In this recent Neil Woodford review we analyse the history of Neil Woodford, his fund performance in Woodford Investment Management, his performance with Invesco Perpetual and his fund performance as an external fund manager managing funds for St James's Place, Quilter and Omnis.

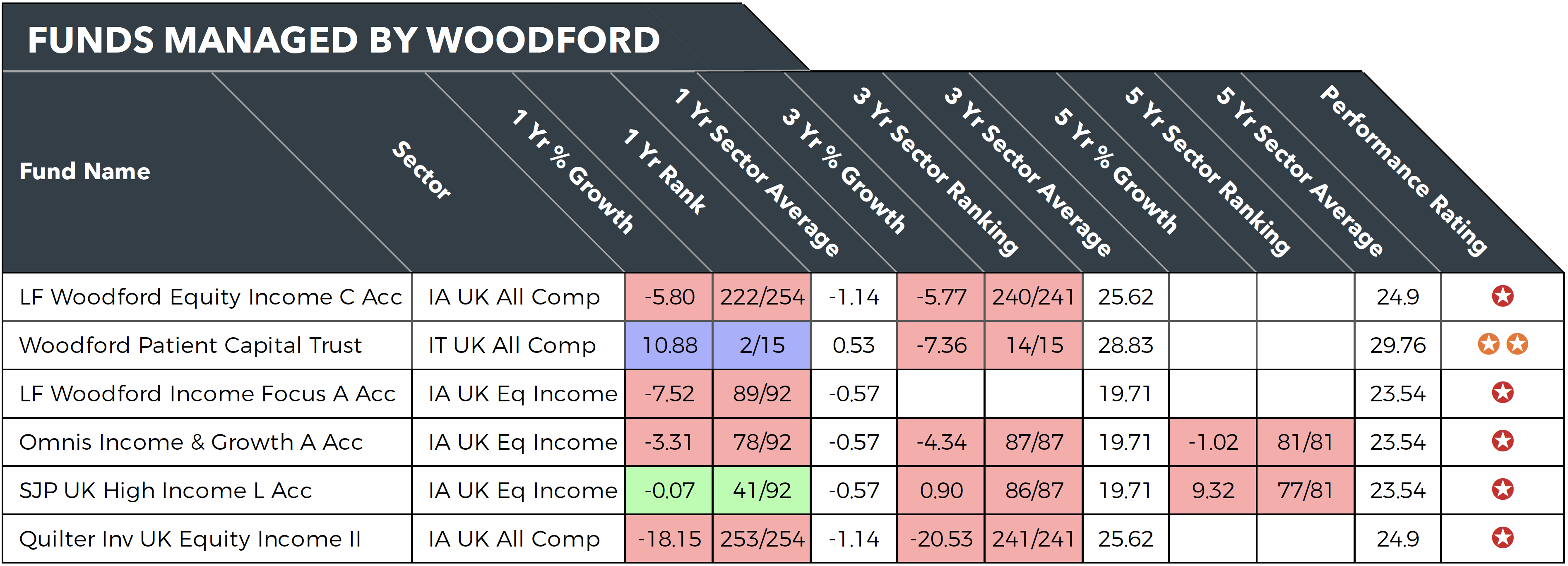

- Woodford Investment Management currently manages 2 funds. Both rank amongst the worst funds within their sector.

- The LF Woodford Equity Income fund ranked 240th out of 241 funds in its sector with 3 year returns of -5.80%.

- With negative growth of -7.52%, the LF Woodford Income Focus has performed worse than 97% of competing same sector funds.

- The Woodford managed Omnis Income & Growth Fund was the worst performing fund in its sector over the 5-year period analysed.

- Recently Quilter pulled the management of their UK Income fund from Woodford amid sustained underperformance, replacing him with Artemis manager Adrian Frost.

Neil Woodford Fund Performance

Our analysis of the 5 funds currently managed by Neil Woodford identified that 4 have made a loss since their inception, with the remaining fund returning growth that was among the lowest in its entire sector.

LF Woodford Equity Income

In June 2014, Woodford launched his flagship LF Woodford Equity Income fund attracting more than £1.6 billion from investors in its first month. His fund had £10 billion in funds under management in just 9 months and consistently topped the most bought fund's list. In less than a year it had become one of the largest funds in the UK.

Over the past 3-years, his flagship LF Woodford Equity Income fund ranked 240th out of 241 funds in its sector as it returned losses of -5.77%. Only the Quilter Investors UK Equity Income II fund, which also happened to be managed by Woodford Investment Management, performed worse. (Quilter Investors have announced that as of 15th April 2019 this fund is to be merged into their UK Equity Large-Cap Income fund, which is managed by Artemis.)

The poor performance of Woodford's Equity Income fund has led to steady withdrawals by investors each month for almost 2 years. At its peak, this fund held assets under management of £10.2 Billion. Confidence in Mr Woodford's decisions has certainly diminished as investors have withdrawn almost £6 Billion, decreasing the fund’s holdings to £4.4 Billion.

Woodford Patient Capital Trust

The Woodford Patient Capital Trust is Woodford's 2nd largest fund – an investment trust, offering exposure to a mix of disruptive early-stage tech and biotech companies with the objective of delivering returns in excess of 10% per year over the longer term. When it launched, Neil Woodford explained the long-term nature of the company and that performance should be judged over a three-to-five-year period. However, since its launch, the trust has struggled.

Over the recent three years, the Woodford Patient Capital Trust returned losses of -7.36%, even though the sector averaged returns of 28.83% for the period. Its poor performance resulted in its exit from the FTSE 250 list in June 2018, but a relatively strong end to 2018 saw it reinstated.

LF Woodford Income Focus

In March 2017, the LF Woodford Income Focus fund became the third fund launched by Woodford Investment Management. At the time of its launch, Woodford's Equity Income fund was under pressure as its performance nose-dived, and as a result, inflows into the Income Focus fund were relatively slow.

Currently, the LF Woodford Income Focus fund manages £573 Million of client assets and despite its objective of providing a high level of income together with capital growth, it has returned significant losses of -9.25% since its launch. Over the recent 12 months, it ranked 89th out of 92 funds in its sector with losses of -7.52%.

St James's Place UK High Income

St. James’s Place and Neil Woodford have had a strong relationship since his days as a fund manager with Invesco Perpetual. When he left Invesco to start up his own company SJP employed him to manage their UK High Income fund. In his 5-years of managing this fund, it has been one of the worst performers in its sector. Over the recent 5-year period it returned growth of just 9.32%, ranking 77th out of 81 funds and falling well below the 23.53% sector average for the same period.

Despite his poor performance as manager of their UK High Income fund, Chris Ralph, St James’s Place chief investment officer, said: “We remain confident in Neil’s ability to manage our clients’ money.”

Over the recent 5-year period only 4 funds have delivered worse returns than the Woodford managed SJP UK High Income fund. One of those funds was the Omnis Income & Growth fund, which also happens to be managed by Woodford.

Omnis Income & Growth

The Omnis Income & Growth fund has been a serial under-performer. Over the past 5-year period it ranked at the foot of its sector as it returned a loss of -1.02%.

Despite prolonged underperformance, Omnis is sticking with Woodford as their chief executive Mark Duckworth commented

"I think Mr Woodford’s had a tough time, it would be fair to say, over 18 months and it’s not the first time in his career. I think he’s been through this twice before. It’s slightly different this time, I don’t think he’s necessarily at a contra-view to the market, but we’ve worked hard with Neil and the Omnis board to understand where he wishes to go."

Quilter Investors UK Equity Income

Quilter Investors launched their UK Equity Income fund in 2014 with high expectations after securing Neil Woodford as the funds manager. But the fund has severely underperformed returning losses of -18.15% and -20.53% over the recent 1 and 3 year periods as it consistently ranked at the foot of its sector.

As a result of this Quilter announced in early April 2019 that Woodford would no longer be managing the fund and that Adrian Frost, of Artemis, would take over.

In regards to Woodford's sacking a spokesman for Quilter said: "The Quilter Investors fund research team has recommended that the current investment adviser, Woodford Investment Management Limited, is replaced with Artemis Investment Management LLP."

Top Performing Alternative To Woodford

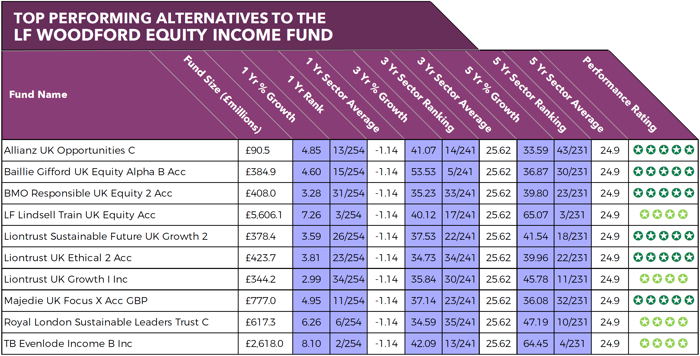

The LF Woodford Equity Income fund sits within the competitive IA UK All Companies sector alongside more than 200 competing funds and dozens of different fund managers. The table below identifies ten funds that have consistently been among the best funds for performance within the sector over the past 1, 3 & 5-years.

These funds have average returns of 4.97% and 39.19% over the recent 1 & 3 year periods. In contrast, the LF Woodford Equity Income fund has returned -5.80% and -5.77% over the same periods.

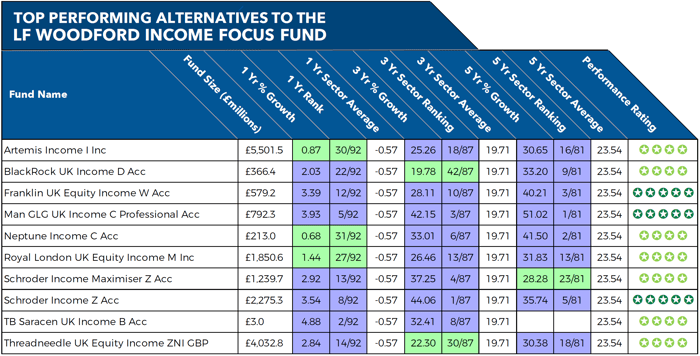

The LF Woodford Income Focus fund is classified within the IA UK Equity Income sector. Although still a relatively young fund it has been a poor performer since its inception with losses of -7.92% this past 12 months alone. Below we feature ten funds from the IA UK Equity Income sector that have consistently delivered competitive returns even as the sector experienced high volatility in 2018.

Performance figures up to 1st March 2019

Neil Woodford Performance With Invesco Perpetual

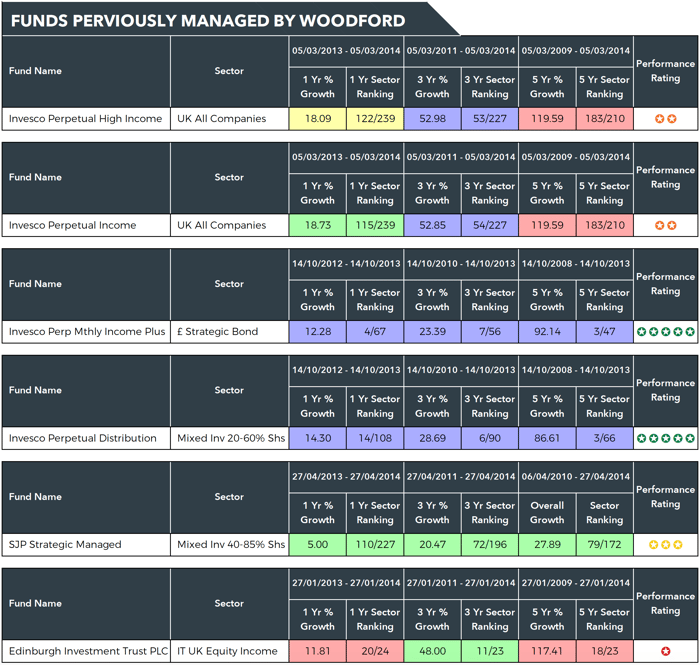

A number of times the Yodelar team have highlighted Mr Woodford's performance when at Invesco Perpetual as poor. The table below demonstrates a variety of quartile rankings.

50% the funds under his management in the 5 year period up to his departure from Invesco Perpetual were in the worst 25% of performers.

Since Neil Woodford's departure most of the highlighted funds have become market leaders under new management under the Invesco Perpetual brand.

Invesco Perpetual High-Income Fund

Woodford took over the management of the Invesco Perpetual High-Income fund in February 1988. During the 26 years he managed this fund he had helped to deliver levels of growth that were among the top in its sector, but towards the end of his reign this fund had begun to lack consistency. In the 5 years up to his departure, the Invesco Perpetual High Income fund returned growth of 119.59%, which ranked 183rd out of 210 funds in the IA UK All Companies sector, and well below the 147.43% sector average.

Invesco Perpetual Income Fund

Similar to the High-Income fund, the Invesco Perpetual Income fund is classed within the UK All Companies sector and achieved somewhat similar levels of performance. In the 5-year period up to Woodford's departure in March 2014 this fund returned growth of 119.09%, which was also lower notably lower than the sector average of 147.43%.

Invesco Perpetual Monthly Income Plus Fund

Neil Woodford managed the Invesco Perpetual Monthly Income Plus Fund between 6th February 1999 and 14th October 2013, and it took some time before this fund began to deliver competitive returns for investors. In Woodford's first 4 years in charge it only managed to return growth of 1%, but in the period between 6th February 2003 to his departure on 14th October 2014 this fund returned growth of 181.46%, which was the highest in its sector.

Invesco Perpetual Distribution Fund

Neil Woodford managed the Invesco Perpetual Distribution fund between 26th January 2004 and 14th October 2013. During this period the fund returned growth of 115.06%, which ranks 4th out of 34 same sector funds that were active during the same period.

St James’s Place Strategic Managed Fund

Outside of Invesco Perpetual, Neil Woodford was also responsible for the management of the St James’s Place Strategic Managed Fund, which he managed between 6th April 2010 to 27th April 2014. During his time, he delivered growth of 27.89%, which ranked 79th out of 172 funds in the same sector.

Edinburgh Investment Trust PLC

Between 15th September 2006 and 27th January 2014, Neil Woodford managed Invesco’s popular Edinburgh Investment Trust. His time as manager of this trust got off to a poor start. Between September 2006 and March 2009 it returned negative growth of -25.45%. During his overall spell as manager of this trust, Woodford delivered returns of 88.58% which was comparatively low when compared to the Finsbury Growth & Income Trust, which sits within the same sector and returned growth of 119.76% over the same period.

What Attracted Investors To Woodford?

Yodelar often refer to Mr Woodford as one of the best marketed fund managers, and not the best performing fund manager.

Strategically he has been able to create many influencers to assist in promoting his personal brand. Even when employed with Invesco Perpetual he was often regarded with more reverence than the Invesco Perpetual brand itself.

Cleverly, Woodford boosted his own popularity in 2 ways:

1. Through the Advice Market:

Before fund supermarkets and the rise of the self investor, most funds were promoted via 'Financial Advisers'. If financial advisers were attracted to a particular fund or collection of funds they would generally do well. Advisers would distribute those funds to private investors.

Woodford and his team were exceptional at attracting financial advisers. They ran regular regional seminars for qualified financial advisers throughout the UK, where advisers would be invited to attend a complimentary lunch. At that lunch, they would be presented with the inner thinking of Woodford strategies, often relaying snippets of wisdom adviser would use when conducting interviews with new and existing clients.

In times of downturn, he claimed defensive strategies, focusing on utilities and less reliant in the growing markets such as technology. The terminology was pleasing to advisers and often quoted to clients who would be assured of such strategies, as the prospect of loss often outweighs the prospect of growth.

However, many of his strategies resulted in under-performance when compared to same sector funds.

As a large proportion of financial advisers during the 90's and 00's, were not performance savvy, poor performance remained undetected by most and Woodford's personal brand continued to flourish. Even today many advisers still defend him and deny the factual performance statistics that exist.

During bull markets, Woodford also historically underperformed when compared to peer fund managers but communicated actual growth and not comparative growth. With a lack of information available to investors and advisers many did not question positive growth in relation to same sector funds eg, while a return of 8% may be positive to most investors, they may not be aware that competing same sector funds could have produced twice as much returns.

His promoters, financial advisers that bought into his quarterly lunch meetings, continued to promote his results with little or no comparison to same sector peers. This winning strategy developed him as a brand attracting investor masses and taking him to the point of launching his own fund management brand.

2. Fund Supermarkets

Hargreaves Lansdown have often promoted their loyalty to Neil Woodford, even during recent times. Woodford Investment Management hold a significant proportion of Hargreaves Lansdown stock. Woodford's own success has been propelled by the fund giant promoting Woodford as a star fund manager.

At Yodelar we have in the past assessed Hargreaves Wealth 150 list and criticised the reasoning for the inclusion of consistently poor performing funds. In recent months the fund supermarket giant reassessed their list and cut it down in numbers and created the Hargreaves Lansdown Wealth 50.

It is an important to note that 24.1% of Hargreaves Lansdown's revenue now comes from the sale and promotion of their own funds. As an independent fund supermarket, Hargreaves Lansdown have now transformed themselves into a fund management firm similar to Woodford.

Access our latest Hargreaves Lansdown Fund Review.

HL and other fund supermarkets propelled Mr Woodford forward, and after his departure form Invesco, helped him gain exceptional traction in the market.

The Turning Point

Fund knowledge and comparative performance is not a regulated requirement for financial advisers. Over 90% of portfolios we analyse via our complimentary portfolio analysis service are invested in bottom quartile funds, funds that consistently perform in the worst 25% of their sector.

While there are exceptional advice firms in the market, we find that a large proportion of efficient portfolios using the best fund managers are managed by self investors. These savvy self investors make use of information available and research performance amongst fund managers. Such investors seem less forgiving and are willing to pull funds away from a fund manager once they understand performance stats.

Neil Woodford has undoubtedly enjoyed huge success in fund management. His ‘Star’ status as a fund manager has come from his unrivalled press exposure and savvy PR.

Neil Woodford is one of the most recognisable names in the investment industry. As an Invesco Perpetual Fund Manager, he cites calling the tech boom in 1999 as a defining moment in his career. However, in the years up to his departure Woodford began to produce inconsistent and poor performance. 24 times during his final 60 months in charge of the popular Invesco Perpetual funds they ranked within the bottom quartile (worst 25%) of their sectors, raising brows to the nature of his departure.

Did he leave on his own accord, or was his departure somehow connected to this poor performance?

At the time, Woodford stated "My decision to leave is a personal one based on my views about where I see long-term opportunities in the fund management industry."

Invesco Perpetual Chief Investment Officer Nick Mustoe commented, “Neil leaving was a positive. It highlighted what good investment managers we have across the team.”

Several weeks after formally departing from Invesco Perpetual the company was issued an £18.6m fine by the FCA for exposing investors to more risk than was suitable. Among the funds at fault were Invesco Perpetual Income, High Income and Managed Income funds – which were all run by Mr Woodford right up until the time he left.

The past few years have been the most difficult in Neil Woodford’s 30-year career. His stock picks have not paid off, and his funds continue to return losses as they languish at the foot of their sectors for performance.

Investor confidence in Neil Woodford and his strategies is at an all-time low. Frustrated by negative returns and with no sign of imminent improvement, investors have lost patience and withdrawn billions from his funds.

Woodford remains confident that his strategies will pay off and his funds will see a revival of fortunes. But many investors see little sense in investing in funds that continue to lose money, preferring to move their money elsewhere.

Are Woodford’s Woes Due to Overly Complex Strategies?

Alongside Neil Woodford as one of the most recognisable profiles in fund management is Terry Smith, the manager of the popular and consistently top performing Fundsmith Equity fund, which is now the 2nd largest fund in the UK

Terry Smith tends to focus on high-quality companies that generate consistent growth, whereas Woodford’s approach in recent years (contrary to previous Invesco Strategies) has been to pick out under-the-radar stocks in sectors such as healthcare and technology that are not on mainstream radars.

When it comes to picking stocks, Woodford takes a deep look into the macroeconomic environment of a company when considering their long-term prospects, while Terry Smith simply ignores it. Smith takes a more simplified approach to stock picking and focuses more on resilient businesses that can sustain a high return on operating capital and whose advantages are difficult for competitors to replicate.

The differences between Smith and Woodford extend to their approaches to portfolio construction. Terry Smith has always held a concentrated portfolio of 25 companies, whereas Woodford’s Equity Income fund has holdings in 102 companies, a number of which are unquoted.

Woodford has been described as a fund manager who often invests against the herd. His funds can look very different to those of his peers (again a strategy he has adopted more outside of the remit of the fund giant Invesco Perpetual). This different approach has not paid off and some have raised concerns that his strategies are overly complex, and simply not working.

In contrast, Smith’s straight forward and pragmatic approach to fund management has been credited for helping his Fundsmith Equity fund deliver exceptional performance year on year.

Stick with Woodford or Invest Elsewhere?

Woodford's reputation as a fund manager and the performance of his funds have been hit hard this past few years but he remains resolute in his strategy and he believes his funds are well positioned to achieve a remarkable turnaround. In a recent interview with the Mail on Sunday, he said:

“The UK is one of the few bright spots – employment, for instance, is at its highest level since 1971. I remain focused on capturing the opportunity that exists in parts of the market that have been left behind since we voted to leave the EU nearly three years ago. The result is a fund that has a strong but selective bias towards profoundly undervalued companies, many that are exposed to the UK economy. Crucially, the portfolio is positioned how I want it to be and is completely focused on a valuation opportunity, the likes of which I haven’t seen for 30 years."

Can Woodford Recover?

Woodford’s optimism will be of comfort to his supporters, but it remains to be seen whether or not his funds can recover and deliver competitive returns consistently.

Successful fund management is as much about mitigating losses during difficult times as it is about maximising gains during others. In recent years, Woodford has failed to do either. Underperformance has plagued his funds resulting in many investors leaving at an alarming rate. But is it premature to write Neil Woodford off?

Neil Woodford remains convinced that his investments will recover and that those leaving his funds are making a mistake. He has said:

“When you passionately believe in what you’re doing, as I do, when clients are saying, ‘nah, we want our money back now because we’d much rather be investing in these things that have gone up’, that, for me, is a frustration. I think they’re making a poor investment decision.”

Time Is of The Essence

Woodford recently told the Financial Times that he has around 'two and a half years' left to turn performance around and curb outflows otherwise he will go 'out of business'.

It is clear that investors have lost patience. and these next 12 months are likely to be the most important of his career.