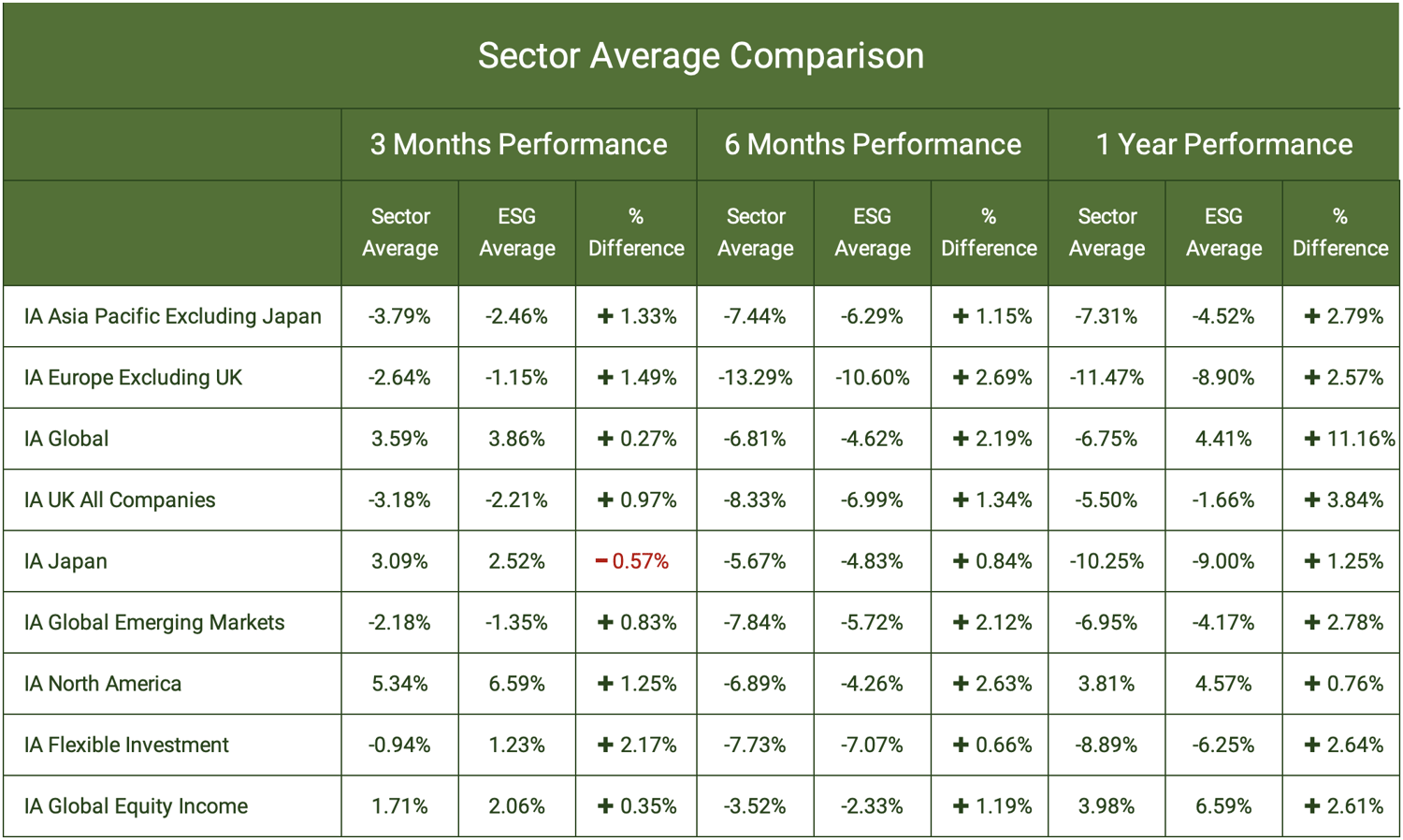

- Over the past 12 months Global sector ESG funds have outperformed the sector average by 65%.

- ESG funds have averaged better returns across all 9 major sectors over the past 6 months and 8 sectors over 3 months.

- Funds with a high ESG rating are now viewed by analysts and fund managers as more likely to deliver higher returns in the future.

Interest in Environmental, Social and Governance funds (ESG) has now intensified to such an extent that it will now likely have a significant role in future investment strategies for both fund manager and investor, even if actual ESG principles are not at the forefront of their investment objectives.

In the past ESG funds lagged behind mainstream funds in performance but over the past year they have averaged better returns, and going forward they are more likely to deliver even more for investors.

In this article we breakdown what ESG investing is, and we identify why companies who adopt ESG principles are better placed to benefit from future growth opportunities, and why this will also benefit investors who invest in mainstream funds that have no defined ESG objectives.

ESG Funds Deliver Better Returns 2022

2022 has been a torrid year for investing with almost every major global market suffering from negative returns. While no portfolio with a diversified asset allocation escaped unscathed, those who invested in funds with a high ESG rating are more likely to have fared better than their traditional peers, and are now viewed by many analysts and fund managers as better placed to deliver better returns in the future.

In the table below we analyse the funds within 9 core sectors and identify the average performance of ESG and non-ESG funds within each sector over the past 3 months, 6 months and 1 year period.

Our analysis of these 9 sectors identifies that over the 3 different time periods, ESG funds had a higher performance average than non-ESG funds at all times with the exception of the Japan sector over the past 3 months.

The above table identifies the sector average of 9 core investment association sectors over the 3 months, 6 month and 1 year period up to 1st November 2022.

What Is ESG Investing

Ethical investing is now a major part of the global investing landscape. Once regarded as a concept that was more likely to compromise returns than enhance them, ethical investing has grown exponentially in recent years, in no small part because of the role played by environmental, social and corporate governance investing - ESG for short.

Whereas ethical investing and what it actually means can be a subjective and complex model to navigate, ESG investing has provided a clear criteria that addresses many core issues, making it easy for investors to understand exactly what they are investing in or not.

What ESG Stands For:

-

Environmental, or ‘E’ in ESG, looks at the impact of resource consumption of any business on the environment like carbon footprint and waste water discharge, among other environmental impacting activities.

-

‘S’ or Social criteria looks at how business interacts with communities where it operates. It also looks at internal policies related to labour, diversity and inclusion policies, among others

-

‘G’ or Governance relates to internal practices and policies that lead to effective decision making and legal compliance. ESG facilitates top-line growth in the long run, attracts talent, reduces costs, and forges a sense of trust amongst consumers.

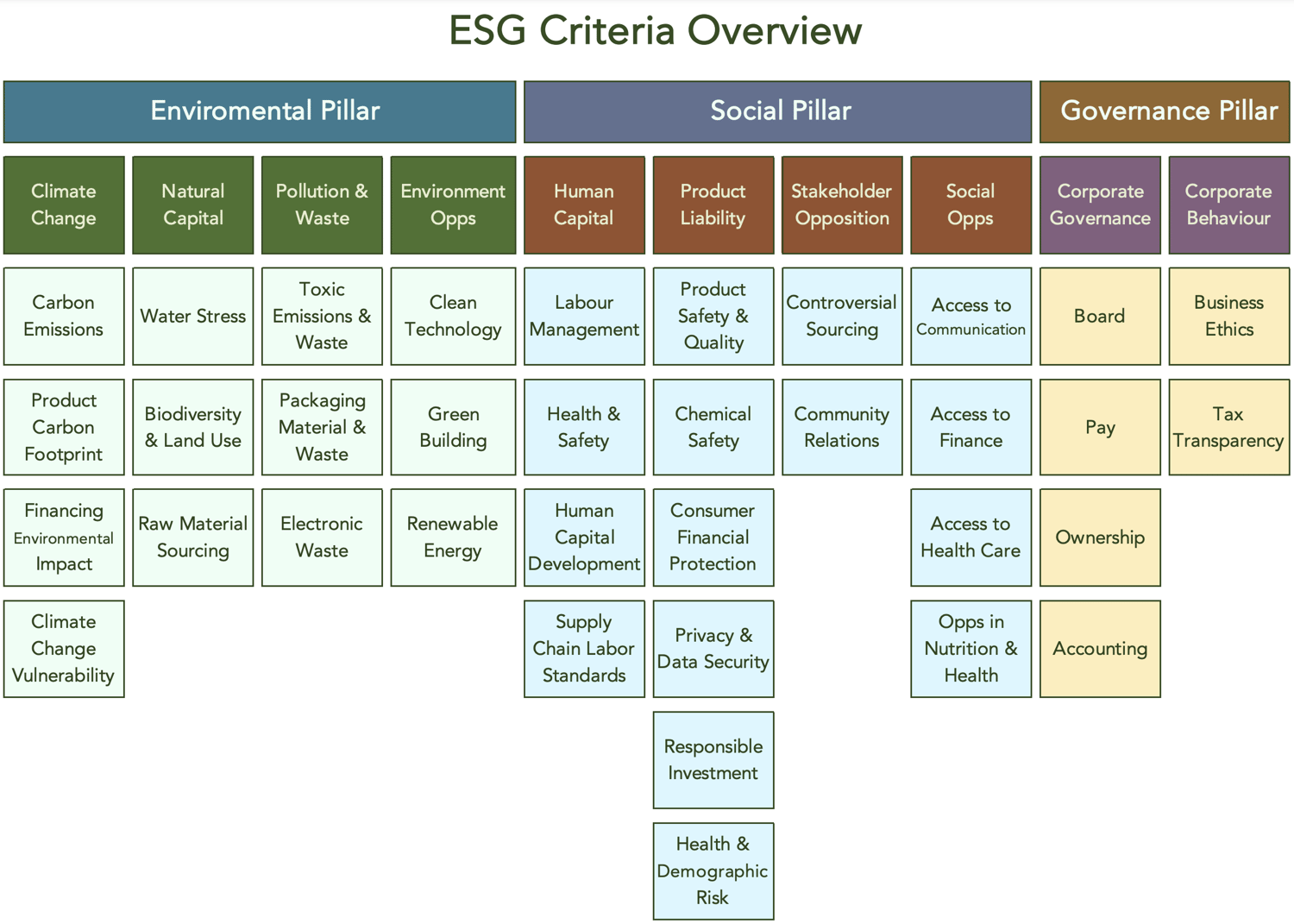

ESG criteria takes into account concerns about a range of issues from climate change to general corporate behaviour, with companies taking action to ensure that people and the planet are treated fairly.

A good example of this has been in Russia, where hundreds of Western companies - under pressure from investors and consumers alike - have unwound their investments, closed stores and paused sales because of the country’s invasion of Ukraine.

ESG covers the most common aspects of ethical investing but it is important to clarify that this criteria might still not suit some investors, particularly those who wish to invest only in funds that do not hold shares in particular types of companies even if they have good environmental or governance practices, such as gambling or alcohol related companies. For such investors their options are limited, and the tools available to identify these funds are not as developed as those now available for ESG qualified funds. However, the ESG framework covers a wide range of topics that is defined below:

Why Investing In An ESG Strategy Is Sensible Investing

An ethically centred approach to customers, employees and the world at large is increasingly seen as an indicator that a company is a good long-term investment.

ESG funds are tied to powerful trends such as sustainability, demographic development or technology – and may grow faster than the wider economy. In turn, investors will be more likely to stick with them through difficult markets, benefiting from the rebound and avoiding losses.

Indeed, sustainable funds outperformed traditional peer funds and reduced investment risk during coronavirus in 2020, according to the Morgan Stanley Institute for Sustainable Investing.

The comparative analysis bolsters favourable perceptions of sustainable investing, which are becoming more widely accepted among investors and asset managers, who see potential for sustainable portfolios to yield attractive financial returns, alongside positive environmental or social impact.

The reality is that Ethical and sustainable investing is no longer niche and should now be a consideration for growth focused investors.

The outlook for funds with holdings in companies that have implemented ESG practices is brighter than those who have yet to make the move, which for investors provides some exciting opportunities for future growth.

In another sign that ESG investing is going to continue to grow exponentially, new plans by the Financial Conduct Authority (FCA) aimed at supporting the move to a low-carbon economy will require all UK listed companies to tell investors all the climate risks they face. Such a requirement will force companies to up their game and will not only benefit the environment but it will also benefit investors.

ESG Investing

ESG has become a more relevant factor in risk mitigation. Those companies with transparent ESG policies have demonstrated an increased ability to be agile and flexible to more modern work practices.

Globally, sustainable funds based on ESG themes pulled in a record-breaking £14.9 billion of new money in 2019 – almost four times the 2018 figure of £3.9 billion, itself a record.

Morgan Stanley’s 2019 Sustainable Signals survey found that around 85% of investors are interested in sustainable investing, up from 71% since 2015.

An ethically centred approach to customers, employees and the world at large is increasingly seen as an indicator that a company is a good long-term investment. Since the COVID-19 pandemic, ESG has become even more important, highlighting the need not only to do well by society, but also a way to mitigate risk in the long term.

ESG funds are tied to powerful trends such as sustainability, demographic development or technology – and may grow faster than the wider economy. In turn, investors will be more likely to stick with them through difficult markets, benefiting from the rebound and avoiding losses.

The reality is that Ethical and sustainable investing is no longer niche and should now be a consideration for all investors. The past year has been a difficult one for investors with high volatility and negative growth across all major markets.

But as the end of the year approaches the outlook for funds with holdings in companies that have implemented ESG practices is brighter than those who have yet to make the move, which for investors provides some exciting opportunities for future growth; and with greater accessibility to online fund performance and ESG rating tools as well as growth focused ESG portfolios, it has never been easier to invest in high quality, sustainable funds.

How ESG Practices Will Enable Investment Growth

ESG is going to become an ever more important aspect for businesses to adopt. The trajectory for many industries is moving away from traditional practices driven by the demand for modernisation and greater accountability. The world is changing at a rapid pace and to keep up or to be an industry leader, companies must have in place ESG practices.

As such, there will be a point in time where the majority of investment funds have high ESG ratings even if ESG is not part of the fund's objectives. Simply put, the leading companies of the future will need to have set ESG practices in place to succeed. Because of this, fast moving companies are structuring their business operations to fit this future. Therefore, a growing number of investment funds with no defined ESG objective, will by default have a high ESG rating.

There are 4 key reasons why ESG is better for business growth and therefore investment fund performance.

1. ESG Facilitates Business Growth

It’s easier for businesses to enter new markets and expand their operations in the existing markets if they have a strong ESG approach. Governments facilitate access by giving licenses and issuing permissions to such companies.

As per GreenPrint’s Business of Sustainability Index report released in March 2021, 75% of Millennials are willing to pay more for an environmentally sustainable product in the US and 77% of the overall sample size are concerned about the environmental impact of products they buy.

2. ESG Reduces Costs

Companies which switch to more sustainable methods of production tend to be more efficient and reduce their costs. One such example is Nestlé, which announced that it will invest up to £1.77 billion by 2025 to shift from virgin plastic packaging to food-grade recycled plastics and the development of other sustainable packaging solutions. This will not only help it cut its carbon footprint but also save it from non-compliance costs among different geographies where it operates and have stricter laws related to the use of plastic packaging.

3. ESG Improves Brand Perceptions

All businesses are affected by some or other forms of regulations depending upon the markets they operate. The business with strong ESG measures, especially on Governance, invite less scrutiny from the regulators and have greater operational freedom. They also face less pressure from climate change from activists, employee unions etc. The consumers also prefer such brands too. For example, Starbucks introduced “Starbucks China Parent Care Program” in 2017 which provided health coverage to over 10,000 parents of Starbucks’ employees in China. It was seen as a strategic move as Starbucks planned to expand in China amid the growing trade dispute between USA & China.

4. ESG Attracts Talent and Boosts Employee Productivity

It is noted that strong companies with good ESG scores attract better talent and have longer retention. Having a clear sustainability agenda generates an internal sense of pride among employees. The younger generation prefers to work for companies with stronger commitments towards society. As per a study by Cone Communications on Millennial Employee Engagement in 2016, 64% of Millennials consider a company’s social and environmental commitments when deciding where to work.

5. ESG Can Optimise Profits & Improve Investment Returns

For many companies and industries a strong ESG proposition can enhance returns by allocating capital to more promising and more sustainable opportunities. Regulatory responses to emissions will likely affect energy costs and could especially affect balance sheets in carbon-intensive industries. Also bans or limitations on such things as single-use plastics or diesel fuelled cars in city centres will introduce new constraints on multiple businesses, many of which could find themselves having to catch up. Foresight flows to the bottom line, and those leaning into the tailwinds of sustainability are presented with new opportunities to enhance returns.

The Opportunities ESG Is Creating For Investors

New technology is helping fund managers keep pace with this sharp rise in demand for sustainable investments. As well as focusing on the ESG credentials of individual companies, fund managers are starting to give more consideration to the sectors, countries and regions that have the resilience and competitiveness to thrive as the world moves towards a low carbon future.

Fund managers see the importance of a company's resilience to ESG demands as a guide of their future growth potential. Resilience is about the readiness of sustainable portfolios to withstand the transition to clean energy and the impact of physical climate events as global temperatures rise. As well as asking which companies are best prepared, fund managers are also now looking at whether the countries in which they invest have the reserves to endure the pain of energy transition and to pay for the adaptation to a low carbon economy.

Cutting carbon emissions will require significant growth in carbon markets, and this growth is seen by many investment professionals as having a key influence on future competitiveness. Countries, industries and companies that are able to take advantage of the advances in technology needed to reach net zero carbon emissions will be best positioned to flourish in this environment and their growth potential could be significant.

Is Funds With High ESG Ratings The Future For Investors?

The reality is that Ethical and sustainable investing is no longer niche and should now be a consideration for growth focused investors. The past year has been a difficult one for many investors, but looking forward, the outlook for funds with holdings in companies that have implemented ESG practices is brighter than those who have yet to make the move, which for investors provides some exciting opportunities for future growth; and with greater accessibility to online fund performance and ESG rating tools as well as growth focused ESG portfolios, it has never been easier to invest in high quality, sustainable funds.

Straight Forward ESG Investing

Yodelar’s diverse range of ESG portfolios aims to provide ethically minded investors with both value and quality. They have been developed to give a structured performance driven ESG solution for investors.

Each of the funds within the Yodelar ESG portfolios have consistently ranked highly within their sectors for performance with our investment committee confident that the fund managers and their strategies will continue to provide exciting growth opportunities for investors, whether or not they are interested in investing in sustainable funds. Across the range of 9 risk adjusted ESG portfolios there is a combined total of 25 funds, each of which has been selected based on their composition of underlying holdings, asset allocation, performance and MSCI ESG rating.

To help ensure the fund's ESG portfolios meet consistent ESG metrics Yodelar follows the MSCI ESG rating criteria. The MSCI is a Global leader in providing expert research, data and technology that helps to add transparency and drive more informed investment decisions. Their ESG measurement criteria is extensive and their unbiased, straight forward, clear rating formula fits perfectly with our whole of market outlook on investing, which we believe is the most beneficial to investors.

The MSCI ESG Rating is designed to measure a company’s resilience to long-term, industry material environmental, social and governance (ESG) risks. They use a rules-based methodology to identify industry leaders and laggards according to their exposure to ESG risks and how well they manage those risks relative to peers.

The Future of Investing

In recent years, topics such as employment conditions, climate change, and sustainable resources have become more recognised and understood, particularly in the aftermath of the Covid 19 pandemic. The shock of the pandemic in particular reverberated around the world with major sectors and industries brought to a standstill. But the resulting fallout has helped to put to the forefront ESG practices and forced many sectors and industries to adapt. As a consequence, we are now seeing the bottom line of the companies who have implemented better ESG practices grow more than those who have yet to adapt.

Having in place defined ESG criteria is going to become a major part of the future success for most key industries. For investors, this will have a major role in the success of their investment portfolio.

What Does The Rise of ESG Mean For Mainstream Investors?

Greater understanding of ESG has led consumers to increasingly demand that ESG practices are met within funds. More fund managers have launched more new ESG focused products. With more than double the ESG funds on the market today than there was just 3 years ago. But what does this mean for mainstream investors with a focus on growth?

Quality companies that make up the holdings of these funds are at the forefront of implementing better ESG practices, because such practices will be key to their future strategy and prove vital to their ongoing success. Therefore, efficient mainstream investors will find that their portfolios will naturally begin to hold ESG rated funds.