- Investors in SJP Polaris portfolios may incur up to an additional 0.81% in annual costs compared to investing in the underlying funds individually.

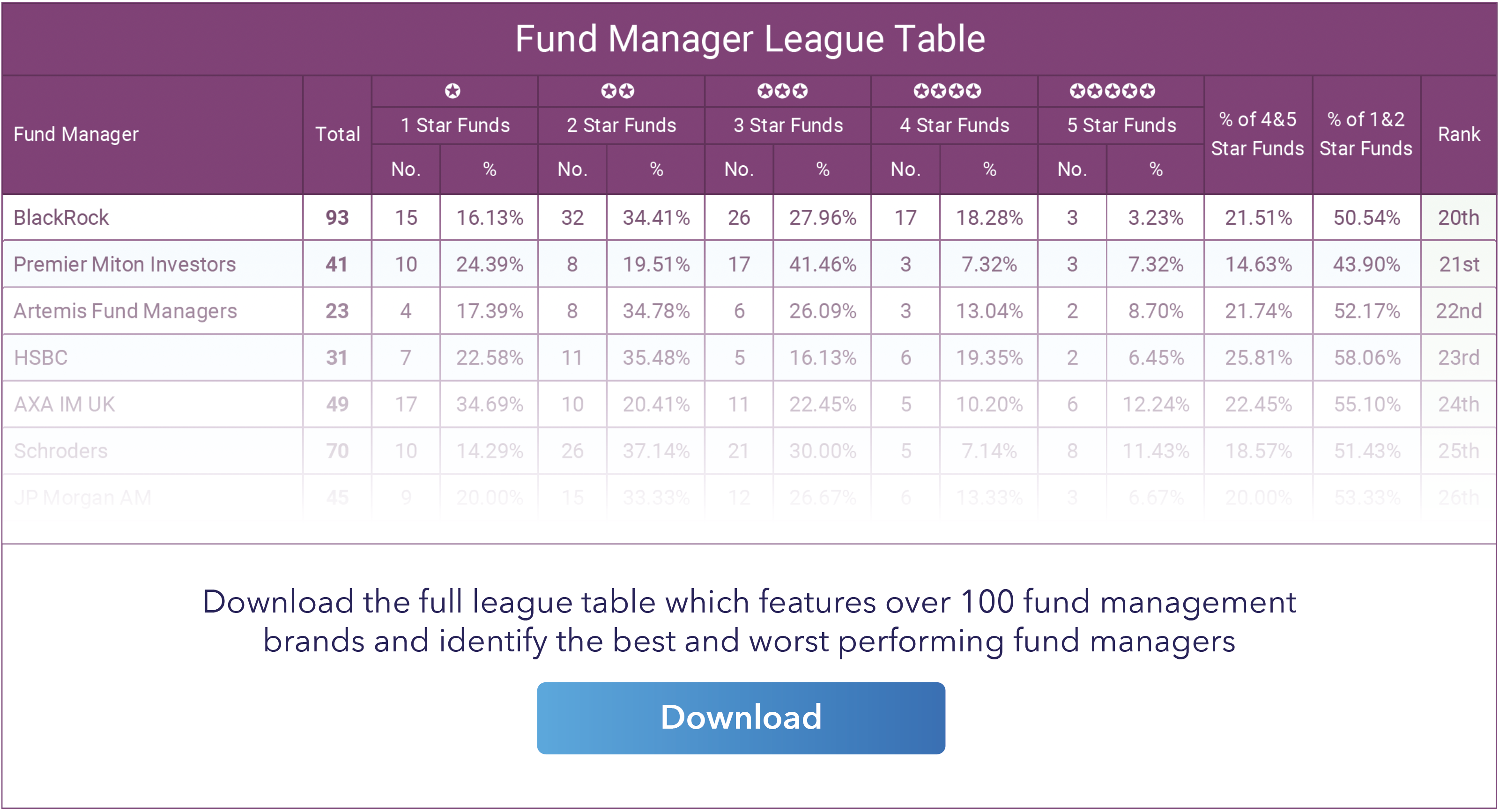

- Underlying SJP funds perform poorly compared to other same sector fund managers

- The Polaris portfolios currently charge total annual fees ranging from 1.93% to 1.98%, despite the combined costs of the underlying funds ranging from 1.12% - 1.28%

- Despite SJP investors voicing concerns about the performance of their investments, they are being offered Polaris portfolios which predominantly include high-cost SJP funds.

- Based on their combined assets, the 4 Polaris portfolios would generate ongoing annual fees of £509.30 million. However, if the funds that make up the Polaris portfolios where invested in directly, outside of Polaris, they would generate annual fees of only £320.16 million - a full £189.14 million less

Investors in the St. James's Place (SJP) Polaris range of portfolios are paying much higher fees compared to the combined costs of the underlying funds within those portfolios.

Our analysis shows that investing in the packaged Polaris range can cost investors up to 0.81% more per annum more when compared to investing directly in the same underlying funds. These findings raise concerns about whether the premium pricing for the Polaris portfolios can be justified, given that they are essentially just a combination of SJP funds and a small selection of low-cost index tracker funds readily available elsewhere.

In this report, we analyse the SJP Polaris portfolios and identify the substantial gap between what investors are charged and the actual expenses of the funds within these portfolios. Are clients simply being asked to pay more for the same poor performing funds?

The Overpriced SJP Polaris Range

St James's Place state that the charges for their range of in-house funds, which form a large part of the Polaris portfolios, are inclusive of all fees, including management and advisory fees. Yet the fee they apply to their Polaris range is significantly greater than the weighted charges of the underlying funds - this includes the portion held in low cost index funds from iShares and State Street. iShares funds available via most Independent Financial advisers have an annual charge of 0.22% as passive index funds, yet SJP are charging up to 1.93% per annum for access to the same fund.

As evidenced in the table above, the overall difference in cost between the underlying funds and all 4 Polaris portfolios is significant. On average there is a 0.75% per annum difference between the Polaris portfolio charges in comparison to the combined charges of their underlying funds.

Poor Performance From SJP Polaris Funds

The table below provides a comprehensive analysis of the individual performance, sector ranking, and overall rating for each of the 16 funds utilised by St. James's Place (SJP) in their range of four Polaris portfolios. These 16 funds comprise 10 of SJP's in-house funds, five funds from iShares, and one fund from State Street.

Note the ranking over different time periods of the individual funds within each sector.

As highlighted in the performance table, a disappointing 10 out of the 16 funds are rated as poor-performing, receiving a poor 1 or 2-star rating. Three funds received a moderate 3-star rating, while only two funds garnered a good 4-star performance rating. Notably, the sole fund to achieve a top-performing 5-star rating is the iShares Pacific ex Japan Equity fund.

Given the inherently high charges associated with the Polaris range, and the underlying funds' poor performance, it becomes difficult to see where investors can discern the value proposition and appeal of the Polaris offering.

What Are The SJP Polaris Portfolios?

Upon launch in November 2022, the introduction of the St. James's Place Polaris range marked a significant strategic move in the firm's investment offerings. This range was welcomed for combining SJP's actively managed in-house funds with third-party passive index trackers sourced from reputable providers such as iShares and State Street.

The asset allocation decisions for the Polaris range are overseen by the SJP investment team, while State Street Global Advisors monitor the range on a daily basis. Their responsibilities encompass ongoing rebalancing of the underlying funds, efficient cash flow management, and strategic currency hedging.

Each of the Polaris fund-of-fund portfolios is differentiated by its equity exposure:

Polaris 1 – the lowest risk solution for clients. It will invest around 40% in equities, making it an appropriate choice for investors who prefer a relatively low level of volatility.

Polaris 2 – a more balanced solution, investing around 60% in equities. It will have the second-lowest level of volatility.

Polaris 3 – will invest around 80% of its assets in equities and is optimised for investors who can tolerate a relatively high degree of volatility.

Polaris 4 – designed to appeal to long term investors who are seeking higher returns and are also willing to accept a high level of volatility. It will invest around 100% in equities and therefore is the highest risk solution.

SJP Clients who express dissatisfaction with SJP fund performance, excessive charges, subpar service, and limited protection under the Government's Financial Services Compensation Scheme (due to their restricted nature) are presented with the Polaris portfolios as a potential enhancement.

Since their launch, the range has become one of the most recommended products to new and existing SJP clients. However, the Polaris portfolios charge total annual fees ranging from 1.93% to 1.98%, despite the combined costs of the underlying funds ranging from 1.12% - 1.28%.

For instance, holding £250,000 in SJP's underlying funds would incur an annual charge of £3,100. In contrast, investing the same amount in the Polaris 3 portfolio would result in an annual fee of £4,925, showcasing a substantial variance of 59% or £1,825 in yearly expenses.

SJP Polaris 1

The SJP Polaris 1 portfolio has a risk rating of 5 out of 10. The portfolio is composed of 70% SJP funds and 30% iShares and State Street run index tracker funds.

The difference between the underlying fund charges and the overall Polaris 1 charge is 0.81%. This equates to an additional £2,000 per year for a £250,000 portfolio.

SJP Polaris 1 Performance and Charges Comparison

Important Information: The value of investments can go down as well as up and you may lose some or all the capital you invest. Unless we specifically agree otherwise, the information within is not a personal recommendation to you to invest. If you are in doubt about any investment, you should consult a FCA-authorised investment firm. Performance figures are in part simulated using a weighted calculation of the underlying fund performance. Simulated past performance or past performance are not a reliable indicator of future performance.

We have compared the performance of the SJP Polaris 1 over the past 1, 3 & 5 years and compared their performance and charges to that of our similar risk rated Yodelar Investment portfolios. As the Polaris portfolio range only launched in November 2022, we have used the backdated performance of the portfolios underlying funds and their current portfolio weighting to identify the 1, 3 & 5 year performance figures.

SJP Polaris 2

The SJP Polaris 2 portfolio has a risk rating of 6 out of 10. The portfolio is composed of 74% SJP funds and 26% iShares and State Street run index tracker funds.

The difference between the underlying fund charges and the overall Polaris 2 charge is 0.75%. This translates to an additional annual charge of £1,900 per year for a £250,000 portfolio.

SJP Polaris 2 Performance and Charges Comparison

Important Information: The value of investments can go down as well as up and you may lose some or all the capital you invest. Unless we specifically agree otherwise, the information within is not a personal recommendation to you to invest. If you are in doubt about any investment, you should consult a FCA-authorised investment firm. Performance figures are in part simulated using a weighted calculation of the underlying fund performance. Simulated past performance or past performance are not a reliable indicator of future performance.

The SJP Polaris 2 portfolio consists of 16 funds. 10 are from SJPs in-house range and 6 are low cost tracker funds from iShares and State Street. SJP have a 1.96% annual charge on the Polaris 2, which is among the highest on the market for a mid risk range portfolio and considerably higher than the 3 highlighted Yodelar portfolios. The difference in performance is also considerable with the Polaris 2 delivering returns that were well below our similar risk rated models.

SJP Polaris 3

Similar to the Polaris 2, the SJP Polaris 3 portfolio carries a Dynamic Planner risk rating of 6 out of 10. However, this portfolio is just slightly below the threshold for a risk rating of 7 out of 10. The portfolio is composed of 82% SJP funds and 18% iShares and State Street run index tracker funds.

The Polaris 3 annual charge of 1.97% is 0.73% greater than the underlying fund charges. This difference equates to an additional annual charge of £1,825 per year for a £250,000 portfolio.

SJP Polaris 3 Performance and Charges Comparison

Important Information: The value of investments can go down as well as up and you may lose some or all the capital you invest. Unless we specifically agree otherwise, the information within is not a personal recommendation to you to invest. If you are in doubt about any investment, you should consult a FCA-authorised investment firm. Performance figures are in part simulated using a weighted calculation of the underlying fund performance. Simulated past performance or past performance are not a reliable indicator of future performance.

With an annual charge of 1.97%, the SJP Polaris 3 portfolio has a 0.40% higher annual charge than the similarly risk Yodelar CORE Mid Balanced portfolio and a 0.87% higher annual charge than the low cost Yodelar INDEX Mid Balanced Portfolio.

Despite the additional charges, the Polaris 3 (which is the largest in the Polaris range with £12.2 billion of funds under management) returned growth over the periods analysed that was considerably lower than each of the Yodelar portfolios.

SJP Polaris 4

The SJP Polaris 4 portfolio carries a risk rating of 7 out of 10, as this portfolio has a higher equity exposure with greater emphasis on growth. Its composition consists of 73% allocated to SJP's in-house funds and 27% invested in index tracker funds managed by iShares and State Street.

The Polaris 4 has the highest price in the range with an annual charge of 1.98%. This is 0.70% greater than the underlying fund charges of 1.28%. Based on a £250,000 portfolio this would result in additional fees of £1,750.

SJP Polaris 4 Performance and Charges Comparison

Important Information: The value of investments can go down as well as up and you may lose some or all the capital you invest. Unless we specifically agree otherwise, the information within is not a personal recommendation to you to invest. If you are in doubt about any investment, you should consult a FCA-authorised investment firm. Performance figures are in part simulated using a weighted calculation of the underlying fund performance. Simulated past performance or past performance are not a reliable indicator of future performance.

The St. James's Place's Polaris 4 portfolio has considerably higher fees in comparison to the similarly risk-rated portfolios from Yodelar Investments. The three Yodelar portfolios have also outperformed the Polaris 4 portfolio, delivering noticeably higher growth over the past 1, 3, and 5-year periods.

Overall, each of the St. James's Place's Polaris portfolios carry significantly higher fees compared to the similarly risk-rated portfolios offered by Yodelar Investments. Each of the Yodelar portfolios have delivered substantially better growth over the past 1, 3, and 5-year periods, which raises concerns about the effectiveness of the Polaris portfolios in generating competitive returns to justify their inflated charges. This comparison highlights the importance of carefully evaluating investment options to ensure an optimal balance between costs and potential returns.

Book a no obligation call to find out more about our efficient investment portfolios.

Passive Investing Without The Cost Benefits

The use of passive funds has grown exponentially in recent years due to the value they can add through consistent performance and low costs. So SJPs decision to include a small selection of passive funds in their Polaris range was welcomed by many.

By their very nature, passive funds can never outperform the market they track but they can often outperform the portion of active funds who underperform the market. But it is widely recognised that the main benefit of using passive funds is the large cost savings they bring simply because they track an index and do not require a fund manager - thus removing fund manager costs. Therefore the inclusion of passive funds in a portfolio will typically result in lower portfolio costs. Yet this is not the case for SJP Polaris investors.

By pricing their Polaris portfolios significantly higher than the underlying funds, SJP deprives investors of one of the key advantages of index funds.

For cost-conscious investors, the appeal of the Polaris range is essentially negated by this pricing contradiction. Over longer periods, the compounded impact of excessive fees can materially diminish returns and erode investors' wealth. This stark disconnect between product structure and pricing makes it difficult to perceive any tangible benefit for investors in the Polaris range.

Why Would SJP Charge More For Polaris?

St. James's Place operates a unique business model that distinguishes it from other fund managers. A significant part of SJP's growth strategy involves the acquisition of financial advice firms across the UK. While this approach has contributed to SJP's expansion, it has continually come under scrutiny as it requires their clients to absorb high costs through SJPs high priced charging model to fund this strategy. Part of this funding came through the application of exit and penalty charges, which SJP became synonymous with.

However, in a pivotal moment for the fund management giant the Financial Conduct Authority's (FCA) recently published their consumer duty legislation, which places significant challenges on traditional revenue models such as SJP’s through the elimination of exit fees. These exit fees represented a crucial revenue source for SJP, and their elimination will likely have profound implications for the firm's long-term viability once the new regulations take full effect.

Since last year, when the severity of the challenges ahead for St. James's Place became more apparent, their share price experienced a sharp and prolonged decline. On 17th April 2023, SJP's share price was £11.99. However, their share value on 16th April 2024 was £4.02, which represents a valuation drop of 66% in just 1 year.

Much of this valuation fall came in response to the FCA’s Consumer Duty with their falling share price reflecting a real concern about the company's ability to adapt and maintain profitability in the face of this regulatory overhaul.

The firm must now balance the need for revenue generation and expansion whilst maintaining value for their clients. The introduction of their Polaris range has been seen as a means to lower their costs and plug the income gap that will come from the removal of exit fees. But the large gap between the underlying costs of running Polaris and the amount investors have to pay could cause further concerns regarding the long term viability of SJPs expensive business model.

More Than £25billion Now Invested In SJP Polaris Portfolios

Yodelar are seeing a significant rise in the number of existing SJP clients who are being advised by their SJP adviser to move into Polaris portfolios, even though they could invest their clients into the same SJP funds that make up the Polaris portfolios at much lower cost. This promotion of the Polaris range amongst SJPs existing client base has helped boost the combined assets held in the 4 Polaris portfolios to £25.88 billion, despite the range only launching in November 2022. The additional fee revenue for SJP is not insignificant.

Based on their combined assets, the 4 Polaris portfolios would generate ongoing annual fees of £509.30 million. However, if investors opted to directly invest in the funds that make up the Polaris portfolios outside of the Polaris structure, the annual fees would be significantly lower at £320.16 million - which is £189.14 million less.

Should SJP Investors Look Elsewhere?

For quality and value oriented investors, it is difficult to see the attraction of the SJP Polaris with significantly lower priced and better performing fund options available on the market via whole of market Independent Financial Advice firms who's remit is to ensure clients are invested efficiently.

If you are an investor with SJP we would recommend a free, no obligation portfolio analysis which will identify the performance, sector ranking and rating for all funds within your portfolio and provide an overall quality rating of your portfolio.