- High charges and poor performance from St. James's Place Wealth Management, the largest restricted advice firm in the UK.

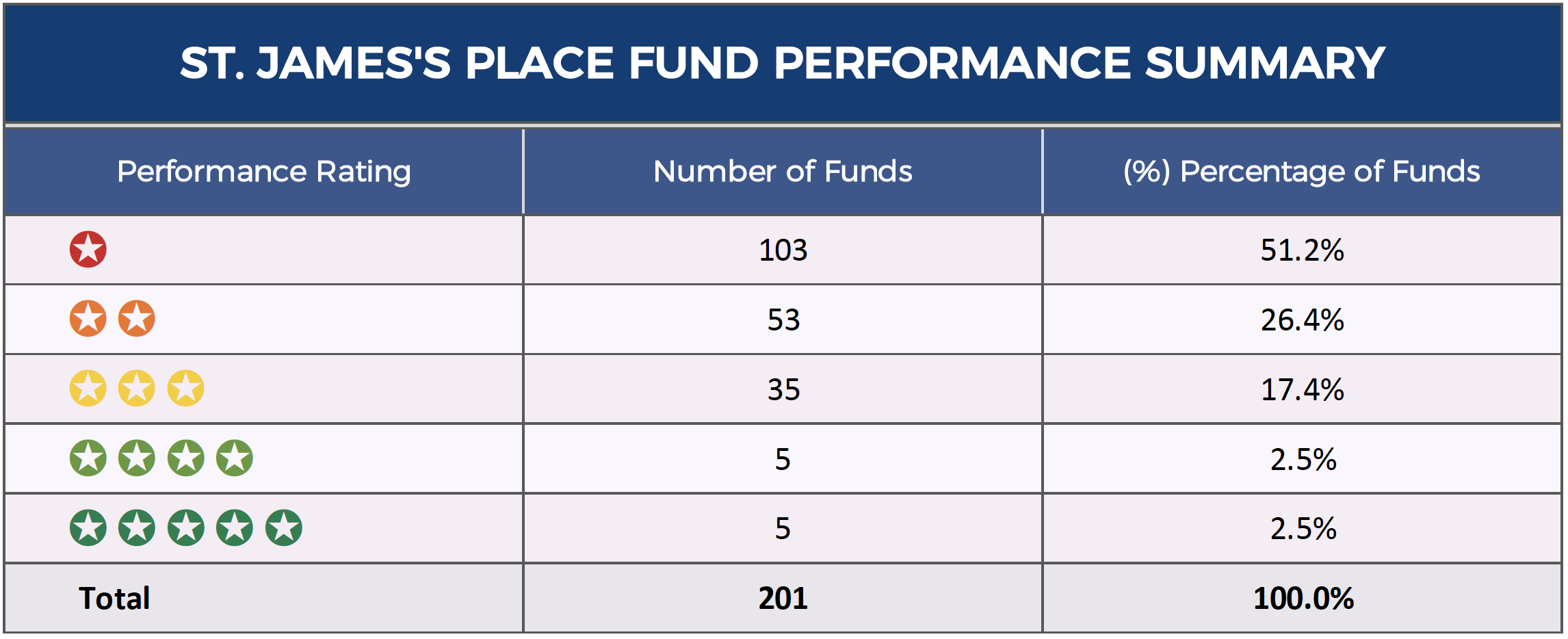

- Only 5% of St. James's Place funds have maintained a top quartile sector performance ranking over the past 1, 3 & 5-years.

- 85% of their unit trust funds performed worse than half of their same sector peers during the last 5-years.

- Initial advice costs between 5-6% of your initial investment, compared to the industry standard of 2.06%.

- Concerns that St. James's Place are 'stalling' when clients request to move their assets to other providers.

Over the past few years Yodelar have carried out several independent reviews of the UK’s largest wealth manager St. James’s Place, exposing the scandalous rewards scheme in place for their advisers, their expensive and punitive fee structure, and the continuous poor performance of their funds and investment products. In recent weeks, the Sunday Times have added to the woes of the investment giant by further calling them out on the above increasing tension within the organisation and fear among their clients, with some of the belief that the embattled wealth managers model is so badly broken that they may struggle to survive.

The latest barrage of negative press will undoubtedly fuel the exodus of nervous clients, but as SJP try to hold back the flames should investors be worried about the long-term viability of the troubled investment giant?

In recent weeks, several investors, who are in the process of leaving SJP, have voiced their anger at what they believe to be stall tactics employed by SJP in order to scupper their plans to move their money away from SJP in favour of a rival provider. Some claim to have waited several weeks for this process to complete only to face seemingly endless delays.

SJP’s delays at paying out are nothing new. They have a reputation within the industry for being notoriously slow and difficult when clients request to move their money out of their products. But this doesn’t mean to say that SJP are not struggling to gather together the cash of want away clients, and if this is the case, the out of touch wealth manager may struggle to survive. Indeed, some opportunistic investors believe SJP’s model is so badly broken that they would consider shorting SJP shares in the belief that their demise is inevitable.

Although such a prospect is far from certain, what is certain is the continued underperformance of SJP funds and the uncompetitive returns their investors are receiving from their expensive funds and portfolios.

St. James's Place Wealth Management

SJP have upfront charges of 5% on their range of unit trust and OEIC funds, 6% on their pension and life products, and ongoing costs that can reach 2.5% per annum, which makes them one of the most expensive wealth management firms in the UK.

SJP charge a premium for their service but with 85% of their funds performing worse than at least half of their peers over the past five years are they really worth their high fees?

In this latest St. James's Place review we provide an updated analysis on the 1, 3 & 5-year performance and sector ranking of 201 St. James's Place investment funds including their range of unit trust funds, pension funds, life funds and offshore funds.

Often criticised for high fees, we review the current St. James's Place charging structure, including upfront charges, ongoing charges and exit charges, comparing the SJP fee structure to alternative providers.

Also included is a detailed review of St James's Place Investment Portfolios, 9-convenient unit trust portfolios that SJP offer to smaller sized clients.

This detailed and factual analysis of the largest restricted advice firm in the UK will assist new and existing investors to evaluate whether St. James's Place Wealth Management is a suitable choice.

St James's Place Charges and Fees.

St James's Place charges and fees have long been a source of contention for their customers who face upfront fees of 5% on their range of unit trust funds, and exit charges of up to 6% on their pension and life funds. Factor in their restricted advice model (SJP advisers are only allowed to recommend SJP branded products) and poor performing funds and it's clear why they continually attract industry criticism.

The press, consumer watchdogs, and non-restricted independent advice firms continue to warn investors to review multiple options. As a publicly listed company, they have been criticised for creating value for their shareholders and less for their customer base. In response to critics, SJP's claim that the vast majority of their clients believe they offer ‘reasonable, good or excellent value for money’.

In 2017, Which? the consumer watchdog completed a damning report on St James's Place. They completed a mystery shopping exercise and found a sample of SJP advisers mislead customers, hyping up performance, not disclosing their charges, and overall labelling them a poor option for consumer investors.

SJP's charges have been a regular source of contention and a recent report by the Sunday Times found their fees are even a concern to their advisers with a leaked call from St James’s Place managing director Ian Gascoigne identifying that some advisers want them to scrap their expensive fees, which have helped to pay for extravagant rewards from cufflinks to cruises which SJP regularly award to their top selling advisers.

Upfront Fees of Up To 5%

The 5% upfront fees charged by SJP for initial advice and set up are still among the highest in the industry with some of the belief that their restricted model makes this advice charge questionable under existing regulation.

SJP’s model means that their partner advisers can only ever recommend SJP products even if they believe other products are better suited to their clients. They are restricted agents, and as such, they cannot provide independent advice. This has led to concerns that SJP Partner advisers are merely sales agents selling their own products, which to some makes their relationship transactional as opposed to advisory.

While advice and investment charges at St. James's Place receive frequent criticism, former chief executive David Bellamy has said that their prices were “lower than average.” However, a recent survey by VouchedFor of 423 advisers from 263 firms found that the average initial cost to clients with a portfolio worth £100,000 or more was 2.06%. This figure is less than half of what is charged by SJP for their unit trust portfolios and almost a third of their upfront fees for their pension products.

St James's Place Upfront Fees

When you invest in any St. James's Place unit trust fund you are charged an entry fee of 5% of the amount you invest. For example, if you invest £100,000 in one of their unit trust funds you will immediately be charged £5,000 in upfront fees. SJP state that this charge is to cover the costs of setting up your investment and for the initial advice and it applies to all of their unit trust funds.

When investing in a St. James's Place pension or bond product investors are charged even more. The initial upfront fee for these products is 6%, of which 4.5% is for initial advice fees and 1.5% is a product charge.

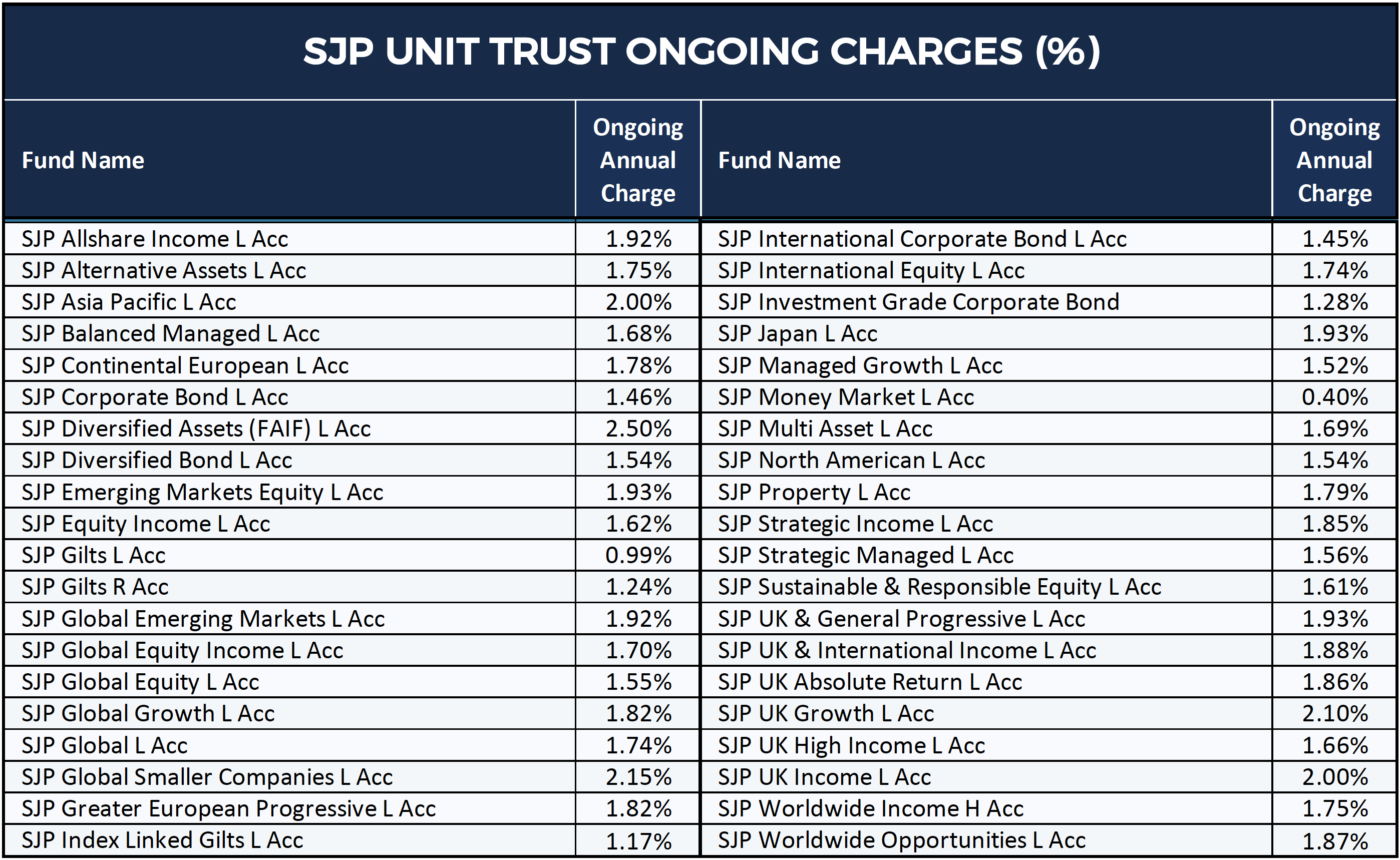

St James's Place Fund Charges

There are currently more than 3,000 unit trust funds available to UK investors and on average their annual ongoing charge comes to 1.01% of the value of your investment in that fund.

The table below shows the current annual ongoing charges associated with each St. James's Place unit trust fund. As can be seen, these fees can reach 2.5%, with the average for all 40 funds sitting at 1.69%, which is almost 70% higher than the industry average.

SJP advise that these ongoing charges cover all aspects of operating each individual fund during the year, including fees paid for investment management, administration and ongoing advice.

* The above fees are charged each year. They are calculated based on the value of your investment at that time. For example, if after 1 year you have an investment in the SJP Allshare Income fund that is valued at £100,000, you would be charged £1,920 in ongoing fees for that year.

Performance Fees

SJP also apply a performance fee to their UK Absolute Return Unit Trust fund. On this fund, a performance fee of 20% of any outperformance becomes payable if the fund outperforms the 3 month Sterling LIBOR benchmark.

Exit Fees

There are no exit fees associated with any of SJP's range of unit trust funds. However, for all pension and bond products investors are levied with an exit penalty that amounts to 6% of the value of their total investment. The size of the penalty imposed by this restrictive policy helps SJP to secure control of clients' investments for several years. This penalty reduces by 1% each year and it is only after staying invested in an SJP pension or bond product for 6 years that no exit penalty applies.

**If you make changes to your SJP pension or bond portfolio by adding more funds for example, then this will automatically reset the exit penalty.

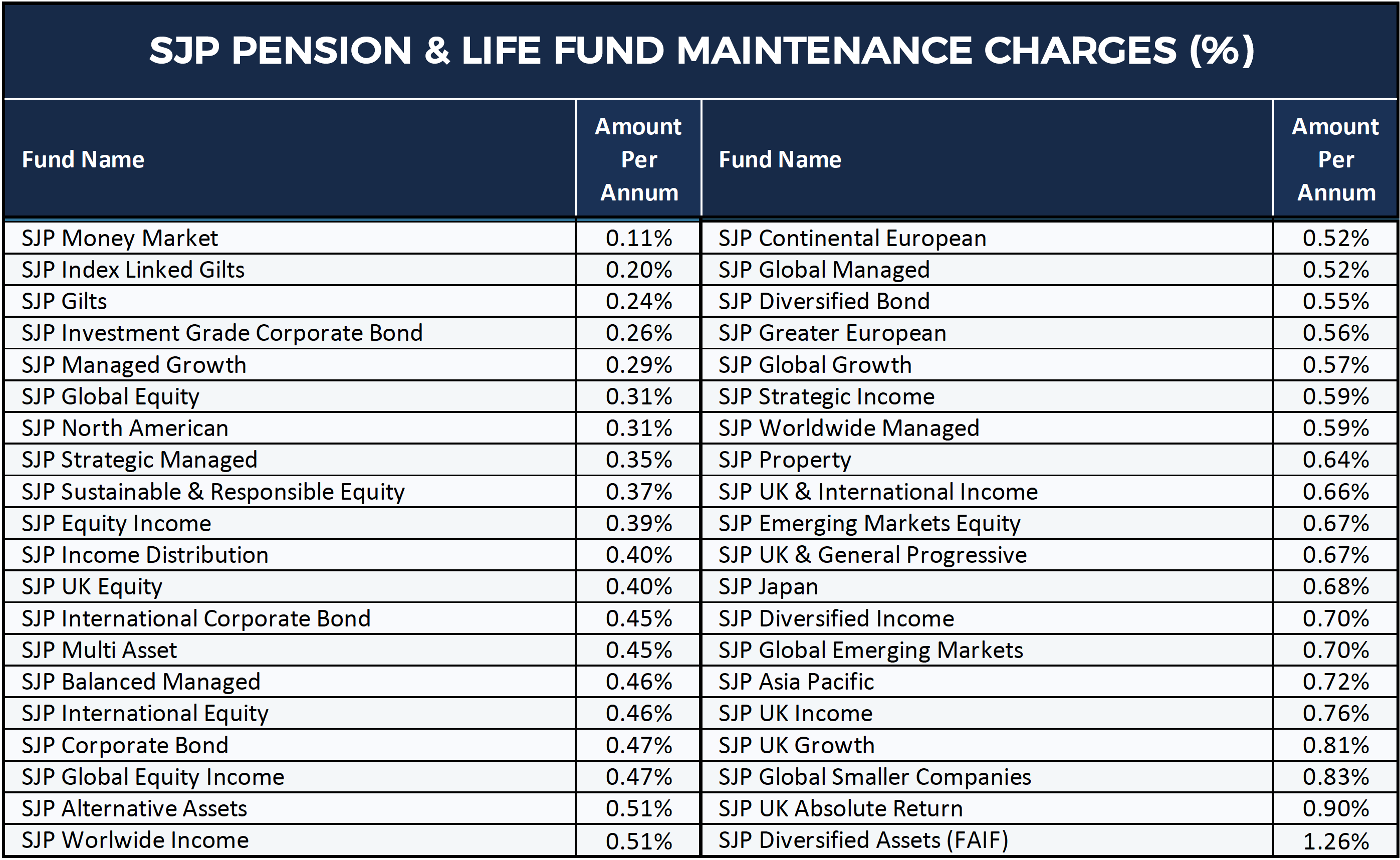

Maintenance Charges

In addition to the initial 6% upfront fee for all St. James's Place pension and bond products SJP also apply an ongoing charge of 0.5% which is to fund the ongoing advice and relationship with their partner advisers. In addition to this, they also levy an annual maintenance charge, which they say is to fund the management and maintenance of your underlying investments.

* These charges include the fee levied by the investment manager for managing and maintaining the investment funds each year, the costs incurred for holding the underlying investments and costs of custody and investment administration.

St James's Place charging model is unique and often chastised for its complexity, but for SJP as a business, it is highly profitable as it is designed to generate significant upfront and ongoing fees, which are currently well above the industry average. Their highly contentious exit penalty of up to 6% on their pension and bond products also helps to lock in investors and therefore maximise their ongoing revenue.

Better To Buy SJP Shares Than SJP Investments?

Many investors have stated that they wish they had invested in St James’s Place Shares instead of their funds. The high charges, cash flow and high profitability has allowed SJP to acquire more financial advice firms than any other firm in the UK, with SJP clients indirectly footing the bill.

As a distribution model, SJP has been able to acquire IFA practices faster and more aggressively than any other firm in the UK. Their ability to extract large chunks of cash from client investments as initial fees and ongoing charges, has allowed them to acquire a large number of advisory firms and associated client banks.

SJP offer large upfront payments to advisory firms as an incentive to join and become a St James's Place partner. Once onboard newly recruited advisers will transfer their client's investments across to SJP portfolios and funds. The associated upfront fees are again generated, creating more SJP sales revenue to acquire more firms. This strategy has been extremely effective for SJP Wealth Management, but questionable for the client, who is indirectly funding further SJP acquisitions and growth.

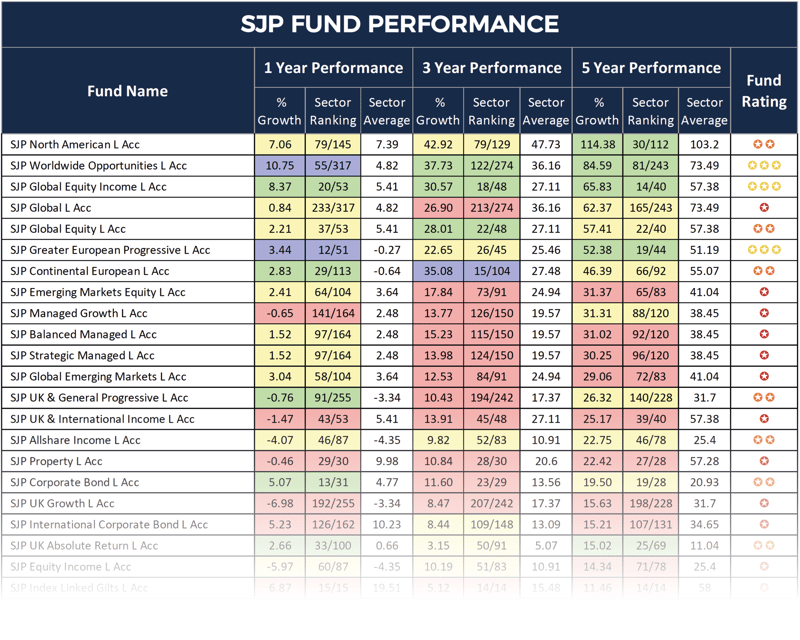

St James Place Fund Performance

Our most recent analysis of 201 St. James’s Place unit trust, pension, life and offshore funds found that 156 consistently performed worse than at least half of their peers, and only 3 of their funds have managed to maintain a top quartile level of performance over the recent 1, 3 & 5-years.

Download the full report >>

Download the full report >>

85% Of SJP Funds Returned 5 Year Performance That Fell Below Their Sector Average

Over the past 5-year period 85% of SJP funds (with at least 5-years performance history) delivered returns that were below the sector average.

One such fund was the unfortunately titled UK High-Income fund, which has been anything but for SJP’s clients. This fund was managed by under fire fund manager Neil Woodford until SJP dropped him in June 2019 awarding the mandate to manage this fund to Richard Colwell of Columbia Threadneedle, and Nick Purves at RWC. This fund currently holds some £1.4 billion of client assets yet it has consistently been the worst performing fund in the entire UK Equity Income sector. Over the past 5-years, it returned negative growth of -8.32% despite the sector averaging 25.4%.

The £524 million SJP Alternative Assets fund has also been a serial underperformer. This Flexible investment fund endured big losses in recent years returning negative of -9.06%, -9.81%, and -8.22% over the recent 1, 3 & 5 year periods. In contrast, the sector averaged growth of 1.64%, 20.84%, and 40.17% over the same time frame.

From their pension range of funds, their UK Equity fund has been among the most disappointing. This fund has continually ranked among the worst performers in its sector. Over the recent 5 years, it returned losses of just -3.53%, which was well below the 26.16% sector average and worse than 98.6% of competing funds within the same sector.

Our analysis of SJP’s range of life funds identified that 87% returned growth over the past 5- year period that was lower than at least half of their peers within the same sectors. Among the worst performers was the £1.2 billion Income Distribution fund. Over the past 5 years, this fund returned losses of -5.20%, which not only fell well below the 41.37% sector average, but it was the second worst of all 159 funds in the same sector.

This wasn’t their only Life fund to rank poorly for performance. The SJP Gilts and the SJP Index Linked Gilts life funds both consistently ranked at the foot of their sectors for growth. Over 5 years the SJP Gilts fund returned growth of 4.36%, even though the sector averaged 21.13%, and the SJP Index Linked Gilts life funds returns of 8.70% was more than 5 times lower than the sector average.

From their offshore range, we analysed 67 funds for performance and sector ranking. From those with at least 5-years performance history, 93% ranked below half of all competing funds within the same sectors.

Will Fund Manager Changes Improve Performance - Or Is It Too Little Too Late?

Although St James's Place only provides access to their own range of fund’s they don’t actually manage these funds themselves. Instead, SJP prefers to outsource this to various fund managers who are selected and overseen by their investment committee. In recent years SJP has pulled the mandate to manage their funds from some high-profile fund management firms, notably Aberdeen Standard Life.

Among the most prominent changes was to the SJP Far East fund. This fund was managed by Aberdeen’s Hugh Young since 2001, but towards the end of 2016, after enduring years of underperformance (this fund continually ranked last in its sector for growth) SJP decided to move the management of this fund from Aberdeen to their rivals Stewart investors, who are part of the First State group. The move saw the fund renamed as the SJP Asia Pacific fund as it adopted a new approach and shifted away from Japanese equities it has improved the fortunes of the fund. Over the past 12 months, it was the top performer in its sector with growth of 8.15%.

More recently SJP has made a raft of changes to the management of several funds.

In July 2018 they announced that the management of their underperforming Alternative Assets fund was switching from BlackRock to Wellington Asset Management. Another fund to switch management was the SJP Continental European fund. This fund was previously managed by SW Mitchell but is now controlled by Investec. This fund has a poor performance history with recent 5-year cumulative growth of 46.39%, which fell well below the 55.07% sector average.

AXA Investment Management was another high-profile fund manager to lose its mandate with SJP. The Balanced Managed fund, which had been managed by AXA, had a history of poor performance. This past 5-years saw the fund return growth of 31.02%, which was lower than 77% of its competitors within the same sectors. The removal of AXA sees the management of this fund move to a joint management team of GMO, which will run 80% of the strategy and Jennison Associates, which will take 20%.

In response to these changes Chris Ralph, the Chief Investment Officer at St. James’s Place, said: “These changes reflect our distinctive investment management approach and commitment to selecting the best fund managers from across the globe”. What impact these changes have on fund performance remains to be seen, but with continued poor performance from a sizeable proportion of their funds, it would not be surprising to see further changes to more of their funds in the near future.

The Top SJP Funds

From SJP’s range of unit trust / ISA funds, only one has managed to maintain top quartile sector performance consistently. This fund was the £2 billion SJP International Equity fund. This fund has competitive 5-year returns of 109.06%, which was not only comfortably better than the 73.49% sector average, but it was also greater than the returns delivered by 92% of its peers.

A Proportion of the relatively new funds launched by St. James’s Place have got off to a strong start, most notably their Global Growth fund. Although this fund has limited history, over the past 12-months it ranked among the top 20% of performers within the Global Equities sector.

The consistently best performing SJP pension fund over the past 1, 3 & 5-years has been their £2.7 billion International Equity Pn fund. During this period, the fund returned cumulative growth of 17.67%, 60.45%, and 113.61% respectively, which were each well above the sector averages for each period. The past 12 months, in particular, has been strong for this fund as its 17.67% growth under challenging conditions was better than 99.4% of all other funds in the same sector.

The large proportion of SJP pension funds have been unable to match this high level of performance with the majority struggling alongside their competitors. However, similar to some of their new unit trust funds a proportion of the recently launched SJP pension funds have enjoyed a positive start. One of these funds was the SJP Worldwide Income pension fund. This past year saw the fund return 10.64%, which outperformed 92% of competing funds within the same sector.

This table contains the most recent funds under management values for each SJP fund. Some of these values have been updated after the publication of SJPs most recent financial results.

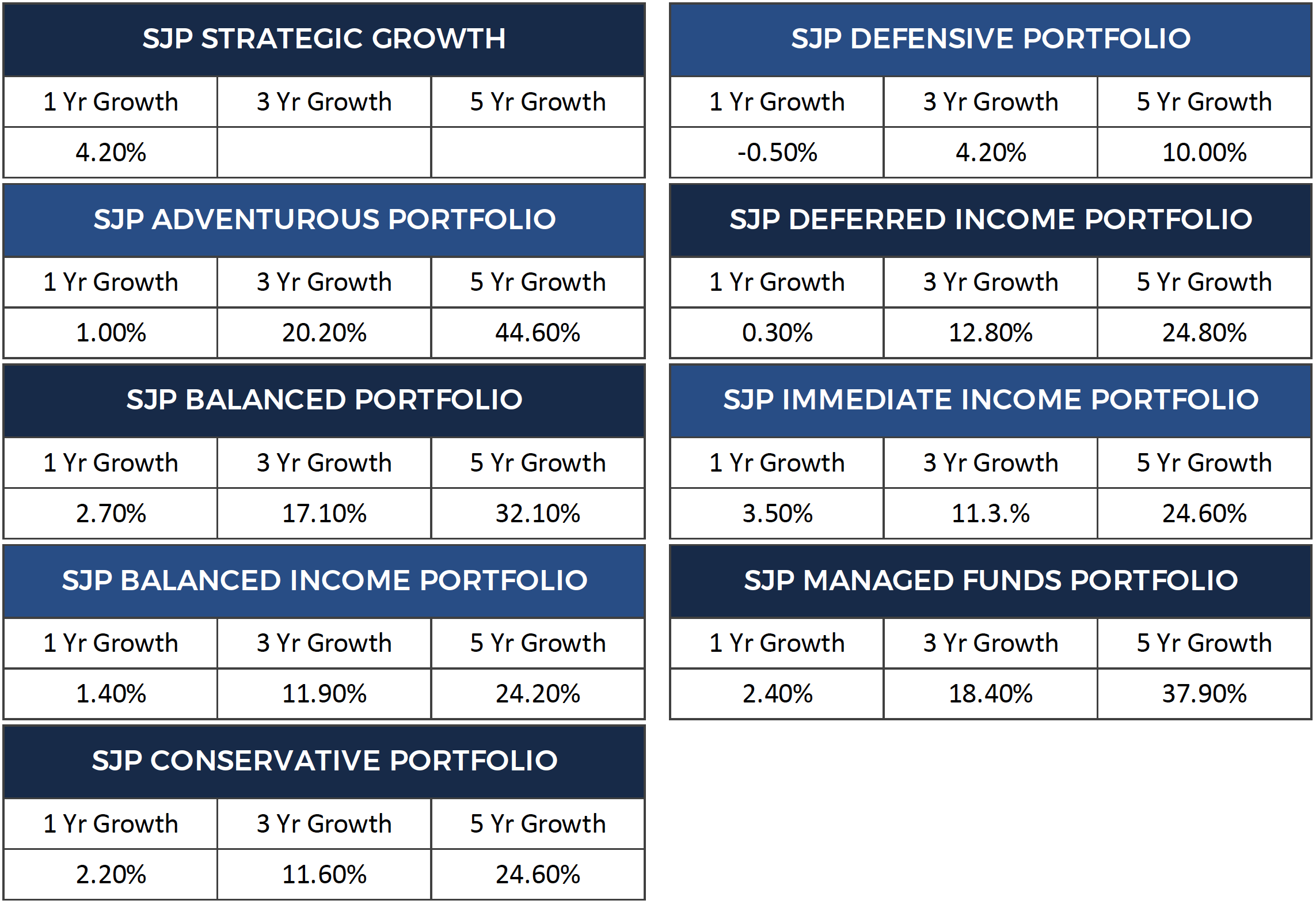

St James Place Portfolio Performance

SJP claims performance comparisons should not be made on single funds but on SJP-recommended portfolios, which its clients usually buy.

These portfolios are weighted based on their particular investment objectives and their associated levels of risk. Of course, they only consist of SJP funds, but as we identified in our fund performance and ranking analysis a large proportion of these funds have a history of poor performance, which will ultimately reflect in their portfolios end performance.

The following tables demonstrate the recent 1, 3 & 5-year returns of all nine SJP unit trust portfolios. Each of these nine portfolios returned a loss for the past 12 months, and over 5-years their highest growth portfolio was their Managed funds portfolio, with cumulative growth of 24.19%. SJP classify the Managed funds portfolio as medium risk, but how competitive is its performance and that of the eight other SJP unit trust portfolios?

Portfolio performance figures up to 31st August 2019

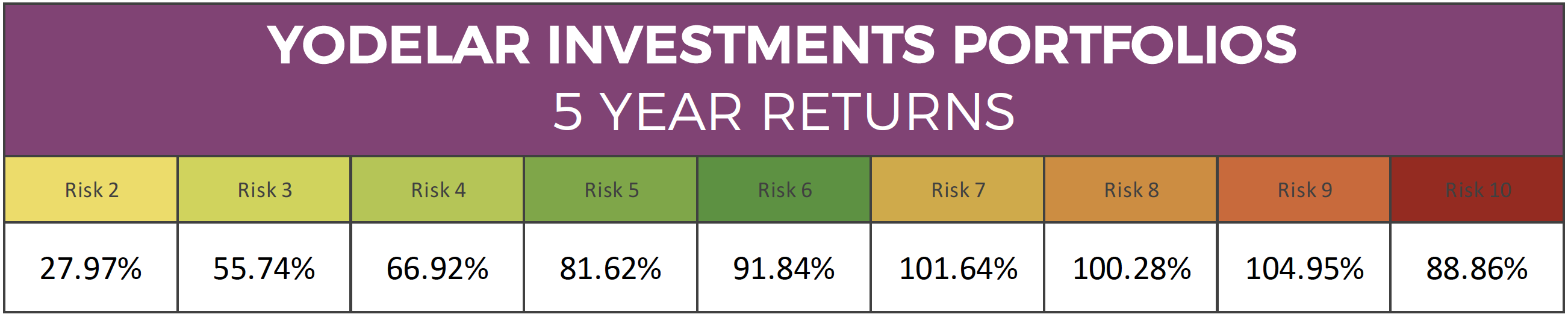

Top Performing Portfolios - Yodelar Investments Portfolios

As identified in our analysis, the majority of the funds that make up each SJP portfolio have consistently underperformed. Therefore, inevitably St. James's Place model portfolios struggle to deliver competitive returns.

Portfolios that contain funds that primarily outperform their competitors and fit within a suitable asset allocation model can deliver significantly higher returns without assuming greater risk. Yodelar Investments' range of risk-rated portfolios provides an excellent example of top-quality portfolios that are built to contain funds that have consistently outperformed at least 75% of their peers and have been strategically balanced to fit within each portfolio’s particular risk category.

Our analysis identified wide performance margins between St James's Place portfolio growth figures and those of Yodelar Investment portfolios.

Portfolio performance figures up to 1st September 2019

The 10 Yodelar Investment portfolios featured in the table below are composed of a mixture of active and passive funds that have been selected from an unbiased analysis of more than 70,000 funds and 100 different wealth management brands. Each fund within our portfolios have consistently ranked among the top performers in their respective sectors.

Expensive Products & Poor Performance

Through their 3,954 partner advisers, St. James’s Place has been able to build long-term, trusted and personal relationships with more than 650,000 clients.

Their business model has seen them grow exponentially year on year and the majority of their clients, who according to SJP’s recent client survey, are more than happy with the firm. This supports the fact that SJP does provide a service that is acceptable to their clients. However, if you consider fund performance and cost to be important, then you may want to look elsewhere.

Our analysis shows SJP and their products to be both expensive and predominantly poor performing, and that lower cost and better performing alternatives are plentiful and readily available elsewhere.

Are recent changes enough? Are such changes due to media pressure or putting the interests of their investors first? Does St James's Place intend to decrease their charging structures and is this even possible under their current distribution/partner model? Will they cease tying investors into pensions when the regulator says investors should be free to move? Will they make their Trust wording more flexible for investors to invest in non SJP funds without creating taxable events? Will the model change? Will the share price for SJP rise or fall now that we are finally entering the information age of investment management? Will advisers move away, or will they stay?

There are plenty of questions to ponder but only time will tell if St. James's Place have a future in an industry where value has become much more important.