In recent years the advancement of digital technology has completely transformed how we work, interact, make decisions and what we expect from service providers.

It has created a demand for greater convenience and easier access to services and products - forcing most industries to adapt while also creating opportunities for new innovative entries into the marketplace.

However, for the financial industry the crash of 2008 had a significant impact on investor confidence and forced many firms to focus on survival and recovery rather than the development of their online proposition.

This difficult period saw a growing percentage of investors adopt a more cautious mindset, which was further reinforced by subsequent regulatory and economic changes that diverted investor focus away from performance and more towards fees and reducing the costs associated with their investments – This changing mentality helped to fuel the rise of lower cost investment options such as ETFs and passive investments.

As the financial industry recovered, the rise of these low-cost investment products combined with the relative lack of digital innovation created opportunities that saw several new online investment services enter the market. Dubbed Robo-advisers, these new digital brands launched with the objective of providing a convenient and low-cost online investment service.

Several years on - has Robo Investing proposition provided investors with a strong enough reason to use their services?

The Advent of Robo-Advice: Nutmeg Become The First To Market

Set up in 2011, Nutmeg became the first of a new breed of financial startups to launch. Celebrated as the UK’s first online discretionary investment management company, they sought to make investing easier and more transparent at a fraction of the cost.

Nutmeg CEO Martin Stead has said: “The way people save, invest and manage their money is changing. Our model is now becoming a mainstream option for smart investors. We’ve combined our team’s investment expertise with cutting-edge technology and design, to platforms.”

Nutmegs online investment platform makes it easy for almost anyone to set up a general investment, ISA or pension portfolio in minutes.

They offer 10 portfolios to suit investors with differing risk profiles and investment objectives, which they determine through their step by step online sign up process. Each customer then has the option of investing a fully managed portfolio or in a fixed allocation portfolio depending on their investment style.

Their proposition was seen as a breath of fresh air for an industry, that to many, was slow to adapt, lacked transparency and was riddled with greed and poor performance. Despite being the largest Robo-Investing firm in the UK, the reality is, Nutmeg has struggled to make any significant impact on the investor market.

Despite Heavy Investment Nutmeg Continue To Haemorrhage Money

After several rounds of fundraising and huge investment from backers such as Schroder's, who invested $32 million in 2014, Nutmeg has continued to haemorrhage money at a worrying rate. Their latest accounts filed with Companies House show continued loses which increased from £8.9 million in 2015 to £9.3 million for 2016. Despite this Nutmeg has said it might need more funding. The business reported: “The directors have carried out a detailed review of the trading position and cash flow projections for the foreseeable future and have, based on the results of this review, determined that the company may require further cash injections to continue to develop and market its product offering and to build its customer base and its assets under management.”

Massive investment has helped Nutmeg increase client numbers to a reported 48,700 with total funds under management reaching £1 billion. However, Director of Numis Securities, David McCann has said “The scale you need to make the business work when you have those fee margins is high. For it to be viable, you need around £5 billion in assets, and £10 billion to be economical.”

To put Nutmeg’s size into perspective, the popular Fundsmith Equity fund has in excess of £13 billion of funds under management and grew by £2.6 billion in 2017 alone.

Moneyfarm & Wealthify Launch To Challenge Nutmeg In The Robo-Investing Market

Despite the business struggles of Nutmeg, strong confidence in the robo-advice concept has seen the launch of several new brands, such as Wealthify and Moneyfarm. Wealthify is a Cardiff based firm who launched in April 2016 with the aim of becoming one of the best robo-advisers by persuading 1 million UK savers to invest within a decade. They promote their proposition as an efficient online investment system using proven algorithms and digital technology - which they believe is the smartest and most appropriate way to invest.

They offer 5 risk-based portfolios that are also comprised of low-cost ETFs and passive funds, which investors can enter for as little as £1, and their management fees are as low as 0.59% (for clients who invest in more than £100k).

Another new entry into the Robo-advice domain was Moneyfarm. Founded by Italian entrepreneurs Paolo Galvani and Giovanni Daprà, Moneyfarm initially launched in Italy in 2011. After receiving funding from venture capitalists as well as investment from insurance giant Allianz, Moneyfarm launched in the UK in February 2016. They currently offer 6 risk based portfolios and their charges increase on a sliding scale based on the amount invested.

Find Out How The Portfolios Of Nutmeg, Moneyfarm & Wealthify Performed >>

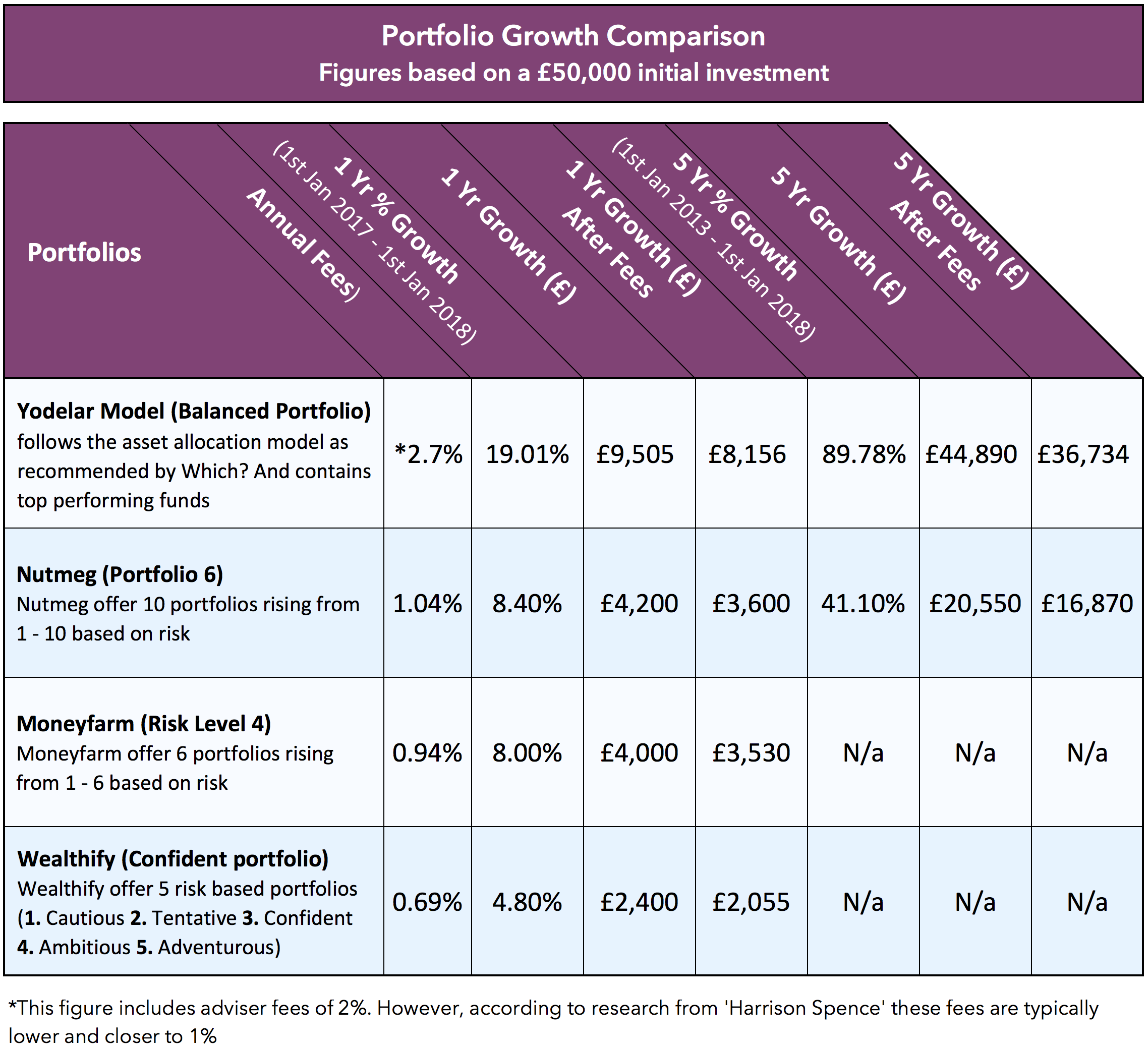

However, despite being heavily funded these new entries into the robo investing space lack diversity and their proposition remains very similar to the concept that was pioneered by Nutmeg. Their business models are each focused on providing a low-cost investment service but is this to the detriment of performance? As demonstrated below their portfolios have lacked performance.

Why A Nutmeg, Wealthify & Moneyfarm Portfolio Could Stunt The Growth of Your Investments

To attract new clients, the current robo-advice model focuses primarily on keeping costs to a minimum - which they do by constructing their portfolios using a selection of low-cost ETFs and passive funds. However, as demonstrated above, investing in lower cost products could end up costing you significantly more in missed growth.

Even with higher fees, a suitably balanced portfolio of consistently top performing funds delivered returns that were significantly greater than those of the 3 top Robo-Advice firms. Therefore, although important, the cost of investing should not take precedence over the pursuit of growth - which in essence, is what investing is all about.

Their Portfolios Offer Little to Investors, But For Savers, They Can Add Real Value

With entry as low as £1, the Robo-Investing market is a product that has appealed primarily to new investors and those with relatively small investable assets. This is supported by the fact that the average investment value of a Nutmeg client is £20,534, which is a proportionately small sum in the £8.1 trillion UK asset management industry.

The fact is, for growth-seeking investors the cost-focused portfolios offered by the 3 main Robo-Advice firms simply lack the performance to become a viable investment option.

However, despite the performance limitations of their products, the robo-investing market has the potential to become a huge asset to UK savers,

According to the FCAs Cash Savings Market Study Report, UK savers currently have around £700 billion stored away in low-interest savings accounts. Many of those savers are risk averse and cost conscious, but through low-cost Robo-investing platforms, they have the potential to achieve gains, which although small, are still notably greater than what they would gain from stagnant high street savings accounts.

The current Robo-Advice proposition was born as result of the opportunities presented through modern technology and the rise of the cost-focused investor. Their use of technology has made investing easier and more accessible to more people, but the robo-investing platforms currently offer little to the more experienced or growth-seeking investors and the fact remains that a suitably balanced portfolio of consistently top performing funds would have delivered significantly greater returns than the low-cost, and comparably low growth, passive portfolios that are offered by the UK’s top 3 robo-advice brands.