- The Scottish Widows Pension Portfolio Two Pension Series 2 fund consistently ranks among the top performing funds in its sector and is used as the default workplace pension fund by Scottish Widows.

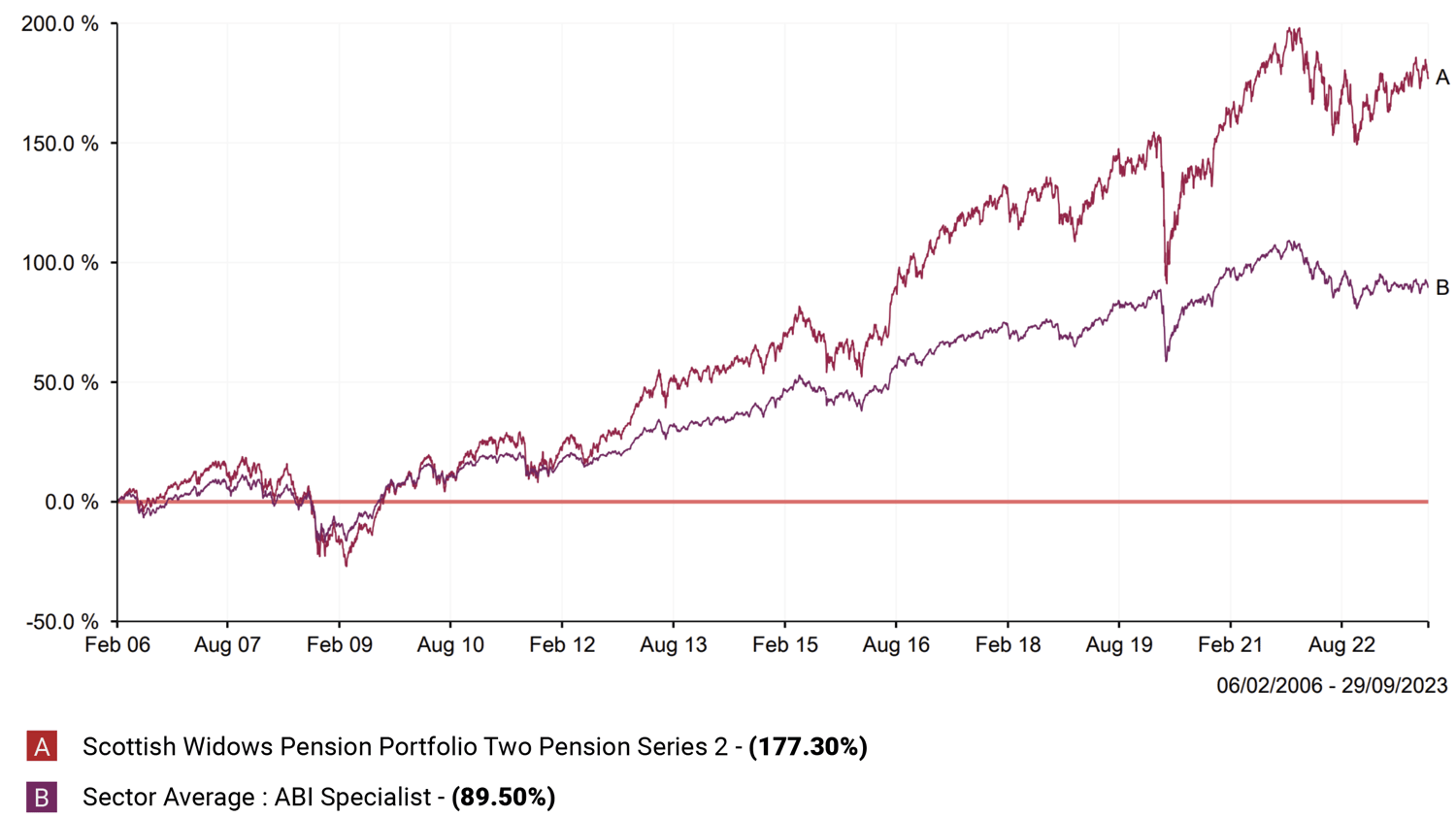

- The Scottish Widows Pension Portfolio Two Pension Series 2 fund achieved total returns of 177.30%, nearly double the sector's average return of 89.50%.

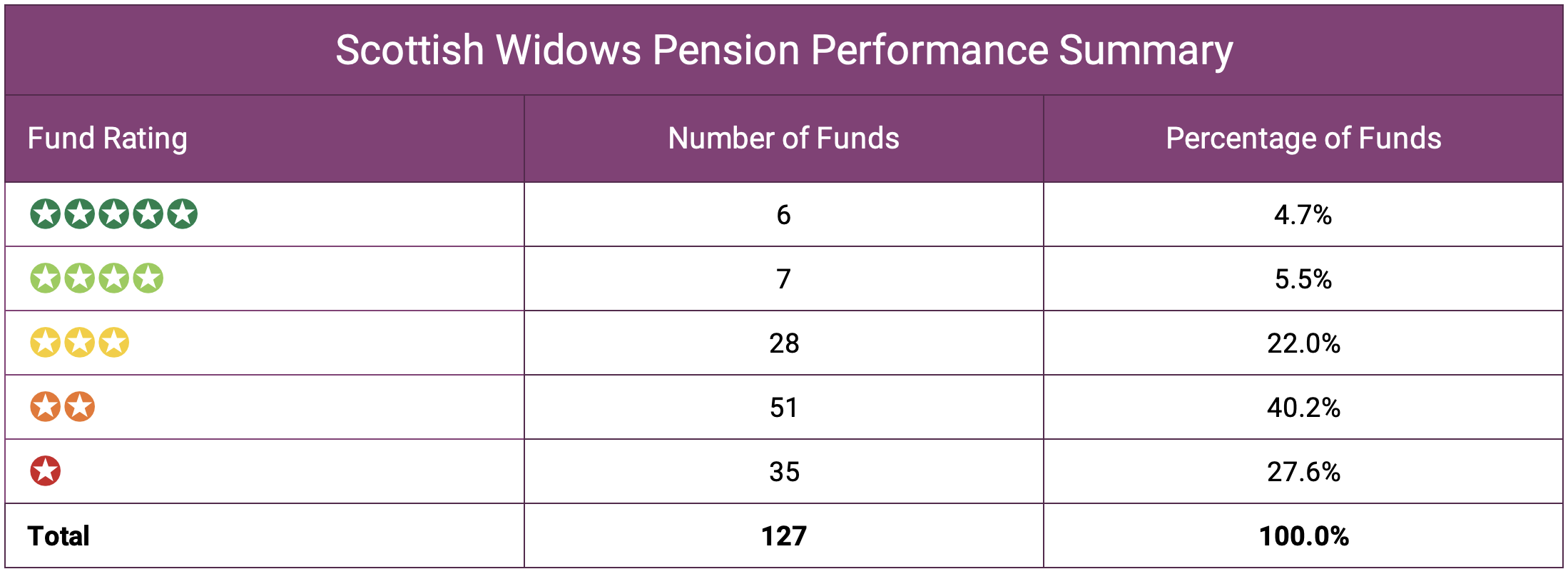

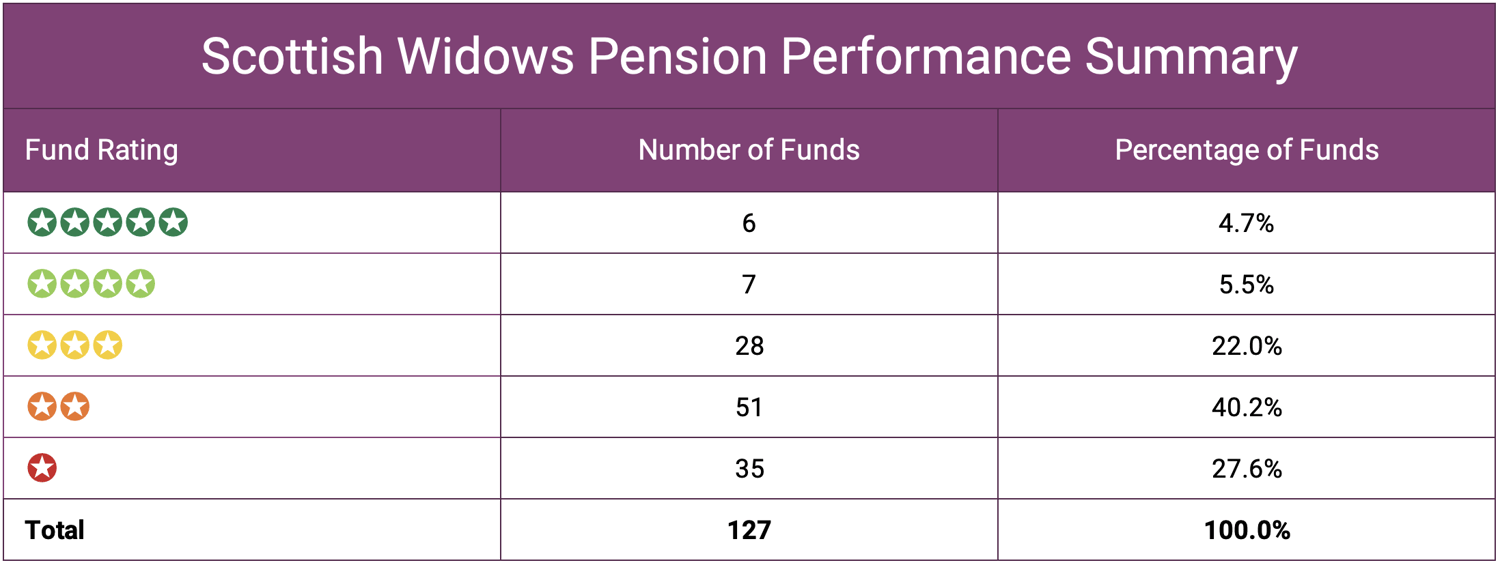

- After analysing all 127 funds, we found that 67.8% received a 1 or 2 star rating, while 22% received 3 stars. However, the remaining 69 funds stood out by consistently delivering exceptional performance over 1, 3, and 5 years, earning them 4 or 5 stars and showcasing their industry superiority.

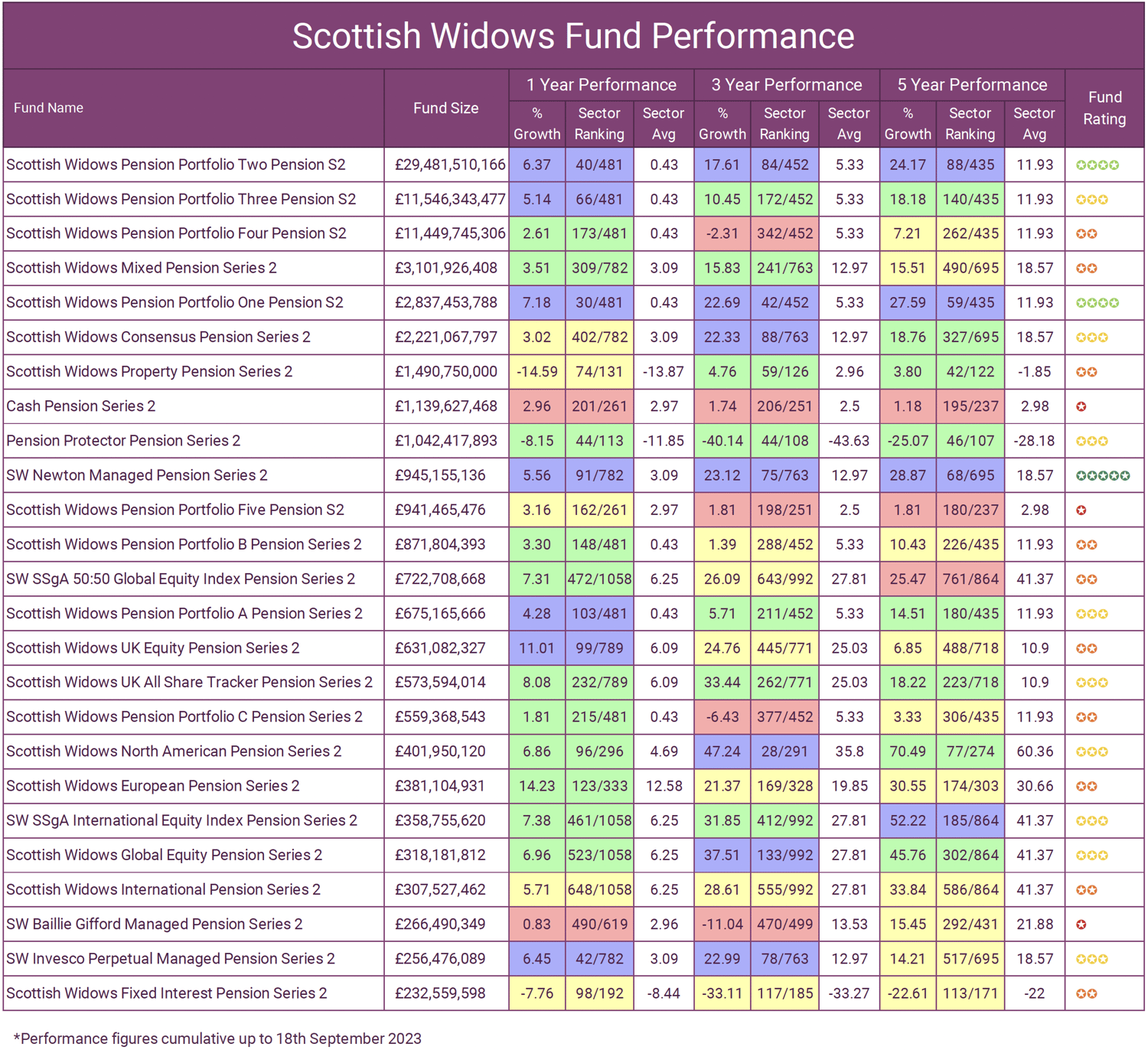

In our Scottish Widows review, we analyse the performance of all their pension funds over the past 1, 3, and 5 years. While many funds have consistently lagged behind their peers, Scottish Widows also offer a selection of funds ranking in the top quartile. We identify which funds have outperformed and which have fallen behind in our analysis of 127 Scottish Widows pension funds.

Scottish Widows Performance Summary

From our analysis of the 127 Scottish Widows pension funds we identified that 67.8% received a poor performing 1 or 2 star rating, 22% receiving a modest 3 star rating, with the remaining 13 funds (10.2%) consistently outperforming the majority of their peers over the past 1, 3 & 5 year periods thus receiving an impressive 4 or 5 star rating.

We analysed 127 Scottish Widows pension funds with a combined £78.7 billion of client funds under their management. The 20 largest funds account for £72.8 billion of funds under management.

How Yodelar Rate Fund Performance

Register for free and access the full Scottish Widows performance review

Scottish Widows Pension Portfolio Two Pension Series 2

The Scottish Widows Pension Portfolio Two Pension Series 2 fund has established an impressive track record since its inception on February 6, 2006. With £29.5 billion under management, it stands by a considerable margin as Scottish Widows' largest pension offering, which is unsurprising as the fund is used by Scottish Widows as their default workplace pension option.

The fund is categorised in the ABI Specialist Pension sector, which contains 481 peer funds. Over its lifespan, the fund has delivered exceptional results compared to its category average. From launch through the end of last quarter, it generated total returns of 177.30%, nearly double the 89.50% sector mean return for the same period.

In addition to robust performance, the fund has consistently ranked near the top of its peer group, placing in the first quartile for the past 1, 3, 5 years. Given its strong long-term track record across changing market environments, the fund remains a compelling choice for investors seeking above-average retirement portfolio growth.

With its substantial assets and history of outpacing peers, the Scottish Widows Pension Portfolio Two Pension Series 2 stands out as an elite performer within its category. For pension investors searching for standout long-term results, the fund warrants strong consideration.

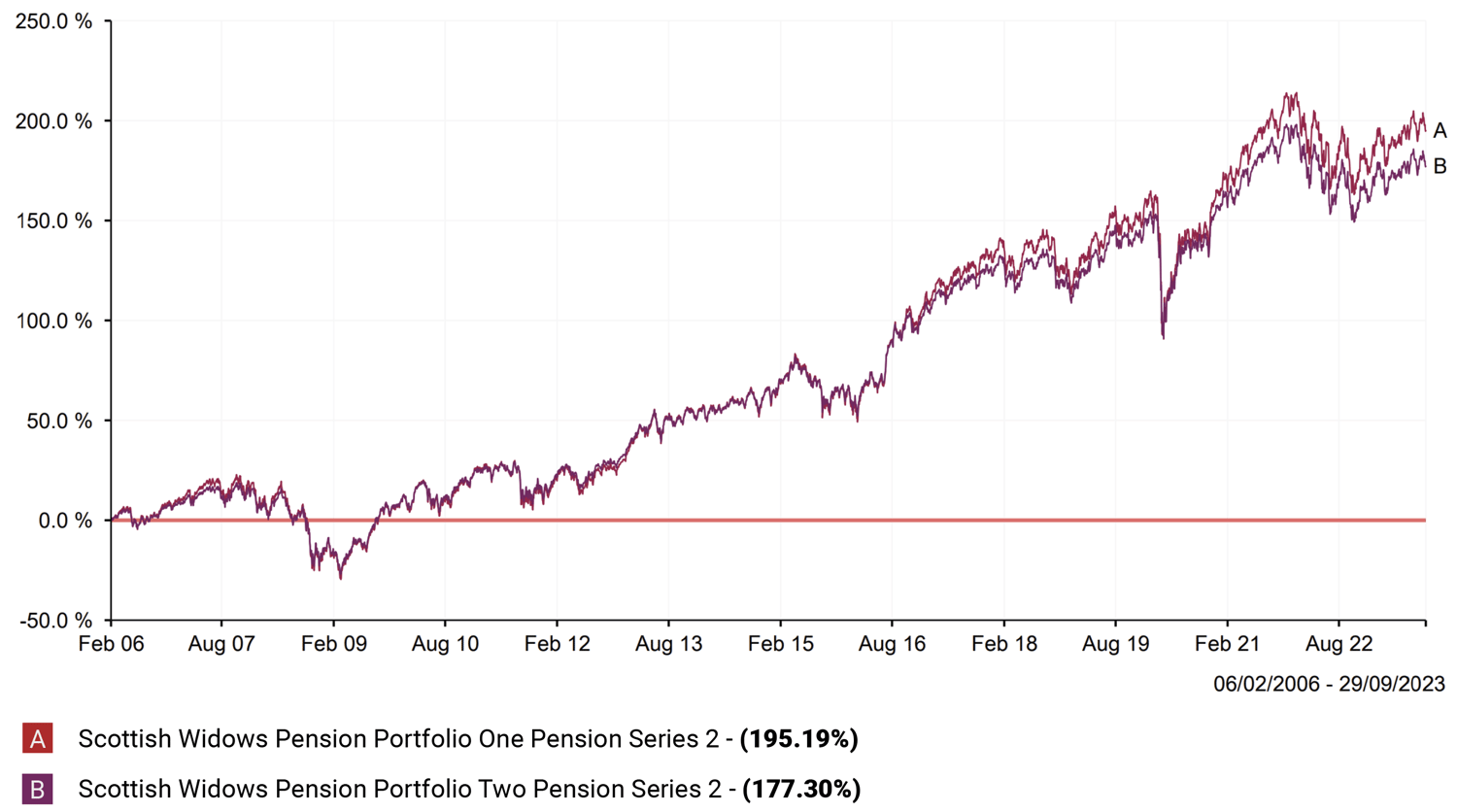

Scottish Widows Pension Portfolio One Pension Series 2

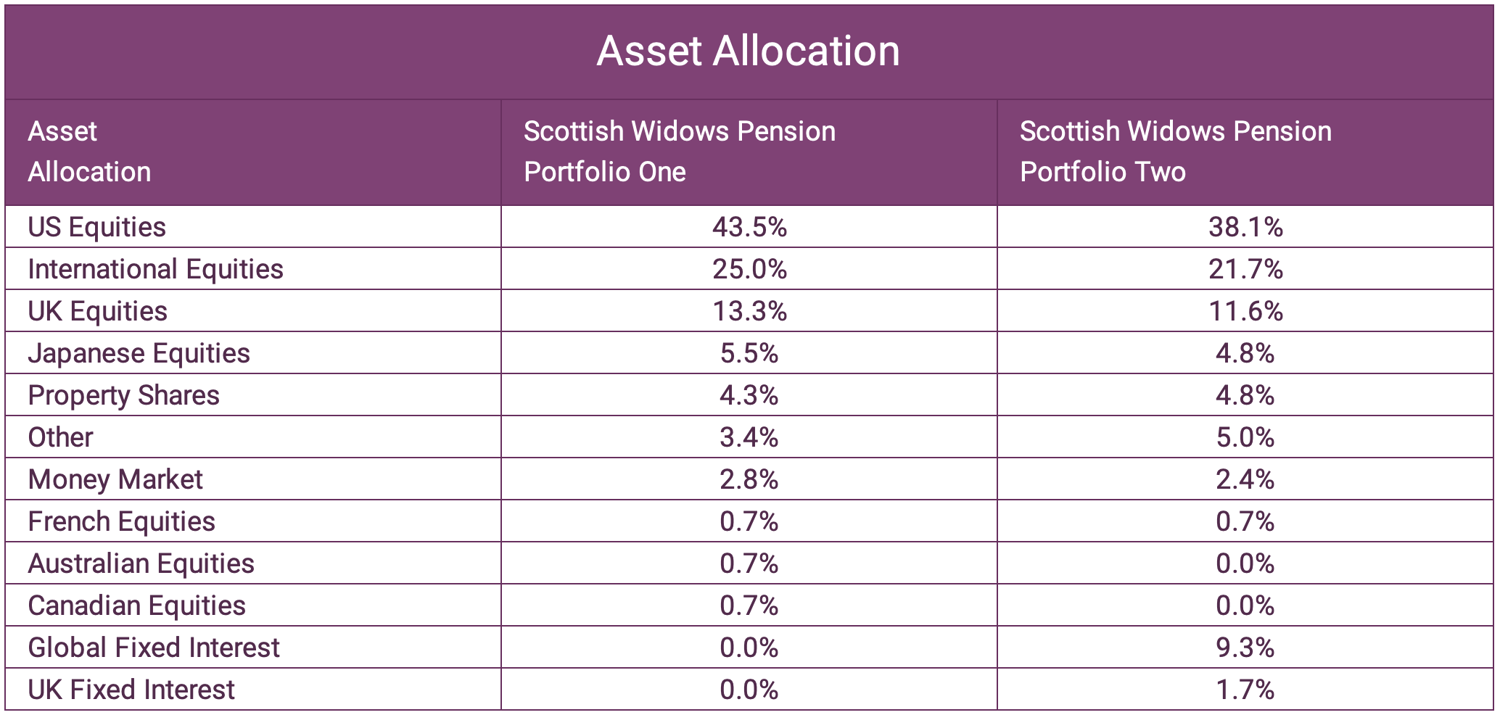

The Scottish Widows Pension Portfolio One Pension Series 2 fund shares similarities and strengths with its sibling offering, the Scottish Widows Pension Portfolio Two Pension Series 2. Launched on February 6, 2006 alongside its counterpart, this fund competes in the same ABI Specialist Pension category containing 481 funds.

Like the Two fund, the One fund boasts an impressive track record, ranking in the top quartile of its sector over the 1, 3, and 5 year periods. Since inception, it has slightly outperformed the Two fund, demonstrating robust long-term results.

Both funds employ comparable risk models and largely invest in the same underlying securities. However, modest differences in asset allocation account for their slightly differing returns.

With £2.8 billion under management, the Scottish Widows Pension Portfolio One fund has substantially fewer assets than the 'Two fund'. However, its sustained success remains noteworthy, reinforcing Scottish Widows' expertise in managing top-tier multi-asset pension solutions.

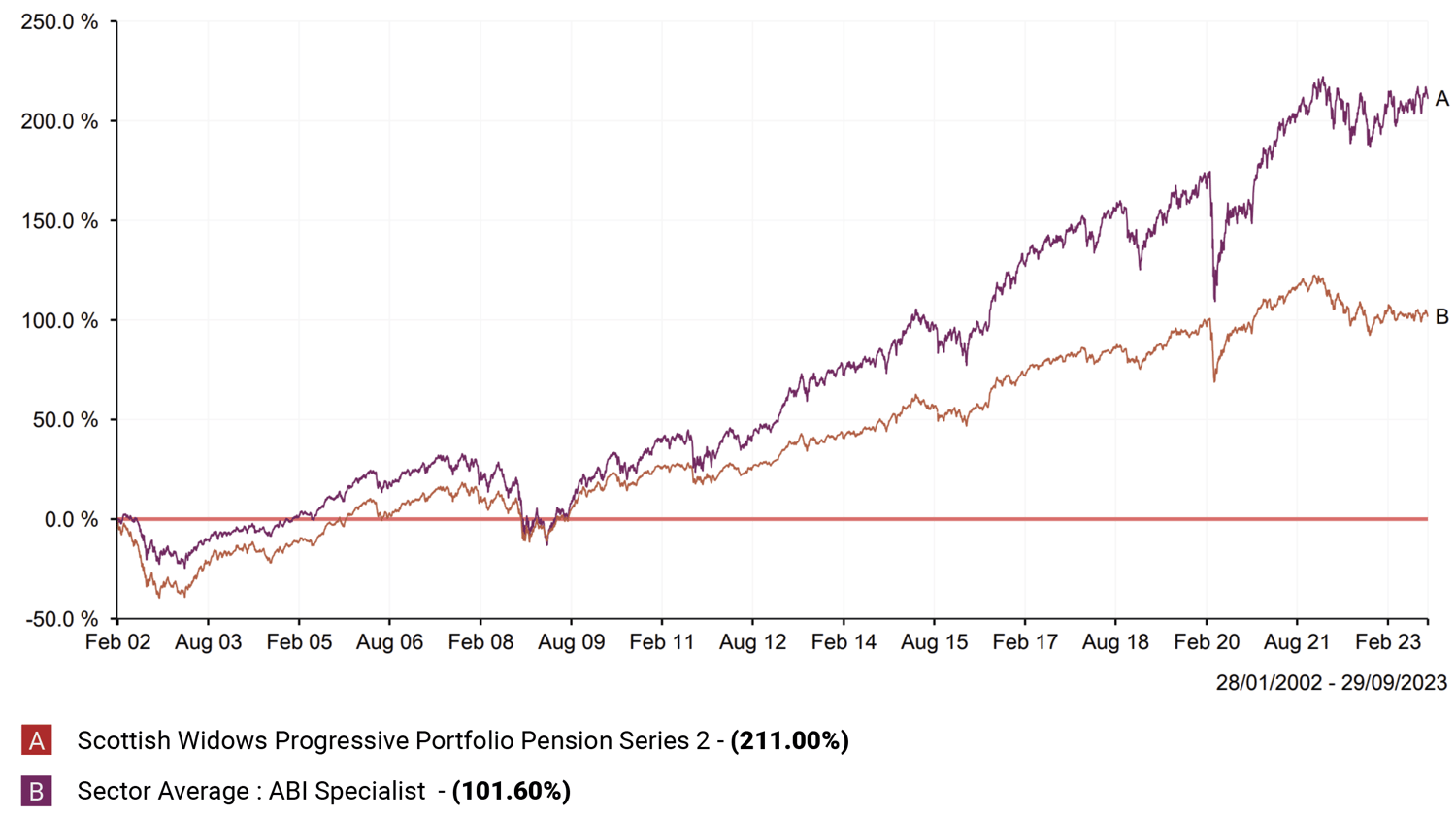

Scottish Widows Progressive Portfolio Pension Series 2

With its launch on January 28, 2002, the Scottish Widows Progressive Portfolio Pension Series 2 became the third standout fund from Scottish Widows in the ABI Specialist Pension sector. Over the past 1, 3, and 5 year periods, the fund has posted returns of 3.95%, 23.28%, and 24.40% respectively, significantly exceeding category averages.

The fund's relatively conservative risk model and cautious investment approach limit its upside compared to higher-growth options like the Scottish Widows Pension Portfolio One and Two funds launched in 2006. However, the Progressive Portfolio has still delivered exceptional long-term performance, returning 211.00% cumulatively since inception versus 101.60% for its peer category.

By maintaining a disciplined strategy focused on asset protection alongside modest appreciation, the fund has generated top-quartile returns with less volatility than most of its sector rivals. For pension investors seeking steady growth with lower risk, the Scottish Widows Progressive Portfolio Pension Series 2 represents an appealing choice within a diversified retirement portfolio.

With its track record of outpacing peers over the long run, this fund adds further evidence of Scottish Widows' skills in structuring and managing top-tier pension solutions tailored to different risk preferences.

Scottish Widows UK Equity Index Pension Series 2

The Scottish Widows UK Equity Index Pension Series 2 fund competes in the UK All Companies pension category, which contains 789 peer funds. With £91.8 million under management, it is one of the smaller offerings in its sector.

Over the past 1, 3 and 5 year periods, the fund has soundly surpassed category averages, positioning it among the top performers in its peer group. However, unlike some other standout Scottish Widows pension options, this fund did not establish a strong long-term track record from the outset.

Launched on July 31, 2000, the fund mostly lagged sector averages in its early years, up until the COVID-19 pandemic sparked a market downturn in March 2020. Since the market lows of March 19, 2020, the fund has delivered exceptional results, returning 64.46% compared to 57.28% for its category.

This reversal has vaulted the fund into the top quartile of its peer group, exemplifying strong active management and well-timed adjustments since the pandemic shook markets.

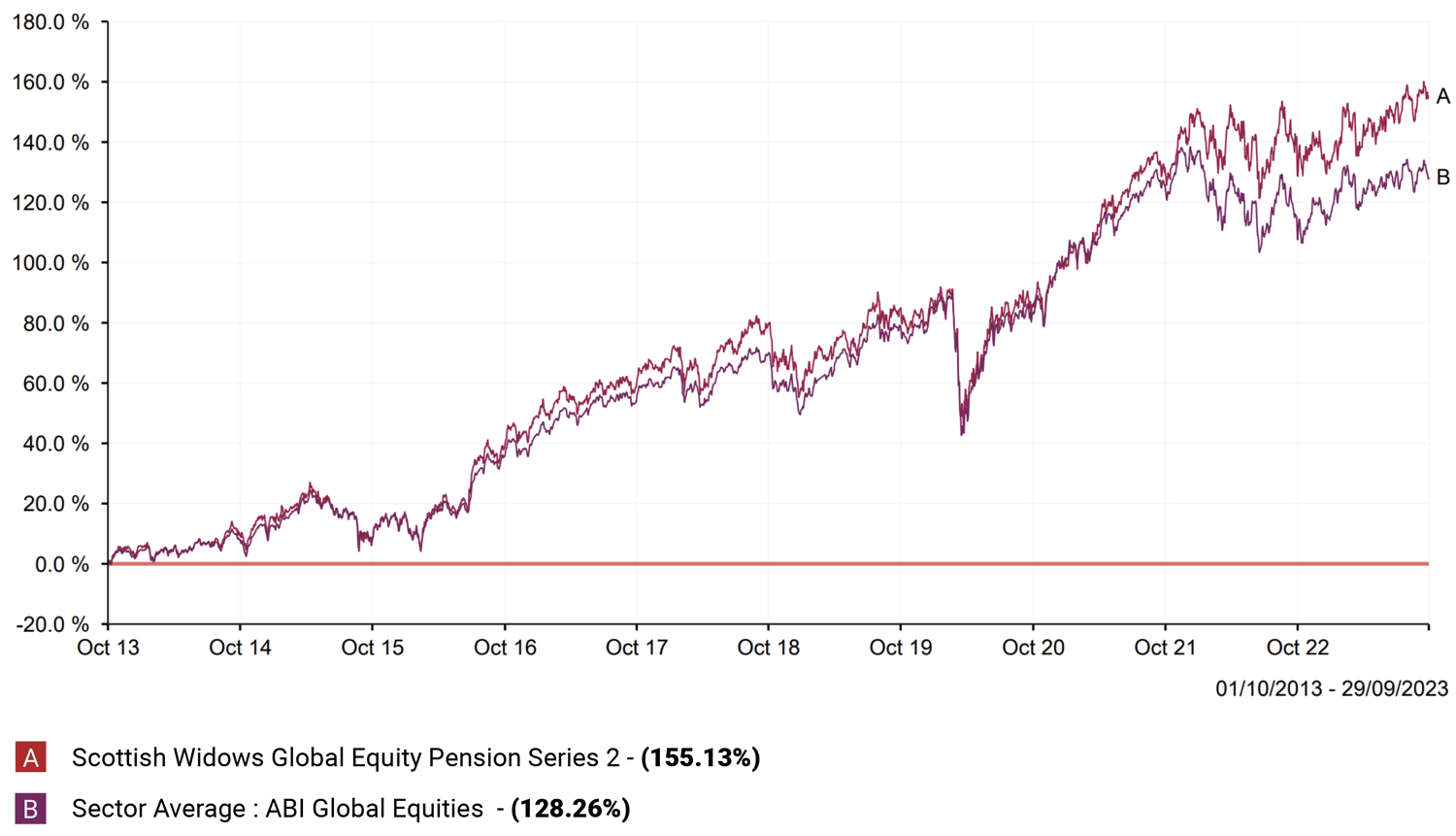

Scottish Widows Global Equity Pension Series 2

The Scottish Widows Global Equity Pension Series 2 fund has competed in the large ABI Global Equities category since its launch in July 2000. With over 1,000 peer funds, this sector is highly competitive. The fund's long-term results have been uneven at times. However, over the past decade, it has delivered standout returns relative to category averages.

Specifically, the fund generated total returns of 155.13% over the past 10 years, significantly exceeding the peer average of 128.26% for the same period. This places the fund in the top quartile of its category for the 10-year stretch, highlighting its recent run of consistently strong performance.

The portfolio maintains a sizeable stake in North American equities, which have been among the best performing markets globally in recent years. Exposure to Europe, the UK, and emerging markets provides helpful geographic diversification. However, the outsized North American allocation has been integral to the fund's success over the past decade, given the robust returns from U.S. large cap stocks.

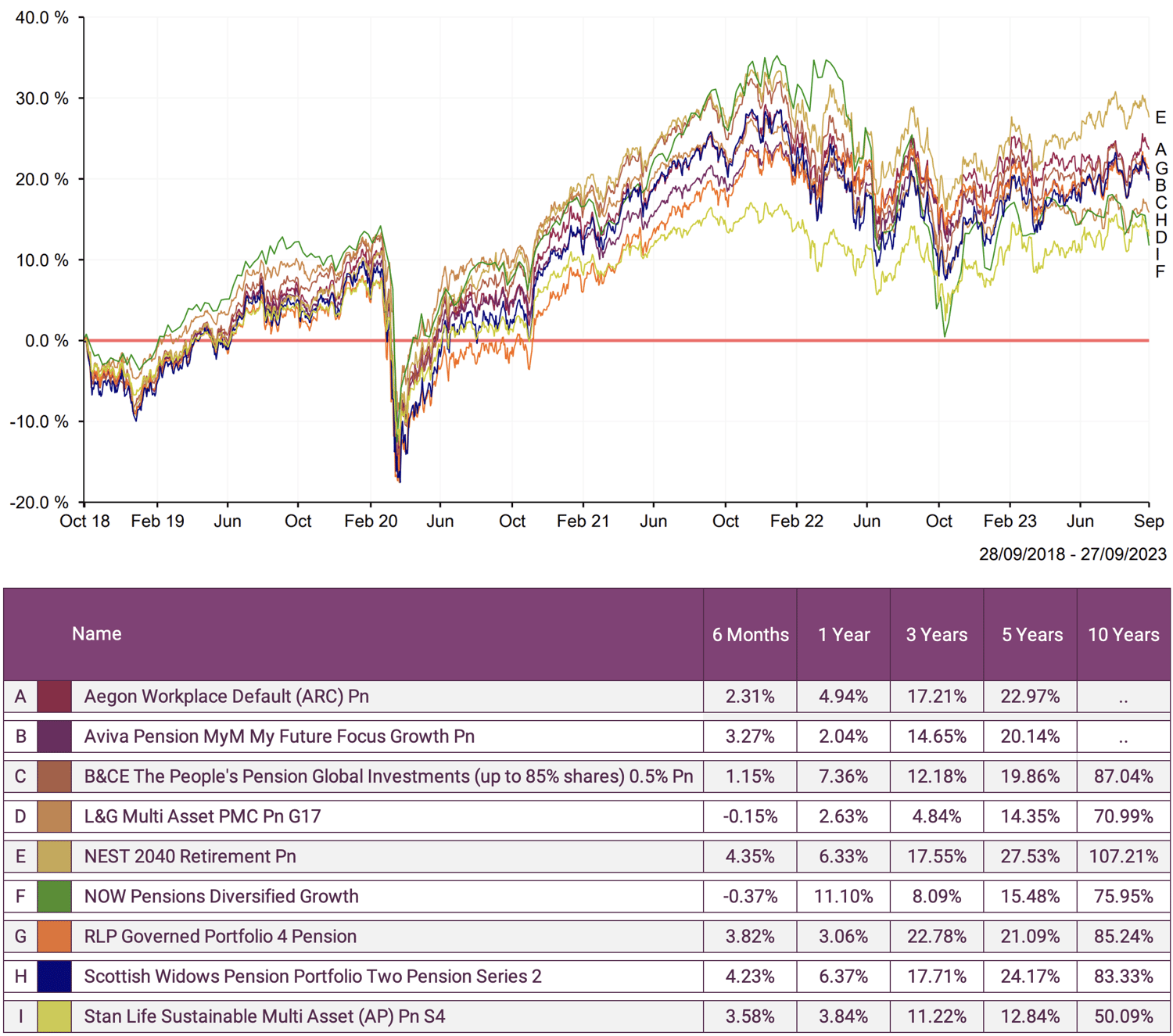

Scottish Widows Default Workplace Pension Comparison

Default workplace pensions represent the investment funds that employee retirement contributions get automatically allocated to, unless individuals opt to select their own choices. Research from The Pensions Regulator indicates over 95% of workers remain in their scheme's default option. Therefore, assessing the quality of these default funds is important.

As previously mentioned, the Scottish Widows Pension Portfolio Two Pension Series 2 fund represents Scottish Widow’s default option. Our analysis of this fund identified strong performance comparative to its sector peers. But how does it perform compared to the default workplace pension funds from other providers?

The above chart illustrates the Scottish Widows default fund to have delivered solid absolute performance, outpacing the majority of its peers over the long-term period.

However, a few rivals achieved even higher 10-year returns, including offerings from B&CE People's Pension, NEST, and Royal London. Specifically, the Scottish Widows fund's 83.33% cumulative return over the past decade lagged the NEST 2040 Retirement fund, which produced the highest 10-year results among defaults analysed.

Over shorter periods, the Scottish Widows default fund ranks competitively, showcasing its consistency. But some alternatives, like NEST's 2040 fund, saw stronger performance over the past 5 years.

With the majority of pension savers passively accepting their employer's default, understanding how these funds stack up is critical. While past performance is not an absolute indicator of future results, historical return patterns can reveal strengths and weaknesses. Given its solid showing against peers in recent years, the Scottish Widows default pension warrants consideration by employees reviewing their workplace retirement plan options.

Summary

Scottish Widows stands as one of the UK's largest pension and investment providers, offering a vast range of products that are widely used by financial advisors and individual investors. Their workplace pensions rank among the most commonly selected options for companies of all sizes.

In this report, we conducted an in-depth analysis on a selection of Scottish Widows' top pension funds. While a portion of their offerings have delivered standout returns, the majority have failed to consistently outperform.

Specifically, our research found that 67.7% of the 127 Scottish Widows pension funds examined received low 1- or 2-star ratings, indicating subpar performance. Just 10.2% earned top 4- or 5-star rankings. This is not entirely surprising, as most broad fund complexes will contain a mix of high- and low-quality options.

In conclusion, Scottish Widows provides both exceptional and lackluster pension funds within its extensive range. By leveraging rigorous research and due diligence, investors can identify and focus on the select funds within the Scottish Widows suite that have consistently ranked at the top of their peer categories across market cycles. Accessing these proven top-tier options can potentially help pension savers work toward their retirement goals more efficiently.

Realising Returns Through Rigorous Research and Insight

While sound investment advice can benefit any portfolio, truly exceptional advisors go beyond the basics to provide additional value for clients. Top firms thoroughly research fund and manager performance, leveraging these insights to identify elite investment vehicles and construct optimised portfolios. This rigorous methodology separates premier advisors from the rest.

At Yodelar, our portfolio development stems from years of exhaustive analysis on the universe of funds and managers. We consistently evaluate over 100 managers, tens of thousands of funds, and 30,000 model portfolios. This ongoing research reveals that only a small subset of funds and managers consistently outperform, with over 90% of portfolios containing chronic under-performers.

These data-driven findings inform our structured portfolio construction process of utilising top-tier, proven funds within each asset class based on rigorous backtesting.

As an FCA-regulated firm, we believe advanced analytics should anchor advice. Our goal is to provide independent guidance and portfolio management designed to meaningfully enhance client returns through research.

By conducting exhaustive due diligence on the global fund universe, our experts identify elite managers with the highest probability of sustained outperformance. These insights allow us to construct optimised portfolios aimed at maximising clients' growth potential within defined risk parameters.

To learn more about our research-driven advisory services and explore how our analytical edge can optimise your portfolio, please contact our team.