- We analysed all 3,999 funds across all 55 sectors and identified the 10 top performing funds for the year, and detail the average returns across each sector, showcasing which investment sectors performed the best.

- We identified that over the past 12 months 1114 funds (27.86%) returned negative growth with 2885 returning positive growth.

- The top performing fund over the past 12 months was the L&G Global Technology fund which returned growth of 37.98%.

- On average investment growth was 2.82% for the year but there were a number of funds and sectors that returned significantly greater growth.

2022 was a turbulent year for investors, with almost all markets experiencing sizeable declines across the board. But as the final weeks of 2022 ended positively many investors felt that 2023 would be a much more positive time for investment markets.

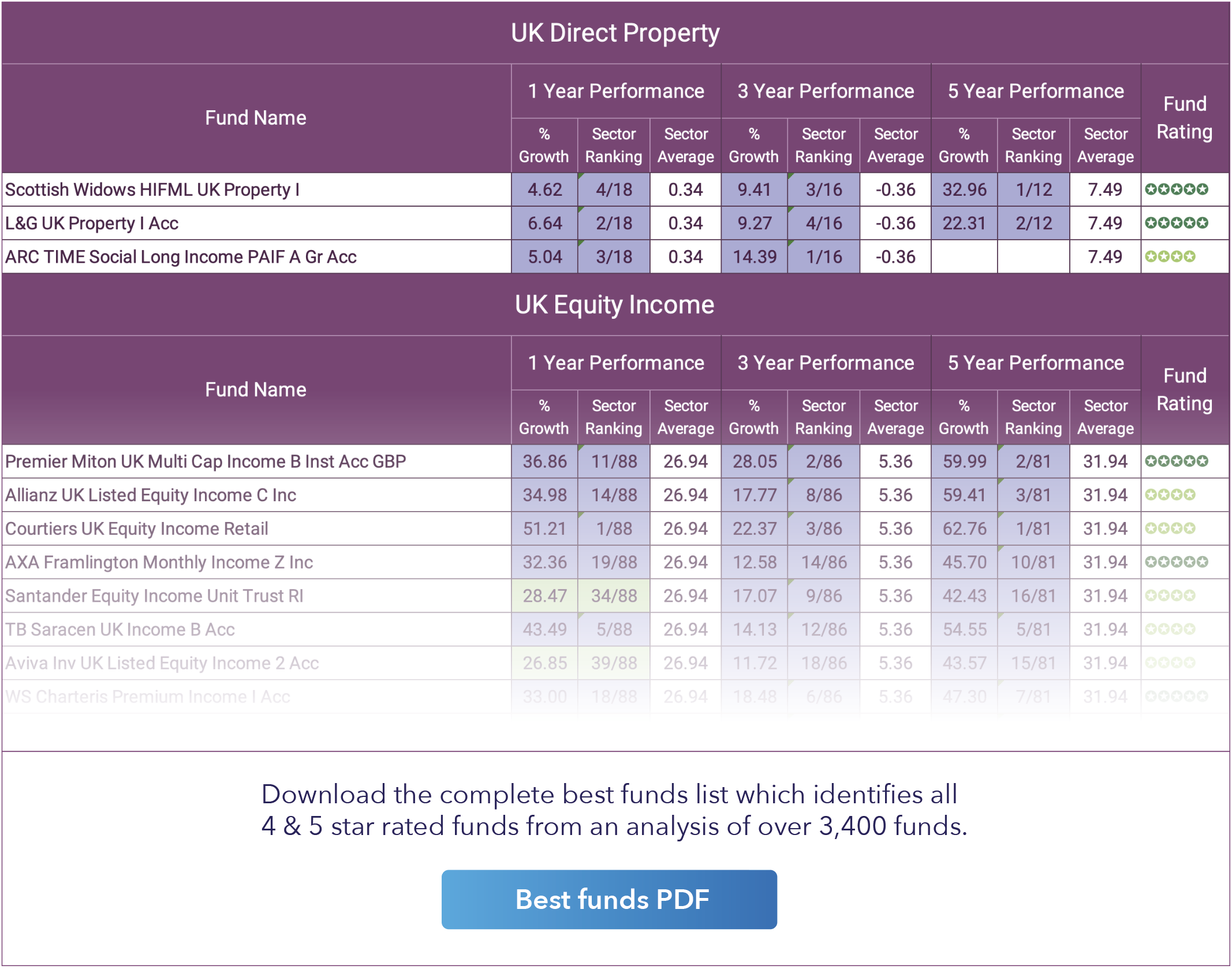

As we enter the last few weeks of 2023 we look back at the performance of all 3,999 investment association funds across 55 different investment sectors and we identify the 10 funds which have performed the best, with some delivering growth in excess of 35%.

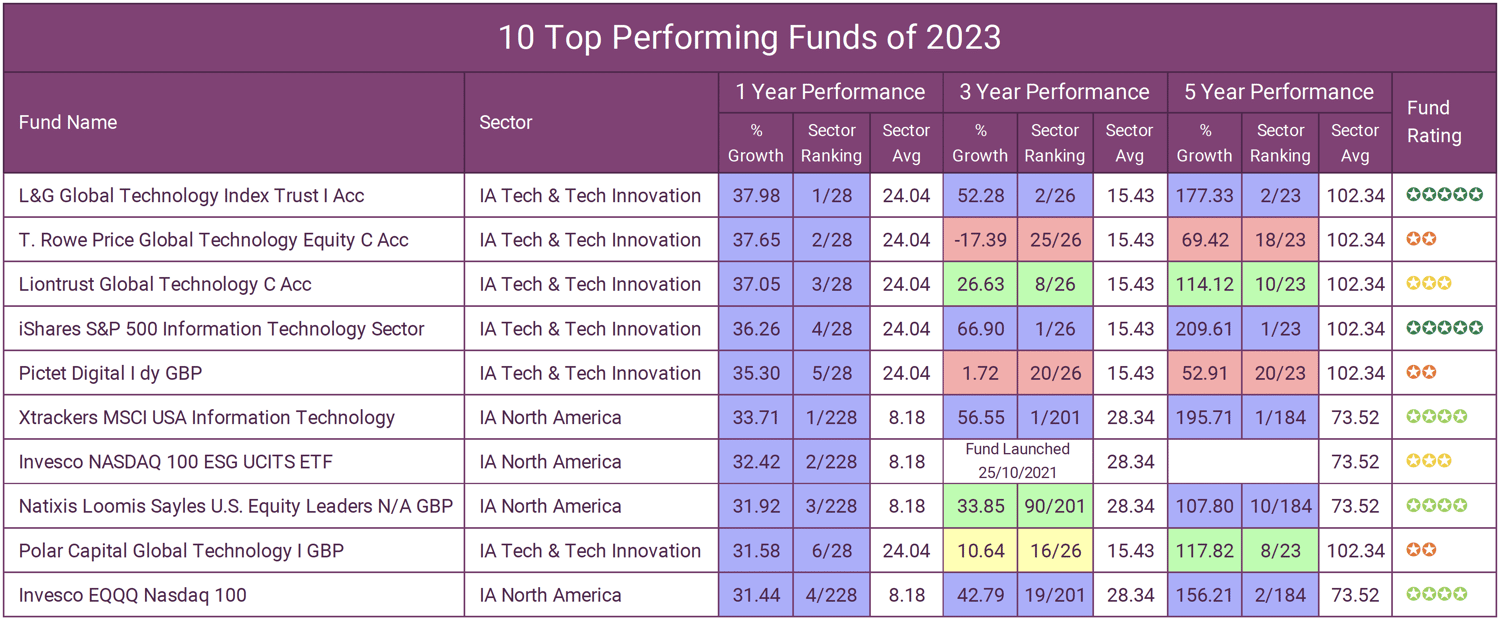

In this report, we also feature the 10 best funds across 6 of the most popular investment sectors with UK investors.

The Best Funds 2023

With 12 month returns of 37.98%, the L&G Global Technology fund was the top performing fund this year. Unsurprisingly, this fund is classified within the IA Technology & Technology Innovation sector, which delivered the highest average returns of any sector this year and consistently averaged among the top performing sectors since the start of the century.

The table below features the 10 top performing funds of 2023. Although there are 55 investment Association sectors available, the 10 funds with the years highest returns come from just 2 sectors - the IA Technology & Technology Innovation and the IA North America sectors.

The average return of the 10 top performing fund this year was 34.5%. In contrast, from all 3,999 funds that were analysed, the average 12 month returns were just 2.82%.

Technology Funds Dominated Performance In 2023

The technology focused funds classified within the IA’s Technology & Technology Innovation sector have been the top performers of 2023. The funds in this sector have vastly outpaced other equity markets for the year, with average 1 year growth of 24.04%. This marks a significant swing in performance compared to the previous year where technology funds suffered a sharp drop in performance.

One of the biggest reasons technology funds had such a tough 2022 was because of the sharp rise in inflation which peaked in October last year. After inflation peaked markets began to settle which helped to propel a major tech stock rebound this year. This was no surprise as in the past, technology stocks have always soared during the 12 months after “peak inflation” in an inflationary cycle.

Prior to 2022, the U.S economy had undergone three hyper-inflationary periods in 50 years: The mid-1970s, the early 1980s, and the early 1990s. Each time, when inflation peaked in that cycle, tech stocks soared over the next 12 months.

- Inflation peaked in November 1974. Over the following 12 months, tech stocks rose by about 25%.

- Inflation peaked in March 1980. Over the following 12 months, tech stocks rose by about 70%.

- Inflation peaked in October 1990. Over the following 12 months, tech stocks rose by about 60%.

With Inflation peaking in the most recent cycle in 2022, the 10 top funds within the IA Technology & Technology Innovations sector have averaged growth of 34% for the past 12 months, which although not quite at the level of previous bounce-backs it still marks a period of excellent performance that could potentially continue into 2024.

The sector remains a highly volatile one but history shows that it recovers quickly and net of all negative market cycles the sector has delivered huge gains over the past 5 years and beyond.

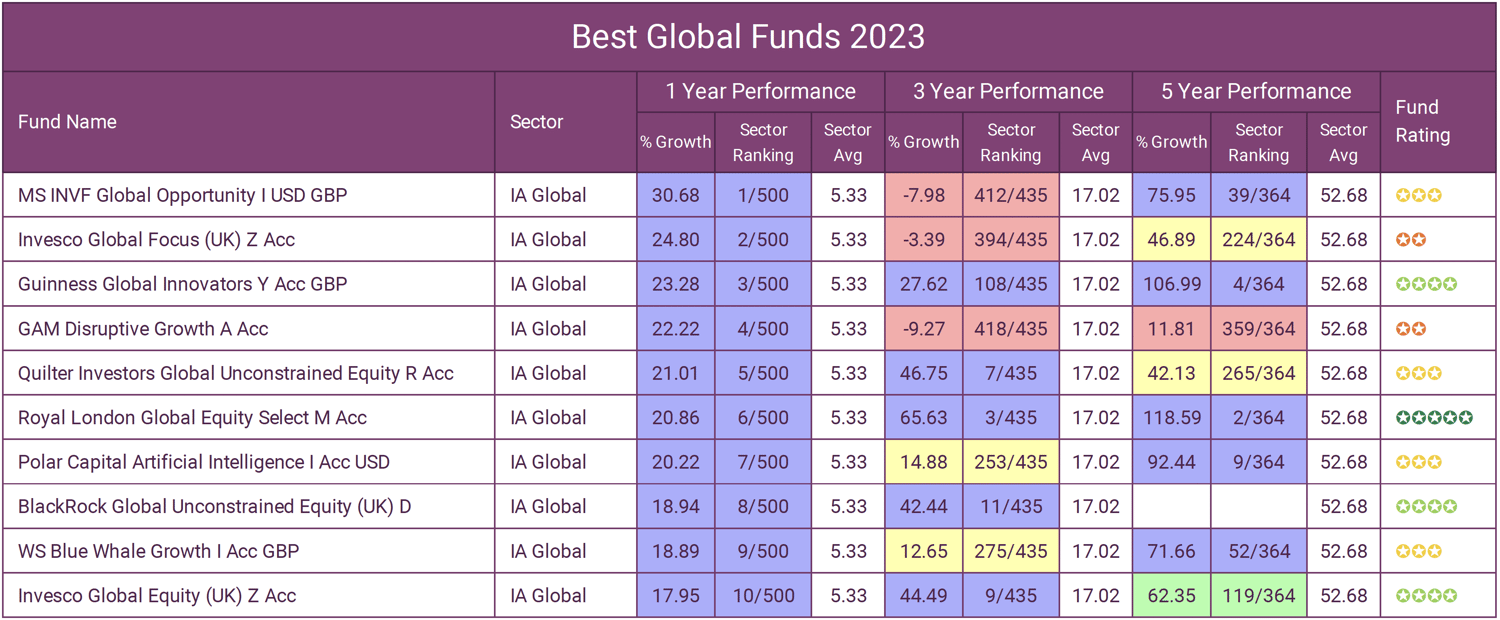

Best Global Equity Funds

From the 55 sectors analysed, by far the largest and most popular with UK investors is the IA Global sector with £169.8 billion under the management of the 500 funds that make up the sector.

The primary reason for the sectors popularity is because Global equity funds have the ability to invest in a wide range of stocks across world markets, potentially helping to minimise the impact of stock market shocks on a portfolio. However, our recent analysis of this sector identified that many of the funds in this sector have a very high concentration in North America, potentially overexposing investors in this sector who believe they are getting a much more diversified investment.

Over the past 12 months the top performing fund in the sector was the Morgan Stanley INVF Global Opportunity fund with 1 year returns of 30.68% - for comparison the sector averaged just 5.33% for the year. Despite having the highest growth this past year the fund has negative returns over 3 years which shows the sharp swings in its performance and potential exposure to higher volatility. However, the competing Guinness Global Innovators fund had the 3rd highest 12 month returns in the IA Global sector but it is one of the few funds to have also outperformed at least 75% of its peers over 1, 3 & 5 years.

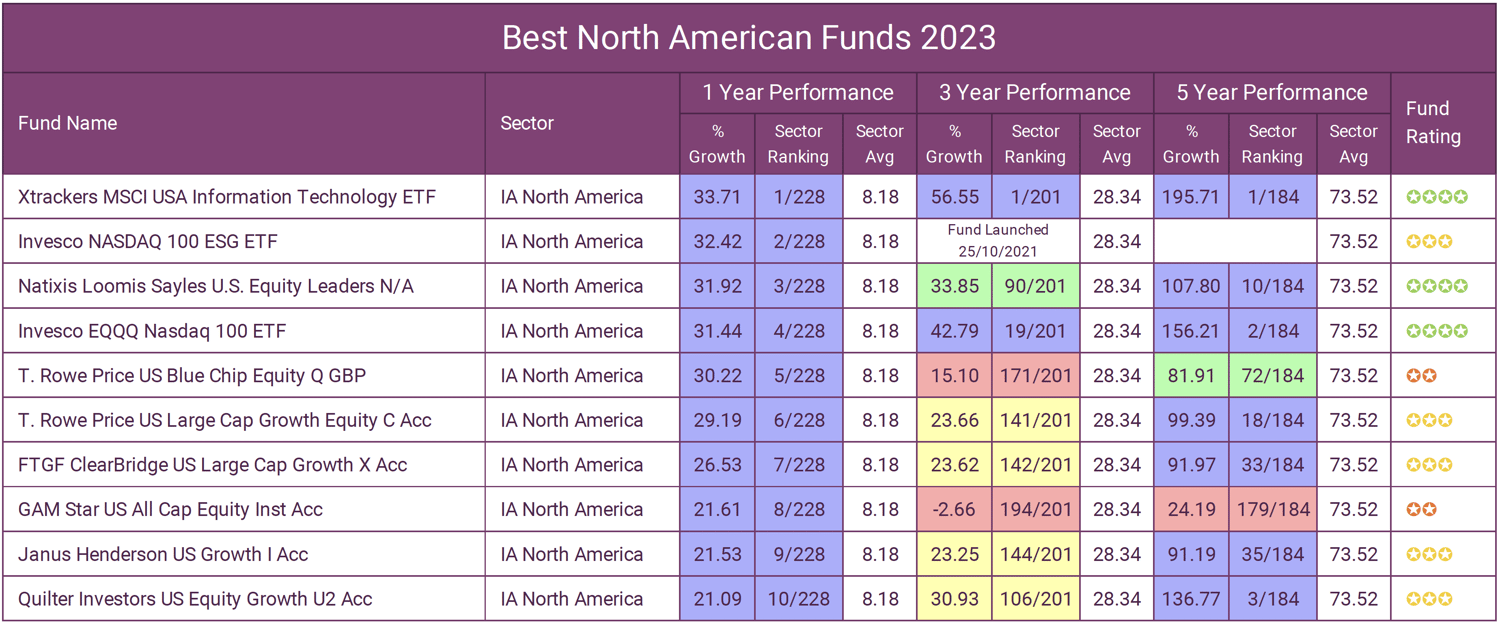

Best North American Equity Funds

The North American sector is the largest regional sector in the world, with the sector typically holding a strong representation in the portfolios of most mid to higher risk investment portfolios.

As a primary asset class, the North American sector is likely to form an integral part in many mid to higher risk investment portfolios. The sector is one of the most competitive on the market, with 228 main unit funds classified within the sector.

Over the past 5 years, the sector has averaged returns of 8.18%, which was the 2nd highest of all 55 sectors - and over 10 years it has averaged the highest returns with an average of 217.18%.

The 10 top performing American funds shown above, combined have averaged 1 year returns of 27.97%.

The Xtrackers MSCI USA Information Technology ETF has delivered exceptional returns in 2023 by providing targeted exposure to America's technology and internet giants that continue leading equity indexes higher amid resilient secular growth trends.

As a passive index fund directly tracking the MSCI USA Information Technology Index, the ETF holds over 70 of the largest US tech stocks. This gives investors focused participation in some of the largest companies in the world including Apple, Microsoft, Nvidia, Visa and Mastercard that are transforming consumer and enterprise markets while taking substantial global market share.

The composition offers direct access to key long-term trends driving outperformance - cloud computing, digital payments, artificial intelligence, 5G networking, automation and more in one cost-efficient ETF. One of the main reasons the fund did so well this year was because it maintained heavy exposure to technology companies while avoiding hard hit sectors like financials and energy.

What is unique about this fund is that it is one of the only funds on the market that has topped the sector rankings this year while also ranking 1st over 3 and 5 years.

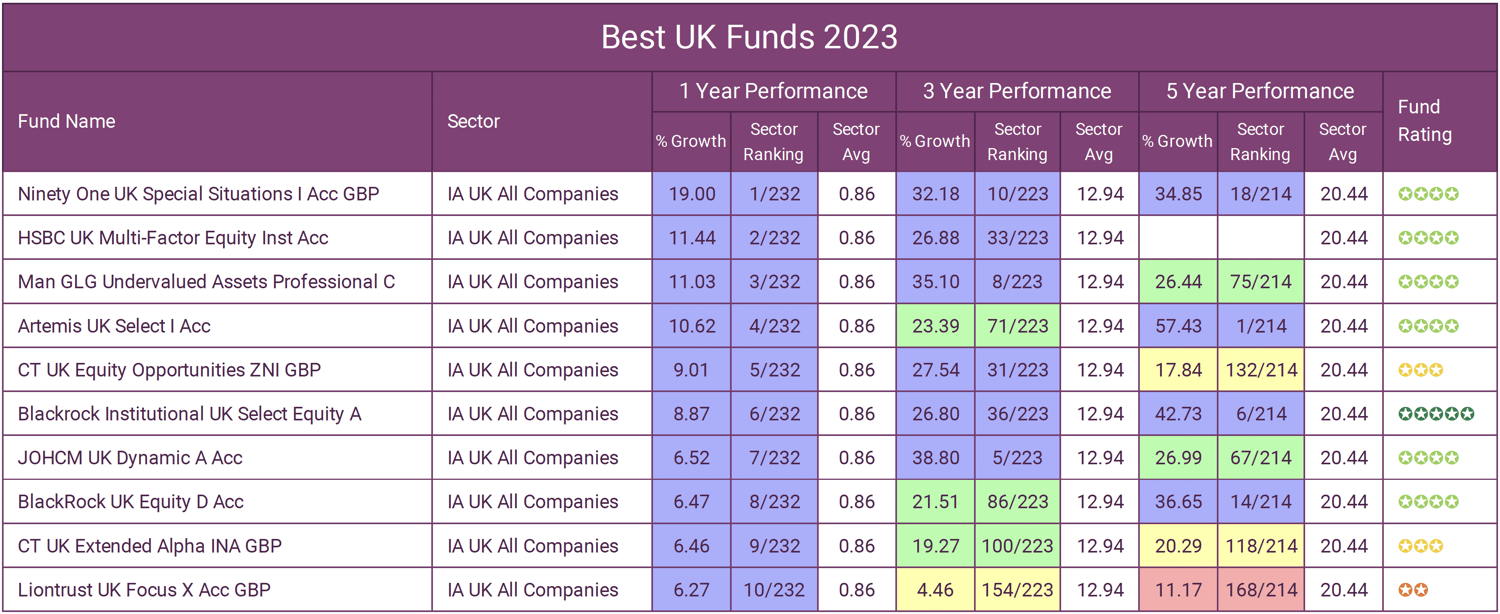

Best UK Equity Funds

UK equities were one of the few asset classes that averaged lower returns in 2023 than they did in 2022. The year has been a tough one for our home region with poor sector performance connected to stubbornly high inflation, rising interest rates as well as continued geopolitical tensions and signs of economic slowdowns across several major economies.

Perhaps the most significant impact on UK markets comes from surging consumer prices which triggered a cost of living crisis across the UK, squeezing disposable incomes and consumer confidence. This has prompted investors to become more cautious, with UK equities impacted particularly hard given the British economy's uncertain outlook.

The first 2 months of the year saw positive gains with the average growth for the UK All Companies sector average peaking at 7% growth by early March before retracting back and remaining relatively stagnant ever since.

Despite the sectors generally sluggish performance, there remained a few select funds that managed to push past the headwinds to deliver strong returns for the year. The below table identifies the 10 top performing funds from the 232 available in the IA UK All Companies sector.

The top performing fund in this sector over the past 12 months was the Ninety One UK Special Situations fund. This fund has navigated challenging market conditions to deliver standout returns through its strategy of focusing on quality domestic mid and small sized companies with strong earnings growth prospects. The funds management team identifies smaller UK firms who they believe have a durable competitive advantage in niche markets.

Over the past 12 months the fund has managed to deliver growth of 19% despite the sector averaging just 0.86%.

Another top performing UK equity fund this year was the Artemis UK Select. This fund currently manages £1.8 billion of investor money and it has consistently outperformed its peers over the past several years. The fund ranked 4th in the sector this year with returns of 10.62% but over the past 5 years it has delivered growth of 57.43%, which was the highest of 214 funds in the sector.

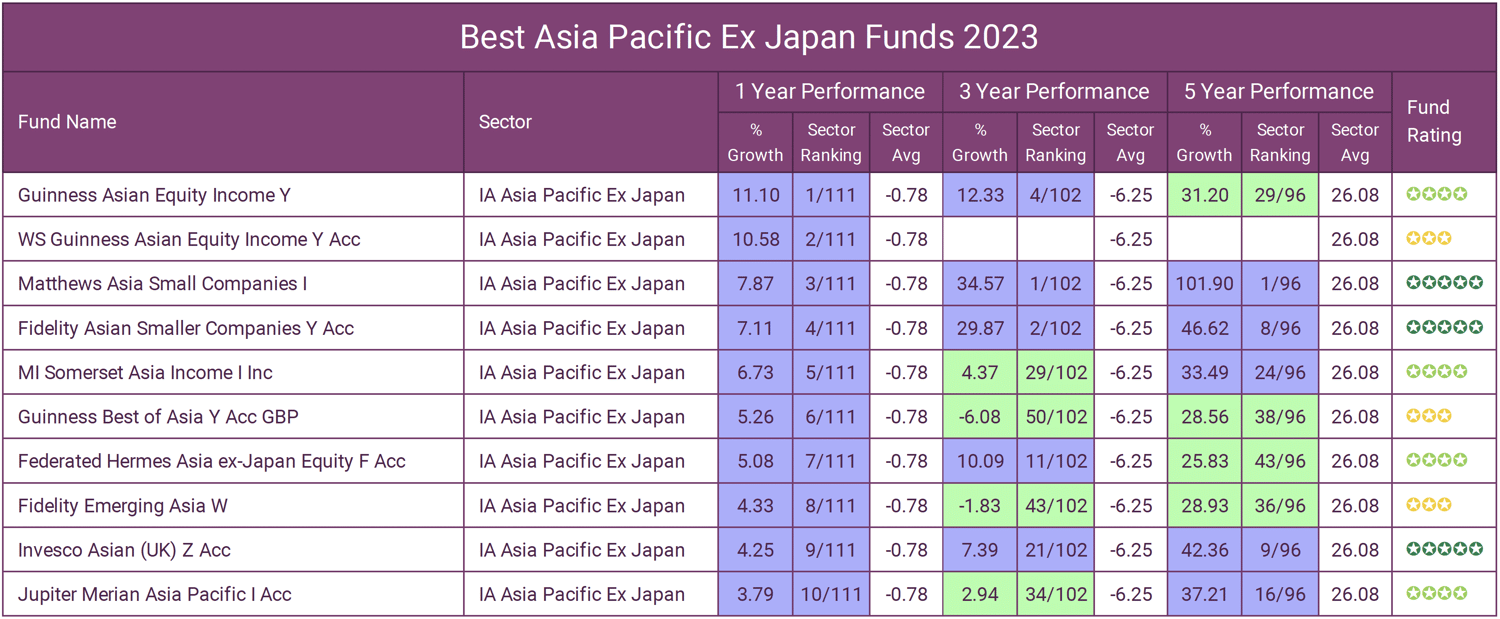

Best Asian Equity Funds

The Asia ex-Japan sector covers the economic region of countries located in Asia, but not including Japan. These countries are generally considered emerging markets and are typically only suited to investors looking for high-growth investment opportunities who have a higher risk tolerance.

The sector itself has had a relatively slow year with average returns of -0.78% from its 111 funds. Although disappointing, it was a marked improvement on 2022 when the sector averaged negative returns of -9.63%. Despite failing to average growth for the year the sector has a selection of funds that have performed well with some delivering double digit returns.

In the table below we feature the 10 best performing funds classified within the IA Asia Pacific ex Japan sector over the past 12 months.

The number 1 ranked fund in the IA Asia Pacific ex Japan sector over the past 12 months with returns of 11.10% was the Guinness Asian Equity Income fund . The fund has a concentrated 35-50 stock portfolio which leans towards sectors like healthcare and consumer staples with the top country weights being China, Taiwan, Australia and Singapore.

The 5 star rated Matthews Asia Small Companies fund was the 3rd top performing Asian equity fund this year. It was also one of the few funds in the sector that consistently ranked among the top performers over 3 & 5 years. Over the past 5 years this fund has returned growth of 101.90% which was almost 4 times the sector average and the highest returns of any fund in the sector over 5 years.

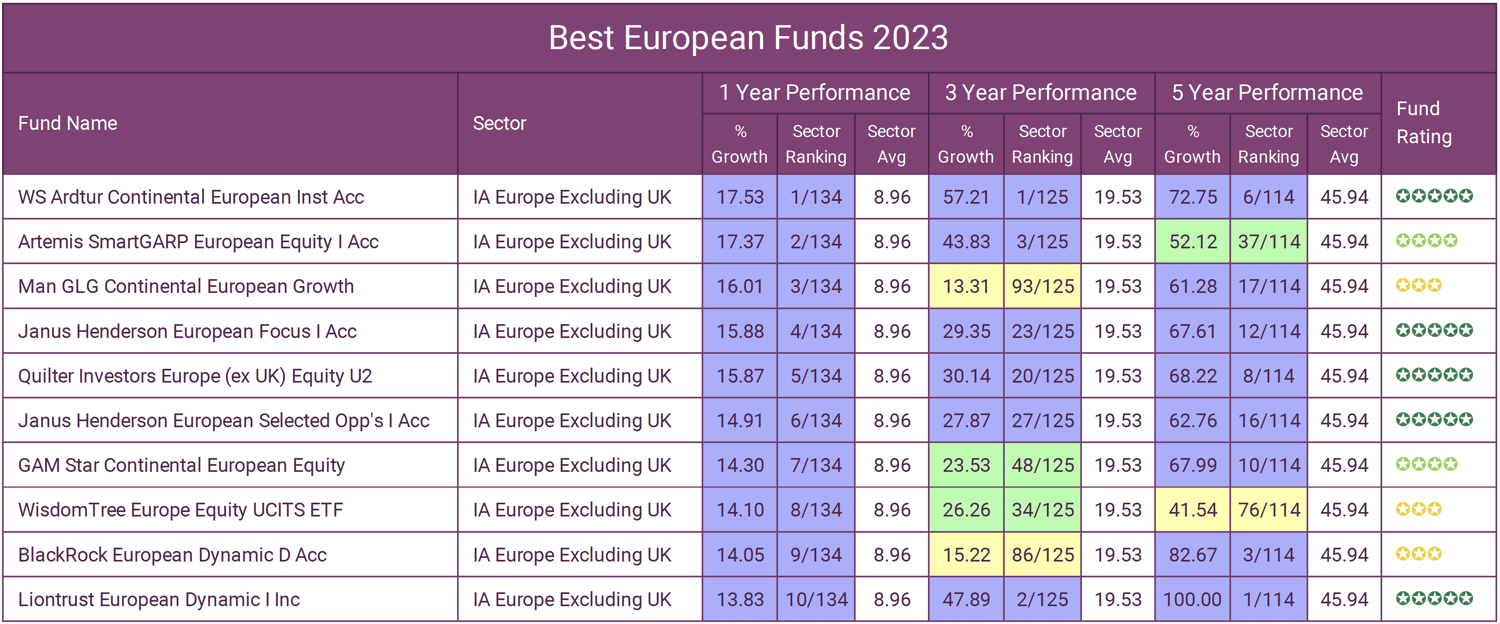

Best European Equity Funds

Europe was hardest hit by the fallout of the Russian invasion of Ukraine which made for a tough 2022. However, in the fourth quarter of 2022 the sector averaged the highest quarterly returns of any sector. This positive momentum was carried through to 2023, and despite periods of volatility, the sector managed to average returns of 8.96% over the past 12 months.

The number one performing fund in the IA Europe ex UK equity sector this past year was the WS Ardtur Continental European fund. Formerly known as the LF Brook Continental European, this fund currently manages just £161 million of client money, making it one of the smallest in the sector. Despite its small size and relative anonymity with UK investors, the fund has consistently been one of the best in the sector. Over the past 1, 3 & 5 years the fund has returned growth of 17.53%, 57.21% and 72.75% respectively.

Closely matching the performance of the WS Ardtur Continental European fund this past year was the Artemis SmartGARP European Equity fund. Similarly this fund is relatively unknown among UK investors but it has consistently been a stellar performer in a highly competitive sector. Over the past 12 months this fund has returned impressive growth of 17.37%.

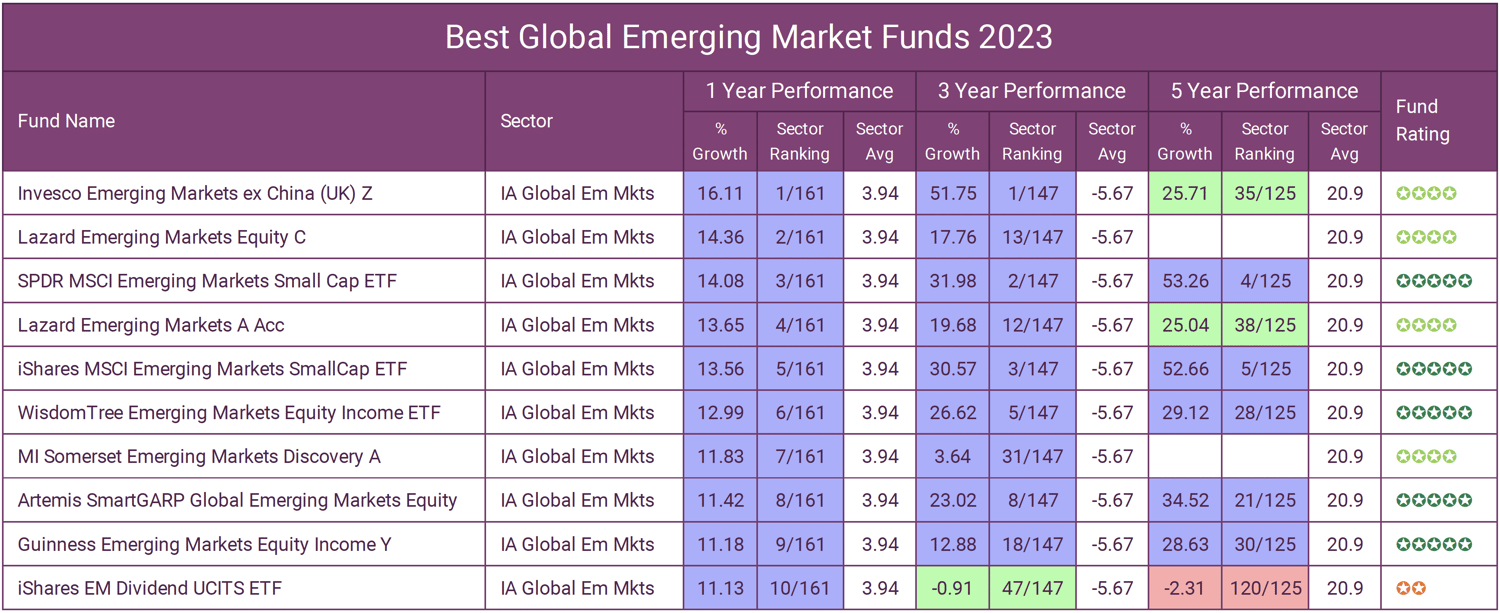

Best Emerging Market Funds

Global emerging market funds has had a tough 2023 amidst an unfavourable environment of slowing growth across several key developing economies. This combination of headwinds prompted many investors to scale back exposure to the sector after an initial promising start to the year soon stalled.

Specifically, surging prices for food, energy and other staple goods precipitated a deepening cost-of-living crisis across parts of Latin America, Africa and Asia. This squeezed disposable incomes, consumer confidence and the outlook for domestic demand just as external factors turned more adverse.

The first 2 months of 2023 saw a sharp upswing in performance for emerging markets but since the beginning of March the sector has been mostly stagnant. A proportion of funds, however, powered through as is demonstrated from the 10 top performing emerging market funds in the below table. But broadly, it was a year that tested even experienced emerging market investors and mandated careful diversification.

The top performing emerging market fund this past year was the Invesco Emerging Markets ex China fund which achieved growth of 16.11% for the year.

This actively managed fund provides exposure to developing economies outside of China. Its exclusion of China is a differentiated approach, as China now dominates broad passive emerging market indexes with over 35% weighting. The fund offers greater diversification across other high growth regions in Latin America, Asia, Eastern Europe, and Africa. The fund manager employs a high conviction, quality growth approach. Rigorous bottom-up analysis focuses on sustainable competitive advantages and long-term earnings potential rather than macro forecasts. A concentrated portfolio of 50-70 names represents the manager’s highest conviction ideas based on fundamental research.

This fund currently manages £164 million of investor assets and it has been the best emerging market fund for a few years now with 3 year returns of 51.75% also ranking 1st in the sector.

The Significance of Fund Performance

Evaluating fund performance is a pivotal metric for investors and quality advisory firms. Its analysis serves the purpose of ensuring that portfolios effectively align with objectives, all the while entrusting fund managers who have consistently showcased their ability to deliver above average returns.

While it's important to note that past performance does not guarantee future returns, investors often exhibit a preference for fund managers who exhibit consistent excellence across various time frames. This article features a selection of funds managed by fund managers who have outperformed the majority of their peers over the past year, with many of the funds outperforming over a multiple periods.

Comparative Performance Assessment

Each fund's performance can be assessed in relation to other competing funds classified under the same sector. This comparative analysis across multiple time frames can shed light on both the fund's overall quality and the competence of its manager.

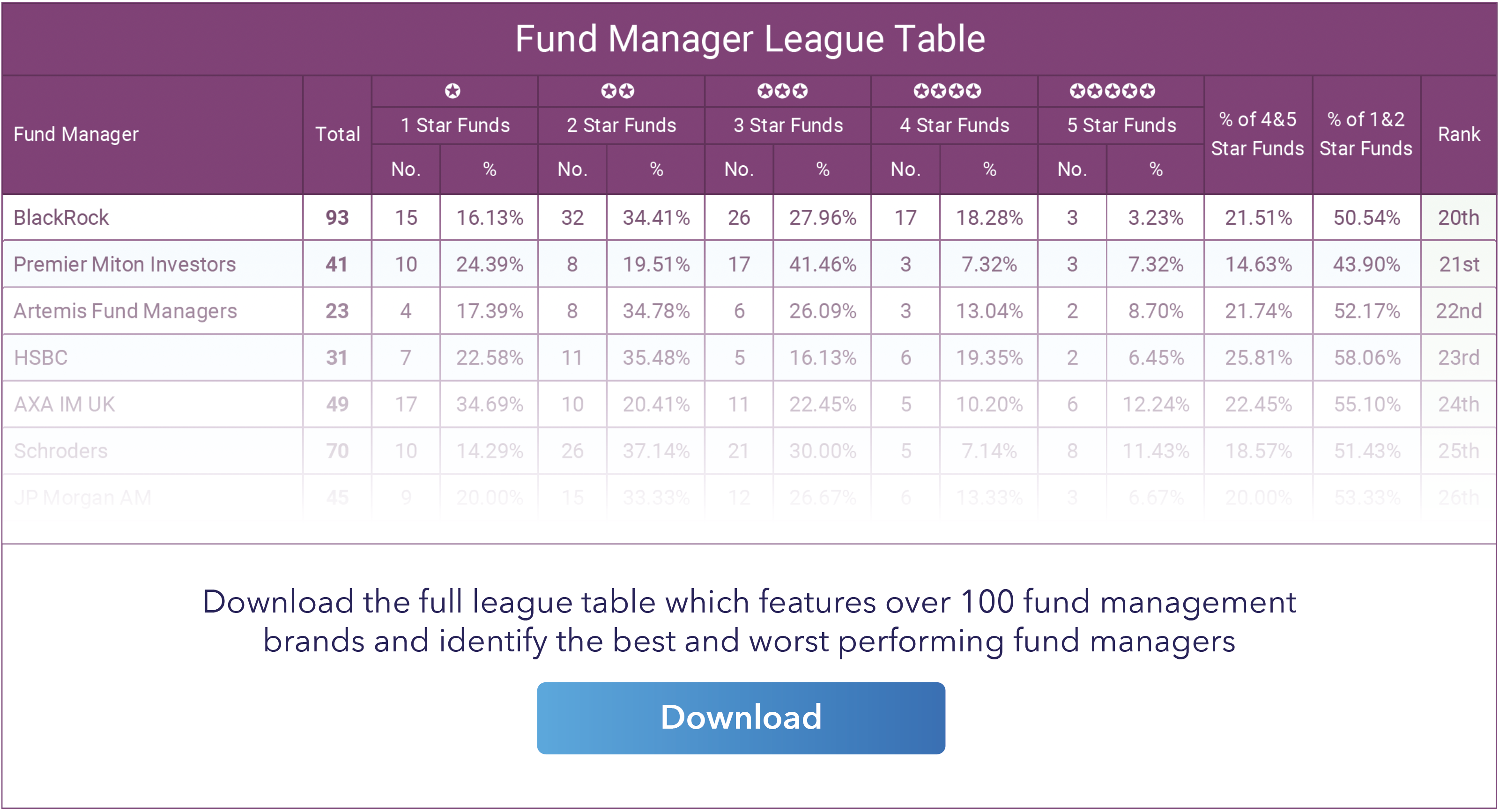

Fund Manager Quality

Past performance serves as a revealing gauge of fund efficacy and the capabilities of its managers. Funds that maintain a consistent high rank within their sectors can indicate a notable level of expertise. Conversely, fund managers overseeing consistently underperforming funds within their sector showcase a deficiency in quality and an inability to deliver competitive returns to investors. While past performance isn't a crystal ball for future returns, it's a crucial tool that holds fund managers accountable for their achievements.

Strong Performance History

Over a span of five years, investments encounter a variety of economic and political challenges. How a fund and its manager navigate these cycles reflects their capabilities and overall competence.

Invest With Confidence

While sound investment advice can benefit any portfolio, truly exceptional advisors go beyond the basics to provide additional value for clients. Top firms thoroughly research fund and manager performance, leveraging these insights to identify elite investment vehicles and construct optimised portfolios. This rigorous methodology separates premier advisors from the rest.

At Yodelar, our portfolio development stems from years of exhaustive analysis on the universe of funds and managers. We consistently evaluate over 100 managers, tens of thousands of funds, and 30,000 model portfolios. This ongoing research reveals that only a small subset of funds and managers consistently outperform, with over 90% of portfolios containing chronic under-performers.

These data-driven findings inform our structured portfolio construction process of utilising top-tier, proven funds within each asset class based on rigorous backtesting.

As an FCA-regulated firm, we believe advanced analytics should anchor advice. Our goal is to provide independent guidance and portfolio management designed to meaningfully enhance client returns through research.

By conducting exhaustive due diligence on the global fund universe, our experts identify elite managers with the highest probability of sustained outperformance. These insights allow us to construct optimised portfolios aimed at maximising clients' growth potential within defined risk parameters.

To learn more about our research-driven advisory services and explore how our analytical edge can optimise your portfolio, please contact our team.