2022 has been a trying year for investors, with everything from inflation to escalating energy prices, interest rate hikes, the Ukraine war and general uncertainty, all of which have contributed to driving Global markets down.

Poor political and economic conditions have driven fear and caused anxiety among investors but there are plenty of reasons for investors to be optimistic in the months ahead.

In this article, we explain why, despite widespread pessimism, many market analysts believe that UK investors will begin to see their portfolio values grow in upcoming months and across 2023. We have also identified 10 funds that have sizeable growth potential going into 2023.

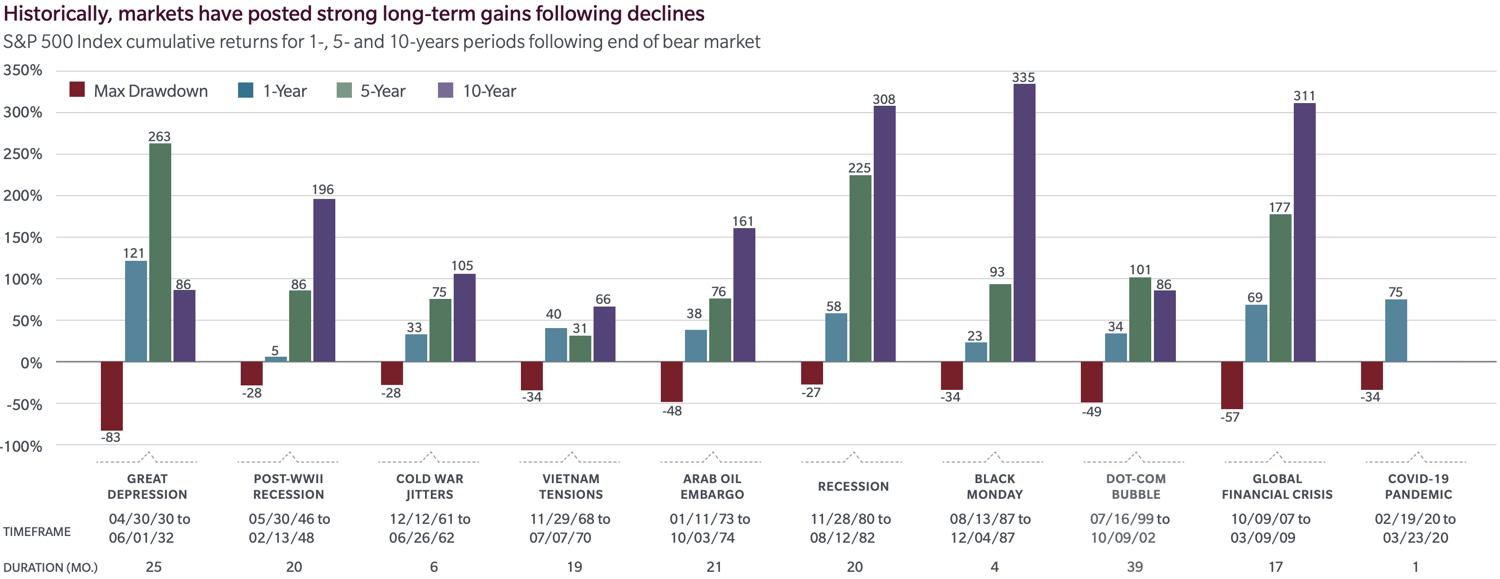

Take Confidence From History

Sharp sudden market declines are disconcerting, prompting many investors to reduce their stock holdings, or pull out of the market. As history has shown, financial markets have always rebounded from market shocks, posting strong long-term gains. All too often, investors that have sold out during a crisis have locked in losses and missed the rebound. Riding out market declines and benefiting from rebounds when they occur is a much more sound strategy.

The Risks The Current Climate Holds For Investors

There remains a danger that the combined effects of high debt levels coupled with rising interest rates could trigger further periods of negative investment growth.

Evidence of this can be found by looking at the indebtedness of Chinese property developers or “fire sales” of high-quality gilts by UK pension funds in the wake of Kwasi Kwarteng’s ill-fated mini-budget.

Pessimism is rife both among consumers and investors. During the Great Financial Crisis, pessimism reached similar levels to those we see today.

However, there are always risks, even at the best of times. When markets are performing well, investors tend to cast these risks aside to focus on the positives. Following an extended period of falling asset prices, risks take on a greater stature.

A number of factors reduce the likelihood of new concentrated areas of risk in the last weeks of 2022 and into 2023. For one thing, the financial system is considerably stronger than it was a decade ago, thanks to greater supervision, stricter controls on the amounts banks must keep in reserve and tighter mortgage lending requirements.

It also seems unlikely, despite the rhetoric about being focused resolutely on inflation, that central banks would wish to preside over a deeper crisis as the world continues to come to terms with a post-pandemic environment of disrupted supply chains and already fragile economic growth.

Given the presence of these safety valves, history suggests the current crisis of confidence in markets could be much closer to an end than a beginning. However, there remains a risk that the bear market may have a few more months left. Despite the risks, there is growing confidence among key analysts and economists that a return to positive investment growth is now in sight.

The Impact of a Recession on the Markets

During a recession, we see widespread downturn in general economic activity or a general reduction in the exchange of goods and services within an economy, which means the public spends less money due to reduced demand. This in turn results in unemployment rates rising, businesses closing and disposable income reducing. If a recession continues for long enough, it could evolve into what is referred to as a ‘depression’, where economic growth continues to spiral downwards. A depression is something we haven’t endured in developed economies since the 1930s.

Recent economic data indicates the UK is likely to enter a recession next year, but does this mean we are likely to see stock markets fall? In short, no.

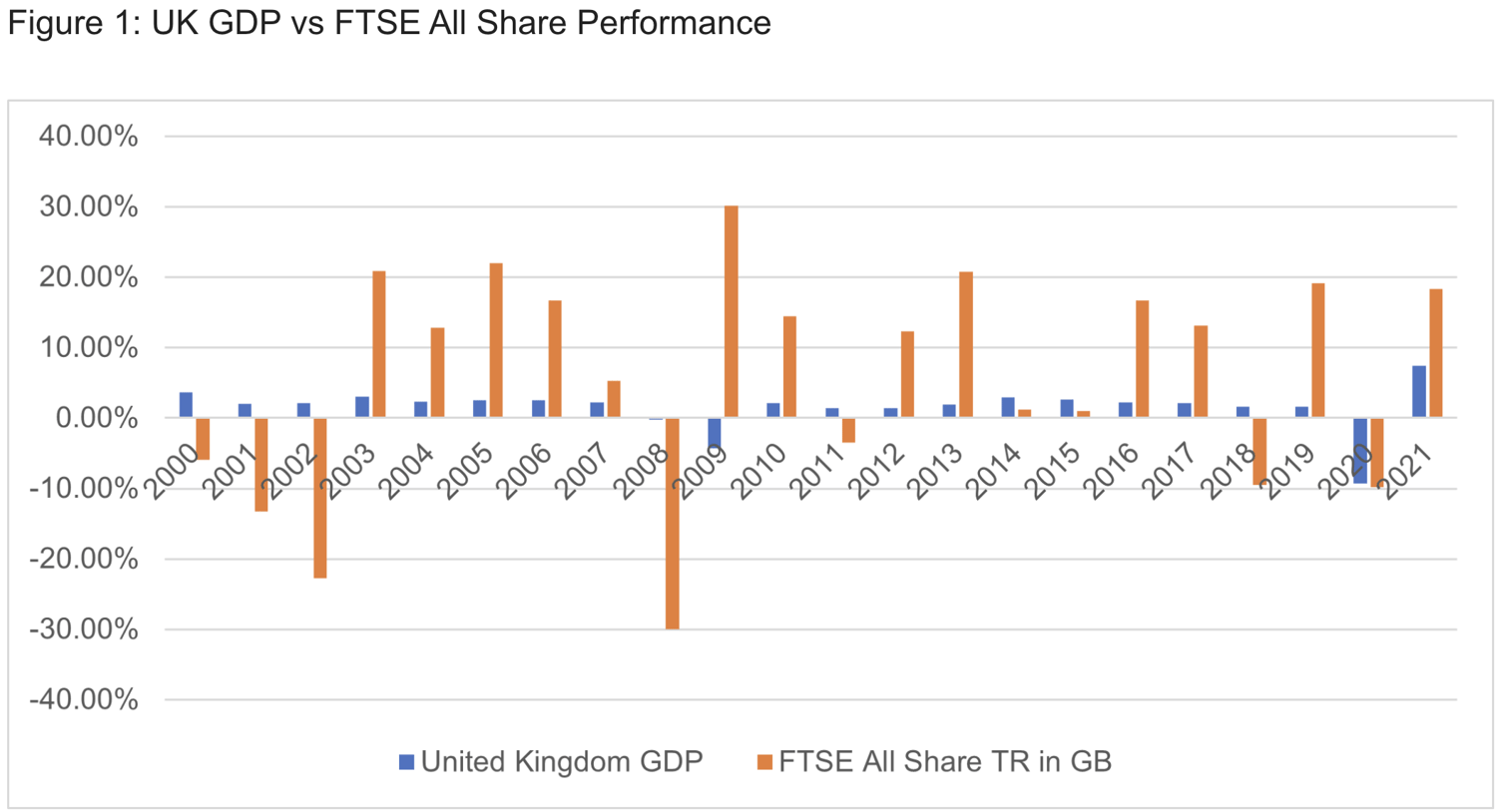

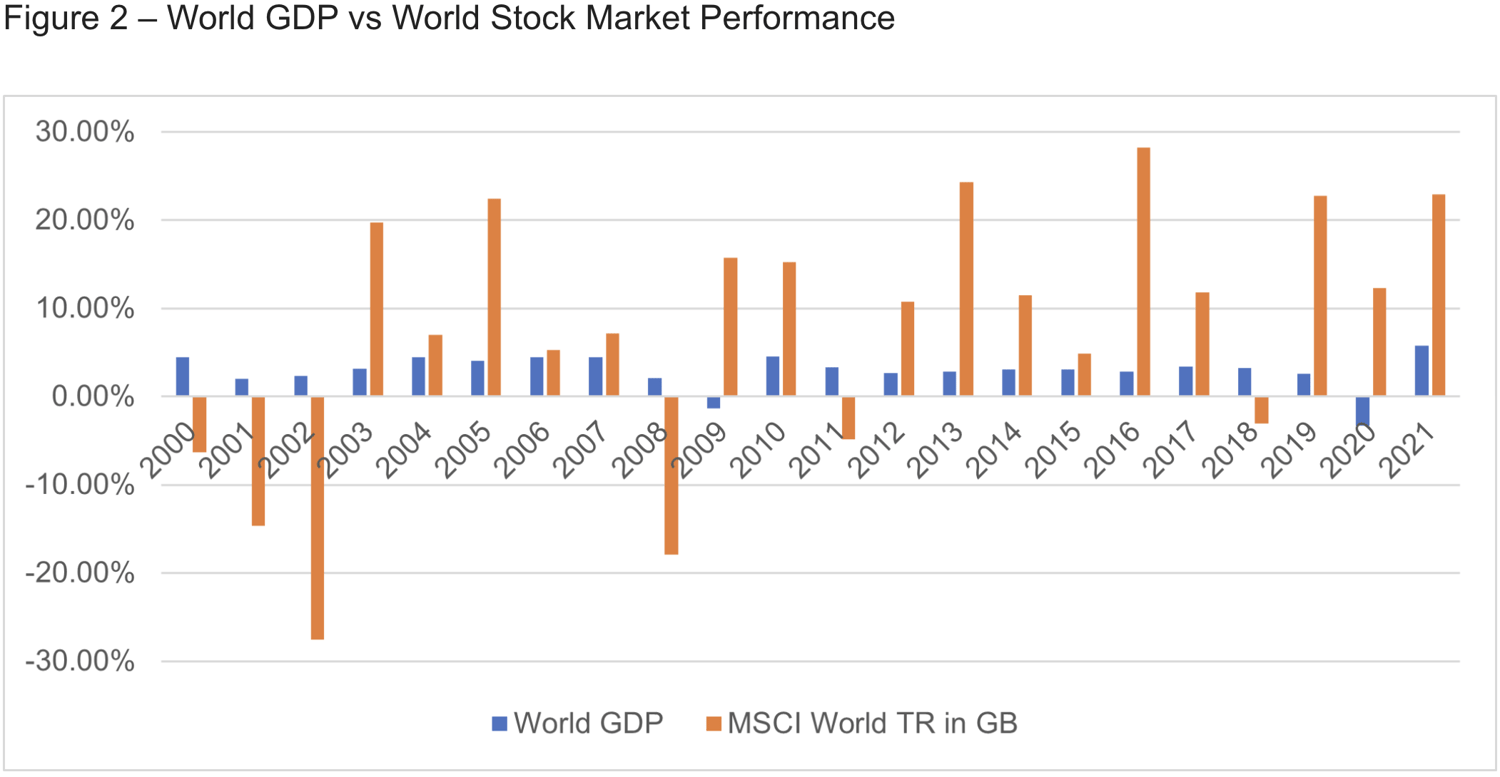

The fact is, the economy and stock market are different things and may not be as correlated as one may expect.

A recession does not mean negative investment returns

Whilst there is some correlation between the economy and global markets. As the tables above show, there are multiple occasions where the two different measures have moved in opposing directions.

There are a few reasons for the disparity between these two metrics.

1. The economy takes many more factors into account such as spending, employment rates and the full population, whereas the stock market only focuses on publicly traded companies and is biased towards the largest institutions.

2. It is also typically the wealthier individuals within a country who hold stocks, so those further down the wealth scale are likely to have little to no impact on the stock market but are counted for within the economy.

3. Stock markets are heavily influenced by the sentiment of traders and investors. As a result the stock market is often forward looking relative to the economy, and up to 9 months ahead.

Even if there is a recession, it doesn’t necessarily mean markets will suffer. In fact, there is a growing belief among economists that markets have or are close to bottoming out. This is inline with previous recession cycles where at the start of a recession markets had already reached the bottom. Therefore, there is optimism towards the end of the year and into the new year for markets, even if there is a somewhat high level of pessimism for economies.

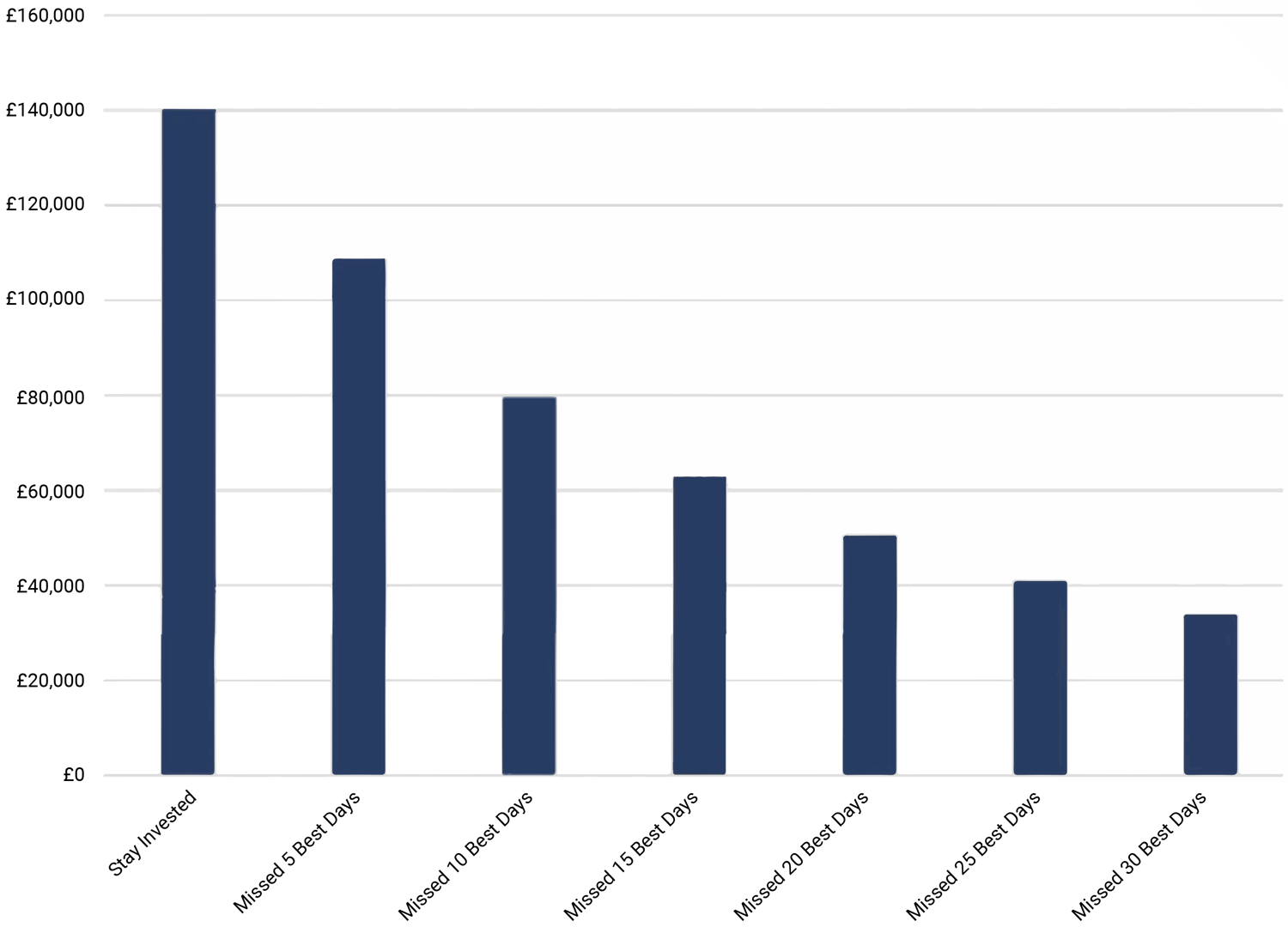

The Consequences of Trying To Time Markets

Recession or no recession, trying to time the market is almost impossible. In an ideal world, you would ‘buy the dips’; in reality, there is no way of really knowing whether the stock market has reached rock bottom and when the recovery will occur. The practice ‘buy low, sell high’ is something that only professional investors should attempt. Do it wrong and you could miss the market’s best days, ending up significantly worse off.

The chart below shows the impact of missing the market’s best days on a £10,000 investment in the FTSE All Share between May 1989 and April 2022. If you kept your £10,000 invested throughout, it would have grown to £140,287 by the end of the period, assuming dividends were reinvested and before fees. However, if you tried to ‘buy low, sell high’ and missed the market’s 30 best days, your investment would have increased to just £33,872.

Investing during volatile periods and watching your investment values drop can obviously be very stressful but as an investor, this is part of the journey. Investment markets do not always grow, but they have always grown more during bull markets than they lost during bear markets.

Throughout history, remaining invested during all cycles has always rewarded investors with positive growth. Therefore, it is vitally important that after experiencing a market crash, such as the one endured this year, that you remain invested during the recovery.

Markets will recover the losses they have endured in 2022, but as the table above shows, trying to jump out of a bear market and jump back in during a bull market will often result in lower overall returns.

Related Articles:

What To Do When Investment Values Fall

The Danger of Timing Investment Markets

Why Markets Will Be Better In 2023

Rapidly rising inflation is a major reason markets have been so volatile this year. Another is the hike in energy prices and global supply chain pressures which were triggered by the Ukraine conflict. But these factors are forecast to improve in 2023, even if the conflict in Ukraine remains. This would boost portfolio recovery from the crash of 2022.

The Bank of England has said inflation will fall sharply in 2023, which would boost recovery and improve investment conditions. There are 3 reasons they believe this will happen

1. They do not expect the price of energy to rise quickly. The Government has introduced a scheme that caps energy bills for households and businesses for six months.

2. They don’t expect the price of imported goods to rise so fast. That’s because some of the production difficulties businesses have faced are starting to ease.

3. They also expect there to be less demand for goods and services in the UK. That should mean the price of many things will not rise as quickly as they have done recently.

Morgan Stanley's chief strategist Mike Wilson also believes that the current bear market will be over by early next year as major industries and sectors who bore the brunt of the year's losses begin to see a return to profitability.

With banks and market analysts predicting a sharp drop in inflation there is growing optimism that investment markets will experience a much more positive year despite the pessimism and recession fears.

Tom Lee, who is head of research at global market strategy firm Fundstrat noted that inflation indicators, like housing prices, are falling rapidly, suggesting a softening of rate hikes could cause stocks to rally as much as 25% by 2023.

Low valuations mean that now could be a great time to invest, with quality growth stocks in particular now so lowly priced that many offer significant growth potential.

Global Growth Opportunities For 2023

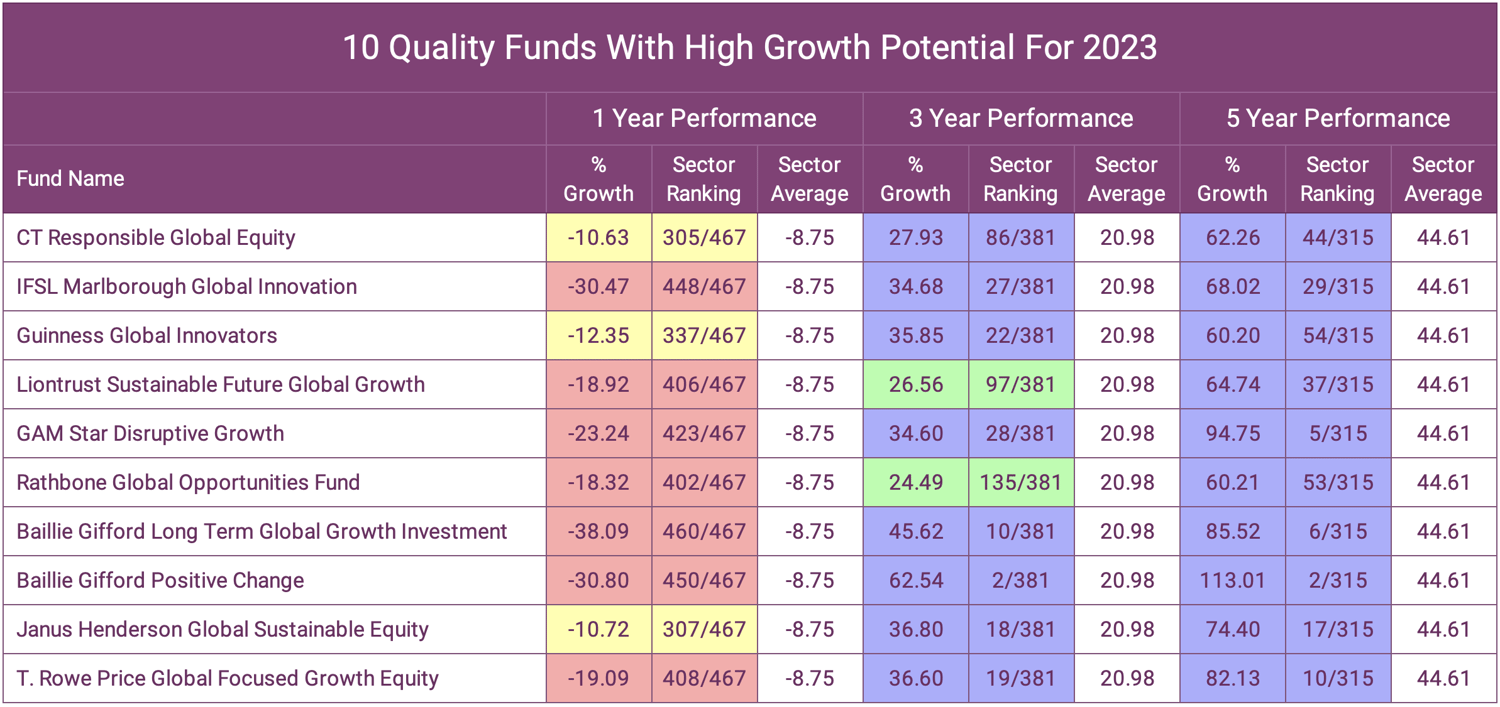

Low valuations across most core equity markets lean towards a positive outlook for 2023 for many investors. But some markets are seen to have more potential than others. However, a popular sector that incorporates a blend of asset classes is the global sector. This sector has over 460 funds and is home to some of the UK’s largest and most popular funds such as Fundsmith Equity and Lindsell Train Global Equity funds.

In the table below we feature 10 funds from the sector that are high quality funds, with a strong performance history but have endured a tough 2022. As such, they are seen by many analysts as undervalued and could offer strong growth opportunities for the year ahead.

*Performance figures cumulative to October 2022. Figures include fund charges. Past performance does not guarantee future performance.

The above funds represent a small selection of global funds that have a history of top performance but have endured a tough 2022. As such, they now have a valuation that is lower than the quality of their holdings suggest which we believe gives them strong future growth potential.

Download our latest best funds report which identifies all funds that have consistently outperformed their sectors over the past 1, 3 & 5 years.

Summary

While negative market conditions do occur, quality fund managers such as those whose funds used by Yodelar investments, have factored in many of these threats to their investment strategy and remain steadfast that they hold quality stocks with significant opportunity that can be realised when market volatility subdues.

There will always be a fluctuation in values during differing market cycles. As such, short term performance won’t provide a true measurement of quality or an indication as to how a portfolio will perform over the longer term. It is how a portfolio performs over both bear and bull markets that matters.

Although we are currently in the midst of a bear market and the current economic conditions mean there will be challenges ahead, we believe, as do many analysts, that the sharp decline in valuations in recent months has left many high quality funds undervalued. As a result, there are significant growth opportunities for investors to exploit, recession or no recession.