- The Scottish Widows American Growth fund returned growth of 45.83% over the past 3 years which was better than 90% of its peers.

- The Scottish Widows Workplace pension fund has consistently ranked among the top performing funds in its sector over the past 1, 3 & 5 years.

- From our analysis of all 645 Scottish Widows pension funds and their 20 ISA funds we identified that 50% of these funds have consistently underperformed.

- Above average costs and below average performance for many of their ISA funds with the annual charge for 16 of their ISA funds more expensive than the sector average.

In this review we provide an independent assessment on the performance of all 645 Scottish Widows Pension funds and their 20 ISA funds, comparing their performance and charges against all other same sector funds available to UK investors to identify the best performing Scottish Widows funds.

The analysis identifies high costs and poor performance from a portion of their ISA funds along with underperformance below sector average for nearly 50% of their pension funds.

Despite underperformance from a portion of their funds we also identified a number of standout funds that have excelled some of which have delivered returns more than double that of their peers.

In this report, we feature the top performing Scottish Widows funds and provide a detailed performance comparison to their sector peers.

Scottish Widows Fund Performance Summary

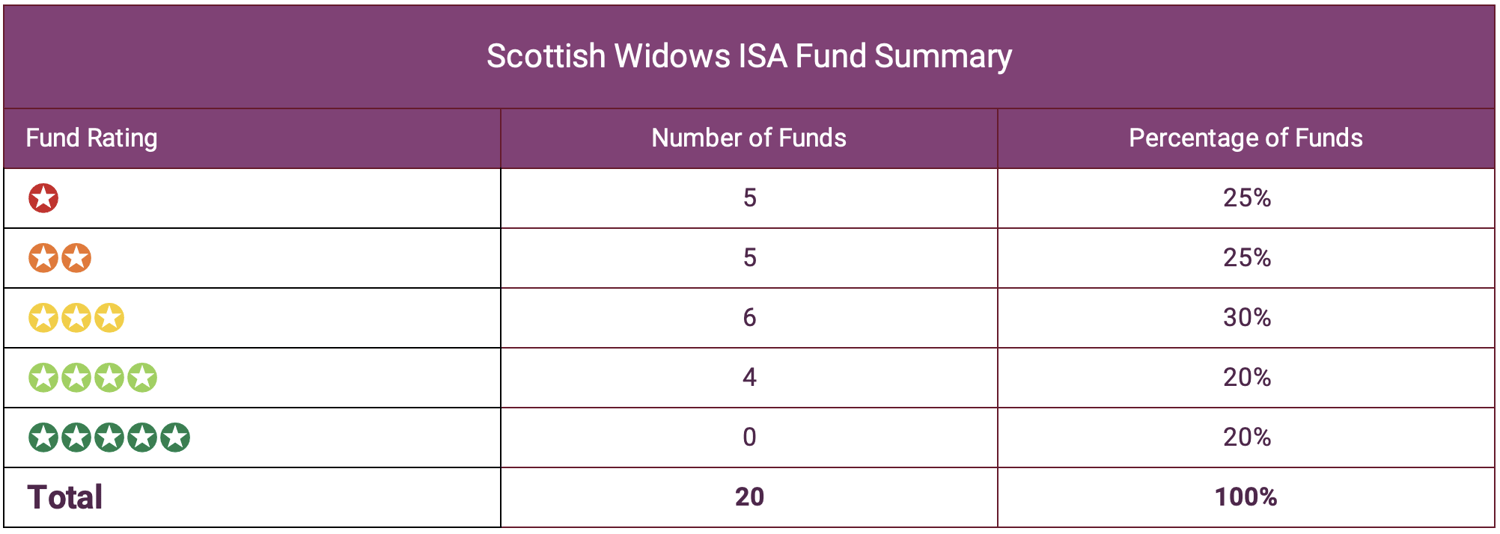

There are 20 main unit Scottish Widows unit trust funds that have a sector classification. Our analysis of these 20 funds identified that 0 received a 5 star performance rating, 4 funds warranted a 4 star performance rating, 6 had a 3 star rating. The remaining 10 funds had underperformed with an equal split receiving either a poor performing 1 or 2 star rating.

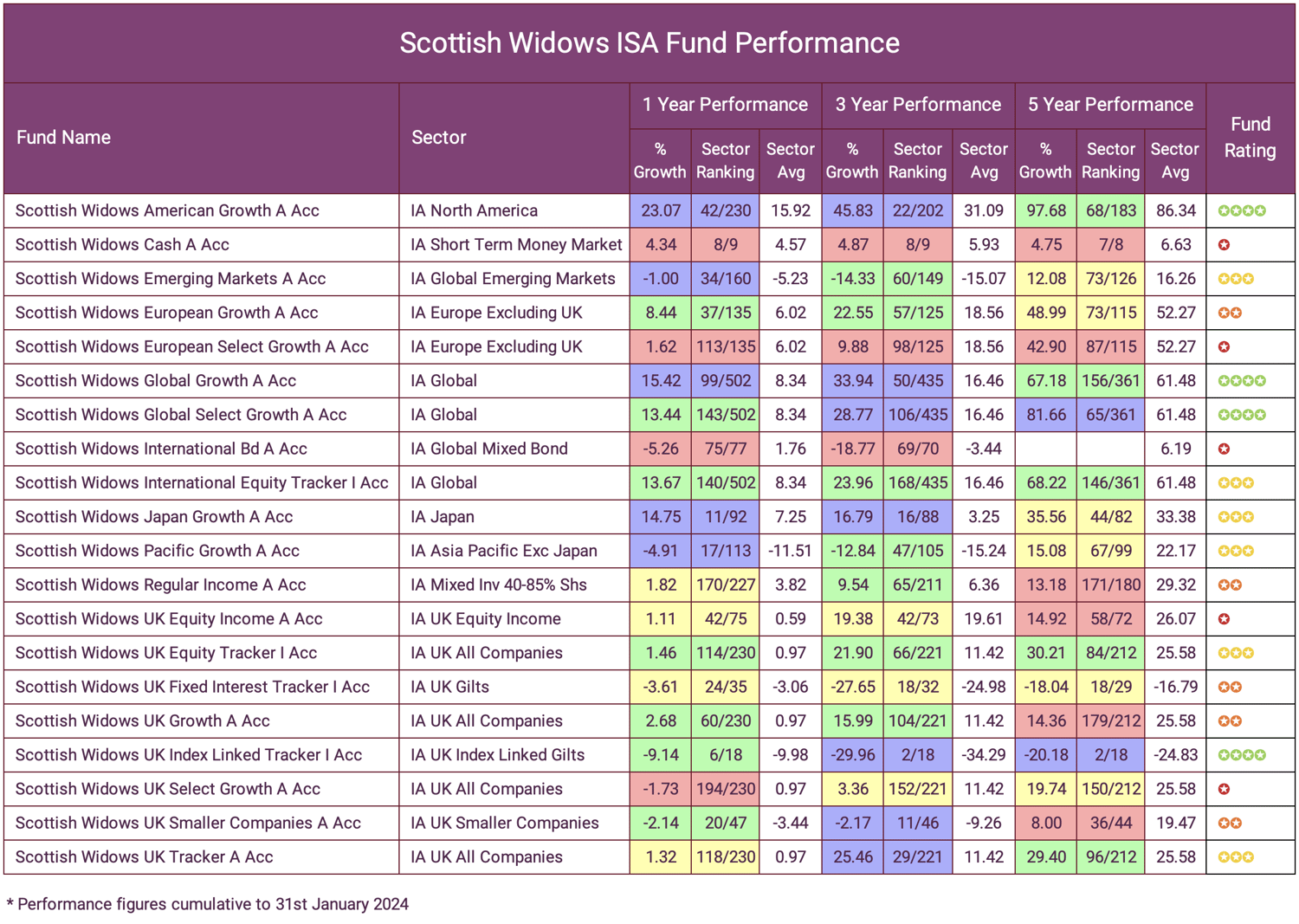

We analysed each of the 20 sector classified Scottish Widows ISA funds comparing their performance against their sector peers over the past 1, 3 & 5 years. The below table shows the performance, sector ranking and overall performance rating for each of their ISA funds.

Below Average Performance At Above Average Prices

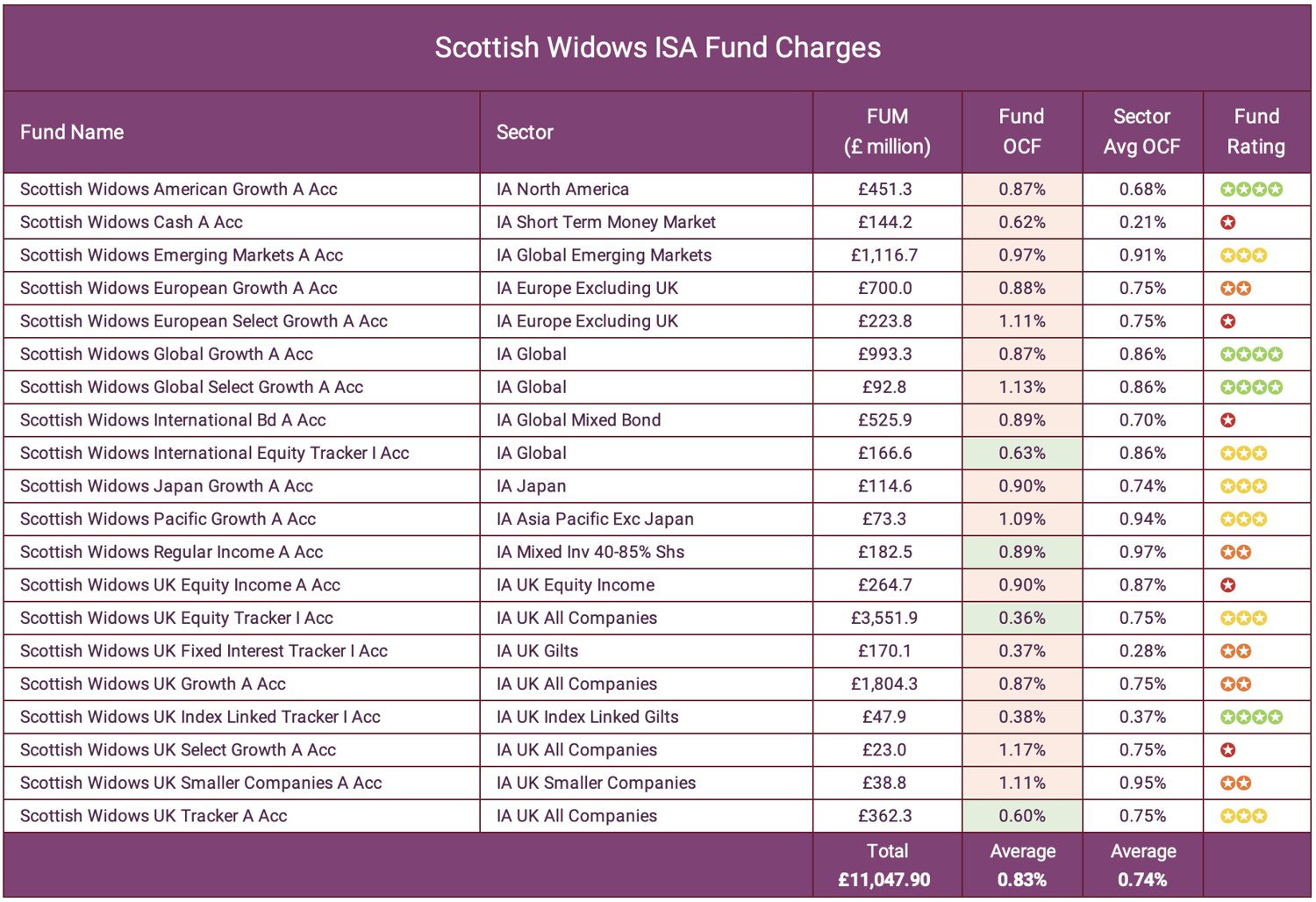

16 of the 20 funds Scottish Widows ISA funds have ongoing charges that are higher than the sector average, with 3 of the 4 that were below average being tracker funds that have no management expenses.

With an average ongoing charge figure of 0.83%, Scottish Widows are considerably more expensive than many of their peers who average charges of 0.74%.

The 20 Scottish Widows ISA funds analysed have a cumulative £11 billion in client assets under management. Per the funds' performance ratings, 10 were awarded poor 1 or 2 star ratings. Presently, £6.78 billion or 61.6% of their ISA client assets is invested in those underperforming funds, with all but one of these funds also having higher than average annual fees.

The Best Scottish Widows Funds

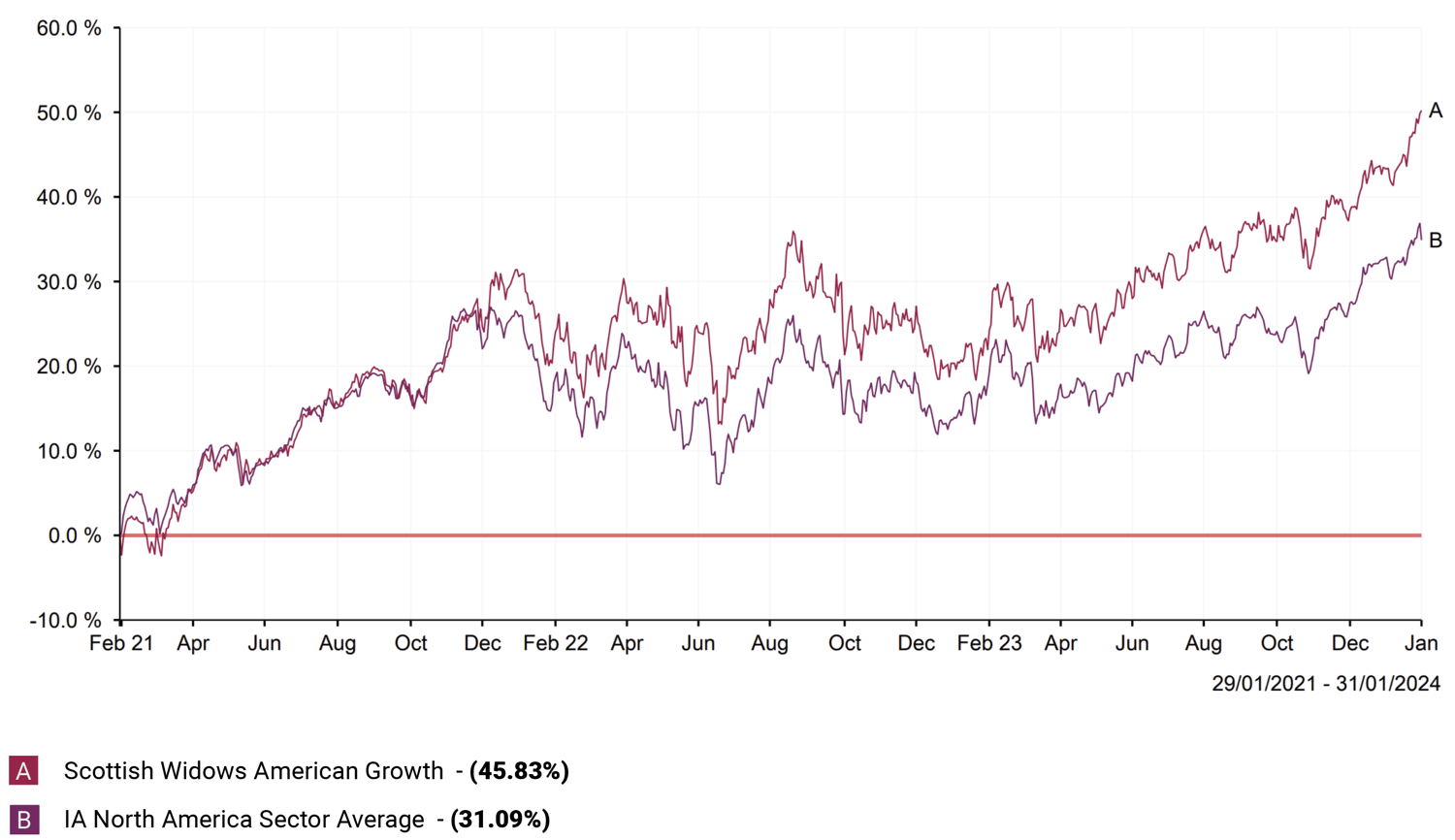

As you will see from our analysis, only a small selection of Scottish Widows funds consistently ranked highly within their sectors. One such fund was the Scottish Widows American Growth fund which has been their highest growth ISA fund over the past 1, 3 & 5 years.

Scottish Widows American Growth

The Scottish Widows American Growth fund has been very impressive in recent years, cementing its status as one of the top performers in the highly competitive IA North America sector. Over the past three years, the fund has achieved impressive growth of 45.83%, significantly outpacing the sector average of 31.09% and ranking it 22nd out of 202 funds in the North America sector.

This standout performance can be attributed in part to the fund's focus on investing in large and mid-cap US companies with durable long-term growth prospects.

Top recent holdings have included influential innovators and disrupters like Apple, Microsoft, Alphabet, Amazon, and Visa - all of which are benefiting from structural growth trends and transitions towards digitalisation. The fund is heavily weighted in information technology holdings relative to the S&P 500 index, which has been a big reason for the fund's strong growth.

Scottish Widows Global Funds Shine

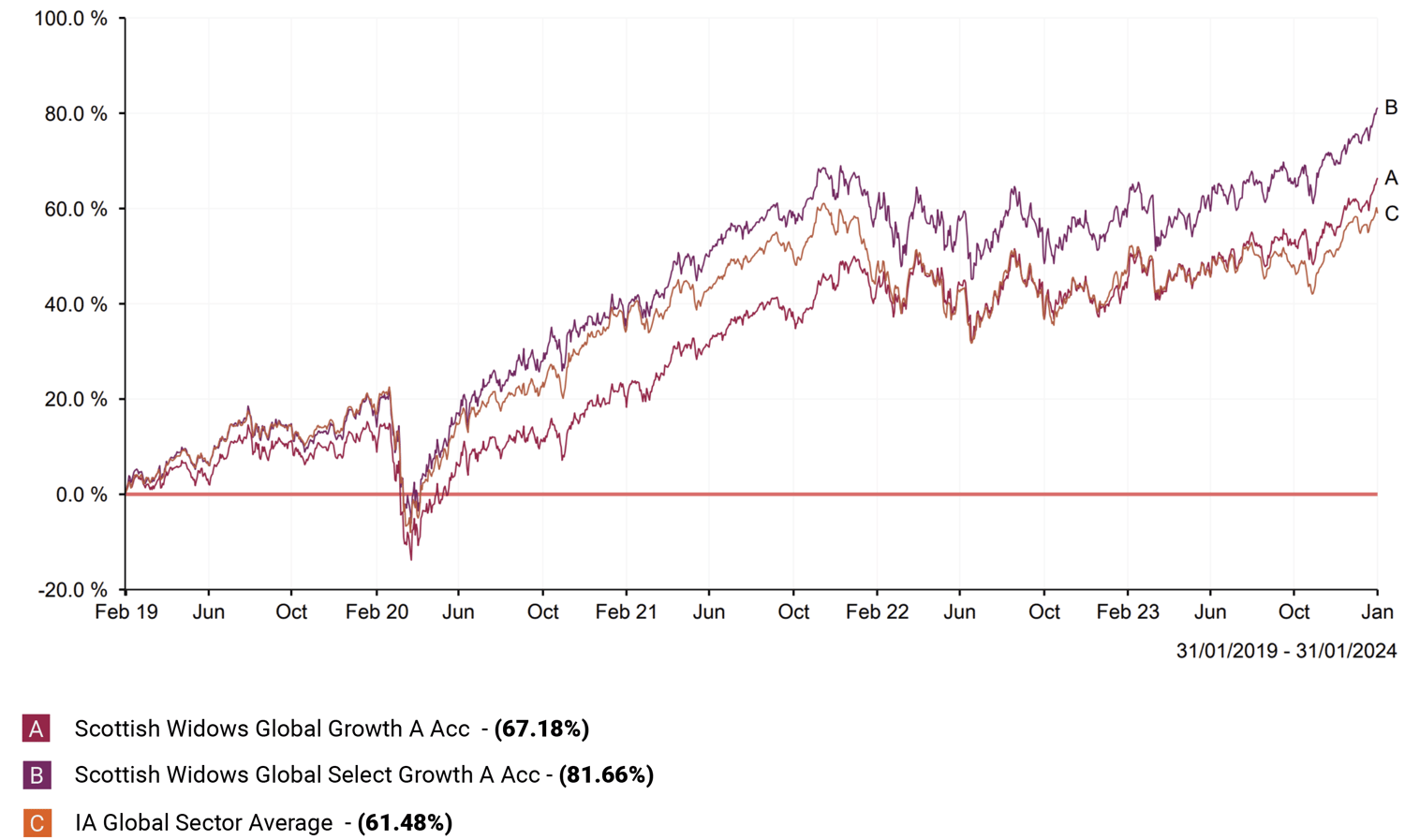

Scottish Widows have a number of funds within their ISA range that are classified within the IA Global sector with 2 in particular performing comparatively well. As Global funds, they have a diverse spread of assets across several core equity markets rather than regional specific funds such as UK or European focused funds.

Scottish Widows Global Growth Fund

The Scottish Widows Global Growth Fund currently holds £993 million of investor assets. The majority of the fund's holdings are in companies within the information technology and Healthcare sectors, with 66% of the fund's assets in North American companies, 15% in European companies, 5% in UK and the rest spread across emerging markets and Japanese markets. The fund has an impressive 4 star performance rating as it has consistently outperformed the sector average over each of the 3 periods analysed. Over the past 12 months the fund has returned growth of 15.42% compared to the 8.34% sector average and over 3 years its returns of 33.94% was better than 89% of the funds in its sector.

Scottish Widows Global Select Growth

The second Global fund from their ISA range is the Scottish Widows Global Select Growth fund. This fund is significantly smaller in size compared to the Global Growth fund with just £92.8million of client assets under management. However, the fund has also outperformed the sector average consistently with 1, 3 & 5 year returns of 13.44%, 28.77% and 81.66% respectively, each of which were considerably better than the sector average. The fund's performance is slightly lower than its sister fund which is in part due to its lower exposure to US Equities.

The Best Scottish Widows Pension Funds

In addition to our performance assessment of their range of ISA funds we also analysed the vast selection of Scottish Widows pension funds and identified which funds have disappointed and which continually outperform.

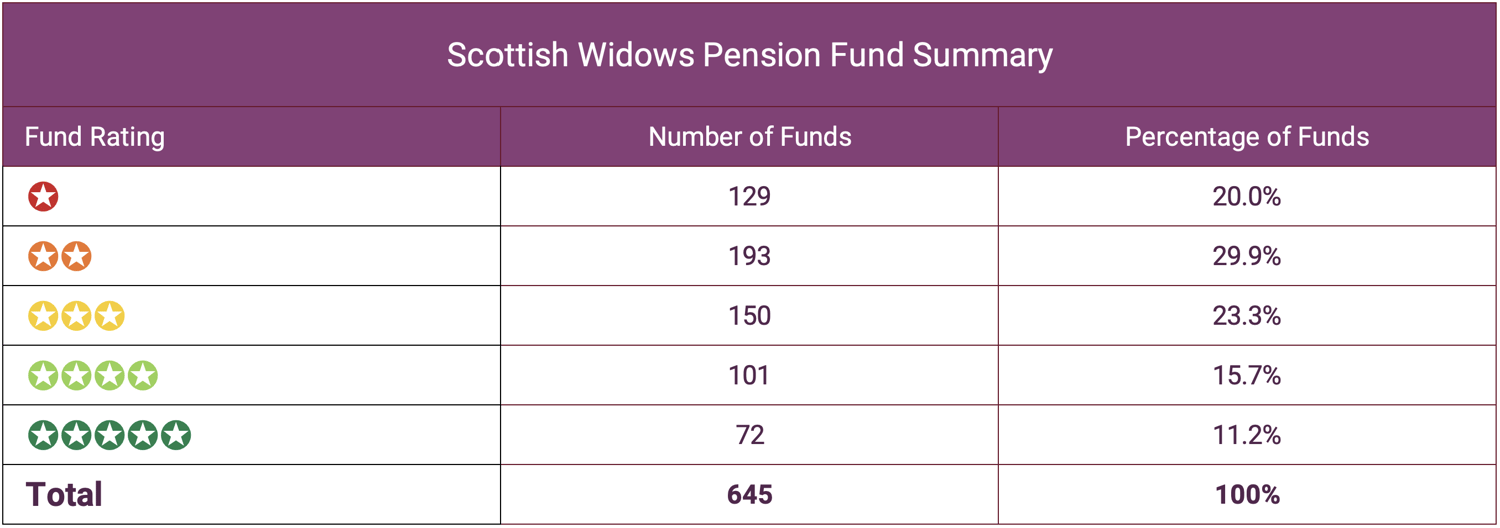

Scottish Widows Pension Fund Performance

Scottish Widows have almost £200 billion of client funds under their management with the vast majority of this in their range of pension funds.

We analysed all 645 sector classified Scottish Widows pension funds and we identified that 322 of these funds (49.9%) received a poor performing 1 or 2 star rating. 23% received a modest 3 star rating, with the remaining 173 funds (26.8%) consistently outperforming the majority of their peers over the past 1, 3 & 5 year periods thus receiving an impressive 4 or 5 star rating.

Scottish Widows Shariah Pension Fund

Of all 645 Scottish Widows pension funds analysed the top performer was from the Shariah law focused fund which returned 5 year growth in excess of 122% - more than double the sector average.

The Scottish Widows Shariah Pension Fund has delivered outstanding returns over all 3 periods analysed. The fund's highly competitive performance can be primarily attributed to its heavy investment in North American equities, which have accounted for approximately 80% of the fund's assets. By maintaining this high US weighting, the fund has been able to ride surging indexes like the S&P 500 and Nasdaq to fuel its growth. While this concentration has contributed to the fund’s strong growth, it's important to be aware of the risks that come with investing in a Global fund that has an overweight reliance on one region as in contrast, should that market experience a downturn, the losses would be above that of a more diversified peer fund.

It is important to acknowledge how well the fund has performed in particular as it has significant constraints on which companies it can invest in due to the fund’s mandate of investing in accordance with Islamic investment principles. This precludes investment in certain industries like financials, pork producers, entertainment, tobacco and weapons manufacturing. Achieving superior returns has meant a concentrated bet on Shariah-approved North American giants mostly in information technology, healthcare, telecoms and consumer staples. Its performance profile has therefore been more comparable to that of a North America equity fund rather than a diversified global equity strategy.

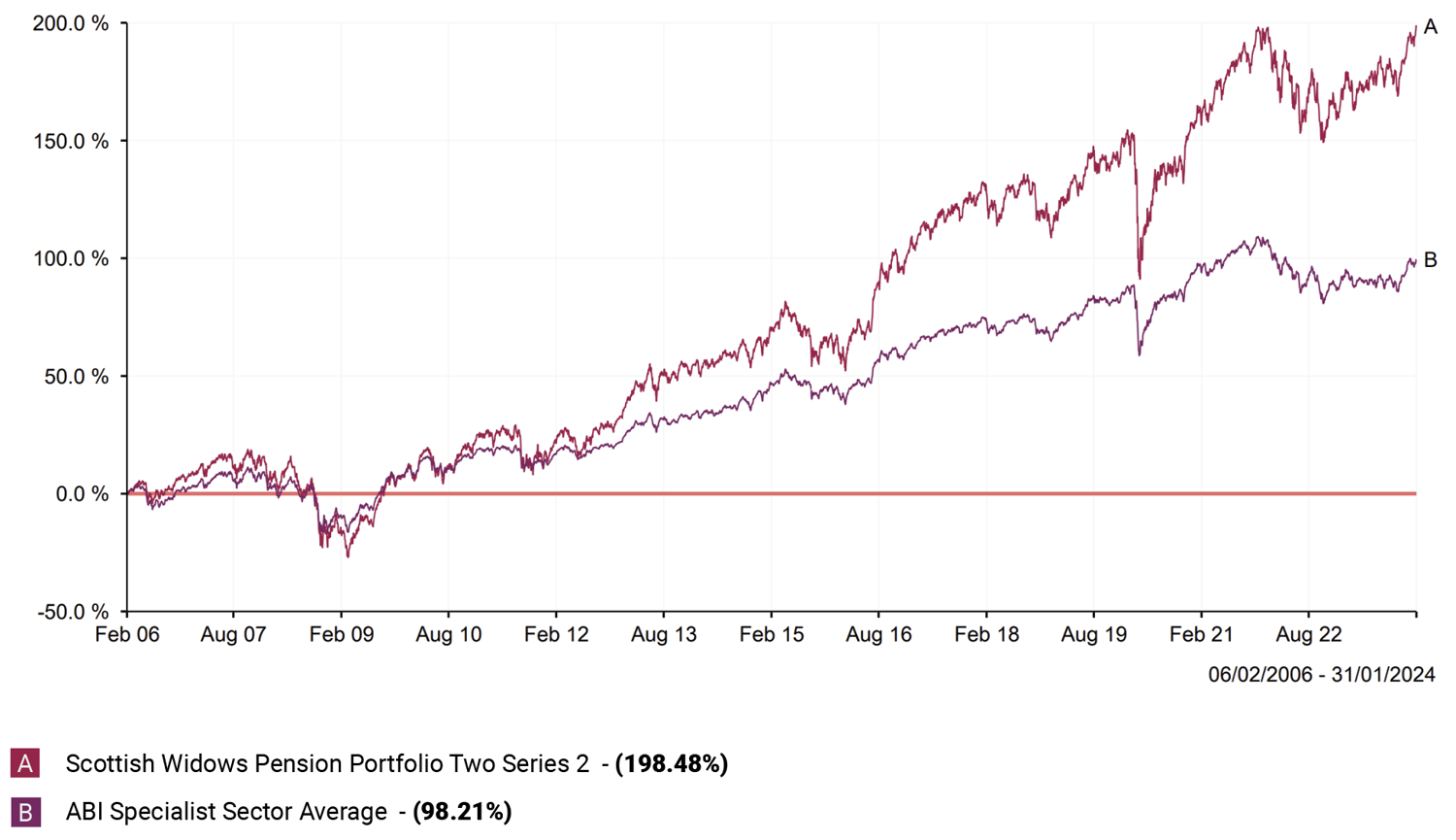

Scottish Widows Pension Portfolio Two Pension Series 2

The Scottish Widows Pension Portfolio Two Pension Series 2 fund has established an impressive track record since its inception on February 6, 2006. With £29.5 billion under management, it is by some margin Scottish Widows' largest pension offering - which is unsurprising as the fund is used by Scottish Widows as their default workplace pension option.

The fund is categorised in the Specialist Pension sector, which contains 473 peer funds. Over its lifespan, the fund has delivered strong results compared to its category average. From launch through the end of January this year, it generated total returns of 198.48%, double the 98.21% sector average return for the same period.

In addition to robust performance, the fund has consistently ranked near the top of its peer group, placing in the first quartile for the past 1, 3, 5 years. Given its strong long-term track record across changing market environments, the fund continues to represent a compelling choice for investors seeking above-average retirement portfolio growth.

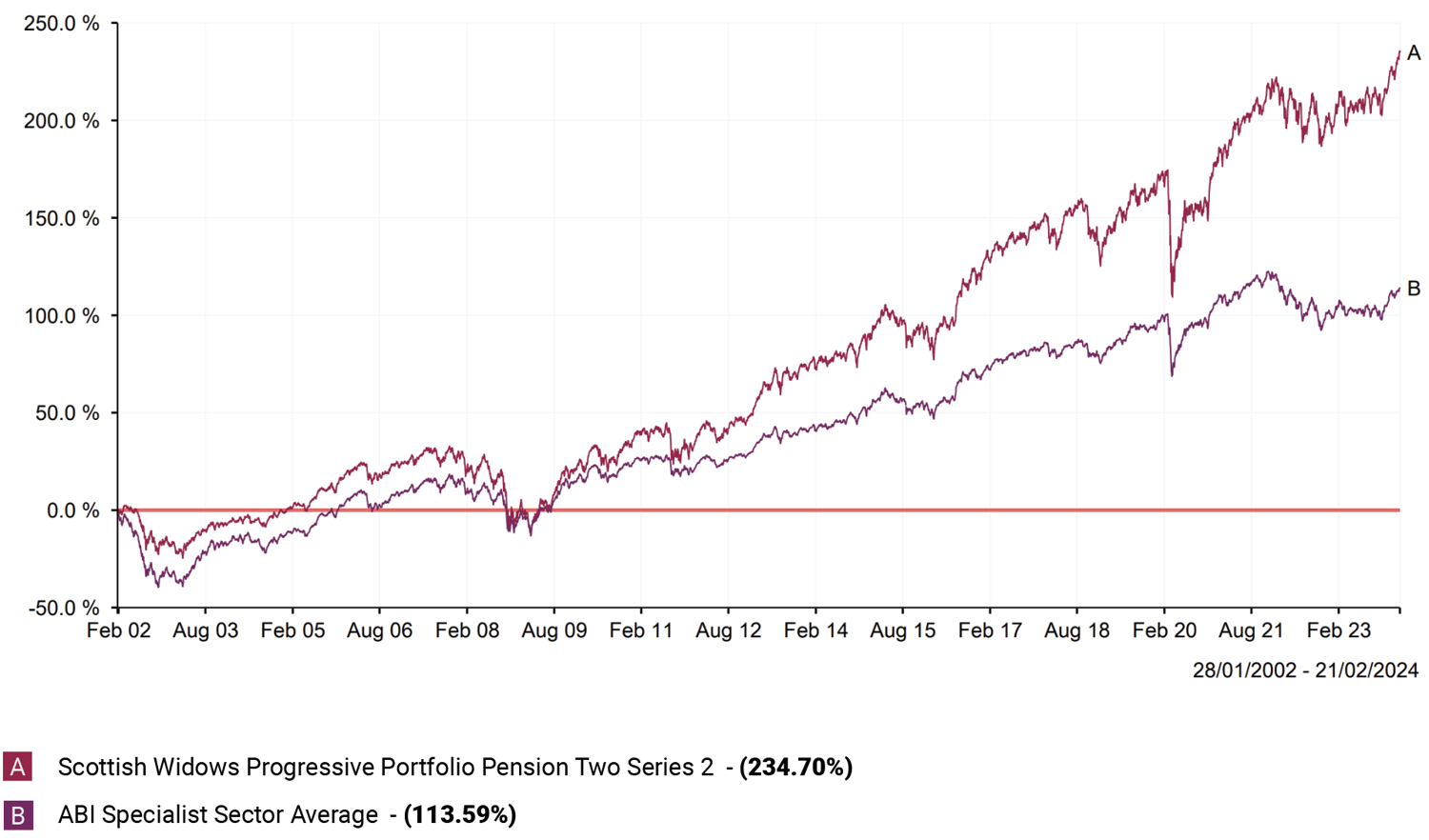

Scottish Widows Progressive Portfolio Pension Series 2

With its launch on January 28, 2002, the Scottish Widows Progressive Portfolio Pension Series 2 is another standout fund from Scottish Widows in the Specialist Pension sector. Over the past 1, 3, and 5 year periods, the fund has posted returns of 6.45%, 15.40%, and 37.96%. For comparison, the sector averaged returns of 2.46%, 1.29% and 18.98% respectively.

The fund's relatively conservative risk model and cautious investment approach limit its upside compared to higher-growth options like the Scottish Widows Pension Portfolio One and Two funds launched in 2006. However, the Progressive Portfolio has still delivered exceptional long-term performance, returning 234.70% cumulatively since inception in 2022 versus 113.59% for the sector.

Scottish Widows Default Workplace Pension Comparison

Default workplace pension funds play an integral role in the retirement planning of most employees, as highlighted by research from The Pensions Regulator indicating over 95% of workers do not elect an alternative to their scheme’s default investment option. These default funds automatically receive individuals’ pension contributions unless active selection of specific investment vehicles occurs. Therefore, evaluating the investment quality and performance of default workplace pensions carries critical importance.

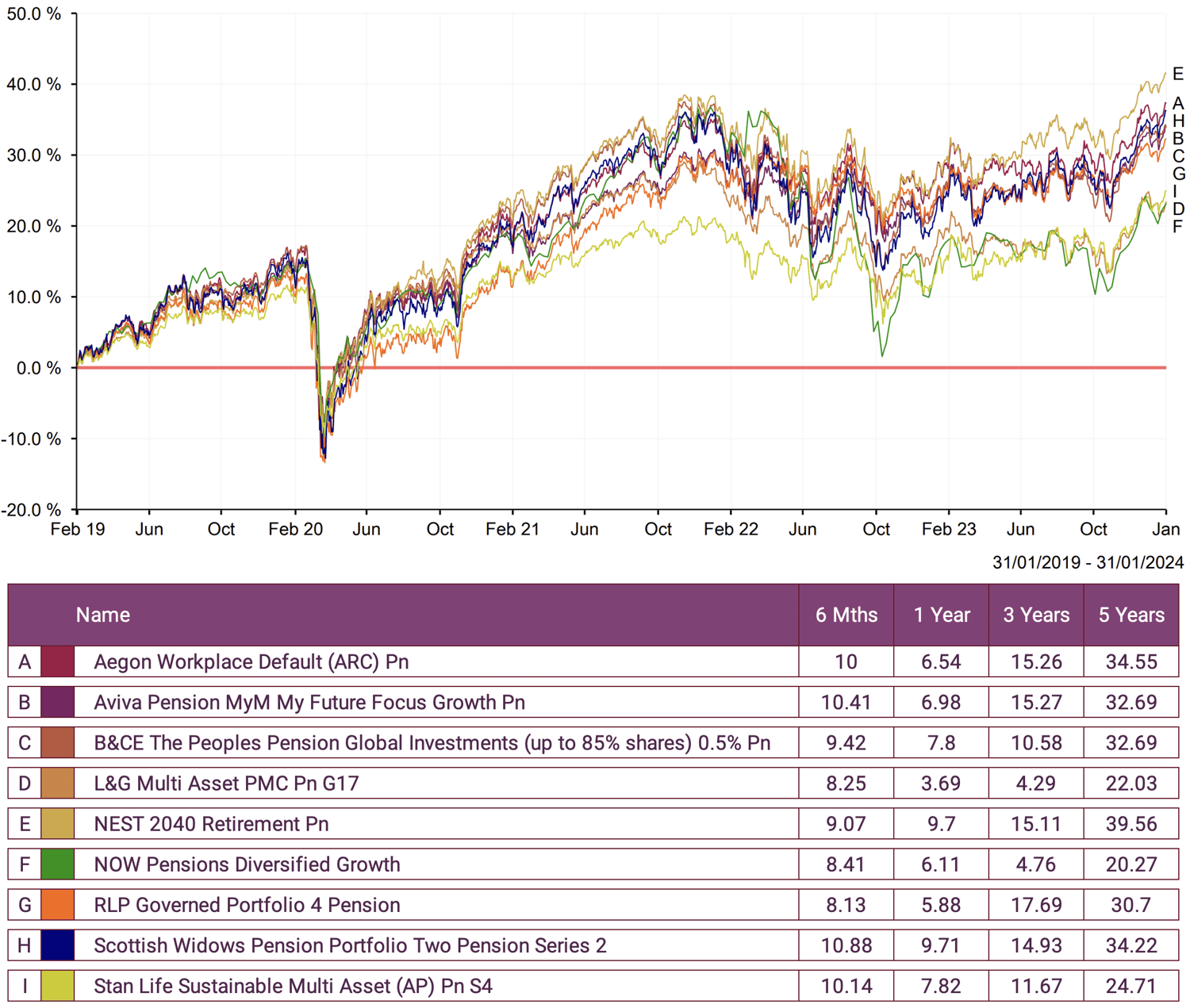

As previously noted, the Scottish Widows Pension Portfolio Two Pension Series 2 represents the default fund offering within Scottish Widows’ pension schemes. Our analysis shows this option has delivered competitive returns against its peer funds within the moderate-risk mixed investment sector. However, benchmarking against default funds from other leading UK workplace pension providers reveals further insight.

The above chart illustrates the Scottish Widows default fund to have delivered competitive performance, comparative to its peers over the periods analysed.

With the majority of pension savers passively accepting their employer's default, understanding how these funds stack up is critical. Given its solid showing against peers in recent years, the Scottish Widows default pension does warrant consideration by employees reviewing their workplace retirement plan options.

However, it is also important to be aware that there are thousands of funds available to UK investors, many of which are under utilised yet consistently represent exceptional value and strong performance.

Book a free no obligation call to discuss high quality investment options for your pension or ISA.

Diarise A No Obligation Call With Our Advice Team

Summary

To summarise this report, we found that 49.9% of Scottish Widows pension funds and 50% of their unit trust/ ISA funds received low 1 or 2 star ratings, which indicates consistent subpar performance from half of their fund range.

Whilst disappointing it is not entirely surprising, as most fund management brands with such extensive fund offerings will see underperformance from a portion of their funds. In contrast, 20% of Scottish Widows ISA/unit trust funds and 26.9% of the pension funds have consistently outperformed their peers warranting a quality 4 or 5 star performance rating.

In conclusion, Scottish Widows provides both exceptional and lacklustre funds within its extensive range. By leveraging rigorous research and due diligence, investors and advisers can identify and focus on the select funds within the Scottish Widows range that have consistently ranked at the top of their peer categories across market cycles.

Get free access now to our entire fund research platform and identify which Scottish Widows funds have outperformed.

Access The Full Scottish Widows Review

Invest With Confidence

There are thousands of fund options from which to construct a portfolio but with most funds underperforming it is often the case that many investors experience disappointing returns from their investments.

At Yodelar, our portfolio development stems from years of exhaustive analysis on the universe of funds and managers. We consistently evaluate over 100 managers, tens of thousands of funds, and 30,000 model portfolios. This ongoing research reveals that only a small subset of funds and managers consistently outperform, with over 90% of portfolios containing chronic under-performers.

These data-driven findings inform our structured portfolio construction process of utilising top-tier, proven funds within each asset class based on rigorous backtesting.

As an FCA-regulated firm, we believe advanced analytics should anchor advice. Our goal is to provide independent guidance and portfolio management designed to meaningfully enhance client returns through research.

By conducting exhaustive due diligence on the global fund universe, our experts identify elite managers with the highest probability of sustained outperformance. These insights allow us to construct optimised portfolios aimed at maximising clients' growth potential within defined risk parameters.

To learn more about our research-driven advisory services and explore how our analytical edge can optimise your portfolio, please contact our team.